Revealed on March twenty fourth, 2025 by Bob CiuraSpreadsheet knowledge up to date each day

Micro-cap shares are publicly-traded firms with market capitalizations between $50 million and $300 million. These symbolize the smallest firms within the inventory market.

The entire variety of micro-cap shares varies relying upon market circumstances. Proper now there are a whole lot of micro-cap shares, so there are loads for buyers to select from.

Because the smallest shares, micro-caps might have stronger progress potential over the long term than large-cap shares or mega-cap shares.

On the identical time, micro-cap shares carry a lot of distinctive threat components to contemplate.

You possibly can obtain a free spreadsheet of all 1400+ micro cap shares proper now (together with vital monetary metrics akin to price-to-earnings ratios and dividend yields) by clicking on the hyperlink under:

The downloadable micro-cap shares listing above was curated from two main micro-cap inventory ETFs:

iShares Micro-Cap ETF (IWC)

First Belief Dow Jones Choose Micro-Cap Index Fund (FDM)

This text features a spreadsheet and desk of all of our micro-cap shares, in addition to detailed evaluation on our Prime 10 micro-cap shares as we speak.

Maintain studying to see the ten finest micro-cap shares analyzed intimately.

The ten Finest Micro Cap Shares At this time

Now that we’ve outlined what a micro-cap inventory is, let’s check out the ten finest micro-cap shares, as outlined by our Certain Evaluation Analysis Database.

The database ranks complete anticipated annual returns, combining present yield, forecast earnings progress and any change in worth from the valuation.

Notice: The Certain Evaluation Analysis Database is concentrated on earnings producing securities. Consequently, we don’t monitor or rank securities that don’t pay dividends. Micro-cap shares that don’t pay dividends had been excluded from the Prime 10 rankings under.

We’ve screened the micro-cap shares with the best 5-year anticipated returns and have offered them under, ranked from lowest to highest.

You possibly can immediately soar to any particular person inventory evaluation by utilizing the hyperlinks under:

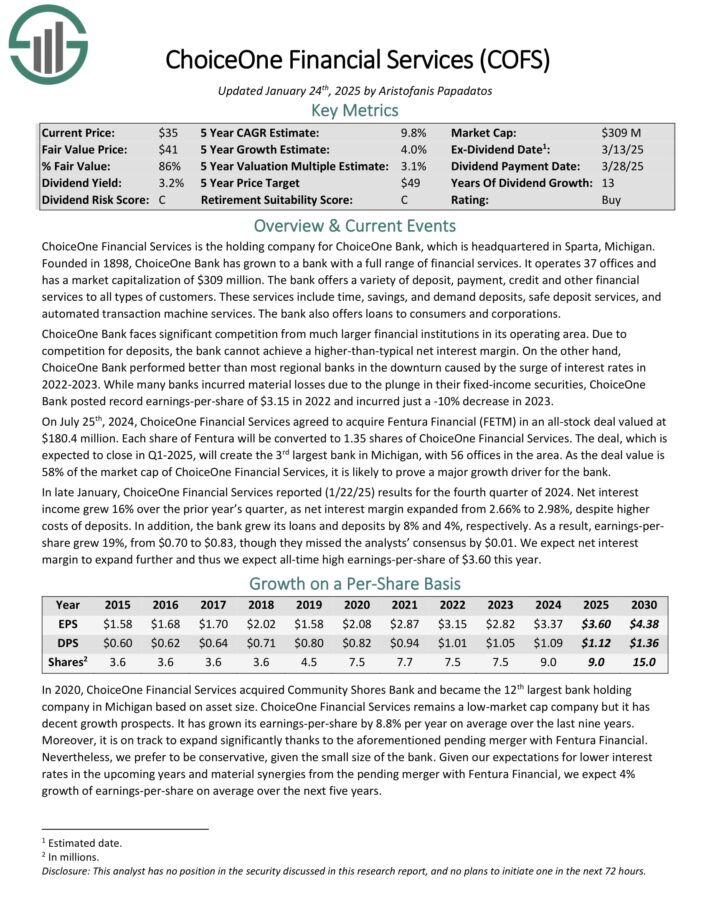

Micro Cap Inventory #10: ChoiceOne Monetary Providers (COFS)

5-year anticipated annual returns: 14.5%

ChoiceOne Monetary Providers is the holding firm for ChoiceOne Financial institution, which is headquartered in Sparta, Michigan.

