Printed on January 14th, 2025 by Bob Ciura

A “one resolution inventory” is a inventory that you simply purchase (the purchase is the one resolution) and maintain for the long term.

There aren’t any different selections wanted, as a result of one resolution shares have sturdy and powerful aggressive benefits coupled with shareholder pleasant managements. They reward buyers extra the longer they maintain them.

“I don’t need numerous good investments; I would like a couple of excellent ones. If the job has been appropriately finished when a standard inventory is bought, the time to promote it’s nearly by no means.”

– Investing legend Philip Fisher

The thought behind one resolution shares is to determine companies which can be prone to reward shareholders with rising worth on a per share foundation over lengthy durations of time, and maintain onto these companies no matter market fluctuations.

The phrase was popularized with the “Nifty Fifty” shares of the late 1960’s and early 1970’s. Three of the “Nifty Fifty” shares which have compounded investor wealth over the past ~50 years are beneath:

Coca-Cola (KO)

McDonald’s (MCD)

Johnson & Johnson (JNJ)

What do these shares have in frequent?

What the three shares above have in frequent is that they’re all Dividend Aristocrats, a gaggle of 66 shares within the S&P 500 Index, with 25+ consecutive years of dividend will increase.

There are presently 66 Dividend Aristocrats. You’ll be able to obtain an Excel spreadsheet of the Dividend Aristocrats record (with metrics that matter similar to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

Disclaimer: Certain Dividend will not be affiliated with S&P International in any approach. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Certain Dividend’s personal overview, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s primarily based. Not one of the data on this article or spreadsheet is official information from S&P International. Seek the advice of S&P International for official data.

There are a number of benefits to “one resolution investing”.

The primary and most outstanding is that it places a larger emphasis in your purchase selections.

In case your anticipated holding interval is a month, the underlying high quality of the enterprise for the inventory you’re shopping for doesn’t matter a lot in any respect…

However in case you are shopping for and holding “eternally”, then the standard of the enterprise is paramount.

The next 10 one resolution shares have elevated their dividends for over 25 years, making them Dividend Aristocrats.

As well as, all 10 have Dividend Threat Scores of ‘A’ within the Certain Evaluation Analysis Database (our highest score), and dividend payout ratios beneath 50%, indicating robust dividend security.

In consequence, these one resolution shares might be counted on for a few years of continued dividend will increase sooner or later.

The one resolution shares beneath are ranked by dividend yield, from lowest to highest.

Desk of Contents

You’ll be able to immediately bounce to any particular part of the article by clicking on the hyperlinks beneath:

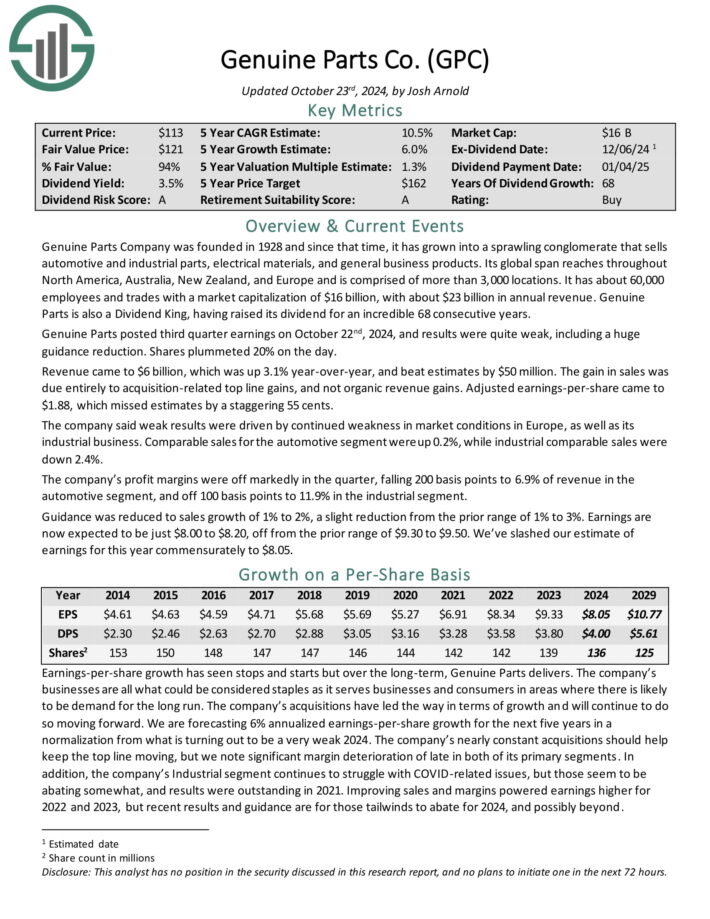

One Resolution Inventory To Purchase Now: Real Components Co. (GPC)

Real Components has the world’s largest international auto components community, with greater than 10,800 areas worldwide. As a serious distributor of automotive and industrial components, Real Components generates annual income of almost $23 billion.

