The panorama of self-managed superannuation fund (SMSF) funding has developed considerably, with trustees more and more exploring refined funding methods to boost returns and handle threat.

Choices buying and selling, when correctly applied inside an SMSF, can function a precious instrument for each earnings era and threat administration.

Nevertheless, this technique requires cautious consideration of regulatory necessities, funding goals, and threat administration protocols.

This complete information explores the important thing points of buying and selling choices inside an SMSF, offering trustees and advisors with important data to make knowledgeable selections and preserve compliance with superannuation rules.

Contents

Funding Technique Necessities

The cornerstone of profitable choices buying and selling inside an SMSF lies in its regulatory compliance.

Earlier than implementing any choices technique, trustees should guarantee a number of key necessities are met:

The fund’s belief deed should explicitly allow choices buying and selling.

Many older belief deeds could not embody particular provisions for derivatives buying and selling, necessitating a deed replace.

Certified authorized professionals ought to conduct this replace to make sure it adequately covers all meant funding actions whereas sustaining compliance with superannuation regulation.

Choices buying and selling should align with the fund’s documented funding technique.

This technique ought to clearly articulate:

The function of choices in reaching the fund’s funding goals

The particular forms of choices methods to be employed

Danger administration procedures

The utmost allocation to options-based methods

How these methods contribute to member retirement advantages

The only real function take a look at stays paramount.

Trustees should reveal that each one choices buying and selling actions are performed with the first goal of offering retirement advantages to members.

This contains sustaining detailed documentation of how every technique contributes to this purpose.

Documentation and Reporting

Correct documentation kinds the spine of compliant choices buying and selling inside an SMSF. Required documentation contains:

Transaction Data

Place Monitoring

Audit Path

Annual Reporting

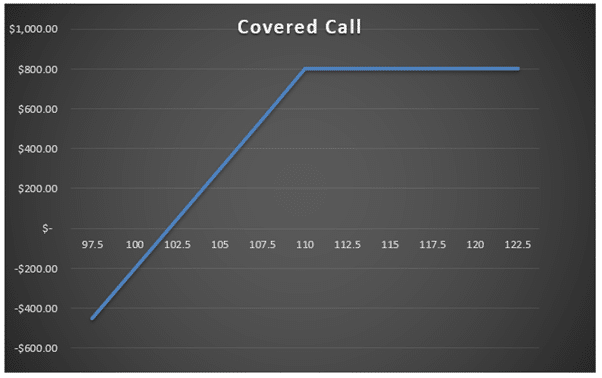

Coated Name Writing

Coated name writing is commonly thought of probably the most conservative choices technique and is extensively accepted inside SMSFs.

This technique entails promoting name choices in opposition to current inventory holdings, producing further earnings via choice premiums whereas accepting a cap on potential upside.

For SMSFs targeted on earnings era and keen to restrict potential capital positive aspects, lined calls can present a dependable earnings stream whereas sustaining the advantages of inventory possession.

Free Coated Name Course

This technique entails:

Writing (promoting) name choices in opposition to current inventory holdings

Gathering premium earnings to boost portfolio returns

Sustaining full protection (no bare calls)

Common monitoring of place delta and potential task

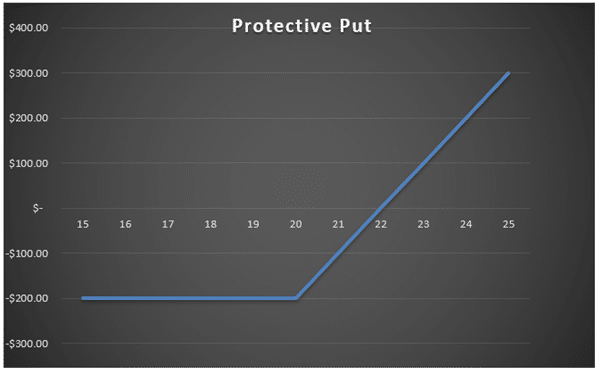

Protecting Put Shopping for

Protecting put shopping for serves as a cornerstone threat administration technique for SMSFs looking for to guard vital inventory positions or portfolio worth in opposition to market downturns.