Based in 1898, ChoiceOne Financial institution has grown to a financial institution with a full vary of economic companies. It operates 37 places of work and provides quite a lot of deposit, cost, credit score and different monetary companies to all kinds of prospects.

These companies embody time, financial savings, and demand deposits, secure deposit companies, and automatic transaction machine companies. The financial institution additionally provides loans to customers and companies.

In late January, ChoiceOne Monetary Providers reported (1/22/25) outcomes for the fourth quarter of 2024. Web curiosity earnings grew 16% over the prior 12 months’s quarter, as internet curiosity margin expanded from 2.66% to 2.98%, regardless of greater prices of deposits. As well as, the financial institution grew its loans and deposits by 8% and 4%, respectively.

Consequently, earnings-per-share grew 19%, from $0.70 to $0.83, although they missed the analysts’ consensus by $0.01. We anticipate internet curiosity margin to develop additional and thus we anticipate all-time excessive earnings-per-share of $3.60 this 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on COFS (preview of web page 1 of three proven under):

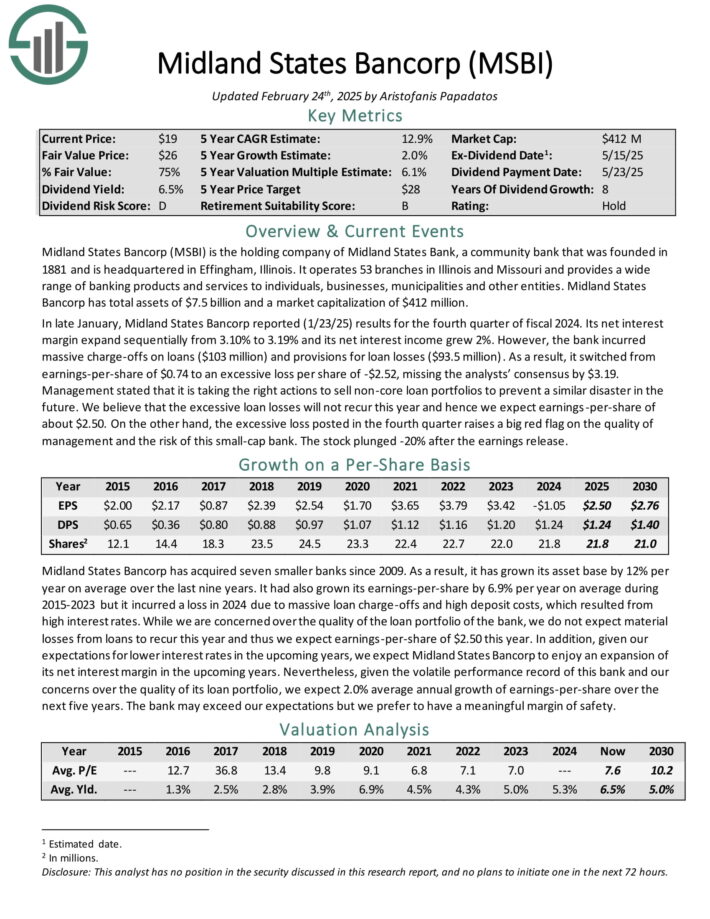

Micro Cap Inventory #9: Midland States Bancorp (MSBI)

5-year anticipated annual returns: 14.7%

Midland States Bancorp (MSBI) is the holding firm of Midland States Financial institution, a neighborhood financial institution that was based in 1881 and is headquartered in Effingham, Illinois.

It operates 53 branches in Illinois and Missouri and offers a variety of banking services and products to people, companies, municipalities and different entities. Midland States Bancorp has complete property of $7.5 billion.

In late January, Midland States Bancorp reported (1/23/25) outcomes for the fourth quarter of fiscal 2024. Its internet curiosity margin develop sequentially from 3.10% to three.19% and its internet curiosity earnings grew 2%.

Nevertheless, the financial institution incurred large charge-offs on loans ($103 million) and provisions for mortgage losses ($93.5 million).

Consequently, it switched from earnings-per-share of $0.74 to an extreme loss per share of -$2.52, lacking the analysts’ consensus by $3.19.