Supply: Investor Presentation

It operates two segments, that are automotive (consists of the NAPA model) and the economic components group which sells industrial substitute components to MRO (upkeep, restore, and operations) and OEM (authentic tools producer) clients.

Clients are derived from a variety of segments, together with meals and beverage, metals and mining, oil and gasoline, and well being care.

The corporate reported its third-quarter 2024 outcomes, with gross sales reaching $6.0 billion, a 2.5% improve from the earlier yr.

Internet earnings fell to $227 million, or $1.62 per diluted share, down from $351 million in Q3 2023. Adjusted diluted earnings per share (EPS) additionally decreased to $1.88 in comparison with $2.49 final yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on GPC (preview of web page 1 of three proven beneath):

One Resolution Inventory To Purchase Now: Johnson & Johnson (JNJ)

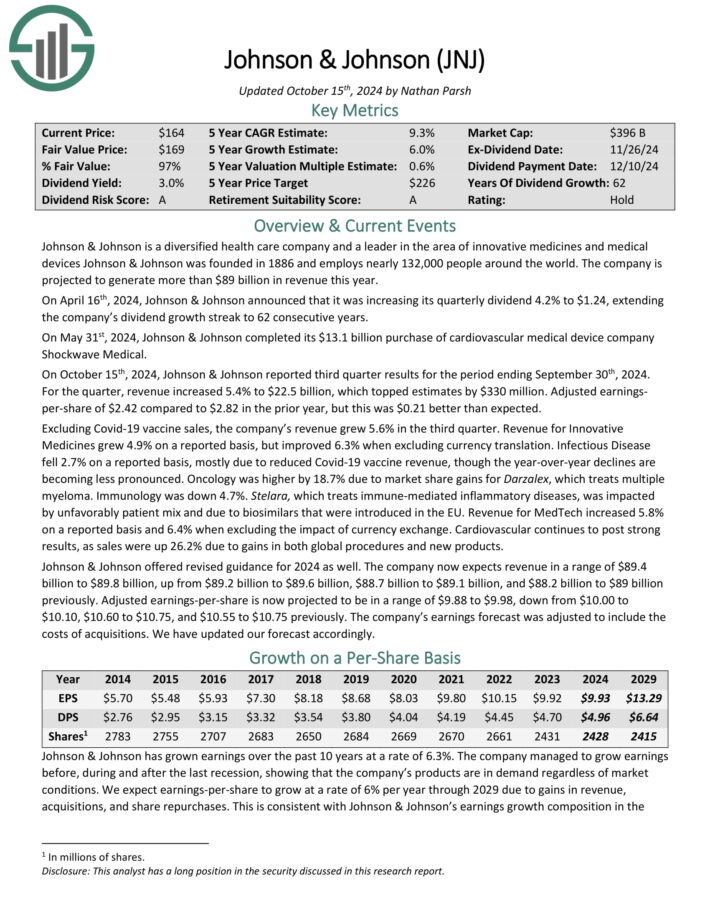

Johnson & Johnson was based in 1886 and has remodeled into one of many largest firms on the earth. Johnson & Johnson is a mega-cap inventory. The corporate generates annual gross sales above $99 billion.

Johnson & Johnson operates a diversified enterprise mannequin, permitting it to enchantment to all kinds of consumers inside the healthcare sector. J&J now operates two segments, prescription drugs and medical units, after spinning off its client well being franchises.

Johnson & Johnson reported third-quarter 2024 gross sales development of 5.2%, reaching $22.5 billion, with operational development of 6.3%.

Supply: Investor Presentation

Nevertheless, earnings per share (EPS) decreased by 34.3%, largely resulting from a one-time particular cost and purchased in-process analysis and improvement (IPR&D).

Adjusted EPS fell 9.0% to $2.42, pushed by the identical IPR&D affect. The corporate made vital developments, together with approvals for therapies like TREMFYA and RYBREVANT, and the submission of a brand new normal surgical procedure robotic system, OTTAVA.

