BalkansCat

Expensive subscribers,

A number of months in the past, I coated Pernod Ricard (OTCPK:PRNDY) – and I imply to take action once more. You will discover that article right here. A number of subscribers requested me whether or not the corporate was value buying right here – it has, in spite of everything, dropped extra, and the present expectation is for Pernod Ricard to have a fairly headwind-heavy 2024E. This has mistakenly (as I see it) resulted in a scenario the place the corporate is now buying and selling at lower than €131/share for the native, which suggests we’re at a excessive yield and a low P/E of the corporate – regardless of the general high quality that we’ve relating to this enterprise.

My investments in European firms at low valuations usually yield their dividends each within the type of dividend funds, but in addition by way of capital appreciation. Most of my high-conviction performs over the previous 2 years have gone pretty nicely – although there are some that haven’t but reached their designated targets or ranges, and I proceed to place cash to work in these companies.

Pernod Ricard is a kind of companies, and on this article, I imply to point out you why I’m shopping for extra.

Pernod Ricard – I imagine The upside will materialize, and there may be an over 80% upside right here till 2026E.

So, Pernod Ricard. You’ve got most likely adopted my work on the corporate in the event you’re desirous about an replace on that thesis. Pernod hasn’t been undervalued to this diploma in additional than 8 years.

that Pernod hasn’t been undervalued to this diploma in additional than 8 years. This may occasionally appear exhausting to imagine at this level and given how a lot the corporate has dropped within the final 12 months – however there it’s. The corporate doesn’t usually transfer beneath 18.5x P/E – and we’re not at a valuation of round 17.2x. My value foundation is round 17.6x normalized P/E, or beneath €150/share for the native ticker RI, on the French/Parisian inventory market.

The namesake spirit of the corporate is simply one of many firm’s spirits and drinks. Whereas that is actually a really helpful one to attempt in the event you drink alcohol ( The spirit/liqueur is an anise-flavored drink, which means it takes a bit like licorice. It has a taste “cousin” within the inexperienced drink, absinthe. ) the general upside relies on extra than simply Pernod.

This can be a firm promoting €12B value of merchandise in a single 12 months, but it’s right now at a market cap of €33B – which means that it is now at lower than 0.4x to income by way of gross sales. The corporate additionally has an especially low debt of 37% long-term debt/capital, and a BBB+ credit standing. The corporate’s yield is not huge – it isn’t a high-yield enterprise – however at nearly 3.6%, it is among the best in yields in all the section. Higher than Diageo (DEO) and higher than LVMH (OTCPK:LVMUY).

Pernod does the European factor – which means it gives solely full updates twice a 12 months, and in any other case, it gives largely buying and selling updates. We’ve 3Q23 outcomes as of late April 2024.

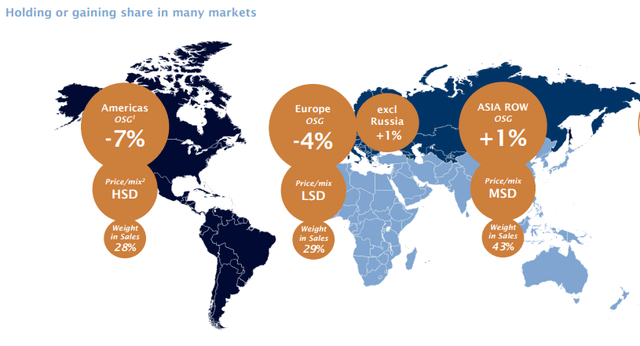

For 3Q24, the corporate reviews sturdy efficiency. Strong efficiency on this context means an natural internet gross sales decline of two% – and that is regardless of the continuing hassle in China. The corporate has progress markets and it has its “must-win” markets – markets like India, Japan, Germany, Turkey, Spain, Brazil, France, and so forth. Progress markets are locations like China.

China stays in a troublesome macroeconomic surroundings because of total political challenges.

Pernod Ricard IR (Pernod Ricard IR)

Excluding the corporate’s problematic markets like Russia, the corporate really grew by way of gross sales, and nearly managed flat 9M24 gross sales for 3Q23. As for volumes, these really grew throughout the quarter, which implies that the corporate really managed to proceed progress after nearly 4 consecutive quarters of decline.