Midland States Bancorp has acquired seven smaller banks since 2009. Consequently, it grew its asset base by 12% per 12 months on common over the past 9 years.

It had additionally grown its earnings-per-share by 6.9% per 12 months on common throughout 2015-2023 nevertheless it incurred a loss in 2024 as a result of large mortgage charge-offs and excessive deposit prices, which resulted from excessive rates of interest.

Click on right here to obtain our most up-to-date Certain Evaluation report on MSBI (preview of web page 1 of three proven under):

Micro Cap Inventory #8: Oak Valley Bancorp (OVLY)

5-year anticipated annual returns: 15.9%

Oak Valley Bancorp is a regional banking holding firm based mostly in Oakdale, California, working by means of its subsidiary, Oak Valley Neighborhood Financial institution. It offers a variety of economic companies together with business and shopper loans, deposit accounts, and funding companies.

On January twenty fourth, 2025, Oak Valley posted its This autumn and full-year outcomes for the interval ending December thirty first, 2024. For the interval, internet curiosity earnings got here in at $17.8 million, in comparison with $17.7 million within the earlier quarter and $17.9 million final 12 months.

The decline over final 12 months was as a result of greater deposit curiosity expense, as the common value of funds rose to 0.78% in 2024 from 0.28% in 2023. This greater curiosity expense was partly offset by year-over-year mortgage progress of $90.0 million (8.8%).

The online curiosity margin for the quarter was 4.00%, down from 4.07% in Q3-2024 and 4.15% in This autumn-2023. Nonetheless, it stays fairly excessive.

For the quarter, earnings per share (EPS) got here in at $0.73, up one cent in comparison with final 12 months. For the 12 months, EPS was $3.04. For FY2025, we anticipate EPS of about $3.20.

Click on right here to obtain our most up-to-date Certain Evaluation report on OVLY (preview of web page 1 of three proven under):

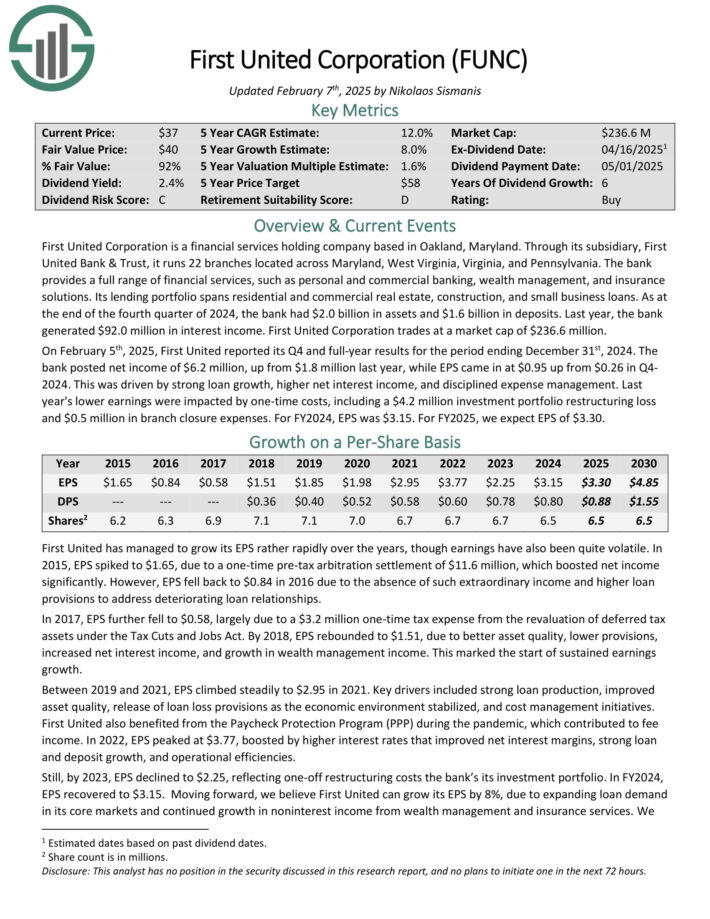

Micro Cap Inventory #7: First United Company (FUNC)

5-year anticipated annual returns: 15.9%

First United Company is a monetary companies holding firm based mostly in Oakland, Maryland. By its subsidiary, First United Financial institution & Belief, it runs 22 branches situated throughout Maryland, West Virginia, Virginia, and Pennsylvania.

