Merchants, I stay up for sharing my high setups for the upcoming week, together with my entry and exit targets for potential trades in Tesla, Bitcoin, and some small caps.

Like I’ve performed for a few months now, I’ll proceed with earlier changes which were outlined. For my part, it stays an intraday atmosphere, the place other than some remoted swing alternatives in China, commodities, and rising markets, the chance has been on an intraday foundation.

Whereas the market stays in a variety close to lows, under declining short-term shifting averages and its 200-day, I’ll proceed with an intraday focus. Coming into the week, I’m open-minded and keen to go lengthy or brief, relying on how we react round vital assist or resistance. For instance, I’m watching $570 for SPY as a possible inflection space, and a maintain under final week’s low as a bearish inflection level.

Now, relying on particular person relative energy, together with the general market’s positioning and internals, listed here are some shares I’ll look ahead to both lengthy or brief intraday alternatives.

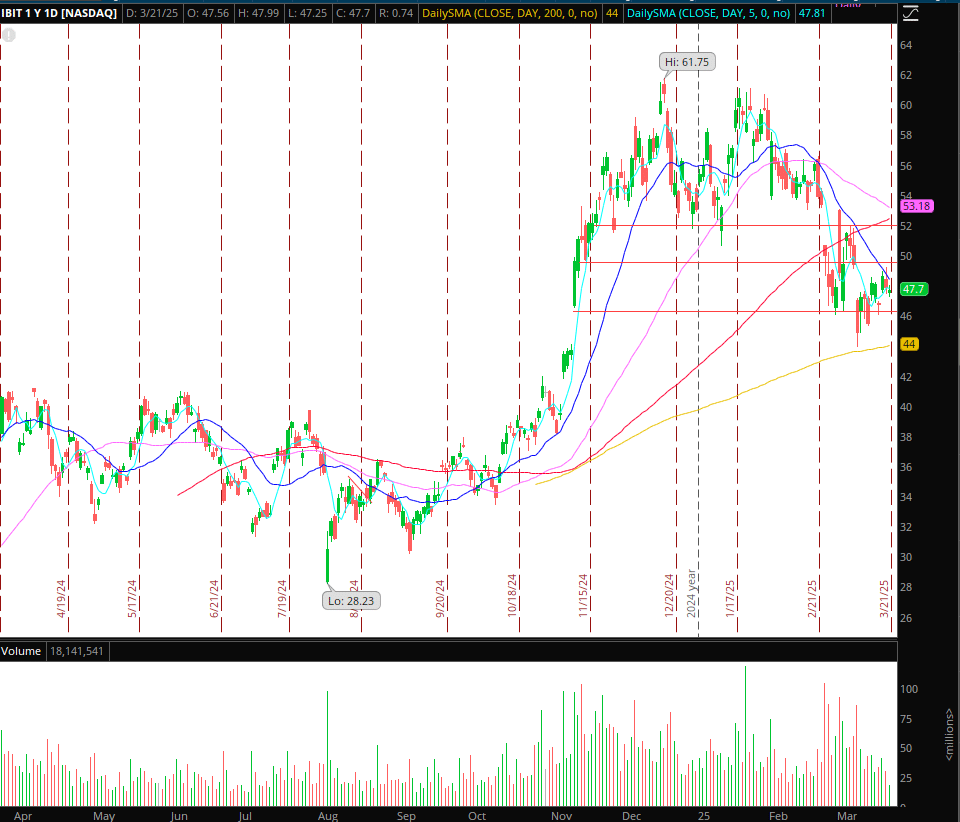

Continuation Decrease in Bitcoin (IBIT)

Bitcoin continues to be in a downtrend with consecutive decrease lows and decrease highs. Which may change if Bitcoin reclaims and bases itself above its 20-day and consolidates greater. Nonetheless, in the interim, I’m extra concerned with momentum brief scalps.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

After all, the thought additionally is dependent upon general market weak spot and potential continuation decrease. So, If Bitcoin breaks this bearish consolidation, across the $82k degree, I’d be concerned with intraday momentum shorts in IBIT.

As it’s intraday, I’d be utilizing VWAP as a information and decrease highs on the 5-minute timeframe. For entries, I’d use intraday aligned with greater timeframe consolidation breakdown ranges, intraday breakdowns, or decrease highs / VWAP stuffs. For exits, I’d use a mix of ATR-measured strikes, development breaks, or extensions from VWAP.

