Maskot

On August twentieth, the administration group at Jack Henry & Associates, Inc. (NASDAQ:JKHY) introduced monetary outcomes protecting the ultimate quarter of the corporate’s 2024 fiscal 12 months. The agency fell wanting expectations when it got here to income. Nevertheless, earnings exceeded forecasts, if simply barely. These combined outcomes despatched shares down roughly 1%. And contemplating how risky the market is, that’s an insignificant transfer. Extra probably than not, the combined outcomes have been kind of offset by the truth that administration got here out with steering for the 2025 fiscal 12 months that, if administration achieves it, ought to bode properly for traders.

I’ve some previous with Jack Henry & Associates. Simply over a 12 months in the past, in early August 2023, I wrote an article that took a slightly impartial stance on the agency. At the moment, the corporate was main as much as its earnings launch for the ultimate quarter of its 2023 fiscal 12 months. Administration had been profitable in rising the corporate from a income perspective. Nevertheless, earnings have been on the downswing. Add on high of this how shares are priced, and I concluded on the time that traders would most likely be smart to take a seat ‘on the sidelines’ till extra information painted a transparent image.

Once I write an organization a ‘maintain’, it is my assertion that shares are more likely to carry out alongside the traces of the broader marketplace for the foreseeable future. Nevertheless, Jack Henry & Associates has fallen wanting these expectations. Shares are literally down 2.7% whereas the S&P 500 is up 23.8%. That is regardless of the truth that continued development has been achieved. And in all probability, that development will proceed for the 2025 fiscal 12 months. Since then, I personally have gotten a bit extra cautious. That is largely due to broader financial issues. Add on high of this how shares are priced relative to related corporations, and it would not be out of the query to downgrade the inventory from a ‘maintain’ to a ‘promote’. And I might have carried out that, had it not been for my recollection of the standard of the enterprise that traders have a possibility to purchase into. That high quality and the expansion potential of the enterprise have satisfied me to maintain it rated a ‘maintain’ in the intervening time.

A combined quarter

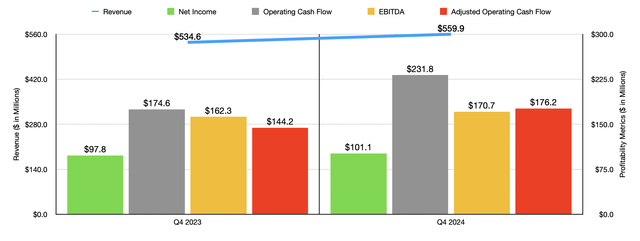

For the ultimate quarter of the 2024 fiscal 12 months, Jack Henry & Associates achieved respectable development. Income got here in at $559.9 million. That is a rise of 4.7% in comparison with the $534.6 million reported only one 12 months earlier. Sadly, it did nonetheless fall wanting analysts’ expectations to the tune of $3.1 million. Wanting deeper, we will see how every of the foremost elements of the corporate carried out throughout this time. Providers and assist income, as an example, elevated by only one.5% 12 months over 12 months. Administration mentioned that this was due to information processing and internet hosting income development of 11.5%. Nevertheless, the agency did undergo from a lower in deconversion income on a quarter-over-quarter foundation.

Creator – SEC EDGAR Information

Deconversion income is just not a typical subject in terms of corporations. Nevertheless, in response to the administration group at Jack Henry & Associates, that is largely income that’s generated when considered one of its prospects agrees to be acquired by one other monetary establishment. This usually ends in the termination of a buyer’s contract with the enterprise. In essence, that is administration’s assertion that this decline in income was outdoors of its management. So if we give the corporate credit score for this, this shortfall in income needs to be weighed solely flippantly. The market is much from environment friendly, however I do suppose that it is environment friendly sufficient to know this. And it is that effectivity that most likely contributed to the muted response by the market.

The corporate additionally generates income from sure processing actions. The truth is, throughout the newest quarter, 43.4% of its total gross sales got here from these actions. Throughout the quarter, processing income popped greater by 9.2%. This was largely due to an 8.3% rise in card income and transaction and digital income development of 14%. Greater fee processing and distant seize, in addition to ACH revenues, all contributed to this transfer up as properly.

As I acknowledged in my prior article on the enterprise, at the moment, the enterprise was affected by weak spot in its backside line. However these days are actually gone. Throughout the newest quarter, administration reported earnings per share of $1.38. That is barely above the $1.34 per share reported on the identical time final 12 months. It is also $0.06 greater than what analysts have been anticipating it to be. The earnings per share reported by administration translated to an increase in internet revenue from $97.8 million final 12 months to $101.1 million this 12 months. However this was not the one profitability metric to see development. Working money circulation popped from $174.6 million to $231.8 million. If we regulate for modifications in working capital, we get a extra modest rise from $144.2 million to $176.2 million. And at last, EBITDA for the corporate managed to develop from $162.3 million to $170.7 million.

Creator – SEC EDGAR Information

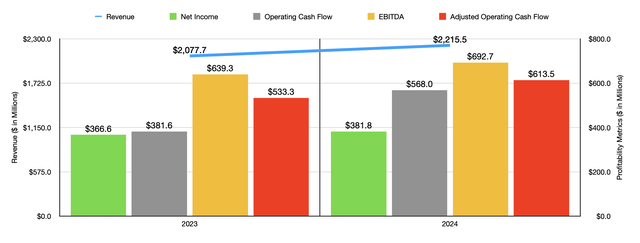

Within the chart above, you’ll be able to see monetary outcomes for all of 2024 in comparison with all of 2023. The expansion in income, earnings, and money flows, all present that the power seen within the closing quarter of this 12 months was not a fluke. The truth is, it seems to be a part of a development whereby the corporate is lastly returning to development on its backside line. The beauty of that is that administration expects this to proceed. Income for 2025 is forecasted to be between $2.369 billion and $2.391 billion. If this involves fruition on the midpoint, it will translate to a year-over-year improve of seven.4%. In the meantime, earnings per share ought to are available at between $5.78 and $5.87. On the midpoint, this may translate to a internet revenue of $425.6 million. That is comfortably above the $381.8 million the corporate reported for 2024.

