With 2024 practically behind us, it’s a good time to replicate on how the Indian markets and financial system have fared this 12 months. On this version of Past The Charts, we’ll take a broader have a look at the ups and downs that formed the previous 12 months.

When you favor watching video over studying, you may watch the episode right here:

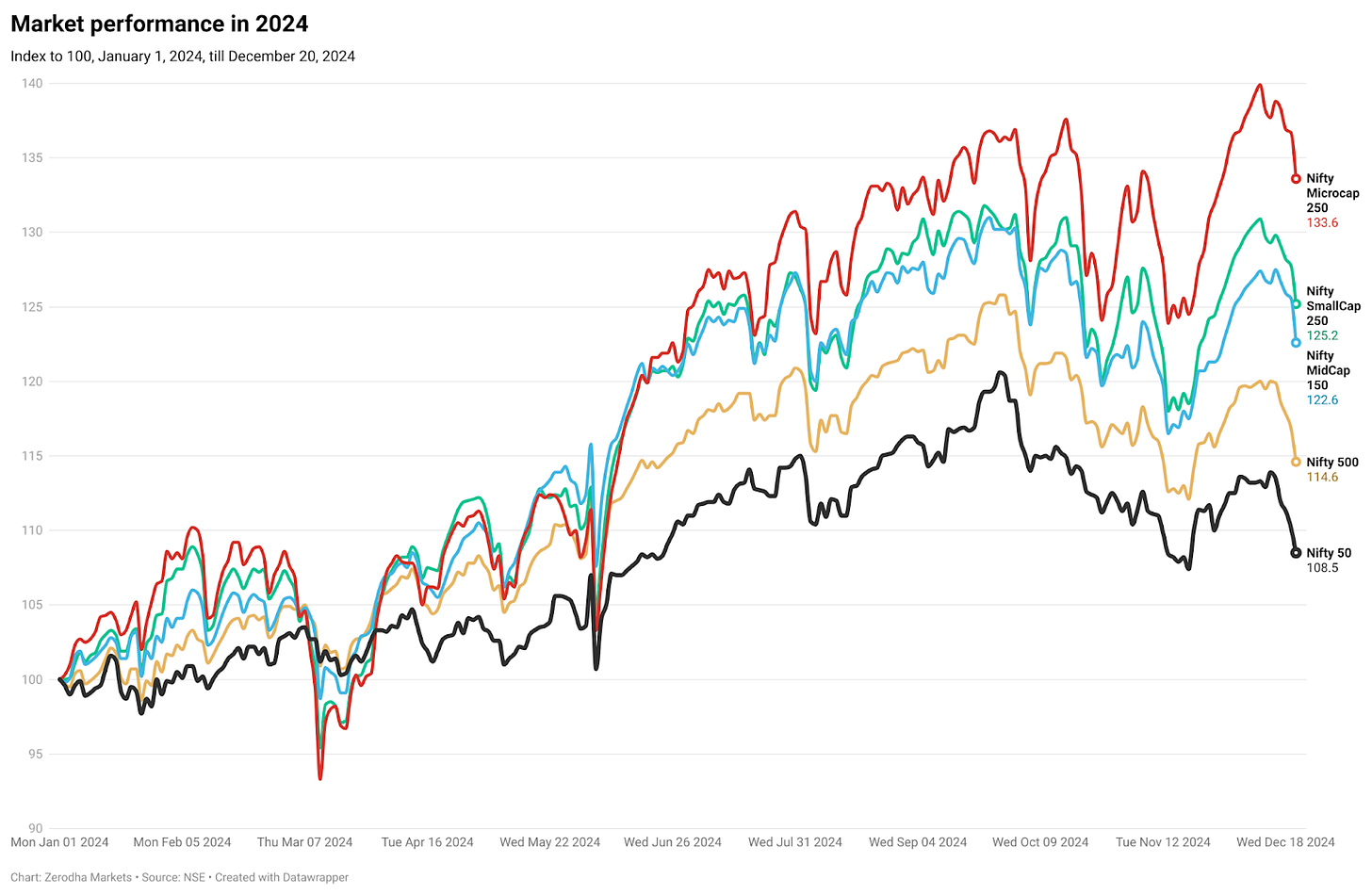

Let’s begin with the inventory markets. It’s been fairly a curler coaster experience—from the report all-time highs and endless optimism to considerations about an financial slowdown, FIIs promoting like there’s no tomorrow and eventual correction. It was an eventful 12 months for markets.