The financial institution offers a full vary of economic companies, akin to private and business banking, wealth administration, and insurance coverage options.

Its lending portfolio spans residential and business actual property, development, and small enterprise loans. As on the finish of the fourth quarter of 2024, the financial institution had $2.0 billion in property and $1.6 billion in deposits. Final 12 months, the financial institution generated $92.0 million in curiosity earnings.

On February fifth, 2025, First United reported its This autumn and full-year outcomes for the interval ending December thirty first, 2024. The financial institution posted internet earnings of $6.2 million, up from $1.8 million final 12 months, whereas EPS got here in at $0.95 up from $0.26 in This autumn 2024. This was pushed by sturdy mortgage progress, greater internet curiosity earnings, and disciplined expense administration.

Click on right here to obtain our most up-to-date Certain Evaluation report on FUNC (preview of web page 1 of three proven under):

Micro Cap Inventory #6: Peoples Monetary (PFIS)

5-year anticipated annual returns: 16.1%

Peoples Monetary Providers (PFIS) is the holding firm of Peoples Safety Financial institution and Belief Firm, a neighborhood financial institution that was based in 1905 and is headquartered in Scranton, Pennsylvania.

It operates 44 branches in Pennsylvania and offers varied banking services and products to customers, municipalities and companies.

On July 1st, 2024, Peoples Monetary Providers accomplished its acquisition of FNCB Bancorp in an all-stock deal. As per the phrases of the deal, the shareholders of FNCB now personal ~29% of the mixed entity.

Because of the merger, the financial institution grew its complete property from $3.7 billion to $5.5 billion and thus it turned the fifth largest neighborhood financial institution in Pennsylvania.

In early February, Peoples Monetary Providers reported (2/6/24) monetary outcomes for the fourth quarter of fiscal 2024. Loans and deposits grew 40% and 28%, respectively, over the prior 12 months’s quarter, due to the acquisition of FNCB Bancorp.

Web curiosity margin expanded impressively, from 2.30% within the prior 12 months’s quarter to three.25% due to the a lot greater internet curiosity margin of the acquired financial institution.

Click on right here to obtain our most up-to-date Certain Evaluation report on PFIS (preview of web page 1 of three proven under):

Micro Cap Inventory #5: Orrstown Monetary Providers (ORRF)

5-year anticipated annual returns: 16.4%

Orrstown Monetary Providers, Inc. is a neighborhood financial institution. ORRF serves because the holding firm for its working financial institution subsidiary, Orrstown Financial institution.

The corporate offers banking and monetary advisory companies to prospects situated within the south-central Pennsylvania counties of Berks, Cumberland, Dauphin, Franklin, Lancaster, Perry, and York. ORRF additionally serves prospects in Anne Arundel, Baltimore, Howard, and Washington counties in Maryland.

Its financial savings merchandise embody cash market accounts, financial savings accounts, certificates of deposit, and checking accounts. Mortgage merchandise provided include residential mortgages, residence fairness strains of credit score, business mortgages, development loans, and business loans.

Monetary advisory companies offered embody fiduciary, funding advisory, and brokerage companies.

On January thirty first, ORRF launched its monetary outcomes for the fourth quarter ended December thirty first. The corporate’s internet curiosity earnings soared 94.4% over the year-ago interval to $50.6 million throughout the quarter, which was principally because of the acquisition of Codorus Valley Bancorp. The opposite tailwind for ORRF was a 34-basis level year-over-year growth within the internet curiosity margin to 4.05% within the quarter.

Because of the acquisition, the corporate’s noninterest earnings additionally surged 73.3% over the year-ago interval to $11.2 million for the quarter. ORRF’s adjusted diluted EPS edged 4.8% greater year-over-year to $0.87 throughout the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on ORRF (preview of web page 1 of three proven under):

