The insurance coverage trade faces a looming workforce scarcity, with the U.S. Bureau of Labor Statistics projecting a deficit of practically 400,000 staff by 2026, whereas professionals proceed to spend as much as 80% of their time on tedious paperwork and knowledge entry. Conventional automation instruments have fallen quick, counting on inflexible workflows and APIs that break down with even minor course of adjustments, leaving insurance coverage operations burdened with inefficiencies. Kay.ai eliminates guide knowledge entry throughout submissions and servicing workflows with AI co-workers designed particularly for insurance coverage brokers and companies. The corporate’s propreitary know-how understands insurance coverage processes, interacts straight with current instruments, and adapts to particular preferences, permitting customers to easily ahead an e-mail or add a PDF and have Kay extract key particulars, enter knowledge throughout provider portals, and generate quotes with out complicated integrations. Early companions are already seeing dramatic effectivity positive aspects, with time financial savings of two hours per utility at 1 / 4 of the price and workflow automation accomplished in beneath two weeks in comparison with months-long API integrations.

AlleyWatch sat down with Kay.ai CEO and Founder Vishal Rohra to be taught extra in regards to the enterprise, the corporate’s future plans, current funding spherical, and far, way more…

Who have been your buyers and the way a lot did you increase?

We raised $3M in seed funding, and the spherical was led by Wing VC, with participation from South Park Commons, 101 Weston Labs, and several other strategic angel buyers.

Inform us in regards to the services or products that Kay.ai provides.

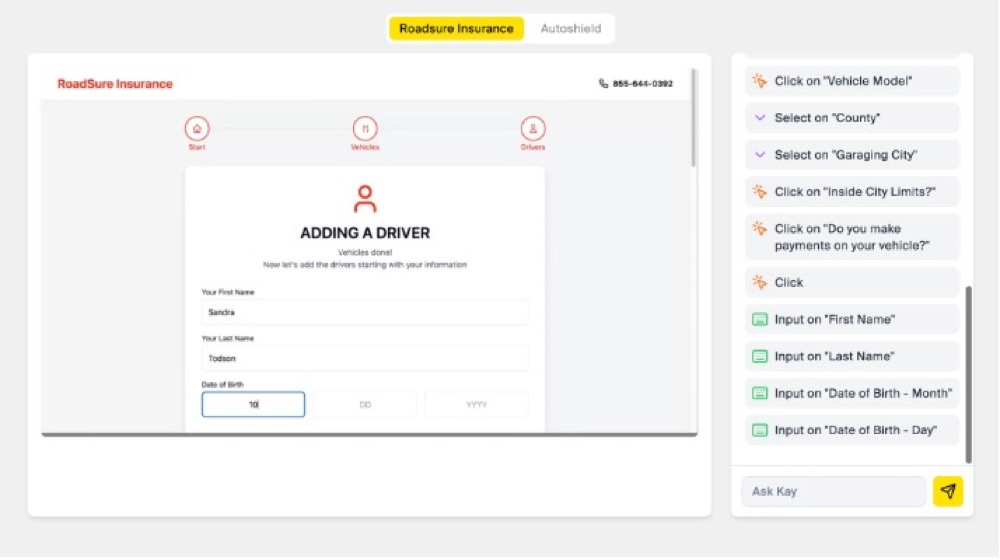

We’ve constructed AI co-workers designed particularly for insurance coverage brokers and companies to remove guide knowledge entry work throughout submissions and servicing. Our AI understands insurance coverage workflows, interacts with their current instruments, and adapts to particular preferences. This eliminates hours of guide knowledge entry daily for account managers and repair groups – customers can merely ahead an e-mail or add a PDF, and Kay extracts key particulars, enters knowledge throughout provider portals, and generates quotes or full service requests with out requiring prolonged onboarding or complicated integrations.

What impressed the beginning of Kay.ai?