Sadly, administration has not come out with any estimates in terms of the 2025 fiscal 12 months from a money circulation perspective. Nevertheless, it would not be a stretch to simply annualize outcomes primarily based on projected earnings development for 2025. By doing this, we might get an adjusted working money circulation of $683.9 million and EBITDA of $772.2 million. Utilizing these figures, it turns into a fairly straightforward course of to worth the corporate.

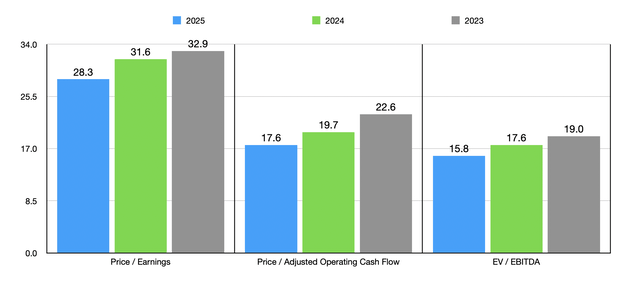

Creator – SEC EDGAR Information

Within the chart above, you’ll be able to see how shares are priced utilizing estimates for 2025, in addition to historic outcomes for each 2023 and 2024. Given how latest the 2024 figures are, I’ve determined to make use of these in valuing the enterprise relative to 5 related corporations as proven within the desk beneath. Sadly, whereas shares aren’t ridiculously expensive on their very own, they’re slightly costly in comparison with comparable corporations. Utilizing every of the three valuation metrics, I discovered that 4 of the 5 corporations ended up being costlier than our candidate.

Firm Worth/Earnings Worth/Working Money Movement EV/EBITDA Jack Henry & Associates 31.6 19.7 17.6 Constancy Nationwide Info Providers, Inc. (FIS) 58.3 10.5 12.9 Fiserv, Inc. (FI) 29.2 19.0 14.2 PayPal Holdings, Inc. (PYPL) 17.3 10.5 9.8 Automated Information Processing, Inc. (ADP) 29.6 26.7 18.9 World Funds Inc. (GPN) 20.0 12.7 11.0 Click on to enlarge

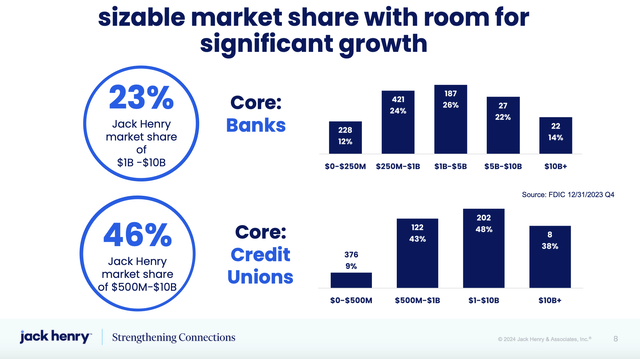

In the long term, the corporate does have some engaging development alternatives. The corporate at present has an honest chunk of management within the markets through which it operates. In relation to banks, it boasts a 23% market share for these establishments with belongings of between $1 billion and $10 billion. Its biggest focus it is on these with belongings of between $1 billion and $5 billion. It boasts a 26% stake there. It additionally has a 46% management of the market of credit score unions with belongings of between $500 million and $10 billion. It additionally has some management over these with belongings exceeding $10 billion.

Jack Henry & Associates

Naturally, this provides the corporate a superb foothold out there. It additionally implies that banks and credit score unions that do not use it are properly conscious of its existence. With the intention to proceed rising on this area, administration makes important investments annually. They aim between 14% and 15% of complete income being allotted towards analysis and growth. This additionally implies that, in principle, the agency may lower its bills slightly considerably if it did not need to develop as quickly. Final 12 months, the agency allotted about $309 million towards analysis and growth prices. The applied sciences they centered on vary from digital options to monetary crimes know-how to cybersecurity and extra.

Whereas making these massive investments, administration can also be centered on returning capital to shareholders. For the fiscal years 2020 by means of 2023, the corporate returned about $1.3 billion to traders. In simply 2024 alone, the corporate paid $155.9 million towards dividends and acquired again one other $28.1 million value of inventory. Whereas administration did tackle $475 million in borrowings on credit score amenities, it really repaid $600 million towards credit score amenities and financing leases. So administration is concentrated on maintaining debt low. And actually, as of the tip of the newest quarter, the enterprise had internet debt of solely $111.7 million.

Takeaway

Essentially talking, Jack Henry & Associates has turn out to be a fairly strong enterprise. Regardless that outcomes have been combined for the quarter, the enterprise did fairly properly. It is an business chief with a superb observe report of worth creation. Nevertheless, shares are very expensive. That is what has prevented me, previously, from taking a extra bullish method to the agency. I perceive that high quality requires a premium. However that is too excessive a premium to justify proper now. Due to this, I’ve determined to maintain the corporate rated a ‘maintain’