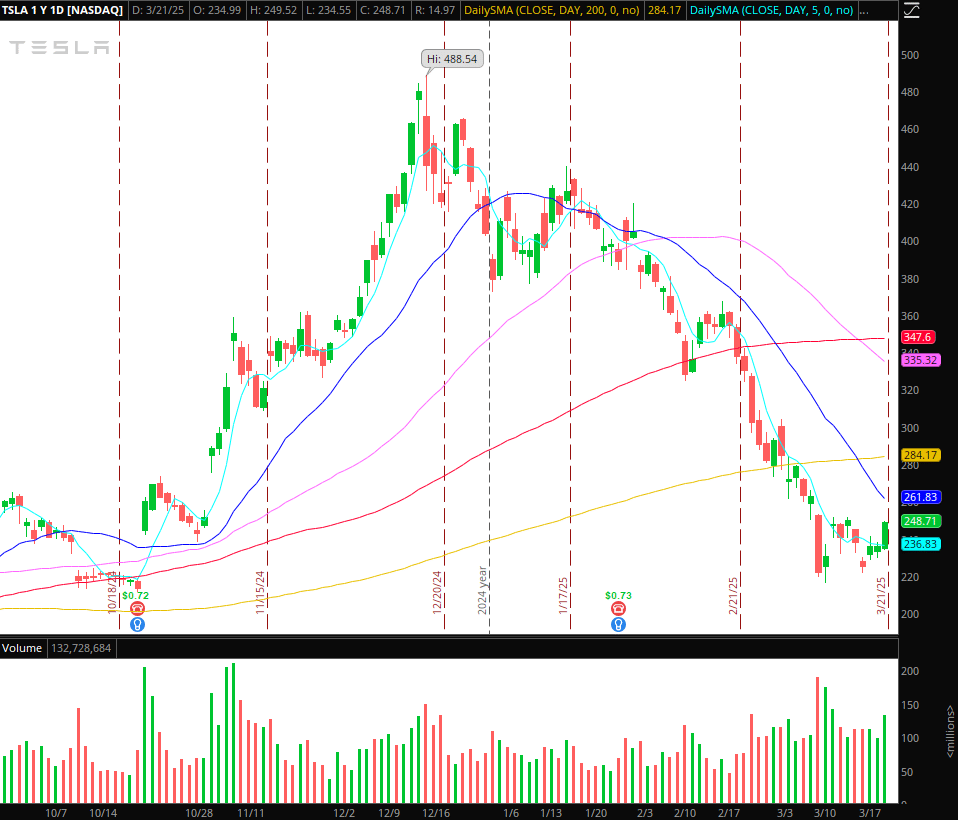

Continuation Greater in Tesla (TSLA)

Good alternative on Friday with relative energy in Tesla, together with Palantir, concepts from final week’s listing. Once more, not specializing in greater timeframe swings whereas Tesla stays under its 200-day. Nonetheless, given the relative energy on Friday and the potential rubber-band impact off its lows, I’d be inclined to search for a continuation greater if the market corporations. I’m not saying it’ll, however within the occasion the market corporations up, Tesla, after Friday’s energy, could be a go-to for follow-through.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

If Tesla expresses relative energy and the market has favorable internals and positioning intraday, I’d search for greater lows above VWAP for entry or consolidation breakouts intraday with a cease under the 5-min greater low / breakout level. As I mentioned in my latest IA assembly, I’m fast to safe features and path my cease for trades like this, so I’ll comply with the identical method outlined intimately in that assembly.