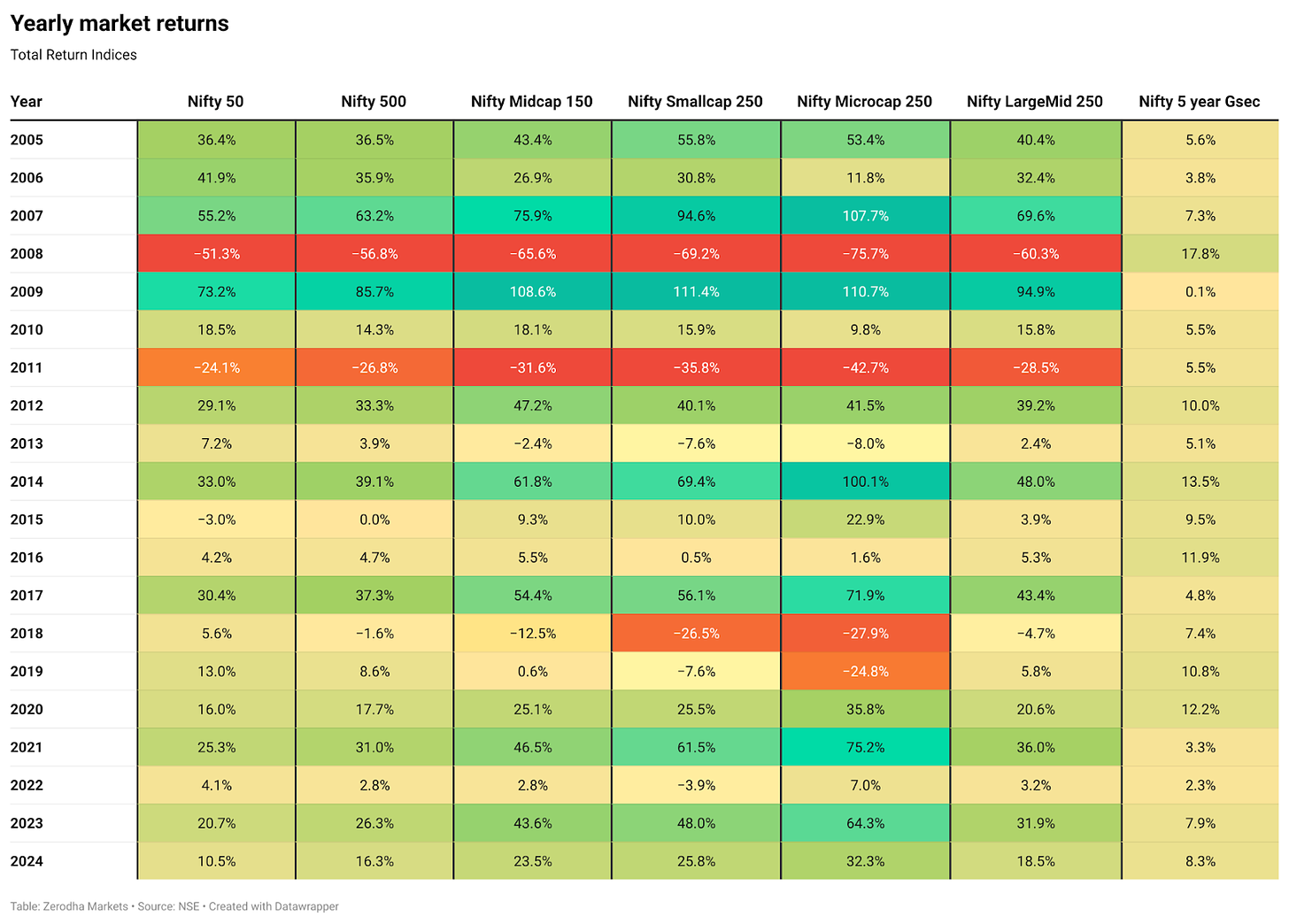

The Nifty 50 had its ups and downs, but it surely nonetheless closed the 12 months with a strong acquire of over 10.5%. The broader markets did even higher—each the Midcap and Smallcap indices rose by greater than 20%, whereas the Microcap index stood out with a powerful 32% improve.