Click on right here to obtain our most up-to-date Certain Evaluation report on JNJ (preview of web page 1 of three proven beneath):

One Resolution Inventory To Purchase Now: Exxon Mobil Corp. (XOM)

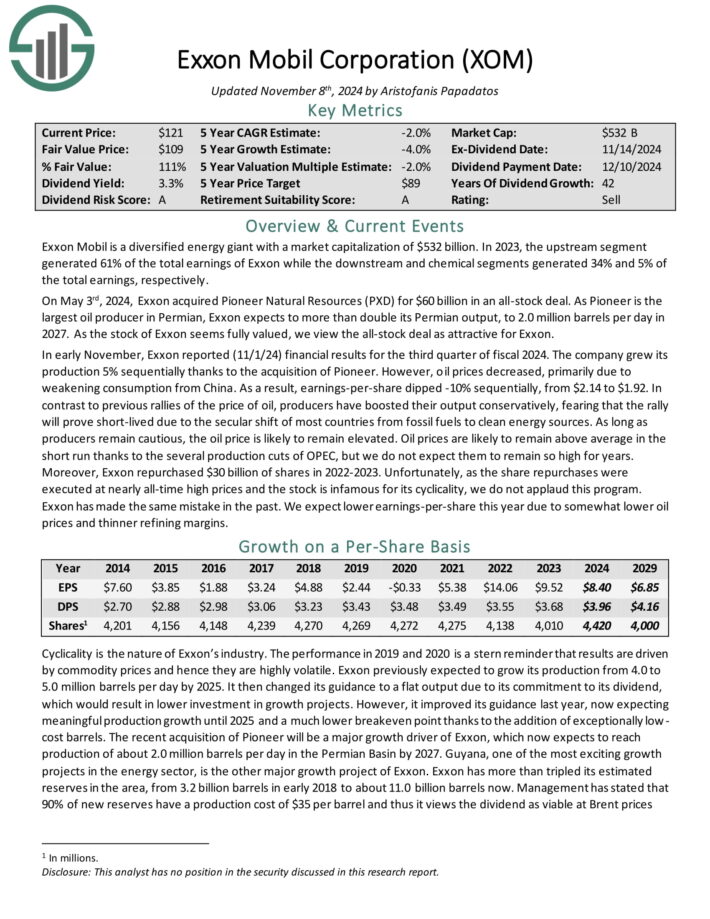

Exxon Mobil is a diversified power large with a market capitalization above $500 billion. In 2023, the upstream phase generated 61% of the full earnings of Exxon whereas the downstream and chemical segments generated 34% and 5% of the full earnings, respectively.

On Could third, 2024, Exxon acquired Pioneer Pure Assets (PXD) for $60 billion in an all-stock deal. As Pioneer is the biggest oil producer in Permian, Exxon expects to greater than double its Permian output, to 2.0 million barrels per day in 2027.

Supply: Investor Presentation

In early November, Exxon reported (11/1/24) monetary outcomes for the third quarter of fiscal 2024. The corporate grew its manufacturing 5% sequentially because of the acquisition of Pioneer.

Nevertheless, oil costs decreased, primarily resulting from weakening consumption from China. In consequence, earnings-per-share dipped -10% sequentially, from $2.14 to $1.92.

The current acquisition of Pioneer will probably be a serious development driver of Exxon, which now expects to succeed in manufacturing of about 2.0 million barrels per day within the Permian Basin by 2027.

Guyana, one of the vital thrilling development tasks within the power sector, is one other main development undertaking. Exxon has greater than tripled its estimated reserves within the space, from 3.2 billion barrels in early 2018 to about 11.0 billion barrels now.

Click on right here to obtain our most up-to-date Certain Evaluation report on XOM (preview of web page 1 of three proven beneath):

