Up to date on November eighth, 2024 by Bob Ciura

Buyers trying to generate greater earnings ranges from their funding portfolios ought to have a look at Actual Property Funding Trusts or REITs.

These are corporations that personal actual property properties and lease them to tenants, or put money into actual property backed loans, each of which generate a gradual stream of earnings.

The majority of their earnings is then handed on to shareholders by dividends.

You’ll be able to see all 200+ REITs right here.

You’ll be able to obtain our full listing of REITs, together with essential metrics reminiscent of dividend yields and market capitalizations, by clicking on the hyperlink beneath:

The fantastic thing about REITs for earnings buyers is that they’re required to distribute 90% of their taxable earnings to shareholders yearly within the type of dividends. In return, REITs sometimes don’t pay company taxes.

In consequence, lots of the 200+ REITs we observe provide excessive dividend yields of 5%+.

However not all high-yielding shares are automated buys. Buyers ought to rigorously assess the basics to make sure that excessive yields are sustainable.

Observe that whereas the securities on this article have very excessive yields, a excessive yield alone doesn’t make for a strong funding. Dividend security, valuation, administration, steadiness sheet well being, and progress are additionally essential components.

We urge buyers to make use of the evaluation beneath as informative however to do vital due diligence earlier than shopping for into any safety – particularly high-yield securities.

Many (however not all) high-yield securities have a big threat of a dividend discount and/or deteriorating enterprise outcomes.

Desk of Contents

You’ll be able to immediately leap to any particular part of the article through the use of the hyperlinks beneath:

Excessive-Yield REIT No. 10: New York Mortgage REIT (NYMT)

New York Mortgage Belief acquires, invests in, funds, and manages mortgage-related belongings and different monetary belongings. The belief doesn’t personal bodily actual property, however slightly seeks to handle a portfolio of investments which can be actual property associated.

The belief invests in residential mortgage loans, multi household CMBS, most well-liked fairness, and three way partnership fairness.

NYMT posted second quarter earnings on July thirty first, 2024, and outcomes had been fairly weak as soon as once more. Adjusted earnings-per-share got here to a lack of 25 cents, which missed estimates for a revenue of a dime by 35 cents. Complete internet curiosity earnings was $19.04 million, which was up 26% year-over-year, however nonetheless missed estimates by over $4 million.

Administration famous that latest rate of interest market exercise was indicative of falling inflation and a slowing economic system, with the two-year Treasury falling 29 foundation factors from its 2024 peak.

Click on right here to obtain our most up-to-date Certain Evaluation report on NYMT (preview of web page 1 of three proven beneath):

Excessive-Yield REIT No. 9: World Web Lease (GNL)

World Web Lease invests in industrial properties within the U.S. and Europe with an emphasis on sale-leaseback transactions. GNL’s portfolio consists of over 1300 properties, spanning almost 67 million sq. toes with a gross asset worth of $9.2 billion.

On August 6, 2024, World Web Lease reported its monetary outcomes for the second quarter of 2024. The corporate recorded a internet loss per share of $0.20, lacking expectations by $0.05. Income for the quarter was $203.29 million, which, regardless of representing a big 112.10% year-over-year enhance, missed estimates by $2.06 million.

Throughout the quarter, GNL elevated its Adjusted Funds from Operations (AFFO) per share by 2% to $0.33, whereas lowering its excellent debt by $251 million. This debt discount improved the corporate’s Web Debt to Adjusted EBITDA ratio from 8.4x to eight.1x.

Click on right here to obtain our most up-to-date Certain Evaluation report on World Web Lease (GNL) (preview of web page 1 of three proven beneath):

Excessive-Yield REIT No. 8: Ares Industrial Actual Property (ACRE)

Ares Industrial Actual Property Company is a specialty finance firm primarily engaged in originating and investing in industrial actual property (“CRE”) loans and associated investments. ACRE generated round $198.6 million in curiosity earnings final 12 months.

