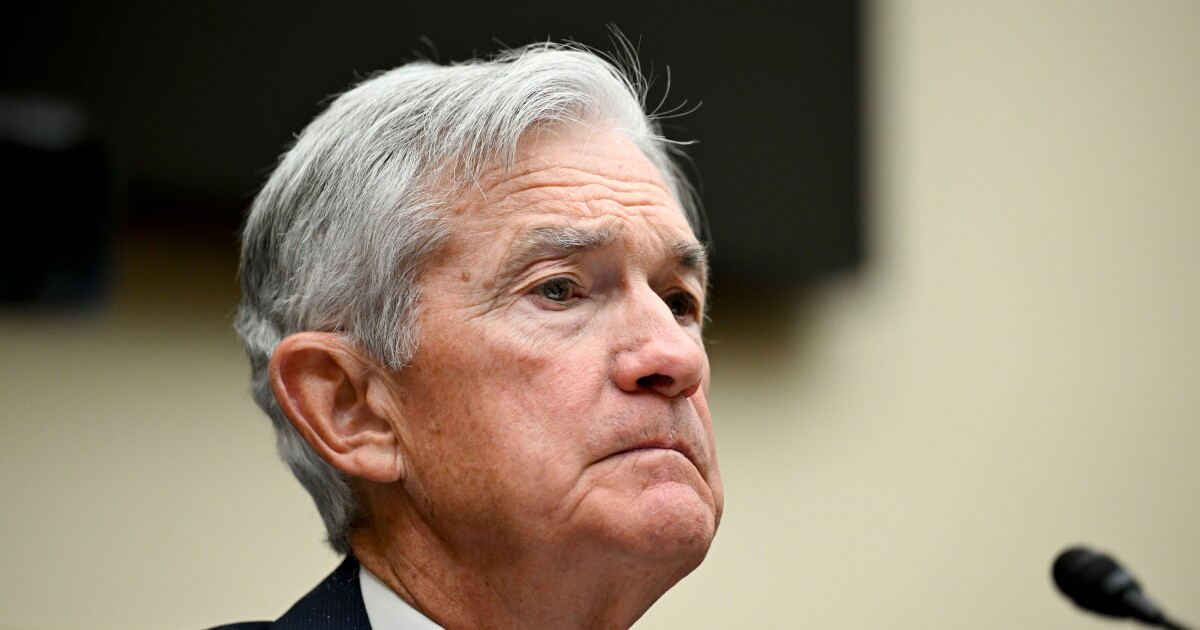

Federal Reserve Chair Jerome Powell cautioned that some areas of the nation could also be uninsurable within the subsequent decade.Talking in entrance of the Senate Banking Committee, Powell famous that insurance coverage firms and banks are already “pulling out of coastal areas, areas the place there are numerous fires.” He predicted that in “10 or 15 years there are going to be areas of the nation the place you’ll be able to’t get a mortgage.”

This situation will fall on owners and on state and native governments, he added throughout his semi-annual report back to Congress on financial coverage Tuesday.

“I do not know that it is a monetary stability situation, but it surely definitely can have vital financial penalties,” he stated.The pinnacle of the Federal Reserve additionally addressed issues about elevated mortgage rates of interest, housing affordability and the potential launch of Fannie Mae and Freddie Mac from conservatorship.

Powell instructed lawmakers that though mortgage charges stay excessive, they don’t seem to be immediately associated to the Fed’s charge, however fairly to the 10-year Treasury. He added that even when charges finally drop, there’ll “nonetheless be a housing scarcity in lots of locations,” partly because of the pandemic’s results, which elevated the price of homeownership.

“It is not apparent that decrease charges would result in decrease housing inflation as a result of that may improve housing demand,” Powell stated. “It could unlock folks’s low mortgages, however that may create each a purchaser and a vendor, so it isn’t clear that may be one thing that may drive down housing inflation.”

As of Feb, 6, the 30-year mounted charge mortgage averaged 6.89%,in contrast with 6.95% one week prior, per the Freddie Mac Main Mortgage Market Survey.

Relating to Fannie Mae and Freddie Mac, Powell stated the present conservatorship “does maintain down mortgage charges.” He deflected a query from Sen. Jack Reed (D-R.I.) about whether or not government-sponsored enterprises going non-public can be “detrimental to the housing market,” as an alternative saying that placing them “again within the non-public sector has some enchantment over the longer run, however I go away that with you.”The Trump administration is anticipated to take steps towards privatizing the 2 entities. In written statements submitted to the Senate Banking Committee in late January, Treasury Secretary Scott Bessent stated Fannie Mae and Freddie Mac needs to be launched, but it surely needs to be executed in a measured means.

“I look ahead to engaged on the present standing of the conservatorship of Fannie Mae and Freddie Mac,” Bessent wrote. “The conservatorships have endured for greater than 15 years, and no conservatorship needs to be indefinite. Nevertheless, any actions pursued needs to be rigorously designed and executed.”