Merchants,

I sit up for sharing my ideas and high concepts with you for the upcoming week.

This week’s format will differ barely from earlier weeks as I’m touring this weekend. So there’ll simply be a weblog put up and no video this weekend.

However relaxation assured, I cannot depart you hanging. I’ve a prolonged watchlist of names for the upcoming week, and I’ll present a short and concise plan for every.

As mentioned in my most up-to-date Inside Entry assembly, I noticed a major shift in market sentiment and momentum. With that shift, a number of high swing lengthy setups introduced themselves. Most not too long ago and notably was the ASTS breakout from Friday, as I mentioned in Thursday’s Inside Entry assembly.

For the week forward, my focus shifts from breakouts to larger lows in a number of names that broke out and bucked the development, together with some small caps on look ahead to pops to quick.

Larger Low in GOOGL

The Concept: Help was discovered, and a better low was shaped inside a better timeframe (day by day and weekly chart). Going ahead, in search of additional construct and continuation to the upside because the bounce continues.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components reminiscent of liquidity, slippage and commissions.

The Plan: I gained’t chase highs. As a substitute, I’m in search of a base to develop over Friday’s low / The next low formation on the hourly chart if the inventory can pull again close to $154 for entry to the lengthy aspect with a cease vs. LOD.

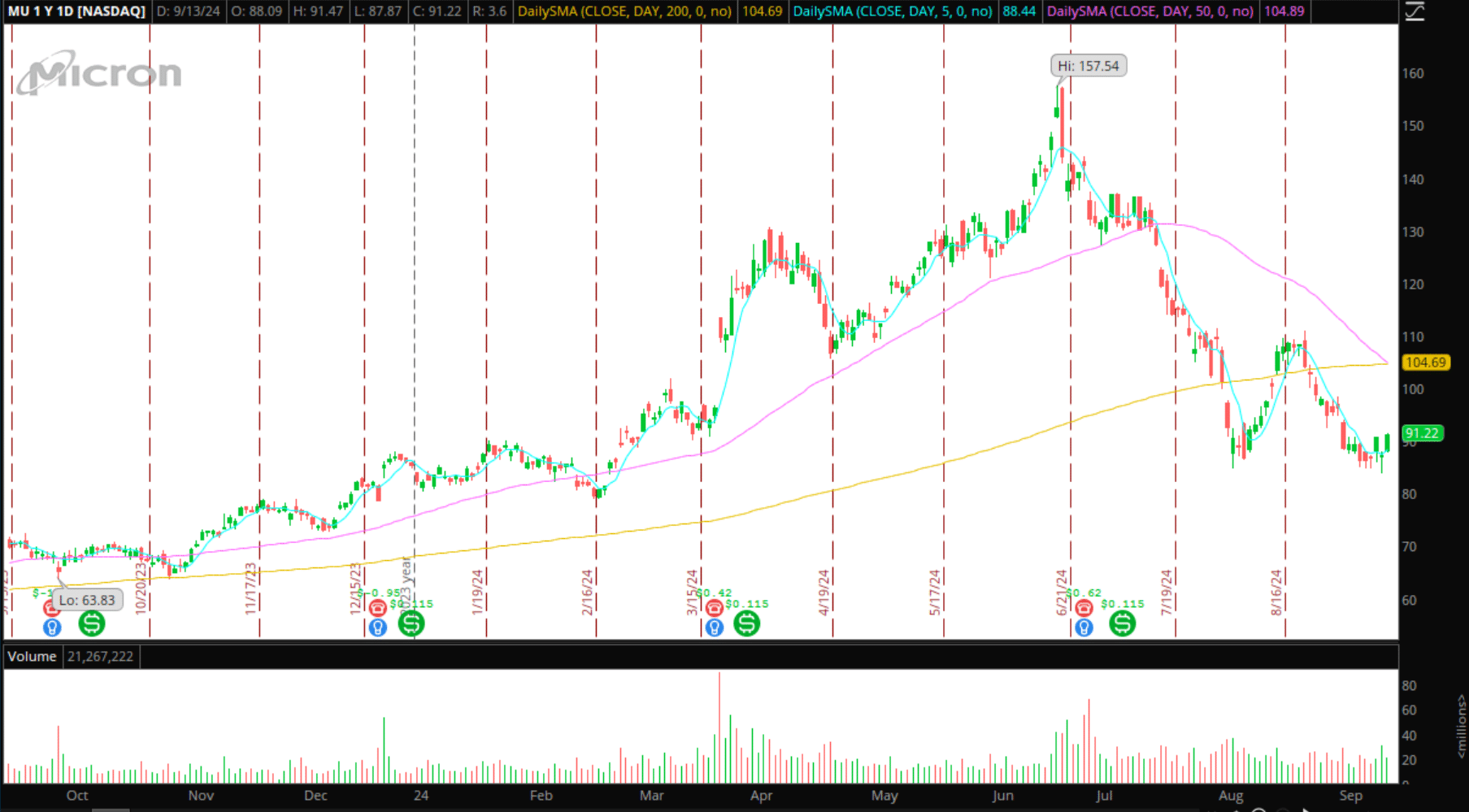

Continuation in MU

The Concept: Double-bottom formation in MU.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components reminiscent of liquidity, slippage and commissions.

The Plan: Additional construct and help above Friday’s excessive for a protracted entry versus the day’s low. Alternatively, a pullback and better low confirmed close to its 5-day SMA.

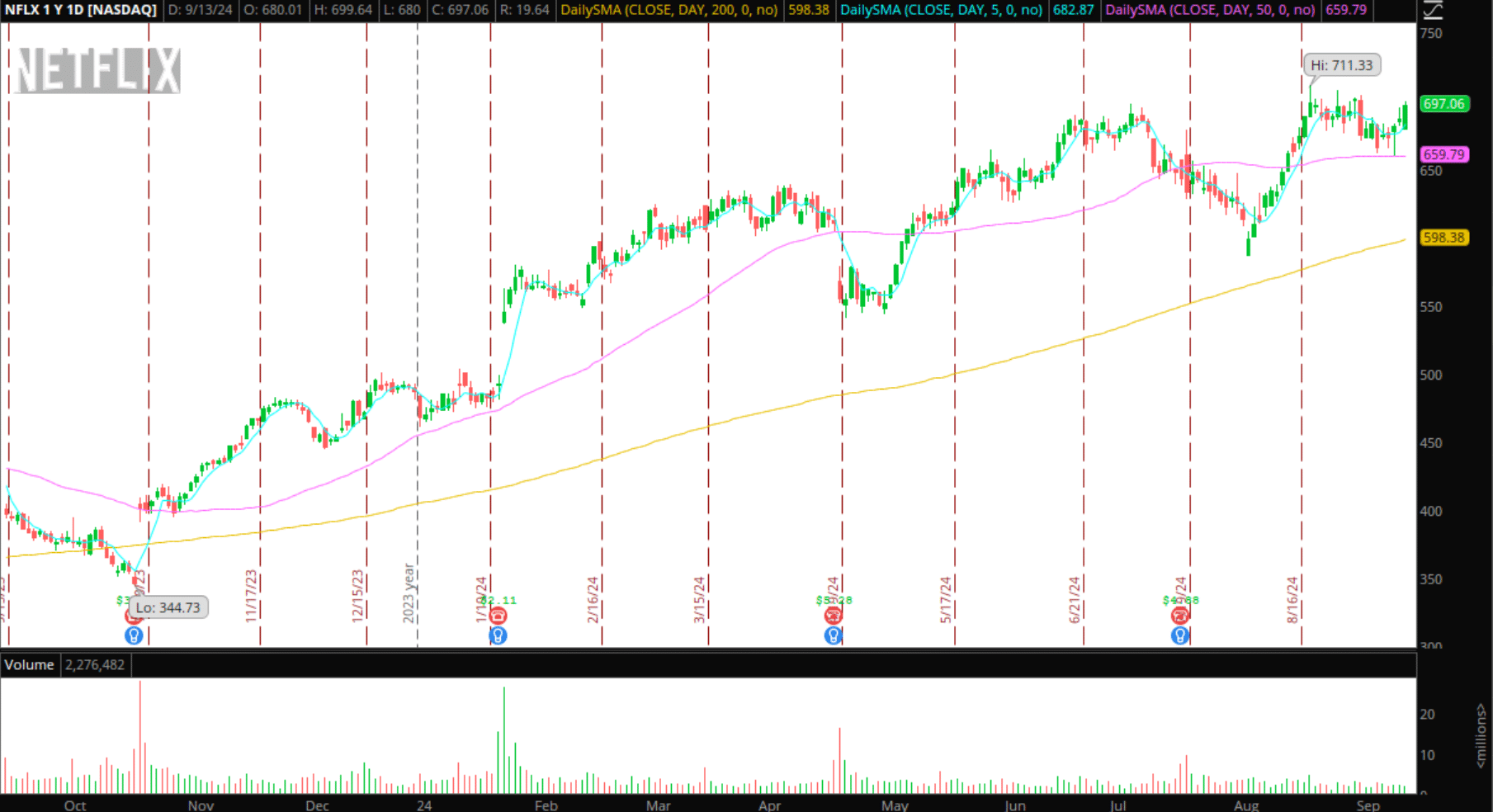

Breakout in NFLX

The Concept: Consolidation close to 52-week Highs, approaching vital breakout zone.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components reminiscent of liquidity, slippage and commissions.