This technique successfully creates a ground value for shares or index positions, offering trustees with a transparent most loss potential whereas sustaining limitless upside potential.

For SMSFs with substantial fairness publicity or these approaching pension section, protecting places can provide precious insurance coverage in opposition to market volatility whereas sustaining compliance with trustee obligations for threat administration.

This technique entails:

Buy of put choices to guard current positions

Portfolio insurance coverage issues

Value administration via strike choice

Period matching with funding timeframes

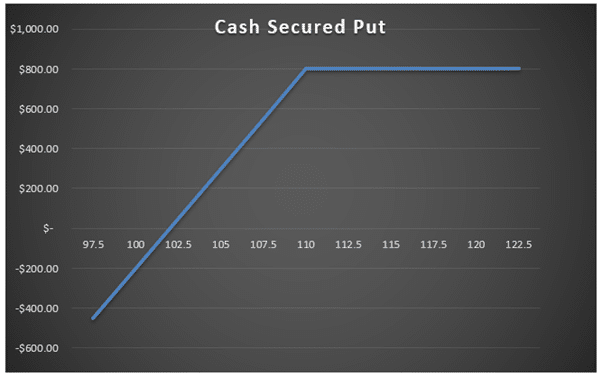

Money Secured Places

Money secured places provide SMSF trustees a methodical strategy to buying shares at costs beneath present market ranges whereas producing earnings via choice premiums.

This technique requires setting apart the total money quantity wanted to buy shares on the strike value, making certain no leverage is launched into the fund.

Like lined calls, money secured places are usually thought of acceptable inside SMSFs attributable to their outlined threat profile and clear alignment with funding goals.

This technique entails:

Writing (promoting) put choices in opposition to absolutely secured money positions

Money protection equal to most potential inventory buy obligation

Premium obtained upfront

Potential to accumulate inventory beneath present market value

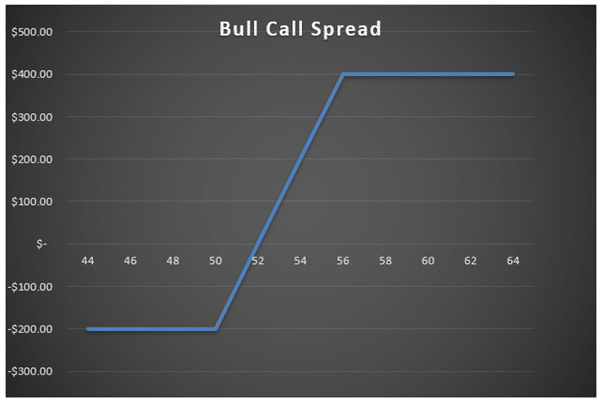

Debit Spreads

Debit spreads present SMSFs with a defined-risk strategy to implementing directional views on particular person shares or indices.

For SMSFs trying to implement directional methods with out the limitless threat of bare positions, debit spreads are a lovely alternative

Bull Name Spreads:

Purchase decrease strike name

Promote larger strike name

Most loss restricted to web premium paid

Outlined revenue potential

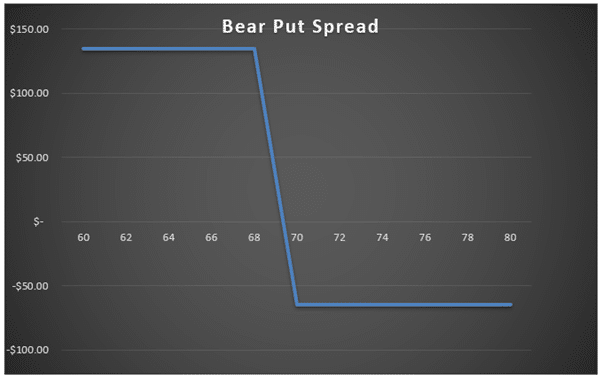

Bear Put Spreads:

Purchase larger strike put

Promote decrease strike put

Most loss restricted to web premium paid

Clear threat/reward parameters

Credit score Spreads

Credit score spreads provide SMSFs a method to generate earnings via choices whereas sustaining strictly outlined threat parameters.

