As proven, the iron condor, butterfly, and calendar are all delta-neutral choice revenue methods, that are so-called “non-directional.”

However are they actually non-directional?

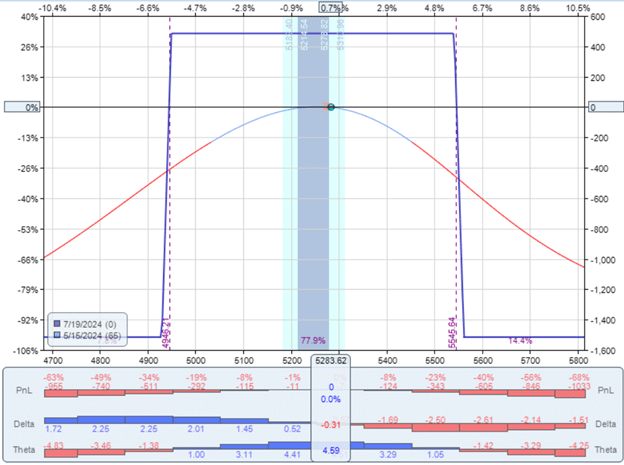

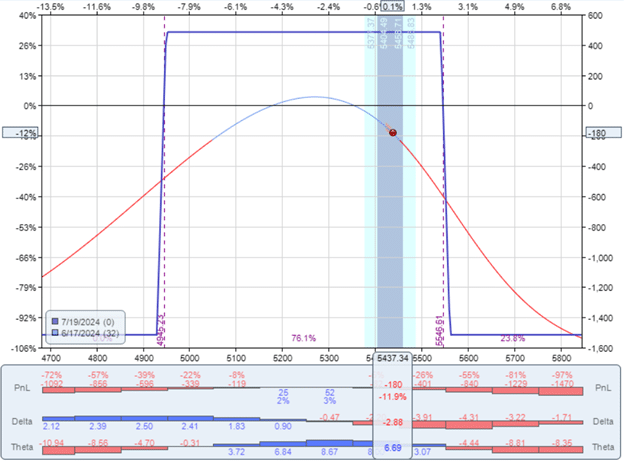

Their present revenue and loss line (also referred to as the T+0 line) has the concaved downward curve typical of such methods.

The present worth dot of the underlying is on the high of the curve the place the delta is near zero, therefore the time period delta-neutral.

Wanting on the Delta histogram, you possibly can affirm that it’s close to zero.

An choice technique with a optimistic delta is bullish, the place the commerce will profit if the underlying worth goes up.

An choice technique with a detrimental delta is bearish, the place the commerce will profit if the underlying worth goes down.

An choice technique with a zero delta is neither bullish nor bearish.

It’s non-directional in that, at this time limit, the dealer is just not choosing the standard up or down route.

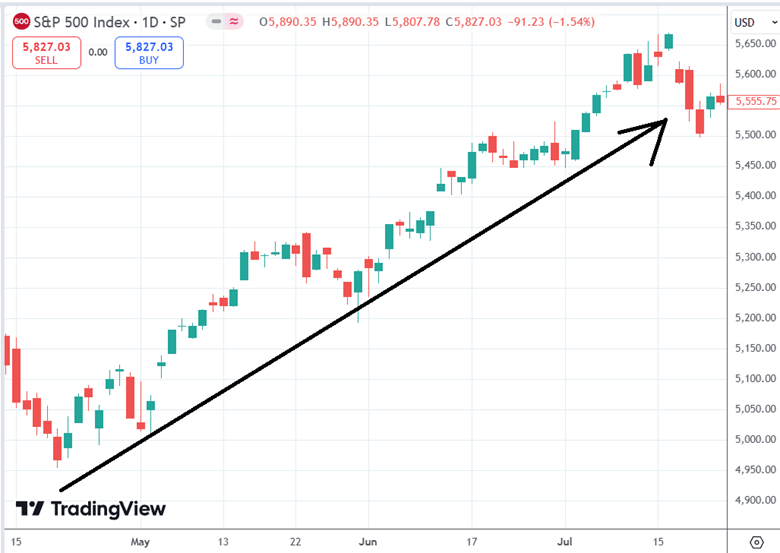

However the market can transfer in three instructions:

Free Lined Name Course

A delta-neutral technique IS choosing a route.