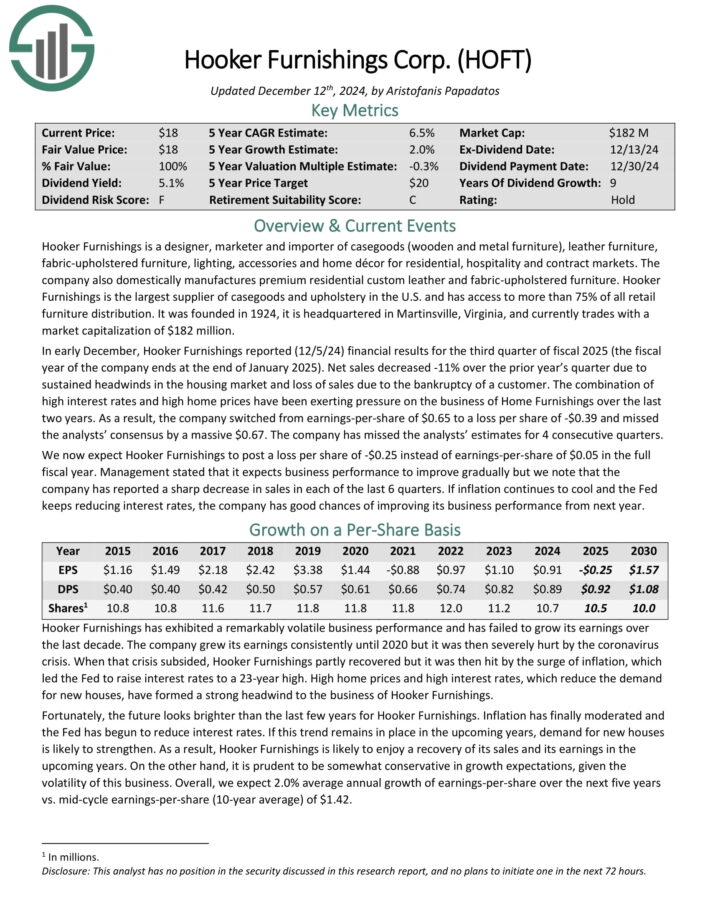

Micro Cap Inventory #4: Hooker Furnishings (HOFT)

5-year anticipated annual returns: 16.5%

Hooker Furnishings is a designer, marketer and importer of casegoods (picket and metallic furnishings), leather-based furnishings, fabric-upholstered furnishings, lighting, equipment and residential décor for residential, hospitality and contract markets.

The corporate additionally domestically manufactures premium residential customized leather-based and fabric-upholstered furnishings.

Hooker Furnishings is the most important provider of casegoods and fabric within the U.S. and has entry to greater than 75% of all retail furnishings distribution.

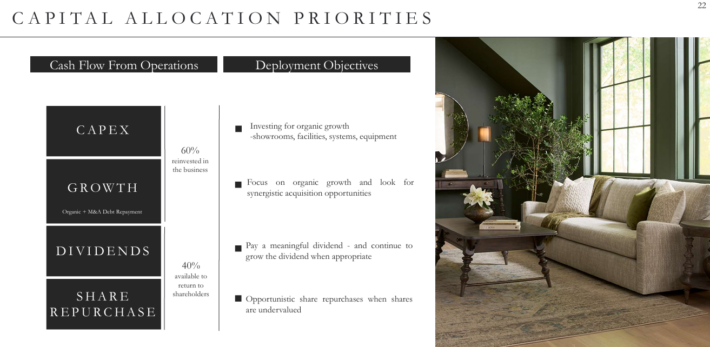

Supply: Investor Presentation

In early December, Hooker Furnishings reported (12/5/24) monetary outcomes for the third quarter of fiscal 2025. Web gross sales decreased -11% over the prior 12 months’s quarter as a result of sustained headwinds within the housing market and lack of gross sales because of the chapter of a buyer.

The mix of excessive rates of interest and excessive residence costs have been exerting stress on the enterprise of House Furnishings over the past two years.

Consequently, the corporate switched from earnings-per-share of $0.65 to a loss per share of -$0.39 and missed the analysts’ consensus by an enormous $0.67.

Click on right here to obtain our most up-to-date Certain Evaluation report on HOFT (preview of web page 1 of three proven under):