The Plan: Relative energy on a market pullback, confirming a better low and maintain over the 2-day / multi-day VWAP for a starter lengthy place. I might look so as to add/provoke a place if NFLX breaks above Friday’s excessive with elevated quantity and bases above the excessive – confirming consumers have stepped larger.

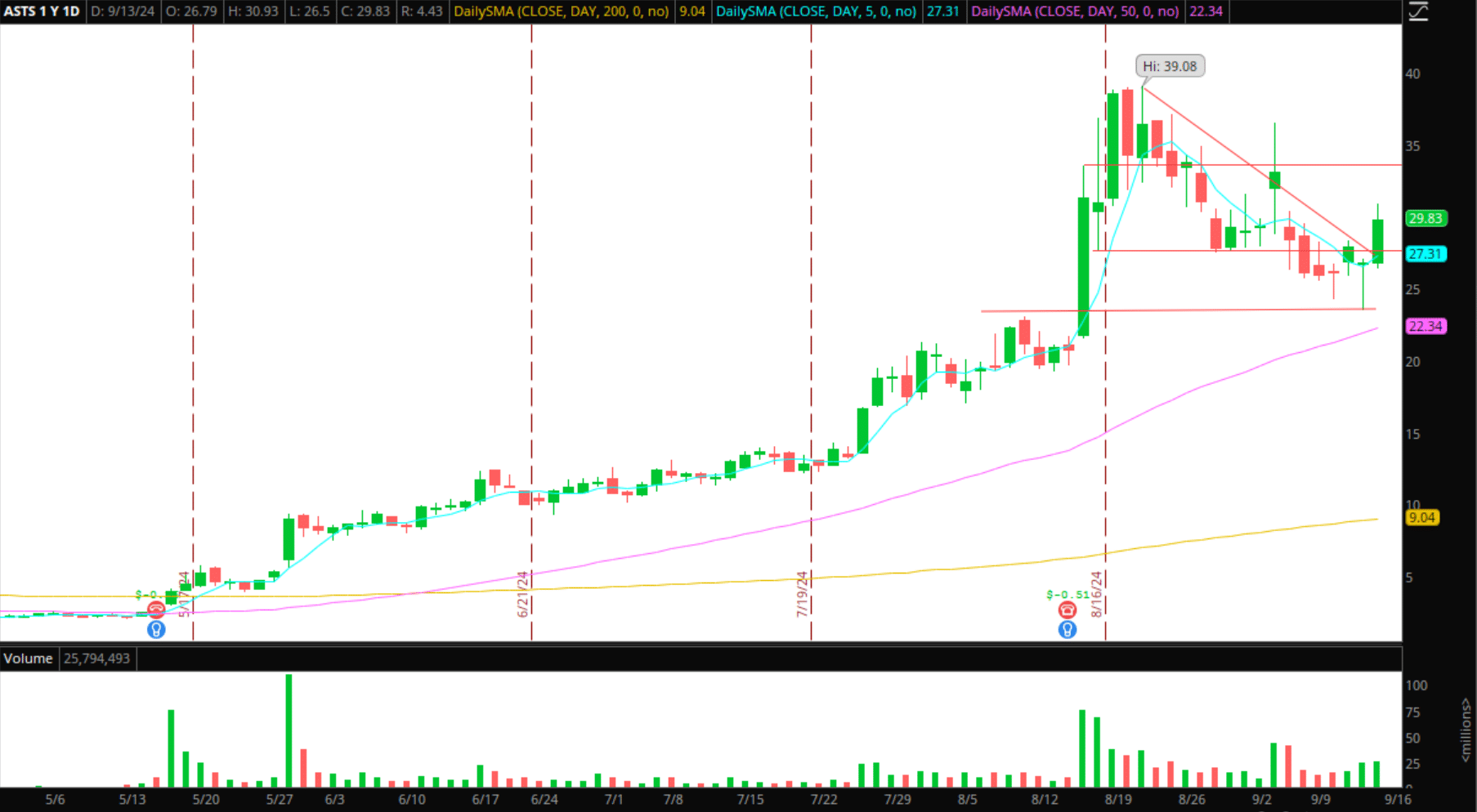

Continuation in ASTS

Following on from the breakout concept given on Thursday within the Inside Entry assembly, I’m now in search of a maintain over the multi-day VWAP and reclaim of $30. After that, I’ll look to be lengthy versus the LOD for continuation, concentrating on a transfer above Friday’s excessive to start trailing my cease on the 5-minute timeframe.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components reminiscent of liquidity, slippage and commissions.