It picks the sideways route, betting the worth will stay inside a sure vary.

These methods are also referred to as “range-bound” trades.

If a dealer has chosen a sideways route and the market strikes up or down greater than the desired vary, the dealer has picked the fallacious route, and the “non-directional” technique loses.

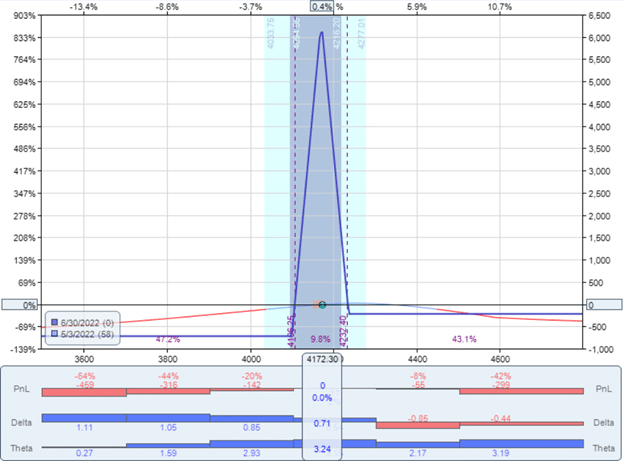

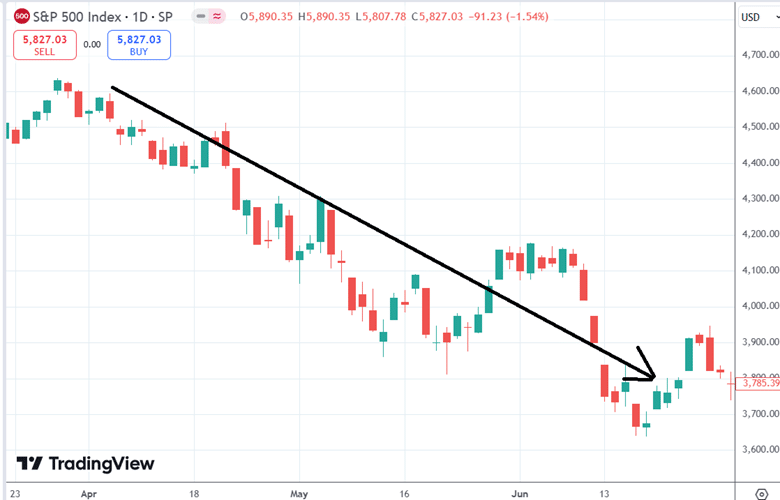

We will see this right here the place the worth has moved up an excessive amount of:

The unique delta-neutral technique doesn’t keep delta-neutral for too lengthy.

Right here, the delta has now develop into detrimental -2.88.

The commerce is now bearish, with the worth going up – a shedding situation.