Sectoral indices

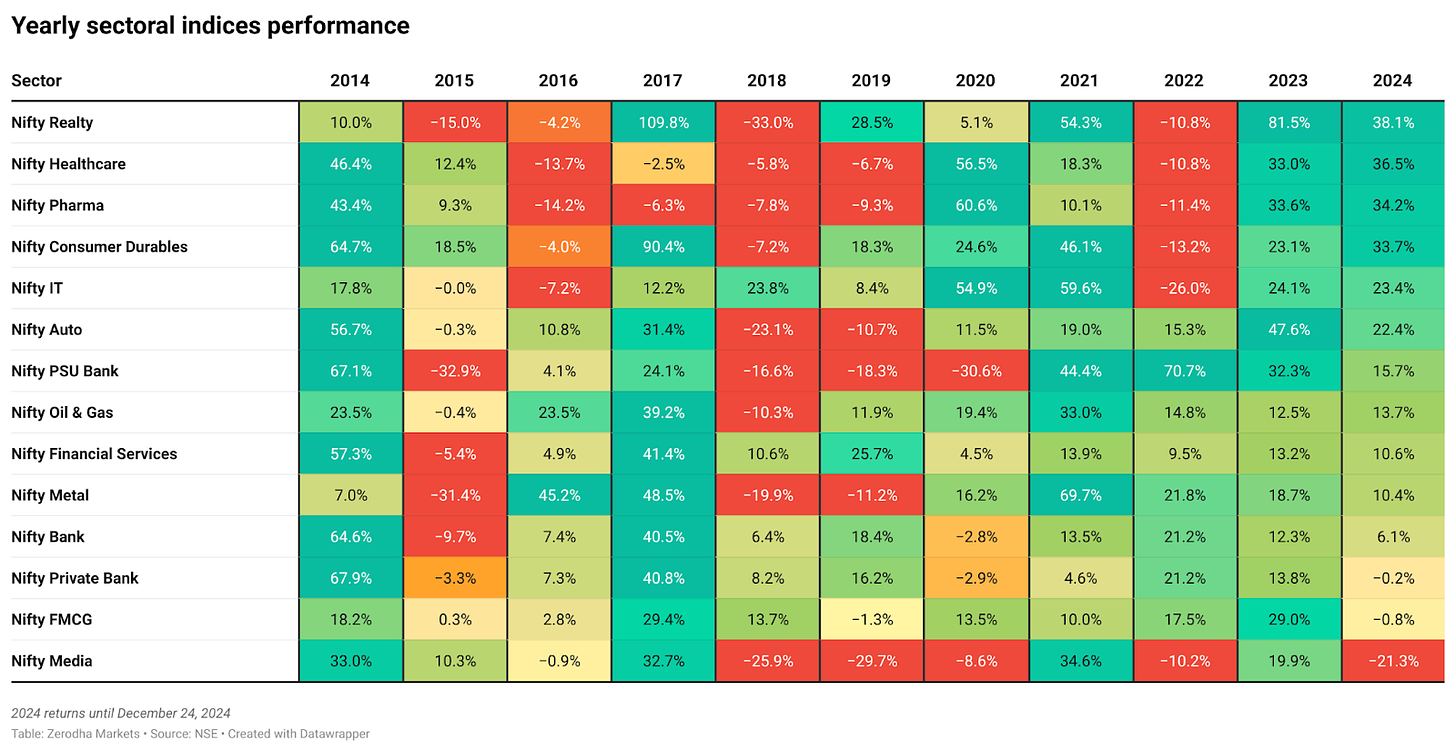

Once we have a look at particular sectors, actual property, healthcare, and prescribed drugs are the celebrities of the 12 months. These sectors delivered robust returns, with their indices climbing greater than 30% throughout the 12 months.

Then again, a number of the traditional market leaders had a quieter 12 months. FMCG (Quick-Shifting Client Items) firms and personal banks struggled to select up tempo, with their indices ending the 12 months nearly the place they began in 2023. This flat efficiency from these key sectors, which regularly drive market progress, actually stood out.