Small Cap Watchlist

IMRX: Failure to reclaim its 2-day / multi-day VWAP for a brief and momentum to the draw back. Concentrating on a fast push and fail close to $2.20 + and fail for a day two quick.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components reminiscent of liquidity, slippage and commissions.

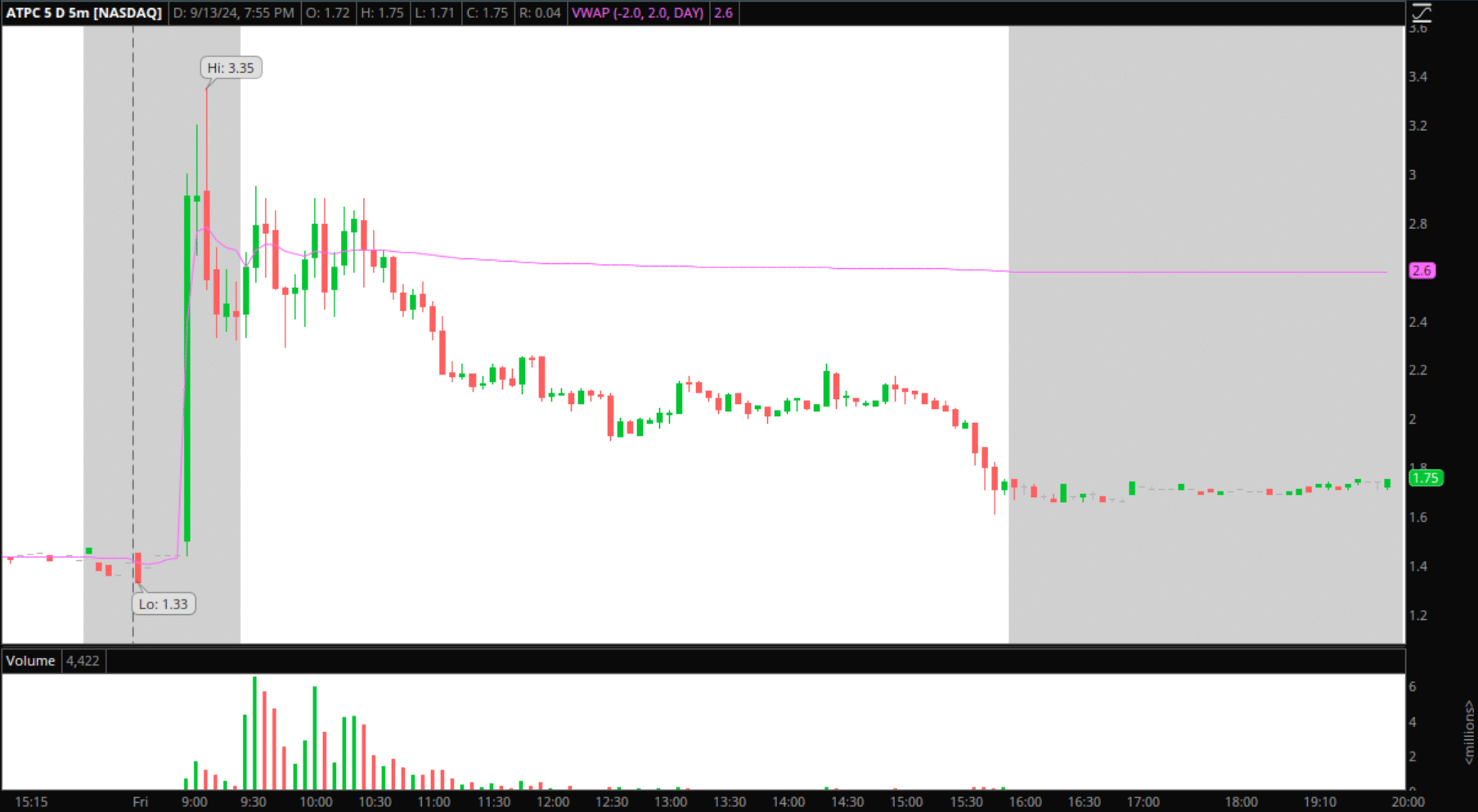

ATPC: Comparable ideas to IMRX. Ideally, a major push close to its 2-day VWAP, $2.2 – $2.5 and fail for the quick.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components reminiscent of liquidity, slippage and commissions.