These methods profit from time decay and could be structured to revenue from each bullish and bearish market views, whereas requiring much less capital than outright inventory positions.

For SMSFs looking for earnings era with quantifiable threat, credit score spreads can function a precious different to conventional yield-focused investments.

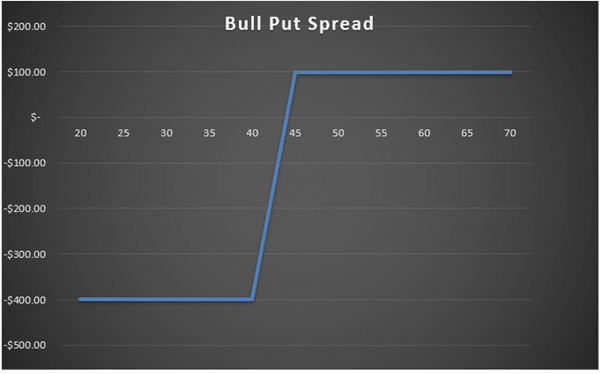

Bull Put Spreads:

Promote larger strike put

Purchase decrease strike put

Most loss is unfold width minus premium

Requires acceptable margin/money protection

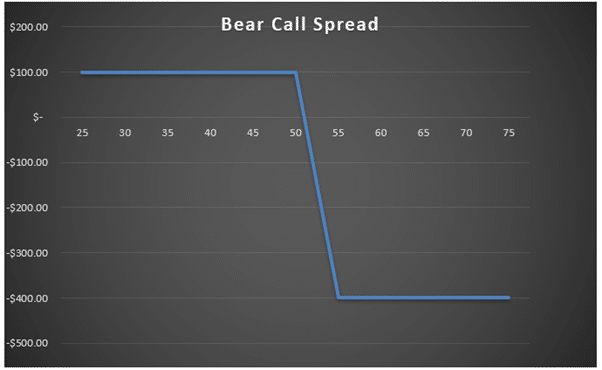

Bear Name Spreads:

Promote decrease strike name

Purchase larger strike name

Most loss is unfold width minus premium

Should align with portfolio goals

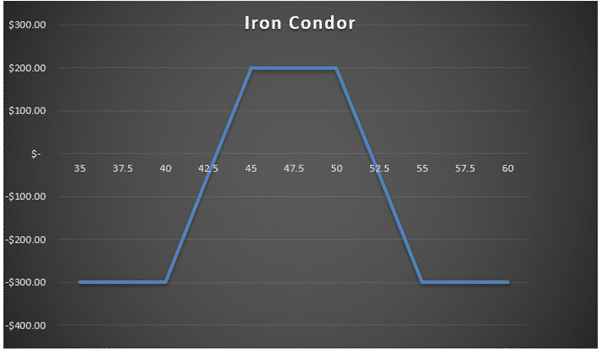

Iron Condors

Iron condors mix two credit score spreads to create a market-neutral technique that earnings from range-bound value motion and time decay.

This technique appeals to SMSFs looking for to generate constant earnings with out taking a robust directional view in the marketplace.

The outlined threat nature and potential for normal earnings make iron condors significantly appropriate for funds in pension section looking for constant returns.

This technique entails:

Bull put unfold

Bear name unfold

Outlined most loss

Revenue era focus

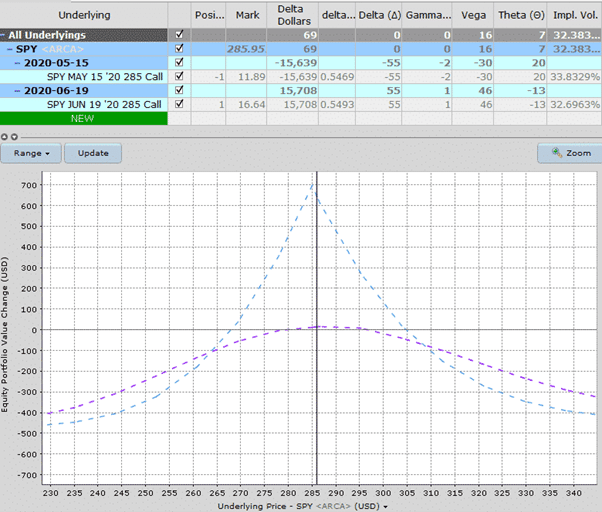

Calendar Spreads

Calendar spreads exploit the totally different decay charges of choices throughout time, providing SMSFs a complicated method to profit from time decay.