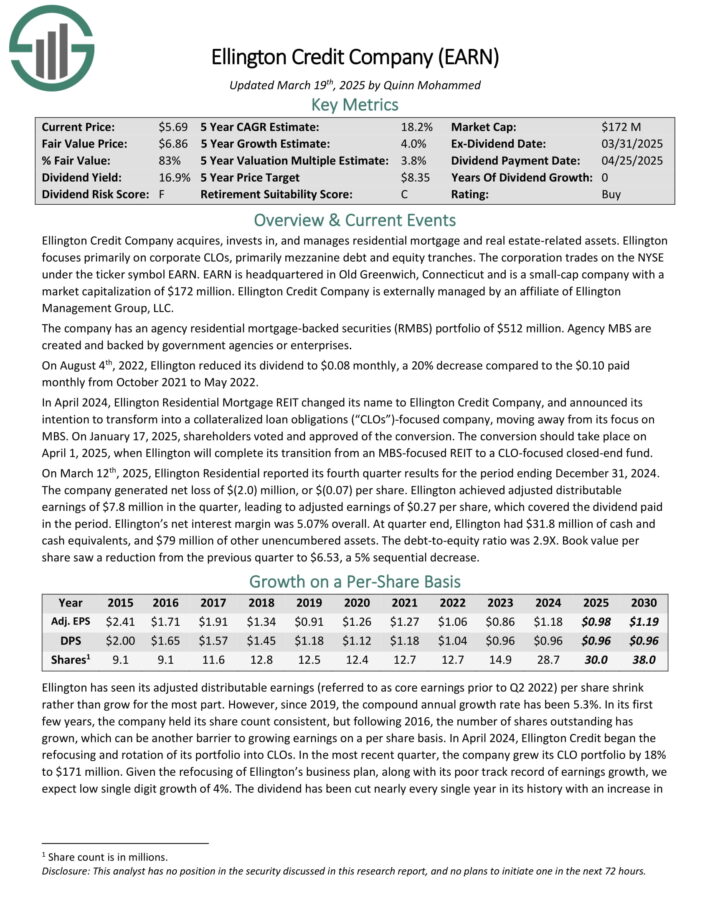

Micro Cap Inventory #3: Ellington Credit score Co. (EARN)

5-year anticipated annual returns: 18.2%

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated property. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities companies or enterprises, whereas non-agency MBS are not assured by the federal government.

On March twelfth, 2025, Ellington Residential reported its fourth quarter outcomes for the interval ending December 31, 2024. The corporate generated a internet lack of $(2.0) million, or $(0.07) per share.

Ellington achieved adjusted distributable earnings of $7.8 million within the quarter, resulting in adjusted earnings of $0.27 per share, which coated the dividend paid within the interval.

Ellington’s internet curiosity margin was 5.07% total. At quarter finish, Ellington had $31.8 million of money and money equivalents, and $79 million of different unencumbered property.

Click on right here to obtain our most up-to-date Certain Evaluation report on EARN (preview of web page 1 of three proven under):

Micro Cap Inventory #2: Clipper Realty (CLPR)

5-year anticipated annual returns: 19.5%

Clipper Realty is a Actual Property Funding Belief, or REIT, that was based by the merger of 4 pre-existing actual property firms. The founders retain about 2/3 of the possession and votes as we speak, as they’ve by no means bought a share.

Clipper owns business (primarily multifamily and workplace with a small sliver of retail) actual property throughout New York Metropolis.

On February 18, 2025, Clipper Realty Inc. reported its monetary outcomes for the fourth quarter of 2024. The corporate achieved report quarterly income of $38 million, marking a 9.1% enhance from the earlier 12 months.

Web Working Revenue (NOI) rose to $22.5 million, reflecting a 12.5% progress, whereas Adjusted Funds From Operations (AFFO) reached $8.1 million, up 29%.

This efficiency was primarily pushed by a $2.9 million enhance in residential income, attributed to sturdy leasing actions and operational efficiencies.

Click on right here to obtain our most up-to-date Certain Evaluation report on CLPR (preview of web page 1 of three proven under):