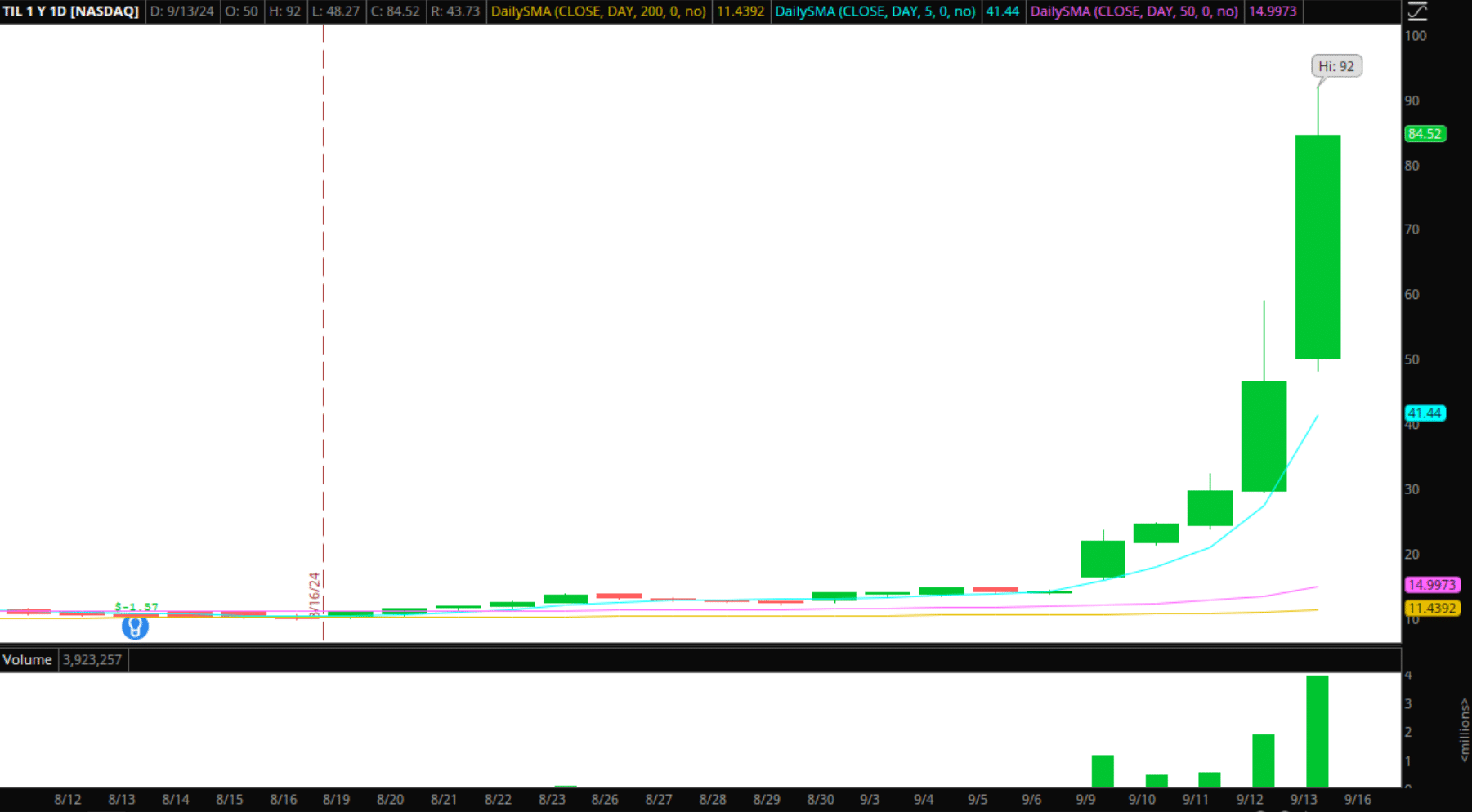

TIL: No real interest in going lengthy at these costs. Certainly, it’s not a inventory to observe for newer merchants, given the liquidity, unfold, and volatility. As soon as this tops out and confirms the bottom, I’ll search for a decrease excessive quick versus a definitive stage with well-defined danger.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components reminiscent of liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Necessary Disclosures