Issue indices

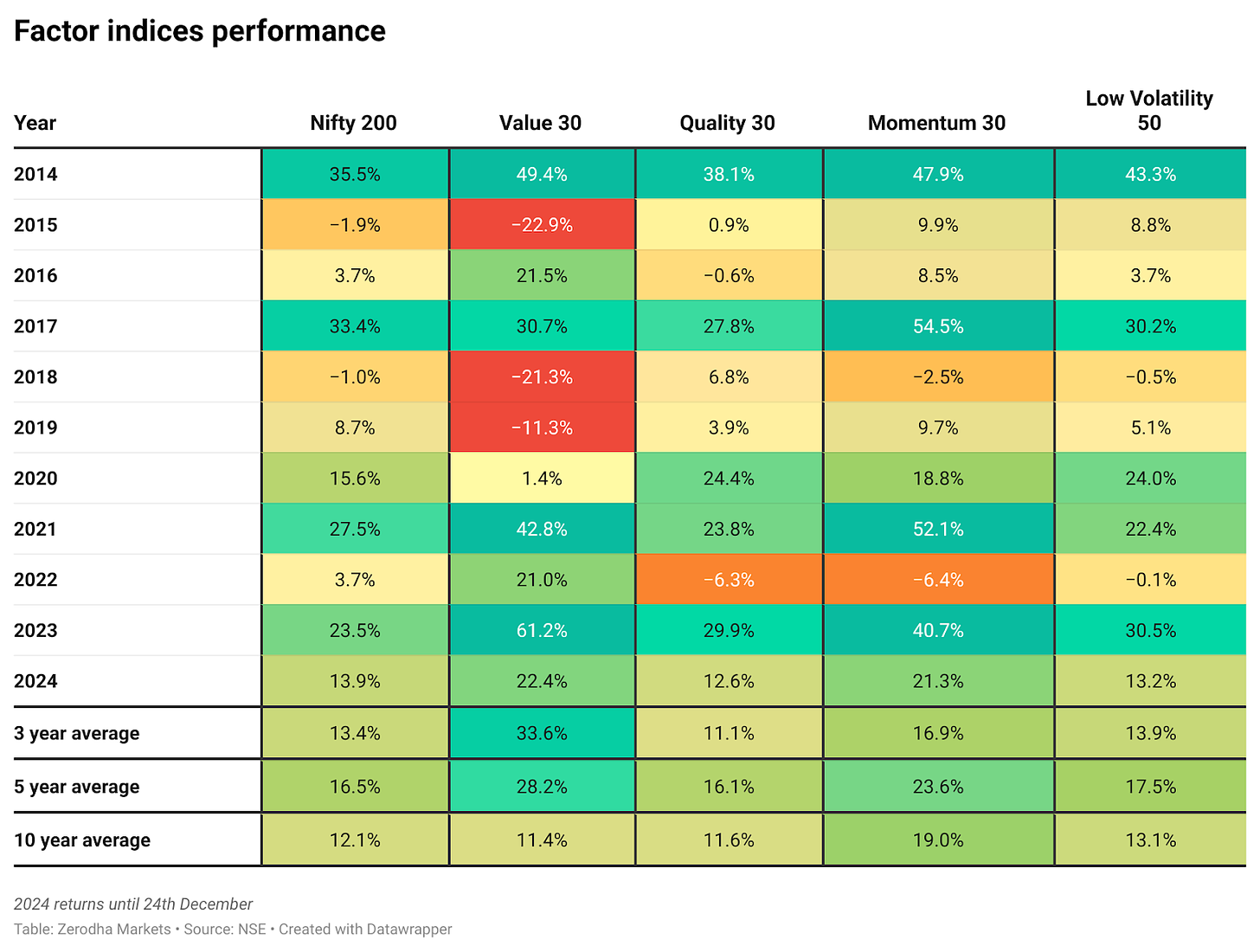

Let’s break down how completely different funding methods carried out in 2024.

Issue investing—which focuses on particular inventory traits – confirmed various outcomes this 12 months. Worth shares (usually thought-about underpriced relative to their fundamentals) and Momentum shares (these displaying robust current efficiency) beat the broader market, outperforming the Nifty 200 benchmark.

Nevertheless, not all methods labored effectively. High quality shares (firms with robust stability sheets and secure earnings) and Low Volatility shares (people who usually present smaller value swings) lagged behind the market.

For these new to investing, consider issue investing like this: As a substitute of simply shopping for shares of the largest firms, you’re selecting shares based mostly on particular traits. It’s much like the way you would possibly store for a automotive – some individuals concentrate on gas effectivity (like High quality shares), whereas others search for efficiency (like Momentum shares). Every method has its moments of power and weak spot, as we noticed this 12 months.

Mutual funds

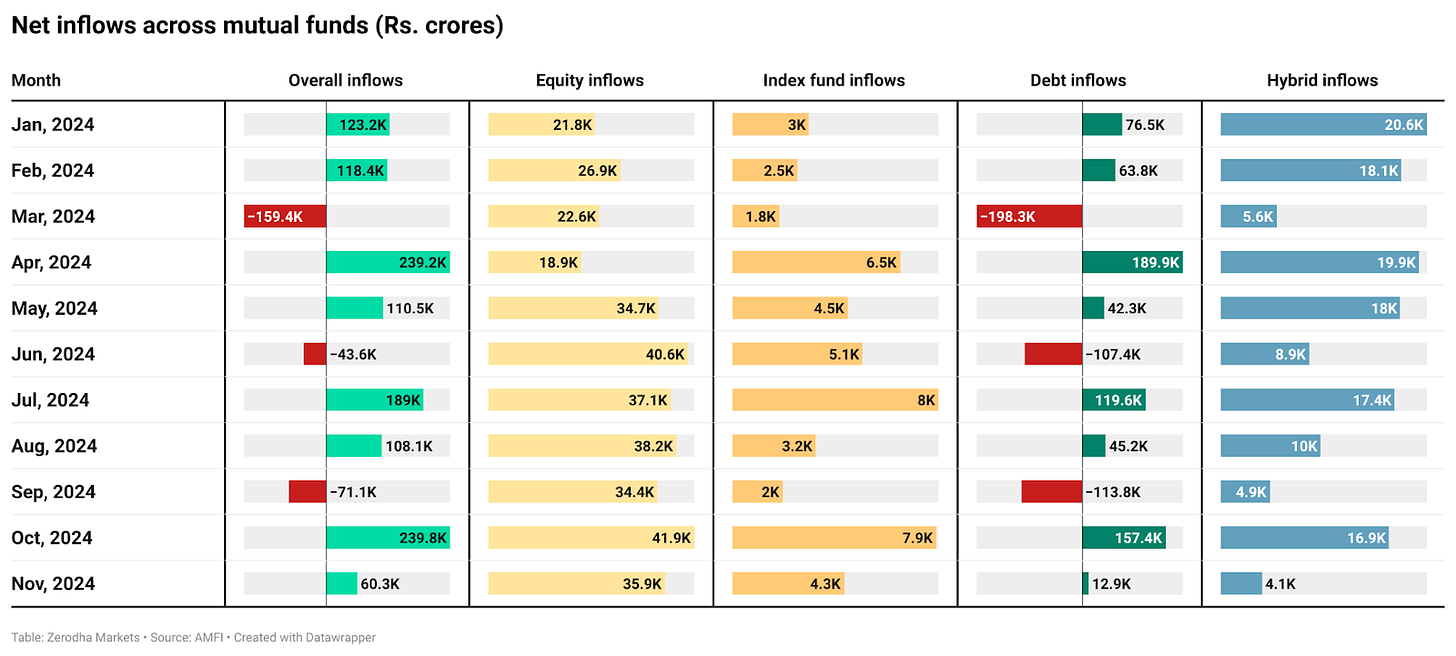

Regardless of market ups and downs, mutual funds noticed outstanding progress, pulling in ₹9.14 lakh crores by November. Of this, over ₹3 lakh crores went into fairness mutual funds alone.

This regular stream of home cash was one of many key causes Indian markets remained comparatively secure, even when international buyers (FIIs) have been promoting.

This pattern additionally exhibits the maturity of Indian buyers, who’re more and more selecting to take a position moderately than sitting on the sidelines or promoting throughout market uncertainty.