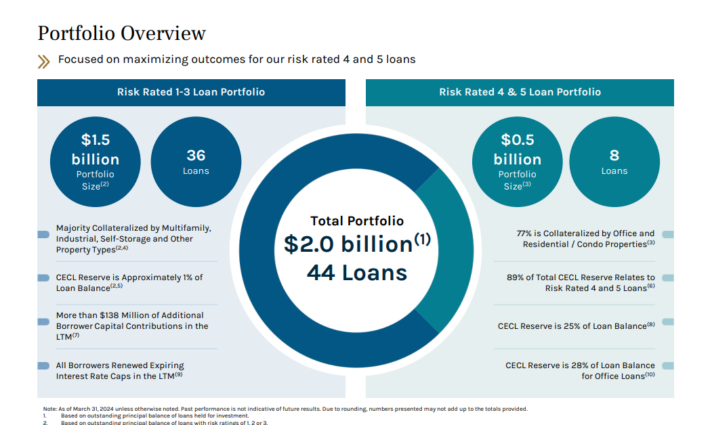

The corporate’s mortgage portfolio (98% of that are senior loans) includes 44 market loans throughout 8 asset varieties, with an impressive principal steadiness of $2 billion. Nearly all of the loans are tied to multifamily, workplace, and mixed-use properties.

Supply: Investor Presentation

When it comes to geographical diversification, ACRE’s publicity encompasses a wholesome combine between the Southeast, West, and Midwest.

On August sixth, 2024, ACRE reported its Q2 outcomes for the interval ending June thirtieth, 2024. Curiosity earnings got here in at $40.8 million, 21% decrease year-over-year.

The decline was as a result of firm’s loans struggling to carry out as greater charges of inflation and sure cultural shifts reminiscent of work-from-home tendencies proceed to affect the working efficiency and the financial values of business actual property.

Within the meantime, curiosity expense rose by 2% to about $27.5 million. Thus, complete revenues (curiosity earnings – curiosity bills + $3.43 million in income from ACRE’s personal actual property) fell by 33% to roughly $16.8 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on ACRE (preview of web page 1 of three proven beneath):

Excessive-Yield REIT No. 7: Dynex Capital (DX)

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged foundation in the US. It invests in company and non–company MBS consisting of residential MBS, industrial MBS (CMBS), and CMBS curiosity–solely securities.

Supply: Investor presentation

Dynex Capital introduced its second-quarter 2024 monetary outcomes on July 22, 2024. The corporate reported a complete financial lack of $(0.31) per frequent share, which represents a lower of two.4% of the start guide worth. The guide worth per frequent share was $12.50 as of June 30, 2024.

The great loss was $(0.18) per frequent share, and the online loss was $(0.15) per frequent share. Regardless of these losses, Dynex declared dividends of $0.39 per frequent share for the second quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on DX (preview of web page 1 of three proven beneath):

Excessive-Yield REIT No. 3: Two Harbors Funding Corp. (TWO)

Two Harbors Funding Corp. is a residential mortgage actual property funding belief (mREIT). As such, it focuses on residential mortgage-backed securities (RMBS), residential mortgage loans, mortgage servicing rights, and industrial actual property.

The belief derives almost all of its income within the type of curiosity by available-for-sale securities.

Two Harbors Funding Corp. (TWO) reported its second-quarter 2024 monetary outcomes, exhibiting earnings per share (EPS) of $0.17, lacking estimates by $0.27. Income for the quarter was -$38.25 million, down 8.48% year-over-year, lacking expectations by $328,000.

Regardless of the difficult market situations, the corporate delivered steady outcomes, sustaining a guide worth of $15.19 per frequent share and declaring a second-quarter frequent inventory dividend of $0.45 per share. For the primary six months of 2024, Two Harbors generated a 5.8% complete financial return on guide worth.

The corporate generated complete earnings of $0.5 million, or $0.00 per weighted common primary frequent share, and repurchased $10.0 million in convertible senior notes due 2026.

Click on right here to obtain our most up-to-date Certain Evaluation report on TWO (preview of web page 1 of three proven beneath):

Excessive-Yield REIT No. 2: Sachem Capital (SACH)

