There positive are quite a few methods of buying and selling and adjusting iron condors.

In the present day, we are going to take a look at an fascinating case research the place the condor ended up as a butterfly.

We aren’t saying that is one of the simplest ways to commerce an iron condor.

Nevertheless, it all the time helps to have a look at other ways of buying and selling and study the professionals and cons of various kinds.

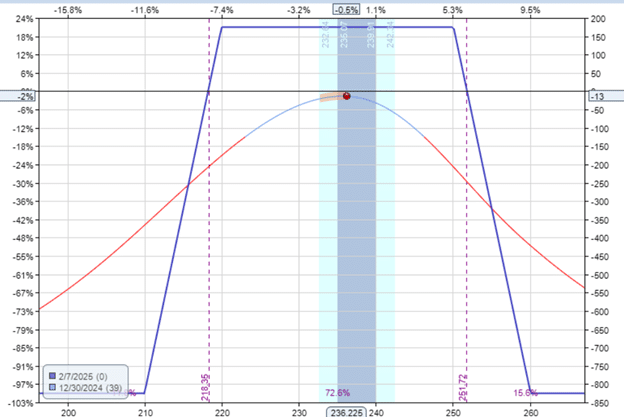

Contemplate an iron condor instance on XLK (the expertise sector ETF) with 39 days until expiration.

Date: December 30, 2024

Value: XLK @ $234

Purchase one February 7, 2025, XLK $260 name @ $0.37Sell one February 7, 2025, XLK $250 name @ $1.32Sell one February 7, 2025, XLK $220 put @ $1.70Buy one February 7, 2025, XLK $210 put @ $0.90

Internet credit score: $175

As you may see from this graph, the danger within the commerce is round $825.

On January 10, the worth of XLK went down, threatening the put credit score unfold.

The brief put is at 30 delta now.

The name unfold is way away with the brief name at six delta.

The investor decides to take revenue on the decision unfold by rolling it down and receiving a credit score for the transaction.

Date: January 10

Value: XLK @ $229

Promote to shut one February 7 XLK $260 name @ $0.14Buy to shut one February 7 XLK $250 name @ $0.37Buy to open one February 7 XLK $250 name @ $0.37Sell to open one February 7 XLK $240 name @ $1.77

Internet credit score $115

After that maneuver, the danger within the commerce has dropped to $700.

The delta has been neutralized, with the worth proper between the 2 credit score spreads.

The next Monday, the worth continues to go down:

The decision unfold has once more gotten distant, with a brief name of lower than 15 delta.

The investor rolls the decision unfold down once more to gather extra credit score.

Date: January 13

Value: XLK @ $226

Promote to shut one February 7 XLK $250 name @ $0.39Buy to shut one February 7 XLK $240 name @ $0.93Buy to open one February 7 XLK $245 name @ $0.45Sell to open one February 7 XLK $235 name @ $2.04

Internet credit score: $105

With every subsequent credit score that the investor collects, the danger goes down.

Danger is now all the way down to $600.

One downside with transferring the decision unfold down too aggressively is that the worth can reverse and go as much as threaten the name unfold because it did on January 15.

4 Ideas For Higher Iron Condors

Seeing that the condor has solely 23 days left till expiration, the investor felt he wanted extra time to get the goal revenue.

So he rolls your complete condor two weeks later within the expiration and facilities the condor on the identical time.

Date: January 15

Value: XLK @ $232.50

Promote to shut February 7 XLK 210 put @ $0.74Buy to shut February 7 XLK 220 put @ $1.20Buy to shut February 7 XLK 235 name @ $3.90Sell to shut February 7 XLK 245 name @ $0.80

Debit: -$356

Purchase to open February 21 XLK $215 put @ $1.29Sell to open February 21 XLK $225 put @ $2.95Sell to open February 21 XLK $240 name @ $3.03Buy to open February 21 XLK $250 name @ $0.74

Credit score: $395

Internet credit score: $39

This new condor is so slender as a result of he needed to get a credit score for the roll.

The one approach to get sufficient credit score is to promote nearer to the cash.

The issue with slender condors is that the unfold can simply be breached, just like what occurred on January 22, when the worth went all the way in which to the short-call choice.

At this level, the investor rolls the put unfold up:

Date: January 22

Value: XLK @ $240.50

Promote to shut February 21 XLK $215 put @ $0.42Buy to shut February 21 XLK $225 put @ $0.97Buy to open February 21 XLK $225 put @ $0.97Sell to open February 21 XLK $235 put @ $2.61

Internet credit score: $108

The danger within the commerce has been lowered to -$450.

The P&L is down solely -$32 with nonetheless 30 days until expiration.

On January 27, the worth swung the opposite means:

Rolling the decision unfold down to gather extra credit score.

Date: January 27

Value XLK @ $229

Promote to shut February 21 XLK $250 name $0.30Buy to shut February 21 XLK $240 name $1.50Buy to open February 21 XLK $245 name $0.66Sell to open February 21 XLK $235 name $3.15

Internet credit score: $128

The danger is all the way down to $325.

On January 31, with 21 left to expiration, the commerce is again to breakeven, with the worth sitting proper on the middle of the butterfly:

The investor has one final trick in his toolbox to additional cut back the danger of the commerce.

That is to roll within the butterfly’s wings to slender it.

Date: January 31

Value: XLK @ $235

Promote to shut the $245 name @ $1.20Buy to open the $240 name @ $2.63Sell to shut the $225 put @ $1.56Buy to open the $230 put @ $2.67

Debit: -$255

However this time, the transfer requires a debit.

Nevertheless, the danger within the commerce has dropped all the way down to about $75.

Then, on February 7, with 14 days until expiration, the commerce confirmed a revenue of $27.

Some traders might name it quits right here.

Nevertheless, with such a small threat on the desk, some traders might take the gamble to carry until expiration, hoping for a pin commerce the place XLK finally ends up near $235 at expiration.

The investor was intent on all the time making changes that lowered the general threat within the commerce.

This got here within the type of rolling the untested aspect in or rolling out in time with a purpose to acquire credit.

The draw back is that it narrows the condor, making the worth a lot simpler to breach considered one of its sides.

In some unspecified time in the future, the condor turns into so slender that it turns into a butterfly.

We hope you loved this text on how an iron condor grew to become a butterfly.

When you have any questions, please ship an e-mail or go away a remark under.

Commerce protected!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for traders who should not accustomed to trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.