This technique entails concurrently shopping for and promoting choices with the identical strike value however totally different expiration dates, making a place that may revenue from sideways or slowly trending markets.

Calendar spreads could be significantly efficient in low-volatility environments when applied as a part of a diversified choices technique.

This technique entails:

Promote near-term choice

Purchase longer-term choice

Similar strike value

Might be applied with places or calls

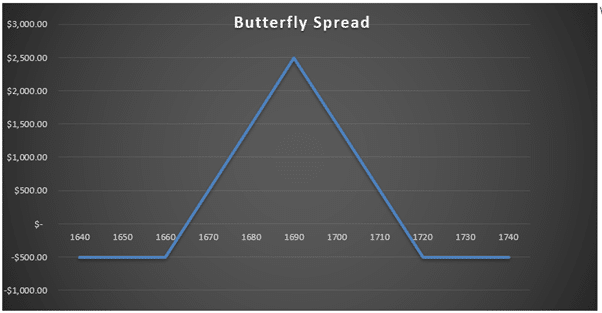

Butterfly Spreads

Butterfly spreads present SMSFs with a exact method to goal particular value ranges whereas strictly limiting potential losses.

This technique entails:

Purchase one decrease strike choice

Promote two center strike choices

Purchase one larger strike choice

Might be applied with calls or places

Understanding actions that will battle with SMSF trustee obligations is essential for sustaining compliance.

Whereas there aren’t express legislative prohibitions on particular choices methods, sure actions require cautious consideration attributable to their potential battle with trustee obligations underneath the Superannuation Business (Supervision) Act 1993 (SIS Act).

Key Legislative Issues

Sole Goal Take a look at (Part 62 SIS Act)

All funding selections should align with offering retirement advantages

Excessive-risk methods that might jeopardize retirement financial savings could battle with this take a look at

Trustees should reveal how every technique serves members’ retirement pursuits

Trustee Obligations (Part 52 SIS Act)

Train due care, talent, and diligence

Act in the perfect pursuits of beneficiaries

Keep an acceptable funding technique

Think about threat and return acceptable to retirement functions

Funding Technique Necessities (Regulation 4.09 SIS Rules)

Think about dangers within the context of the entire funding technique

Keep acceptable diversification

Guarantee ample liquidity

Account for members’ circumstances

Excessive-Danger Methods Requiring Cautious Consideration

Bare Name Writing

Presents theoretically limitless threat publicity

Could battle with trustee obligations attributable to threat degree

Could possibly be difficult to justify underneath the only function take a look at

Usually prevented by SMSFs attributable to threat profile

Complicated Multi-leg Methods

Should be fastidiously evaluated in opposition to trustee obligations

Require complete threat administration documentation

Want clear alignment with funding technique

May have specialist recommendation to implement correctly

Margin Lending and Leverage

Restricted recourse borrowing preparations (LRBAs) have particular necessities

Leverage via choices have to be fastidiously thought of

Want clear documentation of threat administration

Should align with total funding technique

Entry 9 Free Choice Books

Buying and selling choices inside an SMSF can present precious advantages when correctly applied. Success requires cautious consideration to regulatory necessities, threat administration, and ongoing monitoring.

Trustees should preserve acceptable data ranges and interact mandatory skilled help to make sure their choices buying and selling actions contribute positively to member retirement advantages whereas sustaining full compliance with superannuation rules.

This text is for informational functions solely and doesn’t represent monetary recommendation.

SMSF trustees ought to search skilled recommendation from certified advisers earlier than implementing choices buying and selling methods inside their fund.

Choices buying and selling entails vital dangers and might not be appropriate for all SMSFs.

Commerce secure!

Disclaimer: The data above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who will not be acquainted with trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.