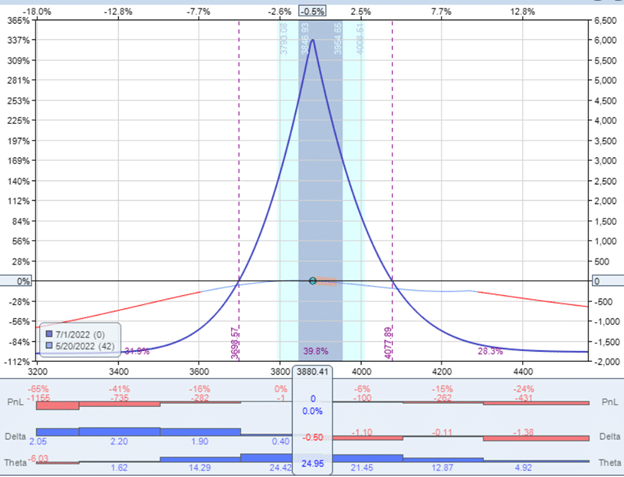

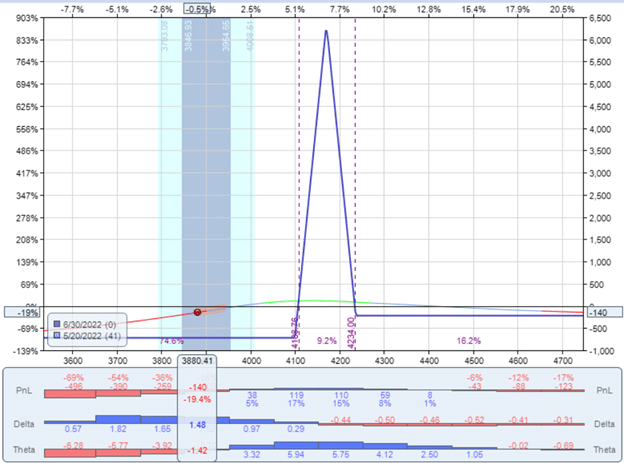

Within the subsequent graph, we see that the worth has moved down an excessive amount of:

The delta has develop into optimistic.

The commerce is now a bullish directional commerce that wants the worth to return as much as be worthwhile.

Is it attainable to assemble a delta-neutral choice technique for as extensive of a worth vary as attainable?

And remove delta fully?

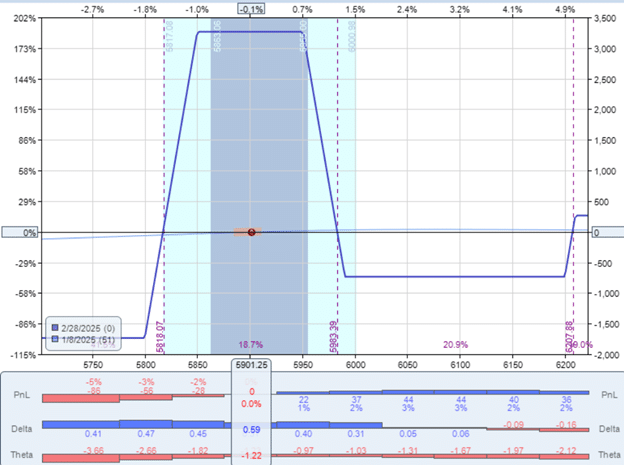

One can attempt, as within the case right here, the place we see a really flat T+0 line that extends far to the left and proper.

Nonetheless, the extra you flatten this T+0 curve, the much less theta you have got.

The above commerce has no theta in any respect and even barely detrimental theta.

With out optimistic theta, the technique cannot generate revenue from the passage of time.

You possibly can affirm within the earlier graphs that it’s only when we have now a concaved downward T+0 curve that we have now a optimistic theta.

Maybe it’s only a matter of semantics.

A delta-neutral technique is choosing a sideways route, anticipating the underlying worth to stay range-bound.

We will nonetheless name it a non-directional technique as a result of it doesn’t choose the standard route of up or down on the present time, however behind our minds, we nonetheless need to know that the directional motion of the underlying nonetheless issues.

It may lose because of the uncooperative motion of the inventory worth.

It’s not realistically attainable to fully remove the delta or route from the equation with out additionally eliminating its income-generating theta.

It’s simply one other manner of claiming it’s inconceivable to earn a living (above the risk-free charge of return) with out taking a directional threat.

If you wish to fully remove directional threat, you possibly can take positions in BIL ETF or purchase U.S. Treasury Payments and make a risk-free charge of return.

We hope you loved this text on whether or not a delta-neutral choices technique is absolutely non-directional.

If in case you have any questions, please ship an e-mail or depart a remark beneath.

Commerce secure!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who will not be accustomed to trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.