Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Regardless of the current crypto crash that despatched most digital belongings tumbling, Ethereum (ETH), Solana (SOL) and Cardano (ADA) have managed to carry their floor. In accordance with newest experiences, these three cryptocurrencies are actually main the charts as essentially the most trending cash available in the market after the crash.

Associated Studying

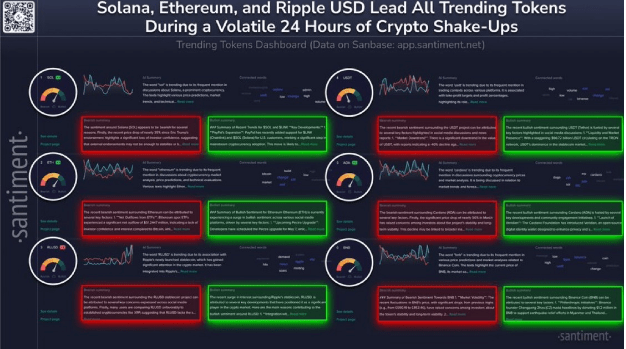

Santiment Unveils High Trending Cryptos

The crypto market took a major hit after fears of new tariffs applied by United States President Donald Trump rattled buyers and despatched digital belongings plunging throughout the board. Nevertheless, whereas US inventory markets closed, indicators of restoration started to emerge throughout particular cryptocurrencies, with Ethereum, Solana, and Cardano main the post-crash chatter.

In accordance with an X (previously Twitter) put up by Santiment, a market intelligence platform, Solana is now again within the headlines as market analysts intently watch its value motion following its crash.

The favored meme coin is seeing an elevated degree of speculative predictions, market tendencies, and technical chart breakdowns. In consequence, SOL is recapturing the eye of retail and institutional buyers. There’s additionally been notable exercise inside the Solana community as anticipation for a value rebound or breakout retains spreading.

Ethereum can also be trending within the crypto market, not only for its extended value droop and response to the crypto crash, however its ongoing transition to Ethereum 2.0 — a key improve centered on scalability and power effectivity.

Santiment notes that analysts are highlighting Ethereum’s community efficiency in the course of the market stress, showcasing a rise in discussions in regards to the cryptocurrency’s market evaluation. There have additionally been elevated value predictions, technical evaluations, and talks in regards to the cryptocurrency’s scalability and adoption.

Identical to Solana and Ethereum, Cardano is seeing renewed consideration as merchants assess the cryptocurrency’s place within the broader market. There was an inflow of mentions surrounding Cardano’s market tendencies, with customers speculating on its future value motion and potential investments. Forecasts for the ADA value additionally vary extensively, with social media buzz and speculative posts fueling the cryptocurrency’s presence on trending charts.

Whereas not as extensively mentioned as ETH, SOL, and ADA, Binance Coin (BNB) has additionally been displaying up in technical forecasts. Santiment reveals that analysts are monitoring BNB’s buying and selling ranges and potential value actions, making it a focus for buyers and merchants.

Associated Studying

Stablecoins Be part of Record Of Trending Belongings

Along with the altcoins above, Santiment has disclosed that stablecoins have additionally joined the listing of prime trending belongings. Whereas Ethereum, Solana, and Cardano skilled main declines after the crypto crash, stablecoins, as their names indicate, remained secure in opposition to the greenback.

Ripple’s newly launched stablecoin RLUSD is trending resulting from its affiliation with the crypto funds firm, which gained important consideration following the completion of its authorized battle with the US Securities and Trade Fee. The stablecoin has been built-in into Ripple’s fee system, enhancing cross-border transactions and attracting institutional curiosity.

There has additionally been a major improve in adoption and buying and selling quantity, with crypto change Kraken reporting an 87% surge within the latter and a $10 billion development within the former.

Featured picture from Gemini Imagen, chart from TradingView