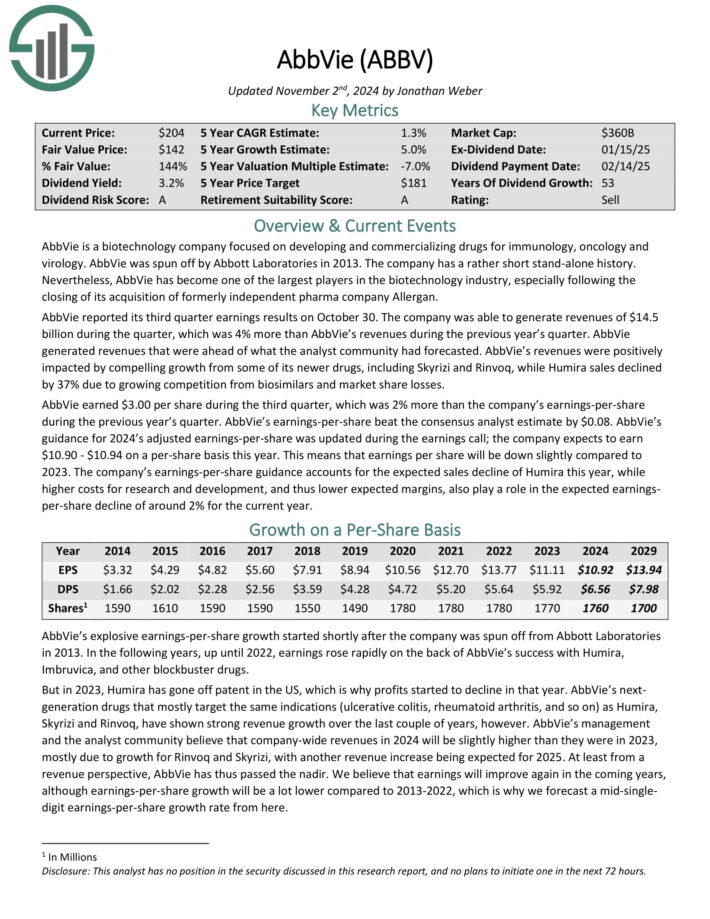

One Resolution Inventory To Purchase Now: AbbVie Inc. (ABBV)

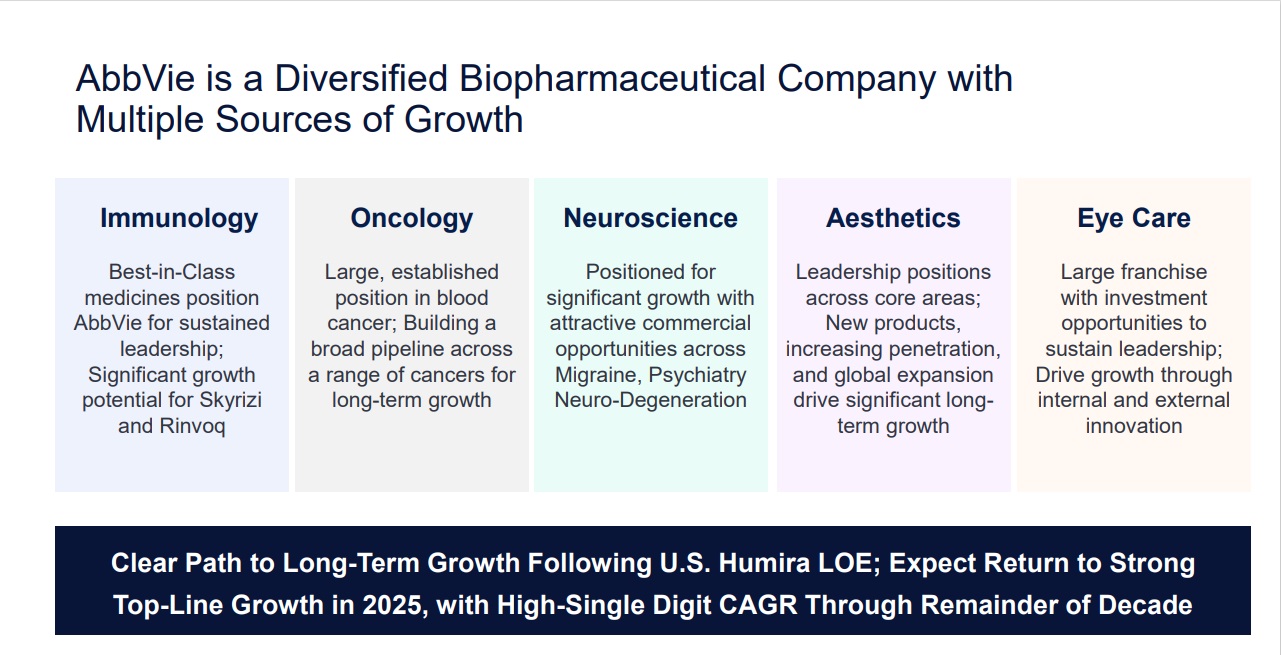

AbbVie is a pharmaceutical firm spun off by Abbott Laboratories (ABT) in 2013. Its most necessary product is Humira, now going through biosimilar competitors in Europe and the U.S., which has had a noticeable affect on the corporate.

Even so, AbbVie stays an enormous within the healthcare sector, with a big and diversified product portfolio.

Supply: Investor Presentation

AbbVie reported its third quarter earnings outcomes on October 30. The corporate was capable of generate revenues of $14.5 billion in the course of the quarter, which was 4% greater than AbbVie’s revenues in the course of the earlier yr’s quarter.