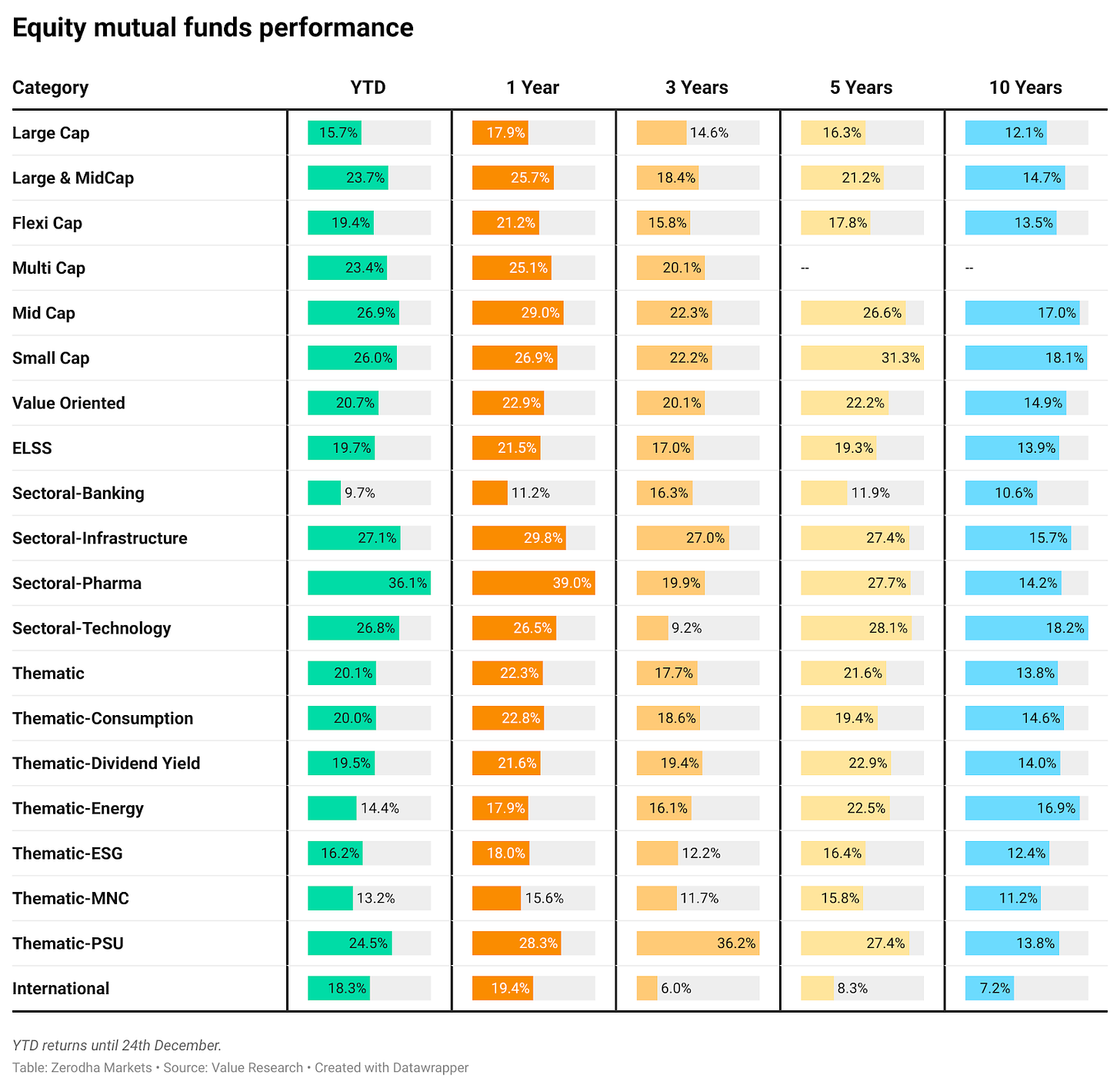

Let’s break down how several types of mutual funds carried out in 2024.

Thematic funds specializing in particular sectors or traits have been favorites amongst buyers, attracting the largest share of cash. Nevertheless, regardless of their reputation, these funds didn’t handle to ship one of the best returns.

The true winners have been funds investing in mid-sized and smaller firms. Each midcap and smallcap funds outperformed their extra specialised counterparts.

