Immediately, we’ll take a look at the choice Greek gamma with regard to credit score spreads.

Whereas many merchants are accustomed to Delta, Gamma is commonly ignored, but it performs an important position, significantly within the habits of credit score spreads.

Contents

The primary few Greeks an choice dealer may be taught are delta, vega, and theta.

They point out how an choice place’s revenue and loss (P&L) may change if the underlying worth, volatility, and passage of time change.

Gamma is completely different as a result of it signifies how delta modifications because the underlying worth modifications.

Gamma positively impacts the place’s P&L.

Nevertheless it doesn’t have an effect on it immediately.

Gamma impacts delta, which in flip impacts the P&L.

As such, it’s extra difficult to grasp and is comprehensible after you will have grasp of delta.

An instance at all times helps.

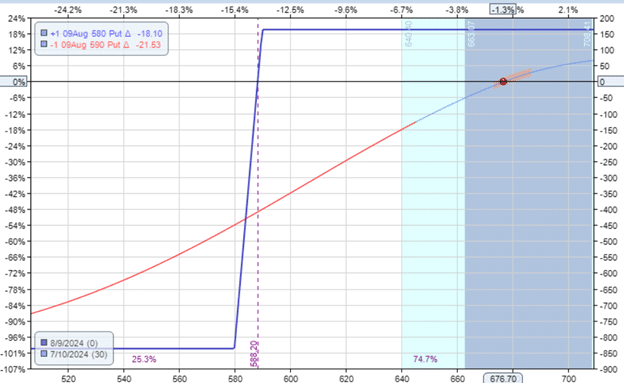

Suppose a dealer has the next credit score unfold on Netflix (NFLX) on July tenth, 2024:

A quick put choice with a strike at $590 and an extended put choice with a strike at $580.

Each with the August ninth expiration, which is 30 days away.

The present Greeks are:

Delta: 3.37Theta: 4.30Vega: -5.65Gamma: -0.07

It is a bull put credit score unfold with a constructive delta of three.37, the place the dealer expects the value of Netflix to go up.

A 3.37 delta in an choice place has a market publicity just like having 3.37 shares of Netflix inventory at $676.70 per share (the value of NFLX on the time).

In different phrases, the bull put unfold has $2280 Delta {Dollars} of publicity.

That’s 3.37 x $676.70.

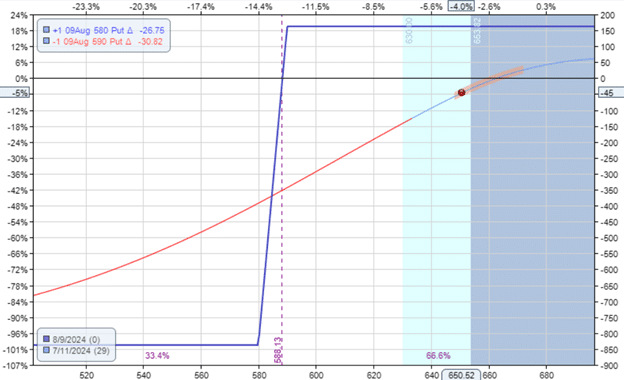

Now, 24 hours later, on July eleventh, the place appears like this as a consequence of a fall in NFLX inventory worth…

And the Greeks at the moment are:

Delta: 4.38Theta: 4.29Vega: -5.39Gamma: -0.06

The P&L (revenue and loss) decreased by $45 as a result of the inventory worth went within the mistaken route.

The delta has elevated from 3.37 to 4.38 due primarily to gamma’s impact.

(We use the time period “primarily” as a result of it’s also affected by different components.

However let’s not over-complicate issues.)

This will increase the Delta {Dollars} publicity to 4.38 x $650.52 = $2849.

Whereas the dealer is likely to be nice with an preliminary $2280 place on NFLX, to start with, he could now not be nice with a $2849 place.

Whereas he could also be nice being bullish at 3.37 delta, he could now not be nice with a 4.38 delta.

A 4.38 place is extra bullish than he had began with.

The worst is that the place turns into bullish when the inventory turns into extra bearish.

The rise in delta made his place worse.

That’s what unfavorable gamma does.

It makes it in order that if the commerce goes in opposition to the dealer, the dealer turns into worse for the dealer.

The bigger the magnitude of this gamma worth, the bigger this impact is.

Once we discuss in regards to the magnitude of gamma, we check with the scale of the quantity with out regard to the signal.

So, a -0.14 gamma has a bigger magnitude than -0.07 and would have a bigger impact.

The impact that gamma has is that it modifications delta.

The bigger the gamma worth, the extra it modifications delta when the value strikes.

A -0.14 gamma will change the delta greater than a -0.07 gamma for a given one-point transfer within the inventory worth.

In technical phrases, we are saying that gamma is the speed of change of delta with respect to the value.

4 Ideas For Higher Iron Condors

No.

Gamma will be unfavorable or constructive for credit score spreads relying on how close to or far the unfold is from the present worth.