Revenues have been positively impacted by compelling development from a few of its newer medication, together with Skyrizi and Rinvoq, whereas Humira gross sales declined by 37% resulting from rising competitors from biosimilars and market share losses.

AbbVie earned $3.00 per share in the course of the third quarter, which was 2% greater than the corporate’s earnings-per-share in the course of the earlier yr’s quarter. AbbVie’s earnings-per-share beat the consensus analyst estimate by $0.08.

AbbVie’s steering for 2024’s adjusted earnings-per-share was up to date in the course of the earnings name; the corporate expects to earn $10.90 – $10.94 on a per-share foundation this yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on AbbVie (preview of web page 1 of three proven beneath):

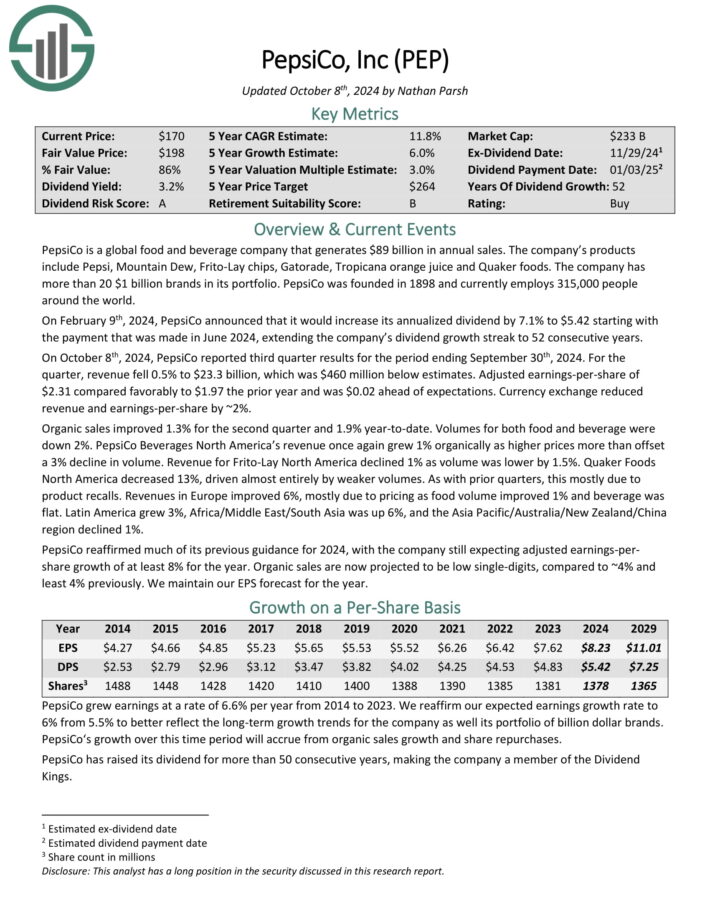

One Resolution Inventory To Purchase Now: PepsiCo Inc. (PEP)

PepsiCo is a world meals and beverage firm that generates $89 billion in annual gross sales. The corporate’s merchandise embrace Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is cut up roughly 60-40 by way of meals and beverage income. It is usually balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On October eighth, 2024, PepsiCo reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income fell 0.5% to $23.3 billion, which was $460 million beneath estimates.

Adjusted earnings-per-share of $2.31 in contrast favorably to $1.97 the prior yr and was $0.02 forward of expectations. Forex trade diminished income and earnings-per-share by ~2%.

Natural gross sales improved 1.3% for the second quarter and 1.9% year-to-date. Volumes for each meals and beverage have been down 2%.

PepsiCo Drinks North America’s income as soon as once more grew 1% organically as increased costs greater than offset a 3% decline in quantity.

Click on right here to obtain our most up-to-date Certain Evaluation report on PEP (preview of web page 1 of three proven beneath):

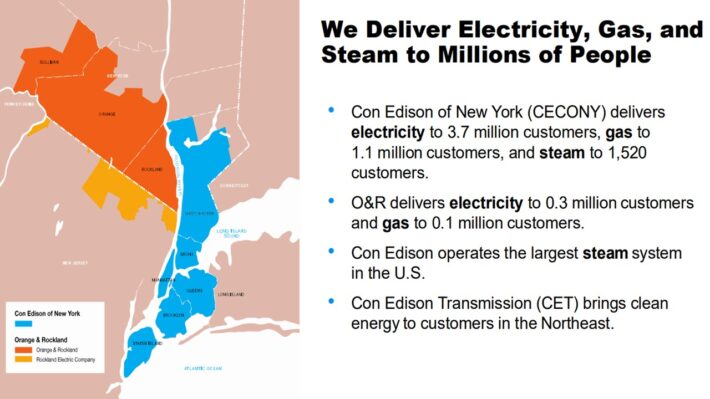

One Resolution Inventory To Purchase Now: Consolidated Edison (ED)

Consolidated Edison is a large-cap utility inventory. The corporate generates almost $15 billion in annual income and has a market capitalization of roughly $36 billion.