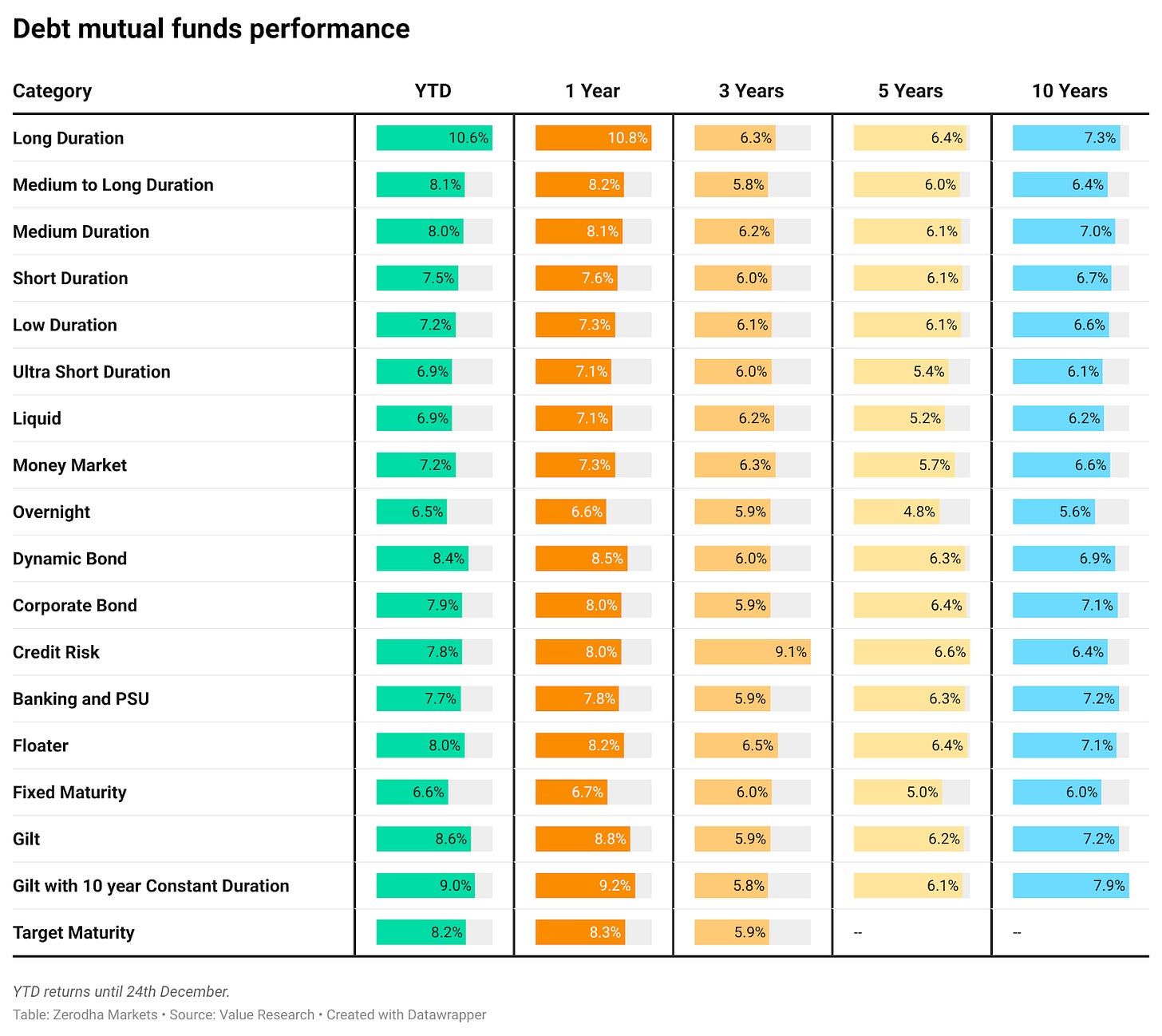

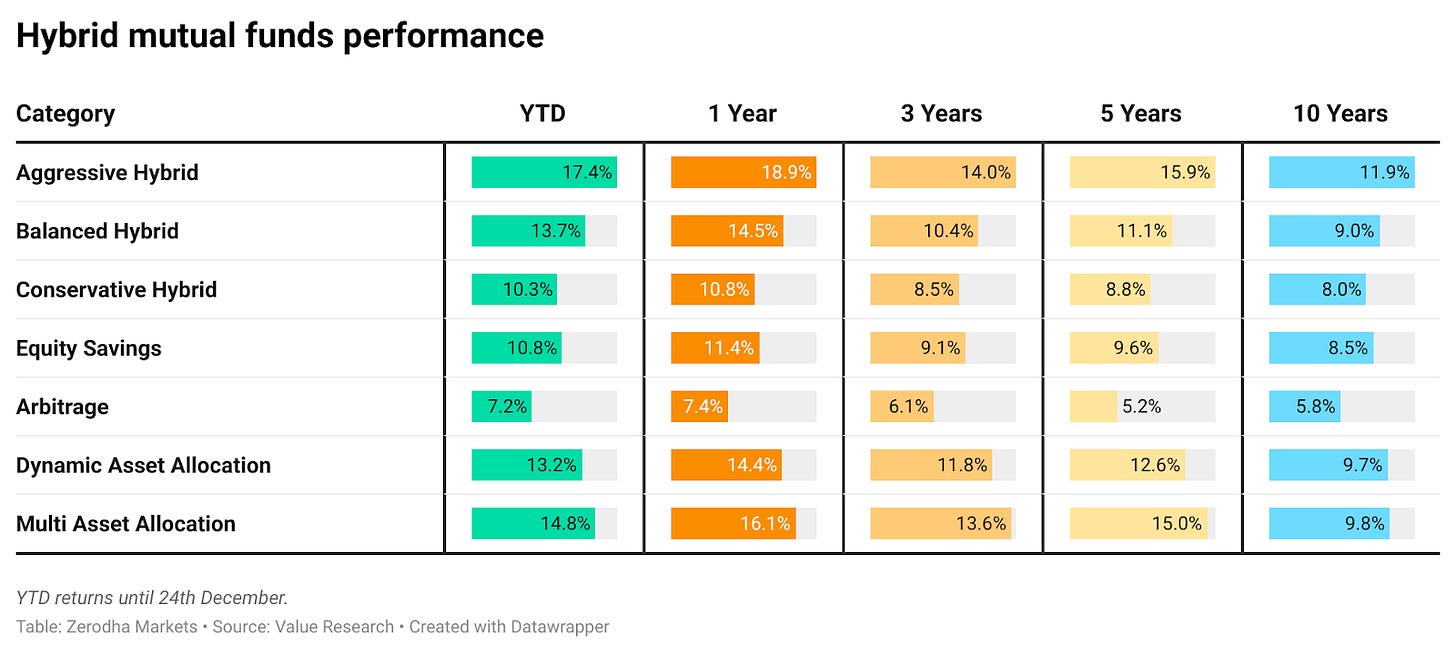

Trying again, 2024 proved to be a profitable 12 months for mutual funds throughout the board. Whether or not you invested in fairness funds for potential progress, debt funds for stability, or hybrid funds for a balanced method—all three main classes delivered constructive returns.