For much out-of-the-money credit score unfold (as in our instance the place the put spreads are far out of the cash at round 20-delta within the choice chain), gamma is unfavorable.

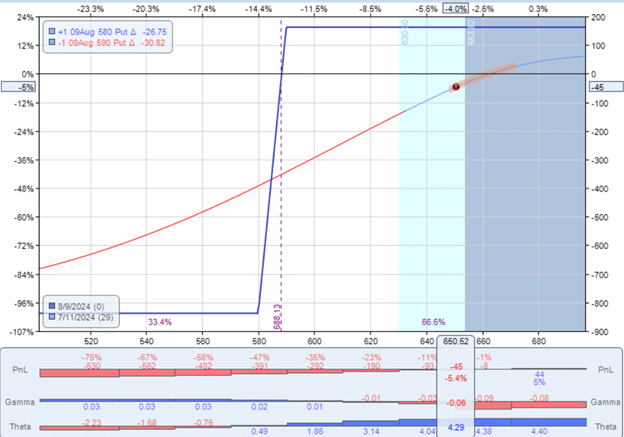

If I activate the gamma histogram in OptionNet Explorer:

You may see that in some unspecified time in the future, when the value of NFLX drops far sufficient such that the credit score unfold turns into within the cash, gamma turns into constructive (as indicated by the blue histogram).

Constructive gamma signifies that the delta will improve because the inventory worth will increase.

If the inventory worth goes down, then delta will lower.

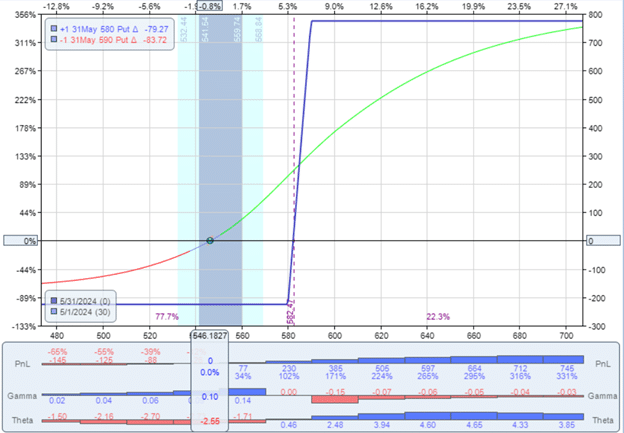

Let’s say we have now an in-the-money $590/$580 bull put credit score unfold as within the following when the NFLX worth is at $546:

We see that we have now a constructive 0.10 gamma.

If NFLX goes up (which is favorable), then the delta will improve (which can also be favorable for the place).

If NFLX goes down (which is bearish), then gamma will trigger delta to lower to make the place much less bullish.

So, in impact, a constructive gamma tends to assist a place as the value strikes.

A unfavorable gamma tends to harm a place as the value strikes.

Most merchants are promoting out-of-the-money credit score spreads with unfavorable gamma.

A big magnitude of gamma causes the delta to alter quite a bit.

When the delta modifications quite a bit, the P&L of the place can change quite a bit as the value strikes (even when the value strikes by just a bit).

That is what’s known as gamma danger.

Gamma will get bigger nearer to expiration.

Some merchants don’t need their delta to alter, particularly not change in a manner that makes their place go in opposition to them extra (assuming that their place has a unfavorable gamma).

Subsequently, they want to cut back the quantity of unfavorable gamma.

There’s at all times a trade-off.

By decreasing the magnitude of gamma, in addition they cut back theta, which they won’t need if their place depends partly on constructive theta to generate revenue (as within the case of credit score spreads).

Research the above gamma and theta histograms.

For probably the most half, with some small minor exceptions, each time gamma is unfavorable, then theta is constructive.

Every time theta is constructive, then gamma is unfavorable.

The larger the magnitude of theta, the larger the magnitude of gamma.

Once you attempt to lower unfavorable gamma, you’ll lower theta as a facet impact.

Once you attempt to improve theta, you’ll improve the quantity of unfavorable gamma.

Constructive theta merchants (who make their cash from time decay) and credit score unfold merchants (who partially make their cash from time decay) should dwell with unfavorable gamma.

Detrimental gamma is a unfavorable for his or her place.

It makes issues worse if the commerce goes in opposition to them.

And if the commerce goes of their favor, it makes their credit score spreads much less highly effective.

What about delta-neutral merchants?

They’re the identical as constructive theta merchants.

Giant gamma can also be a unfavorable for them as a result of the gamma modifications their delta after they desire their delta to be as near zero as doable.

What about lengthy gamma merchants?

Sure, some merchants love massive constructive gamma.

However that could be a completely different story, and they aren’t buying and selling the out-of-the-money credit score spreads we’re discussing immediately.

We hope you loved this text on how gamma impacts credit score spreads.

If in case you have any questions, please ship an electronic mail or go away a remark beneath.

Commerce protected!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who usually are not accustomed to alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.