The corporate serves 3.7 million electrical clients, and one other 1.1 million gasoline clients, in New York.

Supply: Investor Presentation

It operates electrical, gasoline, and steam transmission companies, with a steam system that’s the largest within the U.S.

On November seventh, 2024, Consolidated Edison reported third quarter outcomes. For the quarter, income improved 5.7% to $4.1 billion, which topped estimates by $26 million.

Adjusted earnings of $583 million, or $1.68 per share, in comparison with adjusted earnings of $561 million, or $1.62 per share, within the earlier yr. Adjusted earnings-per-share have been $0.10 greater than anticipated.

As with prior durations, increased charge bases for gasoline and electrical clients have been the first contributors to leads to the CECONY enterprise, which accounts for the overwhelming majority of the corporate’s property.

Common charge base balances are nonetheless anticipated to develop by 6.4% yearly for the 2024 to 2028 interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on Consolidated Edison (preview of web page 1 of three proven beneath):

One Resolution Inventory To Purchase Now: Hormel Meals (HRL)

Hormel Meals is a juggernaut within the meals merchandise business with almost $10 billion in annual income. It has a big portfolio of category-leading manufacturers. Only a few of its high manufacturers embrace embrace Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

It has additionally pursued acquisitions to drive development. For instance, in 2021, Hormel acquired the Planters snack nuts enterprise from Kraft-Heinz (KHC) for $3.35 billion, which has boosted Hormel’s development.

Supply: Investor Presentation

Hormel posted fourth quarter and full-year earnings on December 4th, 2024, and outcomes have been consistent with expectations. The corporate posted adjusted earnings-per-share of 42 cents, which met estimates. Income was off 2% year-on-year to $3.14 billion, additionally hitting estimates.

Working earnings was $308 million for the quarter on an adjusted foundation, or 9.8% of income. Working money stream was $409 million for This fall. For the yr, gross sales have been $11.9 billion, and adjusted working earnings was $1.1 billion, or 9.6% of income. Adjusted earnings-per-share was $1.58. Working money stream hit a document of $1.3 billion.

Steering for 2025 was initiated at $11.9 billion to $12.2 billion in gross sales, with natural web gross sales development of 1% to three%.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven beneath):

One Resolution Inventory To Purchase Now: Archer Daniels Midland (ADM)

Archer-Daniels-Midland is the biggest publicly traded farmland product firm in america.

Archer-Daniels-Midland’s companies embrace processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter outcomes for Fiscal Yr (FY) 2024 on November 18th, 2024.

The corporate reported adjusted web earnings of $530 million and adjusted EPS of $1.09, each down from the prior yr resulting from a $461 million non-cash cost associated to its Wilmar fairness funding.

Consolidated money flows year-to-date reached $2.34 billion, reflecting robust operations regardless of market challenges.

Click on right here to obtain our most up-to-date Certain Evaluation report on ADM (preview of web page 1 of three proven beneath):

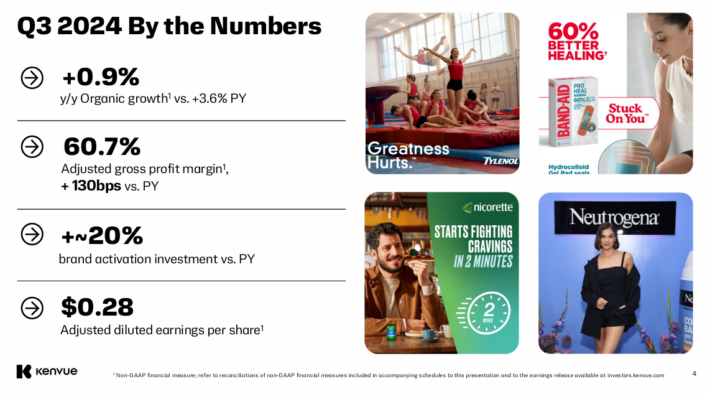

One Resolution Inventory To Purchase Now: Kenvue Inc. (KVUE)

Kenvue is a client merchandise firm that was spun off from Johnson & Johnson. It has three segments, together with Self Care, Pores and skin Well being and Magnificence, and Important Well being.