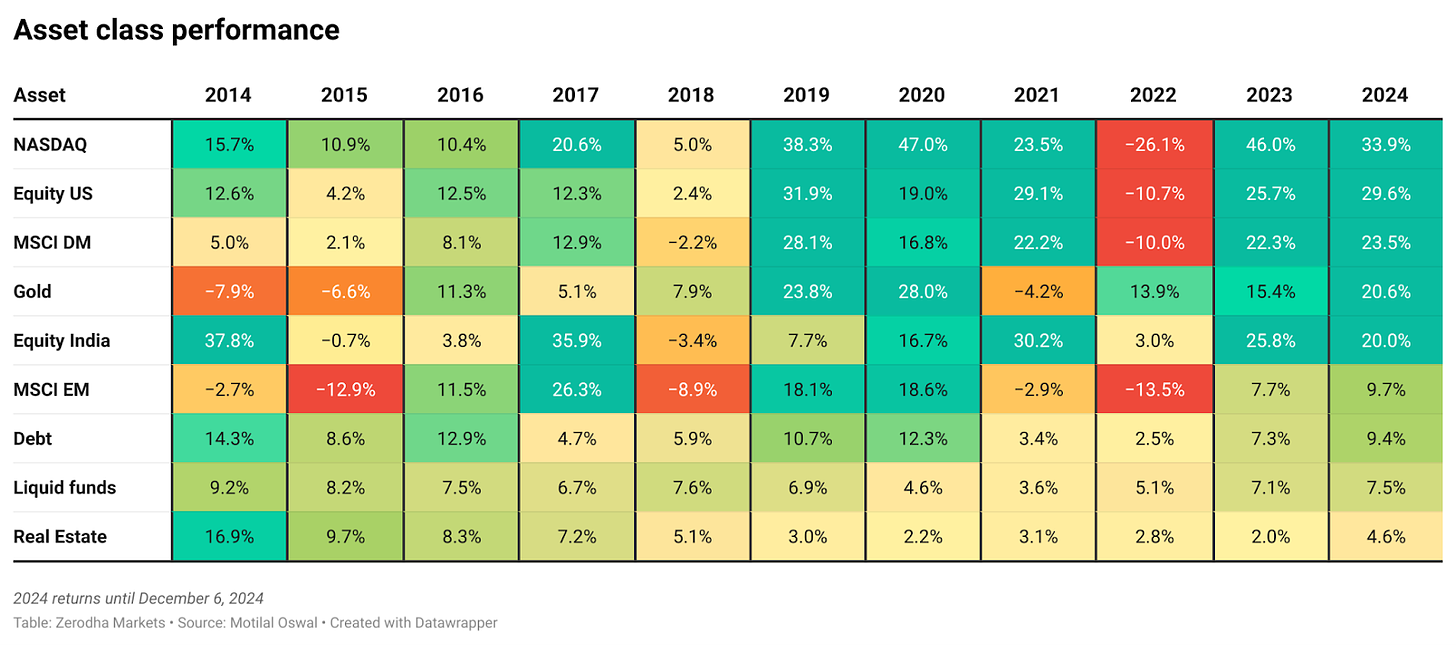

Asset class efficiency

Taking a look at returns throughout completely different markets and property. Equities have been high performers amongst main asset lessons—notably the US and different developed markets, which managed to carry out higher in comparison with India and different rising markets.

