Merchants,

I look ahead to sharing my high setups for the upcoming week, together with potential trades in Tesla, Palantir, QQQs, and extra.

I’ll proceed with earlier changes to take care of a move2move mindset for the early a part of subsequent week, barring any important developments or headlines and whether or not or not the market can agency up above its 5-day SMA.

So, let’s get proper into my high concepts for the week.

Continuation Increased in Tesla: With a powerful rally within the markets and reclaim of its 5-day in SPY, QQQ, and Tesla, I’m searching for a better continuation subsequent week, barring any important headlines.

For Tesla, I’d prefer to see important relative power to its sector. Secondly, I’d prefer to see a breakout above Friday and final week’s excessive for an entry lengthy. Relying on the intraday motion, I’d both have a LOD or a consolidation breakout cease. To exit, I’d piece out round a core because the inventory extends from VWAP intraday, particularly if it extends near a full ATR from entry.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements resembling liquidity, slippage and commissions.

If the inventory closes sturdy together with the markets, I’d be open to swinging a 3rd of the place versus the LOD. Ideally, I need to see $250 turn into assist after performing as important resistance final week. That will probably be a vital clue, together with relative power or weak spot. An ATR goal is the first aim. The lofty aim is the 200-day if the thought materializes.

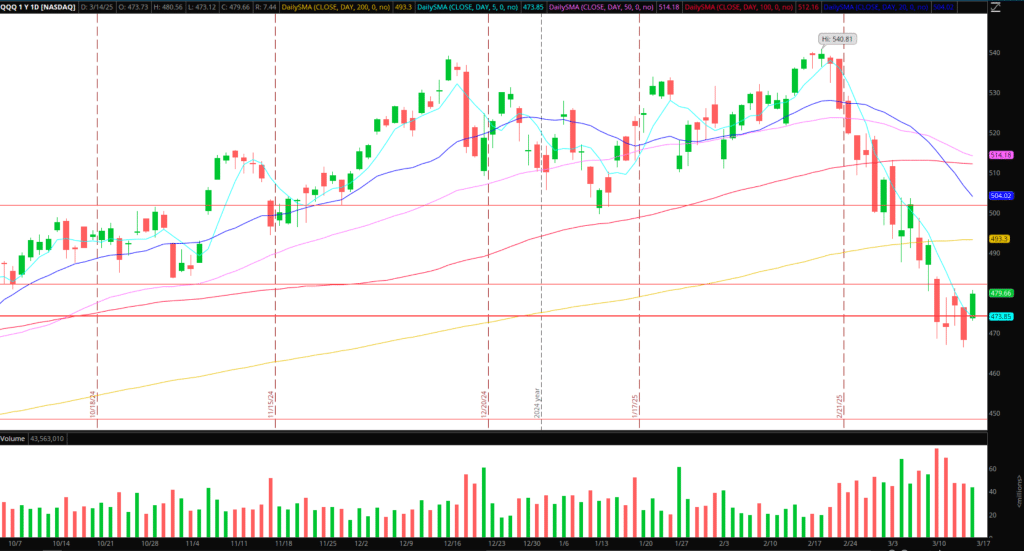

Bounce Continuation in Tech (QQQ): Just like the thought in Tesla, the QQQs, after their sturdy shut on Friday and over 11% correction from 52-week highs, current the same bounce setup. For buying and selling the QQQs, will probably be needed to observe relative power, together with market internals and positioning of its high holdings.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements resembling liquidity, slippage and commissions.

I’d provoke an extended starter place if I discover constructive internals and the QQQs holding on the 2-day VWAP and ensure a better low. Nevertheless, ideally, I’d prefer to see the market agency above Friday’s excessive earlier than getting lengthy. My first goal for continuation from Friday’s bounce could be final week’s excessive, over $483. The lofty aim could be a whole ATR transfer, placing the goal nearer to $490 and its 200-day SMA. Like Tesla, I’m extra centered on an intraday transfer, but when there’s a good shut and regular uptrend above VWAP, I’d be open to carrying a small piece in a single day.

Together with QQQs and Tesla, I’ll monitor AMZN and PLTR for comparable alternatives.

After all, if the market fails to carry Friday’s excessive early subsequent week and we churn again within the vary close to the lows, my bias and plan will shift to comparatively weak shares for momentum shorts. It’s important to stay open-minded and nimble within the present atmosphere.

Potential Promote the Information in Quantum: Sturdy bounce within the quantum basket on Friday. With NVDA’s quantum day on the twentieth, Thursday, subsequent week, I’m hopeful we’ll get a sell-the-news alternative. Early on within the week, given the vary and liquidity in names like QBTS, RGTI, and IONQ, I’ll be open to each lengthy and brief scalps.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements resembling liquidity, slippage and commissions.

Nevertheless, the overarching thought and potential A+ alternative could be if we obtained some continuation to the upside and exhausted some cussed swing shorts forward of the convention. That value motion and additional vary enlargement to the upside would possibly arrange a improbable sell-the-news brief alternative forward of the occasion / throughout it on Thursday.

Final Week’s Small Caps on Watch: HMR, SUNE, and GV will probably be on the radar with alerts round potential overhead and resistance zones – Within the occasion any of the names have a short-lived push larger again into resistance zones for potential intraday fades. Alternatively, if a number of days cross they usually take out prior resistance, it would arrange a liquidity entice for an extended.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t replicate the influence, if any, of sure market elements resembling liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Essential Disclosures