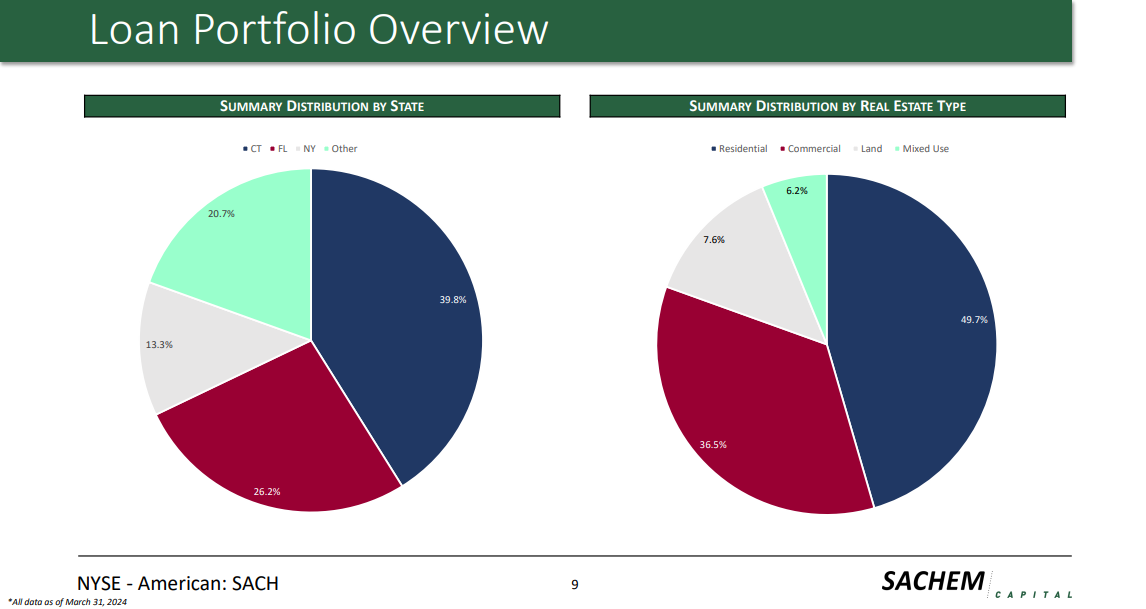

Sachem Capital Corp is a Connecticut-based actual property finance firm that focuses on originating, underwriting, funding, servicing, and managing a portfolio of short-term (i.e., three years or much less) loans secured by first mortgage liens on actual property positioned primarily in Connecticut.

Every of Sachem’s loans is personally assured by the principal(s) of the borrower, which is often collaterally secured by a pledge of the guarantor’s curiosity within the borrower. Sachem generates round $65 million in complete revenues.

Supply: Investor Presentation

On August 14th, 2024, Sachem Capital posted its Q2 outcomes for the interval ending June thirtieth, 2024. Complete revenues for the quarter got here in at $15.2 million, down 7% in comparison with Q2-2023.

The lower in curiosity earnings was resulting from decrease variety of loans originated, modified or prolonged in in comparison with final 12 months. In consequence, payment earnings from loans, primarily made up of origination charges, had been down about 37.2% year-over-year.

Click on right here to obtain our most up-to-date Certain Evaluation report on SACH (preview of web page 1 of three proven beneath):

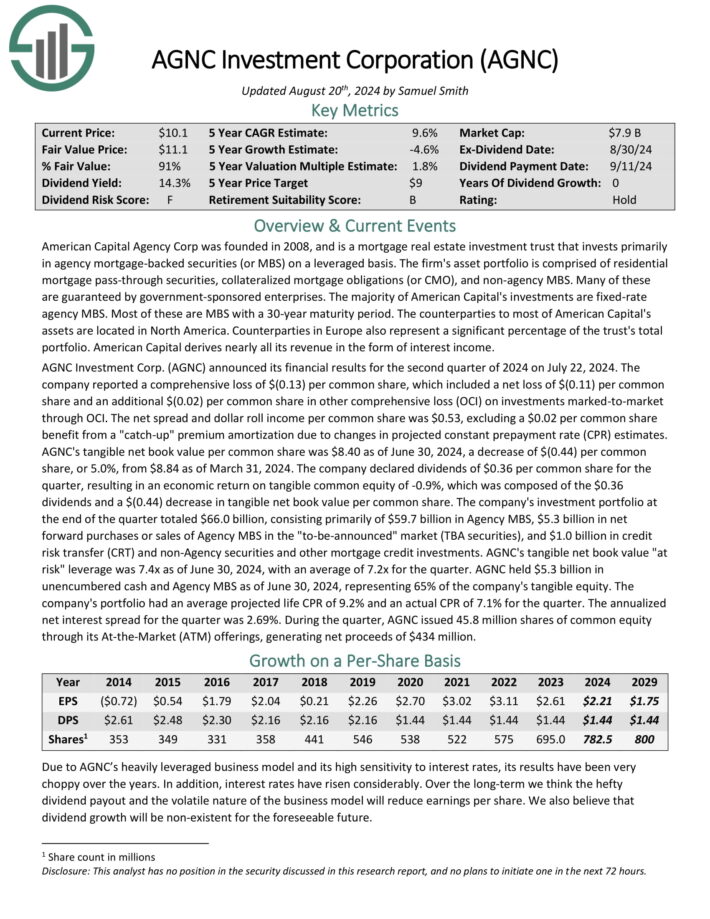

Excessive-Yield REIT No. 5: AGNC Funding Corp. (AGNC)