Asia particularly noticed a pleasant rebound in gross sales – 8% progress, apart from China, with robust progress in India (robust demand for spirits, accelerating gross sales, larger premiumization, and the like). If we have a look at China alone, that one is declining 9% because of weak FX and softening client sentiment.

The most effective consequence although, was in International Journey Retail, which was up 38%. Improved sell-out momentum amplified by phasing in addition to total favorable comps.

The corporate was in a position, because of this quarter, to estimate the FY24 outcomes. Since we have already seen the 9M developments, the corporate communicates with a excessive diploma of confidence a long-term progress – together with for this 12 months, of round 4-7% high line, with an natural working leverage of 50-60 bps.

It’s a difficult present surroundings, however regardless of this the corporate expects secure growth, with persevering with robust value management, and slight progress in natural margin – and a few slight adverse FX.

In whole, Pernod additionally expects €300M value of share buybacks for the 12 months – with half of that already accomplished. This, I imagine, along with an EPS forecast of not less than €8/share adjusted, means that there’s a huge total upside for this firm going ahead.

Pernod Ricard IR (Pernod Ricard IR)

There is a vital normalization within the total spirits market presently ongoing, with a decline in natural gross sales, natural PRO, and the tip of the so-called post-COVID-19 “supercycle”. The declining gross sales don’t imply that the corporate is doing badly, nor that it will not go up once more – it simply implies that the corporate is presently in a slight stoop.

Earlier than the 3Q24, I anticipated above €8/share in EPS. The event and forecasts now imply that the upside I’ve forecasted for Pernod is maybe in 2025-2026 right now, with present 2026E forecasts over €9/share. This 12 months is prone to keep beneath €9/share.

Nonetheless, I imagine the market is focusing an excessive amount of on the corporate’s challenges and is lacking the longer-term upside and reversal potential, and what such a reversal would imply even at a low premiumization, which I believe this firm is well “value”. The identical developments we see in different spirits firms are driving the upside. By this, I imply that the premium portion of the portfolio is driving gross sales. Additionally, do not forget that Pernod is on the tail finish of two years of very good progress, with a CAGR of 4% in America, 7% in Europe, and 11% in Asia, all between 2020 and 2024. In order that we’d see a little bit of a stoop or draw back right here just isn’t all that unusual.

Even with rationalization, I imagine Pernod Ricard to be value way over the market says it’s right here, and I think about the related valuation to be as follows.

Pernod Ricard – The upside is now vital

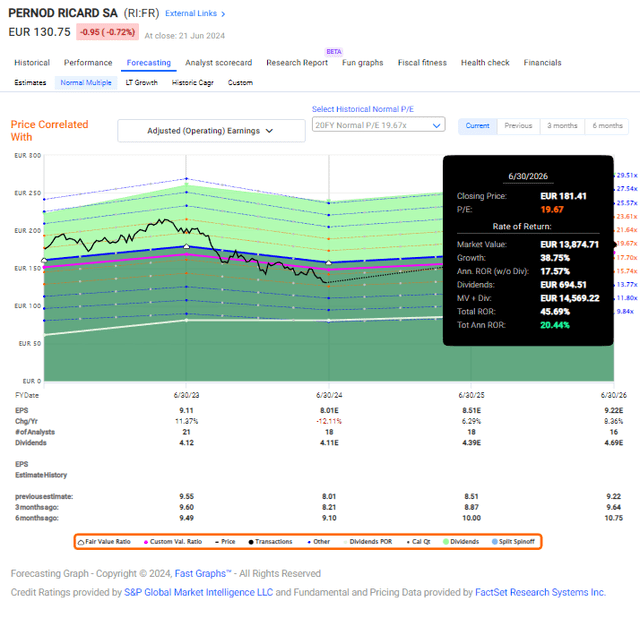

So – valuation stays one of many core questions right here – and that is getting higher and higher as the worth drops and the valuation upside improves. As issues stand now, just under €131 for the native ticker, the corporate is massively enticing. At lower than 16.5x normalized P/E, is cheaper than it has been for a few years.

Whereas I do acknowledge that the drop in earnings, and the present macro and hassle in progress segments needs to be mirrored in valuation, I imagine it is a huge overreaction. The corporate has a mean EPS progress fee of seven%, which along with the BBB+ credit score and the low debt to me makes it value not less than 20-24x. On the very low level of that spectrum, just under 20x, we nonetheless discover a 20% annualized upside right here.