The Self Care product portfolio consists of cough, chilly, allergy, smoking cessation, and ache care merchandise amongst others. Pores and skin Well being and Magnificence holds merchandise similar to face, physique, hair, and solar care. Important Well being incorporates merchandise for girls’s well being, wound care, oral care, and child care.

Properly-known manufacturers in Kenvue’s product line up embrace Tylenol, Listerine, Band-Help, Neutrogena, Nicorette, and Zyrtec. These companies contributed roughly 17% of Johnson & Johnson’s annual income.

On November seventh, 2024, Kenvue reported third quarter earnings outcomes for the interval ending September thirtieth, 2024. Income decreased 0.5% to $3.9 billion, which was $20 million lower than anticipated.

Supply: Investor Presentation

Adjusted earnings-per-share of $0.28 in contrast unfavorably to $0.31 final yr, however this was $0.01 above estimates.

Natural gross sales have been up 0.9% for the quarter, which follows a 3.6% enchancment final yr. For the quarter, pricing and blend profit of two.5% was offset by a 1.6% decline in quantity.

As soon as once more, quantity development in Important Well being was offset by weak point in Pores and skin Well being and Magnificence and Self Care. Gross revenue margin expanded 100 foundation factors to 58.5%.

Click on right here to obtain our most up-to-date Certain Evaluation report on KVUE (preview of web page 1 of three proven beneath):

One Resolution Inventory To Purchase Now: Federal Realty Funding Belief (FRT)