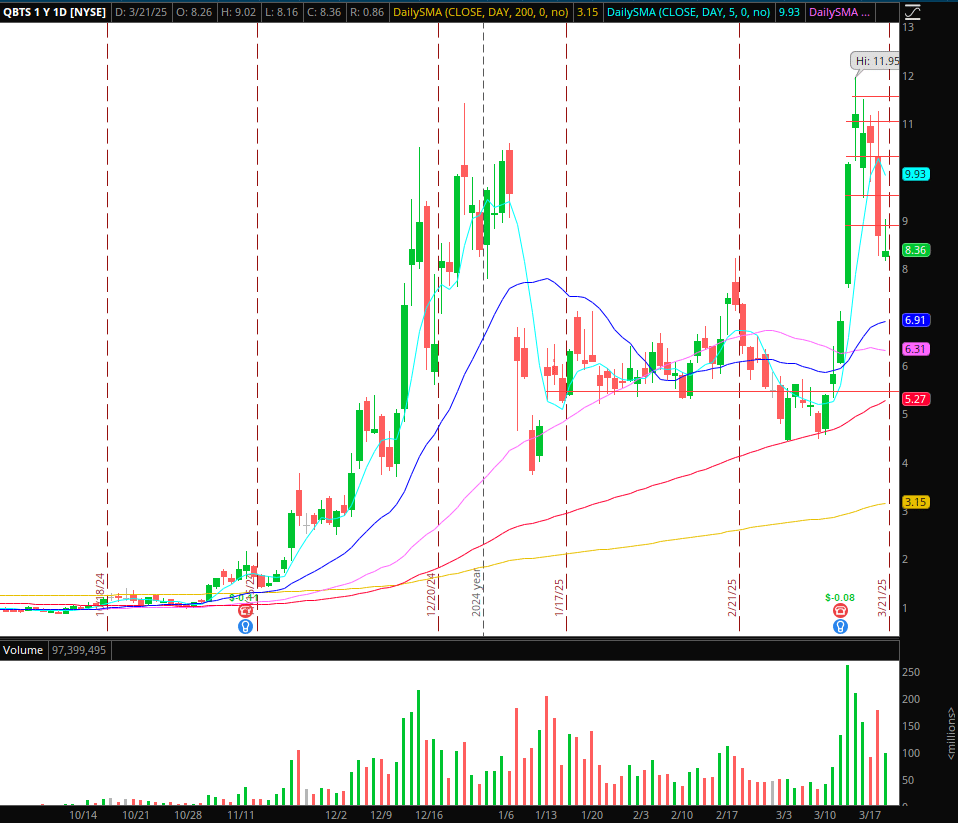

Pops to Brief in Quantum

Concerning the quantum theme, my go-to identify is QBTS. As outlined within the earlier watchlist, Thursday was a superb Promote the Information alternative. Now, going ahead, I’m in search of a pushback into prior areas of resistance and failure to re-short.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

So, whereas a number of situations exist, I’ll define only one for a possible intraday brief alternative. Areas I’m concerned with are $9 and $9.5. If QBTS can push again towards Friday’s excessive, close to $9, and fail whereas displaying some relative weak spot to the quantum basket, I’d look to place brief versus the HOD. I’d be concentrating on a transfer towards Friday’s low. One other central space of potential resistance is $9.5 – the place the inventory broke down from on Thursday and the earlier main space of assist, which I’d prefer to see develop into resistance within the coming days.

Small-Caps on Watch:

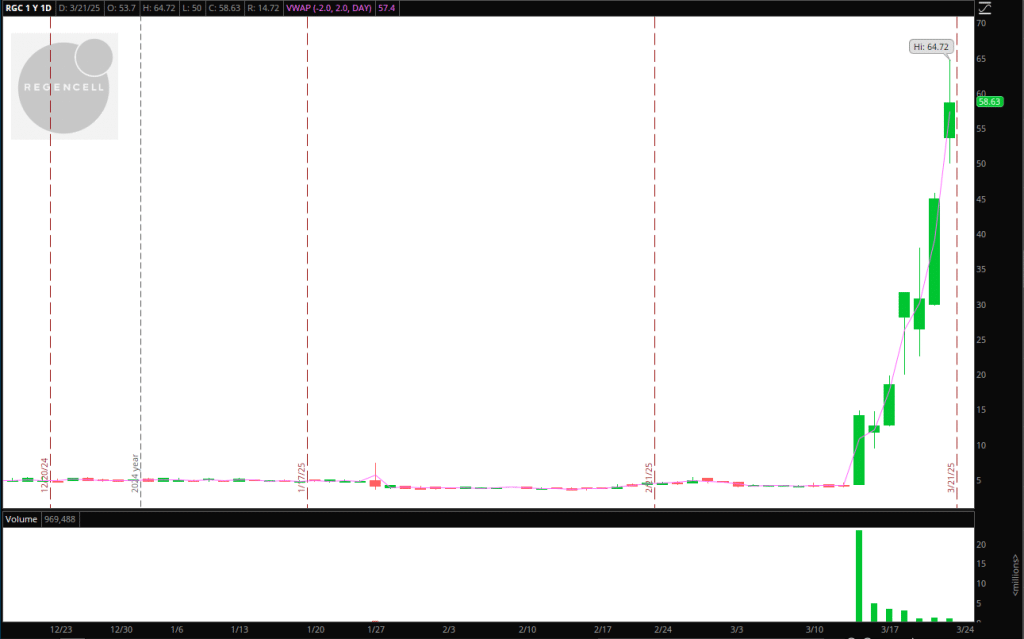

RGC: Low float, small-cap, and never a reputation to commerce or watch until it’s an space of energy for you. I feel its surge is extra in regards to the mechanics versus the basics. As soon as cussed shorts have actually exited and offered the liquidity for a locked float to be unwinded/precise promoting enters the fray for the primary time, a brief alternative might current itself. So, I’ll preserve it on aspect look ahead to that state of affairs and search for the bottom to verify earlier than paying nearer consideration this week.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