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage cross–by securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

AGNC Funding Corp. (AGNC) introduced its monetary outcomes for the second quarter of 2024 on July 22, 2024. The corporate reported a complete lack of $(0.13) per frequent share, which included a internet lack of $(0.11) per frequent share and a further $(0.02) per frequent share in different complete loss (OCI) on investments marked-to market by OCI.

The online unfold and greenback roll earnings per frequent share was $0.53, excluding a $0.02 per frequent share profit from a “catch-up” premium amortization resulting from adjustments in projected fixed prepayment charge (CPR) estimates.

AGNC’s tangible internet guide worth per frequent share was $8.40 as of June 30, 2024, a lower of $(0.44) per frequent share, or 5.0%, from $8.84 as of March 31, 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on AGNC Funding Corp (AGNC) (preview of web page 1 of three proven beneath):

Excessive-Yield REIT No. 4: Ellington Credit score Co. (EARN)

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated belongings. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities businesses or enterprises, whereas non-agency MBS are not assured by the federal government.

Supply: Investor Presentation

On August twelfth, 2024, Ellington Residential reported its second quarter outcomes for the interval ending June thirtieth, 2024. The corporate generated a internet lack of $(0.8) million, or $(0.04) per share.

Ellington achieved adjusted distributable earnings of $7.3 million within the quarter, resulting in adjusted earnings of $0.36 per share, which coated the dividend paid within the interval.

Ellington’s internet curiosity margin was 4.24% total. At quarter finish, Ellington had $118.8 million of money and money equivalents, and $44 million of different unencumbered belongings.

Click on right here to obtain our most up-to-date Certain Evaluation report on EARN (preview of web page 1 of three proven beneath):

Excessive-Yield REIT No. 3: ARMOUR Residential REIT (ARR)

ARMOUR Residential invests in residential mortgage-backed securities that embody U.S. Authorities-sponsored entities (GSE) reminiscent of Fannie Mae and Freddie Mac.

It additionally consists of Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate dwelling loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different sorts of investments.

Supply: Investor presentation

ARR reported its unaudited second-quarter 2024 monetary outcomes and monetary place as of June 30, 2024. The corporate introduced a GAAP internet loss associated to frequent stockholders of $(51.3) million or $(1.05) per frequent share.

The corporate generated internet curiosity earnings of $7.0 million and distributable earnings accessible to frequent stockholders of $52.5 million, equating to $1.08 per frequent share.

ARMOUR paid frequent inventory dividends of $0.24 per share per 30 days, totaling $0.72 per share for the second quarter. The typical curiosity earnings on interest-earning belongings was 5.00%, whereas the curiosity price on common interest-bearing liabilities was 5.52%. The financial curiosity earnings was 4.74%, with an financial internet curiosity unfold of two.05%.

Click on right here to obtain our most up-to-date Certain Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven beneath):