My cofounder Achyut Joshi and I are each machine studying engineers with backgrounds at huge tech firms. After collaborating within the South Park Commons Fellowship, we explored numerous AI purposes earlier than recognizing a large effectivity hole in insurance coverage back-office operations. We really began this journey at an insurance coverage convention in New York, the place we acquired to work together with 100s of insurance coverage professionals beneath one roof. It shortly grew to become clear to us that language fashions have been a serious inflection level, able to drastically altering how admin work will get completed on this house. We have been past excited with what was attainable, and shipped our first prototype every week later.

How is Kay.ai totally different?

In contrast to conventional software program or legacy RPA instruments that depend on APIs and inflexible workflows that break when processes change, Kay learns and operates like an precise group member. Our AI co-workers perceive your course of, work together together with your instruments in your behalf, and adapt together with your preferences. This enables us to automate a spread of workflows throughout submissions, renewals, and servicing that couldn’t be automated earlier than. Our early companions are already seeing main effectivity positive aspects – saving two hours of quoting time per utility at 1 / 4 the price, automating workflows in beneath two weeks (in comparison with months-long API integrations), and eliminating guide errors whereas enhancing quoting accuracy.

What market does Kay.ai goal and the way huge is it?

We’re concentrating on the insurance coverage operations market, notably brokers, companies, MGAs, and carriers who’re burdened with guide knowledge entry and paperwork. We’re additionally tapping into the $300 billion Enterprise Course of Outsourcing (BPO) market, the place enterprises at the moment outsource high-volume, repetitive duties however wrestle with excessive worker turnover, sluggish turnaround occasions, and dear human errors.

What’s your enterprise mannequin?

AI coworkers flip conventional SaaS user-based pricing on its head. It’s not simply software program, it’s a set of teammates that seamlessly function throughout your current instruments. Our pricing straight aligns with the worth we create for each activity we automate. We usually scale back administrative spend by round 80% for every workflow automated, creating clear, measurable ROI for patrons.

How are you getting ready for a possible financial slowdown?

Whereas we’re strictly targeted on development, our mannequin inherently helps robust money flows and effectivity. The insurance coverage trade faces a 400,000-worker scarcity, so we consider the demand for clever AI options like ours will stay robust, even in difficult financial climates.

What was the funding course of like?

We began at South Park Commons, a vibrant neighborhood of builders, former founders, and other people experimenting via the earliest levels alongside us. This community offered invaluable assist, mentorship, and connections. As soon as we discovered conviction in our route, we shortly raised a spherical by speaking to folks we already knew within the trade. Our buyers selected to again us as a result of they believed within the group earlier than the rest.

What are the most important challenges that you simply confronted whereas elevating capital?

The funding course of for this spherical was comparatively easy. For us, the first focus was on discovering the precise companions who believed in our imaginative and prescient, have been in it for the long run, and will assist us via each highs and lows.

What components about your enterprise led your buyers to jot down the verify?

Our buyers felt that Achyut and I carry a singular mixture of deep machine studying experience and a relentless give attention to product usability, which positions us to redefine how insurance coverage work will get completed. The large operational bottlenecks within the insurance coverage trade, mixed with the rising labor scarcity, created a compelling case for our resolution.

What are the milestones you intend to realize within the subsequent six months?

Our major focus is development. We’re quickly onboarding extra prospects, increasing throughout further workflows, and constructing a powerful in-person group in NYC.

What recommendation are you able to supply firms in New York that don’t have a recent injection of capital within the financial institution?

Keep prudent together with your funds and solely scale whenever you’ve reached clear conviction in your product-market match. Immediately’s AI instruments allow startups to remain lean and achieve greater than ever earlier than. Focus relentlessly on what strikes the needle and reduce out all the opposite noise.

The place do you see the corporate going within the close to time period?

Within the close to time period, we’re targeted on increasing our AI co-worker capabilities to deal with extra complicated insurance coverage workflows past quoting. Our objective is to assist our prospects remove operational inefficiencies throughout their whole enterprise, from submissions to renewals and servicing. We consider our know-how will redefine how insurance coverage work will get completed, permitting professionals to give attention to high-value actions whereas our AI handles the repetitive duties.

What’s your favourite spring vacation spot in and across the metropolis?

Domino Park in Williamsburg. It’s proper by our workplace. Come be a part of us for some seaside volleyball!