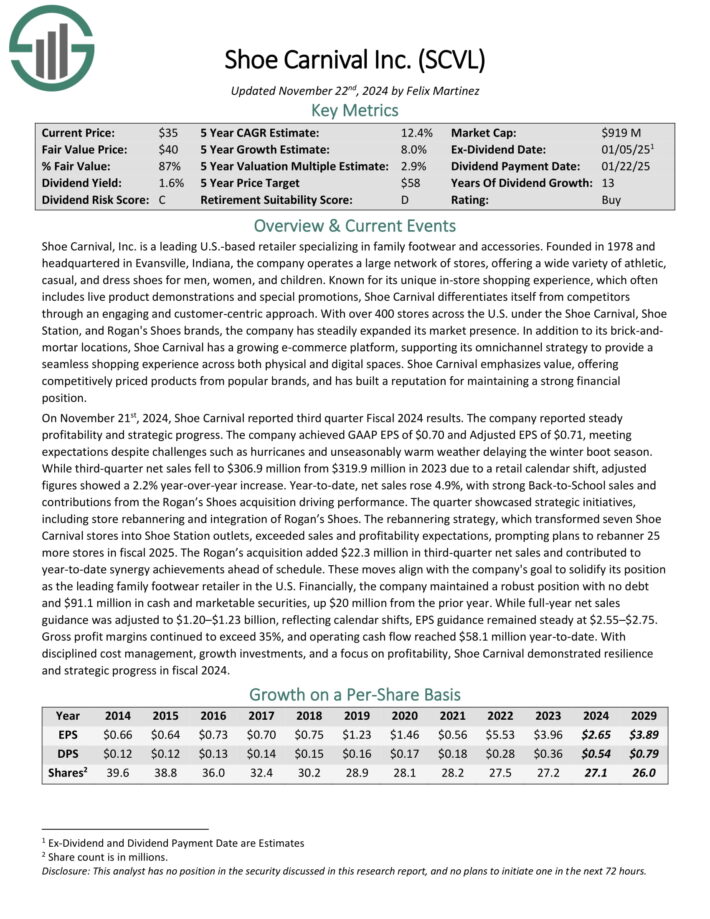

Micro Cap Inventory #1: Shoe Carnival, Inc. (SCVL)

5-year anticipated annual returns: 23.7%

Shoe Carnival, Inc. is a number one U.S.-based retailer specializing in household footwear and equipment. The corporate operates a big community of shops, providing all kinds of athletic, informal, and gown footwear for males, ladies, and youngsters.

With over 400 shops throughout the U.S. underneath the Shoe Carnival, Shoe Station, and Rogan’s Sneakers manufacturers, the corporate has steadily expanded its market presence.

Along with its brick-and mortar places, Shoe Carnival has a rising e-commerce platform, supporting its omnichannel technique.

On November twenty first, 2024, Shoe Carnival reported third quarter Fiscal 2024 outcomes. The corporate reported GAAP EPS of $0.70 and Adjusted EPS of $0.71, assembly expectations.

Whereas third-quarter internet gross sales fell to $306.9 million from $319.9 million in 2023 as a result of a retail calendar shift, adjusted figures confirmed a 2.2% year-over-year enhance.

Yr-to-date, internet gross sales rose 4.9%, with sturdy Again-to-Faculty gross sales and contributions from the Rogan’s Sneakers acquisition driving efficiency.

Click on right here to obtain our most up-to-date Certain Evaluation report on SCVL (preview of web page 1 of three proven under):

Remaining Ideas

Micro-cap shares are the smallest firms presently buying and selling on the inventory market. The potential advantage of investing in micro-cap shares is the potential for greater progress, and shareholder returns, over time.

After all, buyers must fastidiously contemplate the distinctive dangers related to investing in micro-cap shares. The ten micro-cap shares on this listing all pay dividends to shareholders and have constructive anticipated returns.

Consequently, these 10 micro-cap shares could possibly be engaging for dividend progress buyers.

Different Dividend Lists

The next lists comprise many extra high-quality dividend shares:

The Dividend Aristocrats Checklist is comprised of 69 shares within the S&P 500 Index with 25+ years of consecutive dividend will increase.

The Excessive Yield Dividend Aristocrats Checklist is comprised of the 20 Dividend Aristocrats with the best present yields.

The Dividend Achievers Checklist is comprised of ~400 NASDAQ shares with 10+ years of consecutive dividend will increase.

The Dividend Kings Checklist is much more unique than the Dividend Aristocrats. It’s comprised of 55 shares with 50+ years of consecutive dividend will increase.

The Excessive Yield Dividend Kings Checklist is comprised of the 20 Dividend Kings with the best present yields.

The Excessive Dividend Shares Checklist: shares that attraction to buyers within the highest yields of 5% or extra.

The Month-to-month Dividend Shares Checklist: shares that pay dividends each month, for 12 dividend funds per 12 months.

The Dividend Champions Checklist: shares which have elevated their dividends for 25+ consecutive years.Notice: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have further necessities like being in The S&P 500.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.