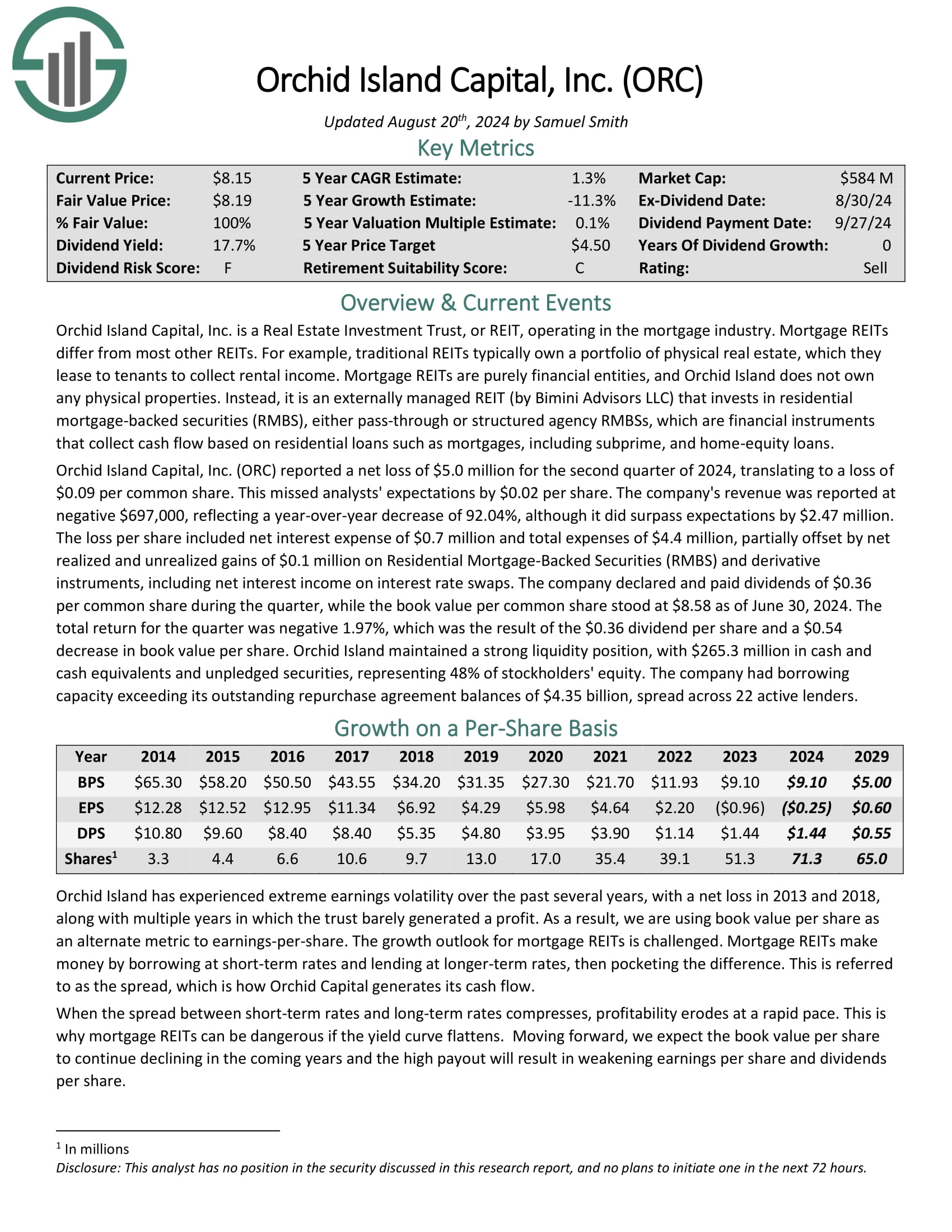

Excessive-Yield REIT No. 1: Orchid Island Capital Inc (ORC)

Orchid Island Capital is a mortgage REIT that’s externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), together with pass-through and structured company RMBSs.

These monetary devices generate money circulate primarily based on residential loans reminiscent of mortgages, subprime, and home-equity loans.

Orchid Island reported a internet lack of $5.0 million for the second quarter of 2024, translating to a lack of $0.09 per frequent share. This missed analysts’ expectations by $0.02 per share.

The corporate’s income was reported at destructive $697,000, reflecting a year-over-year lower of 92.04%, though it did surpass expectations by $2.47 million.

Supply: Investor Presentation

The loss per share included internet curiosity expense of $0.7 million and complete bills of $4.4 million, partially offset by internet realized and unrealized positive factors of $0.1 million on Residential Mortgage-Backed Securities (RMBS) and by-product devices, together with internet curiosity earnings on rate of interest swaps.

The corporate declared and paid dividends of $0.36 per frequent share throughout the quarter, whereas the guide worth per frequent share stood at $8.58 as of June 30, 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on Orchid Island Capital, Inc. (ORC) (preview of web page 1 of three proven beneath):

Ultimate Ideas

REITs have vital enchantment for earnings buyers resulting from their excessive yields. These 10 extraordinarily high-yielding REITs are particularly enticing on the floor, though buyers needs to be conscious that abnormally excessive yields are sometimes accompanied by elevated dangers.

In case you are focused on discovering high-quality dividend progress shares and/or different high-yield securities and earnings securities, the next Certain Dividend sources shall be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.