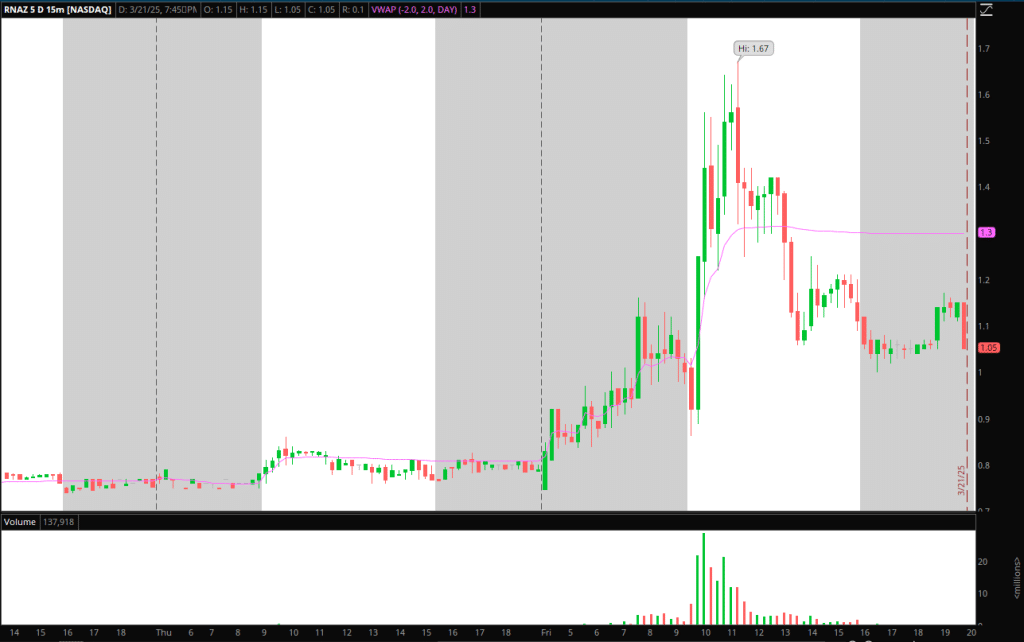

RNAZ: Good failure on Friday. Easy plan right here for an intraday commerce; I’m in search of pops to brief again towards multi-day VWAP and $1.4 failure zone from Friday.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

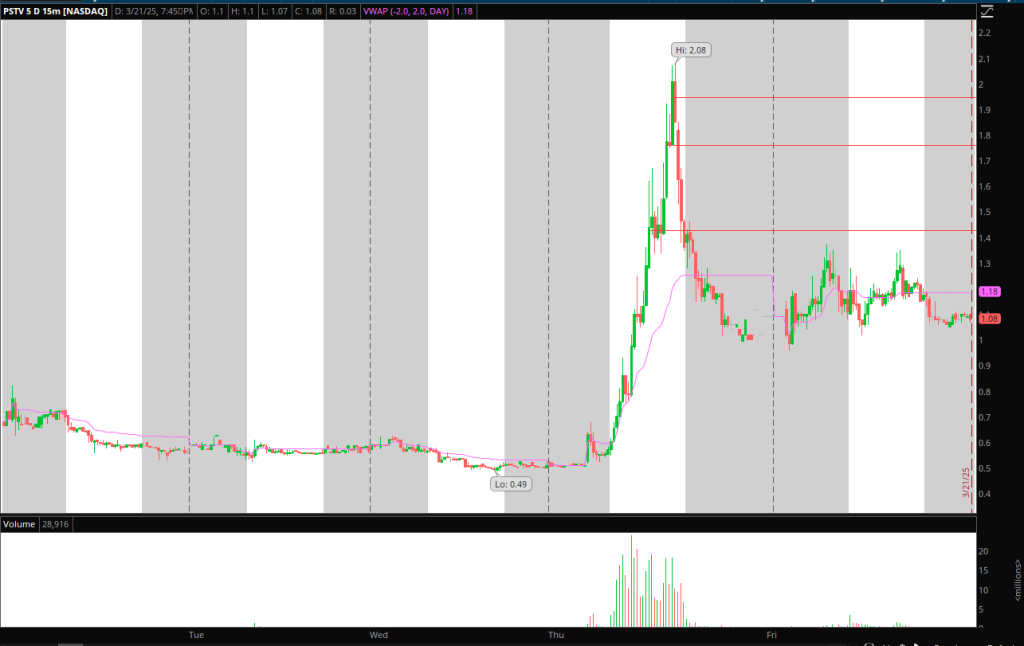

PSTV: Improbable dealer on Thursday, adopted by a possible liquidity lure forming on Friday. I’m hoping this has a secondary squeeze and push greater within the coming days, which might arrange a dead-cat bounce brief into the $1.3 – $1.6 zone, ideally.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements comparable to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Necessary Disclosures