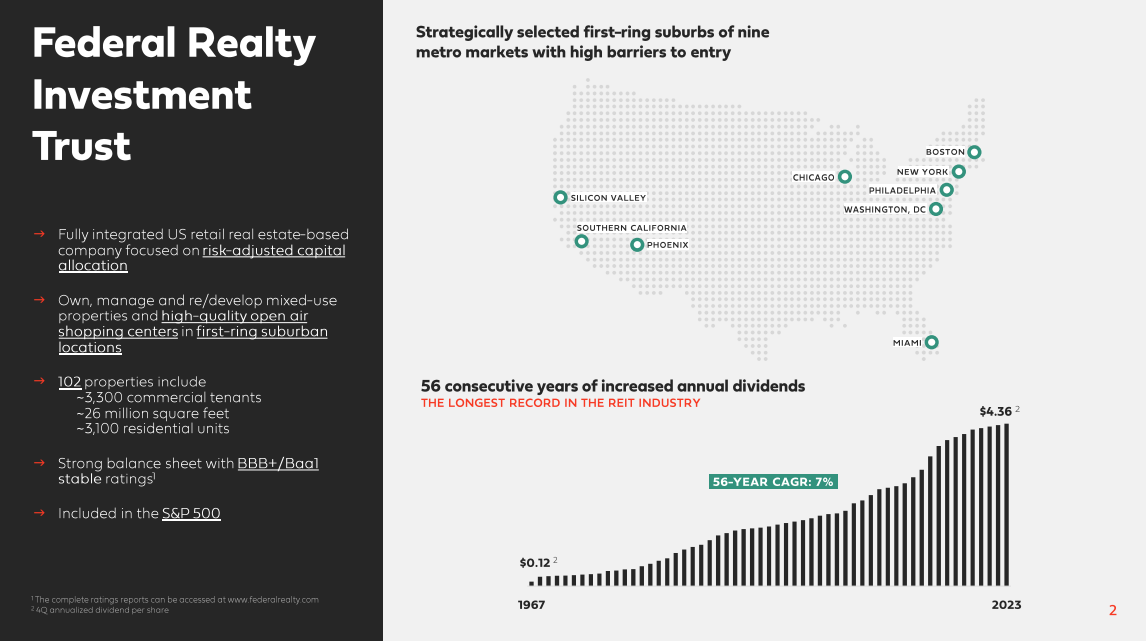

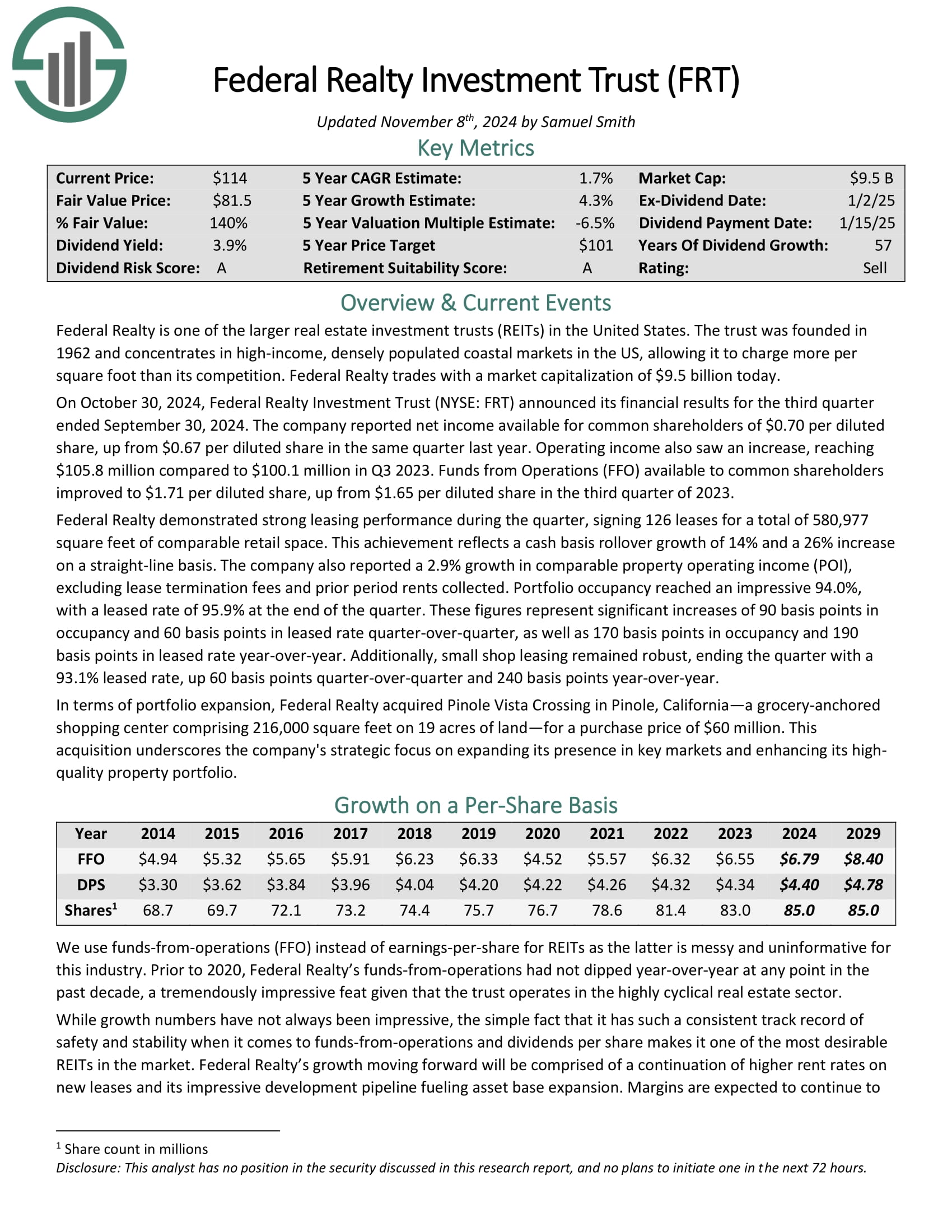

Federal Realty was based in 1962. As a Actual Property Funding Belief, Federal Realty’s enterprise mannequin is to personal and hire out actual property properties.

It makes use of a good portion of its rental earnings, in addition to exterior financing, to accumulate new properties.

Supply: Investor Presentation

On October 30, 2024, Federal Realty Funding Belief introduced its monetary outcomes for the third quarter ended September 30, 2024.

The corporate reported web earnings accessible for frequent shareholders of $0.70 per diluted share, up from $0.67 per diluted share in the identical quarter final yr. Working earnings additionally noticed a rise, reaching $105.8 million in comparison with $100.1 million in Q3 2023.

Funds from Operations (FFO) accessible to frequent shareholders improved to $1.71 per diluted share, up from $1.65 per diluted share within the third quarter of 2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on Federal Realty (preview of web page 1 of three proven beneath):

Different Dividend Lists & Remaining Ideas

The Dividend Aristocrats record will not be the one approach to shortly display screen for shares that repeatedly pay rising dividends.

The Dividend Kings Listing is much more unique than the Dividend Aristocrats. It’s comprised of 54 shares with 50+ years of consecutive dividend will increase.

The Blue Chip Shares Listing: shares that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

The Excessive Dividend Shares Listing: shares that enchantment to buyers within the highest yields of 5% or extra.

The Month-to-month Dividend Shares Listing: shares that pay dividends each month, for 12 dividend funds per yr.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.