F.A.S.T graphs Pernod Upside (F.A.S.T graphs Pernod Upside)

If we ratchet this 20-year common as much as a 5-year common, we nearly double that upside at over 80% 3-year estimated RoR. Even at a 15x-16x P/E, which I might think about an impaired valuation, we see an RoR of 8% per 12 months inclusive of the three.6% yield. (Paywalled F.A.S.T graphs hyperlink)

So, in each situation I think about possible primarily based on the valuation, the corporate has vital draw back safety and an excellent upside. That is precisely the form of funding that I search for in my work, and what I personally put money into.

My typical allocation to an organization like this throughout a valuation like this involves 1-1.5%, not more than that – and meaning I nonetheless have room to buy extra shares right here.

I imagine analysts are drastically underestimating the upside that this firm has. There are dangers – macro and the corporate’s progress segments might impair the corporate’s enterprise for a number of years. The best danger to the corporate is cyclicality, and it is a extra cyclical luxurious enterprise than LVMH. However there’s an over-focus on these near-term geopolitical dangers which ignores this upside.

Present analyst targets, except for my very own, are between €133 as a low goal, down from a excessive of €167 a couple of 12 months in the past, and a excessive of €210, down from about €268 from a 12 months in the past. This involves a mean of €164, down from round €220/share from a 12 months in the past, which suggests an upside of about 26% from immediately’s share value. That implies that no matter the way you think about the corporate, there is a non-trivial upside. 9 out of 20 analysts have the corporate at a “BUY”, the remaining are at a “HOLD” (Paywalled TIKR.com hyperlink).

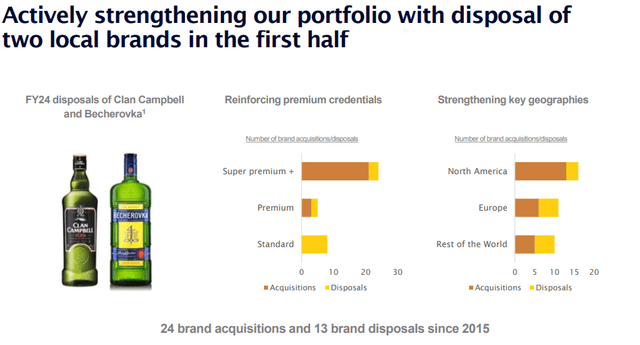

Catalysts for an eventual upside embrace the corporate’s enticing aged spirits section, with additional funding in manufacturing capability.

Pernod Ricard IR (Pernod Ricard IR)

This along with the substantial measurement of the corporate’s portfolio and continued gross margin enchancment (as we noticed in 1H24) is a part of my constructive case for Pernod Ricard.

Right here is my thesis for Pernod Ricard as of 2024.

Thesis

Pernod Ricard is among the extra attention-grabbing luxurious vintners and distillers on the market. The corporate owns a portfolio of one of the vital market-beating firms and types on the market, giving it an excellent moat and making it very investable on the “proper” form of total value. The corporate has been overvalued or not less than absolutely valued for a while.

Nonetheless, at beneath €140/share, it not is overvalued, and I’ve considerably been including shares to my portfolio, I’m now over 0.6% in each my non-public and my industrial portfolio-

I imagine Pernod Ricard, primarily based on a progress estimate of 6-9% for the subsequent few years (down from double digits, and with a troublesome 2024E), nonetheless has the potential to outperform the market at 13-20% per 12 months, and because of this it qualifies as a conservatively-adjusted market-outperforming firm so far as my method is anxious. I fee it a “BUY” with a €190/share long-term share value, at minimal. I am not altering this goal right now.

Keep in mind, I am all about:

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly huge – firms at a reduction, permitting them to normalize over time and harvesting capital good points and dividends within the meantime.

2. If the corporate goes nicely past normalization and goes into overvaluation, I harvest good points and rotate my place into different undervalued shares, repeating #1.

3. If the corporate does not go into overvaluation, however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

This firm is total qualitative.

This firm is essentially secure/conservative & well-run.

This firm pays a well-covered dividend.

This firm is presently low cost.

This firm has a practical upside primarily based on earnings progress or a number of enlargement/reversion.

I went backwards and forwards on calling this firm “low cost” right here, however I do actually imagine that it’s “low cost” at sub-€150/share. Which means the corporate fulfills each single certainly one of my standards, making it comparatively clear why I view it as a “BUY” right here.

Thanks for studying.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.