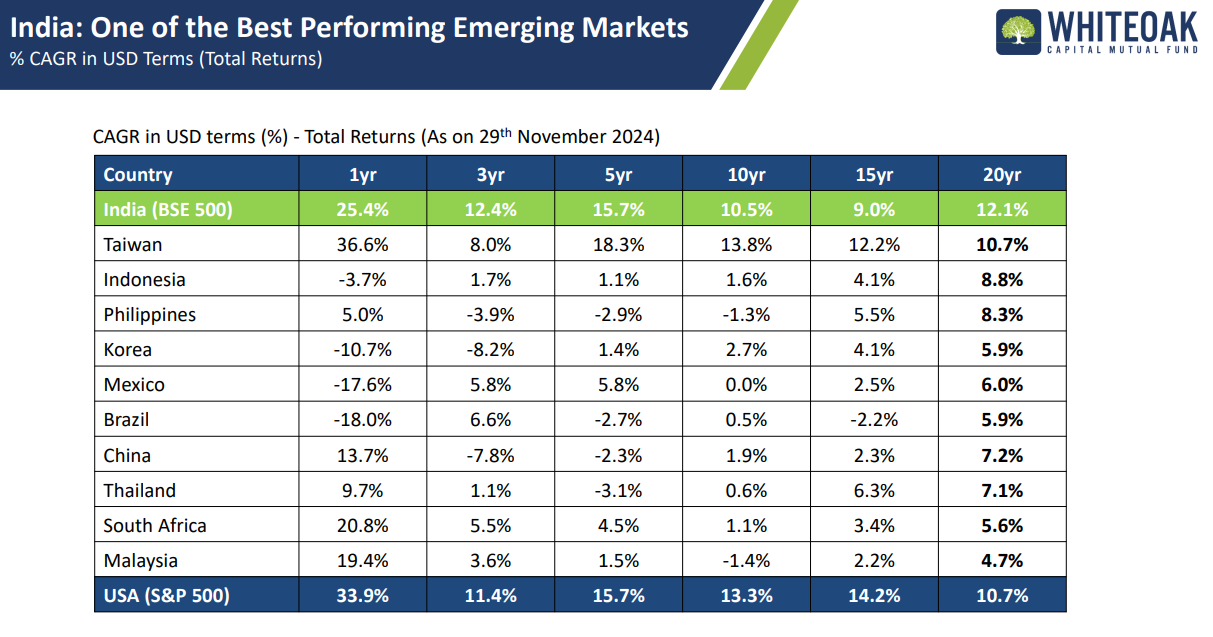

India’s growing international stature

Indian markets have been one of many best-performing markets amongst rising markets in recent times. Over the previous 12 months, India delivered a 25.4% return, second solely to Taiwan. In the long run, India’s 20-year CAGR of 12.1% is the very best amongst rising markets.

And this efficiency has definitely helped India improve its international stature.

Supply: Whiteoak Mutual Fund

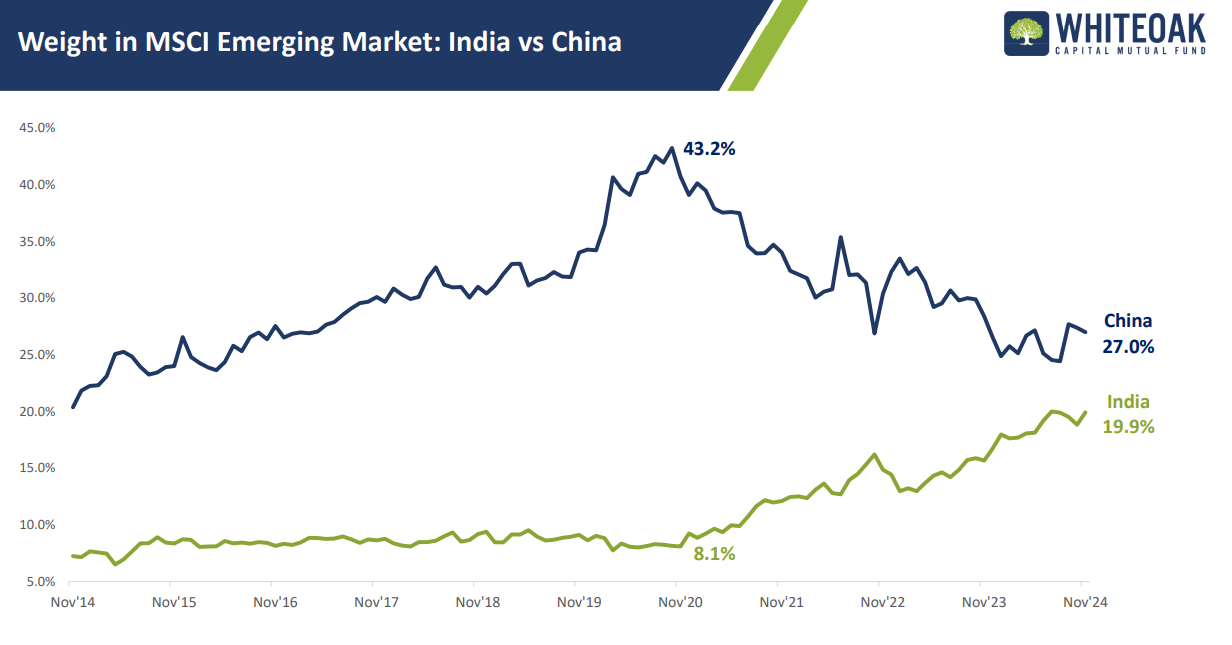

Firstly, India’s weightage within the MSCI Rising Market Index which tracks the efficiency of shares over 20 rising markets has seen a big improve.

India’s weightage on this index has elevated to 19.9% from 8.1% in 2020. On the identical time, China’s weightage has dropped from a peak of 43% to round 27%.

Supply: Whiteoak Mutual Fund

Second, India’s share of world market capitalization has elevated, now contributing round 4.3% to the world market cap in comparison with simply 2.2% in 2020.

Supply: Whiteoak Mutual Fund

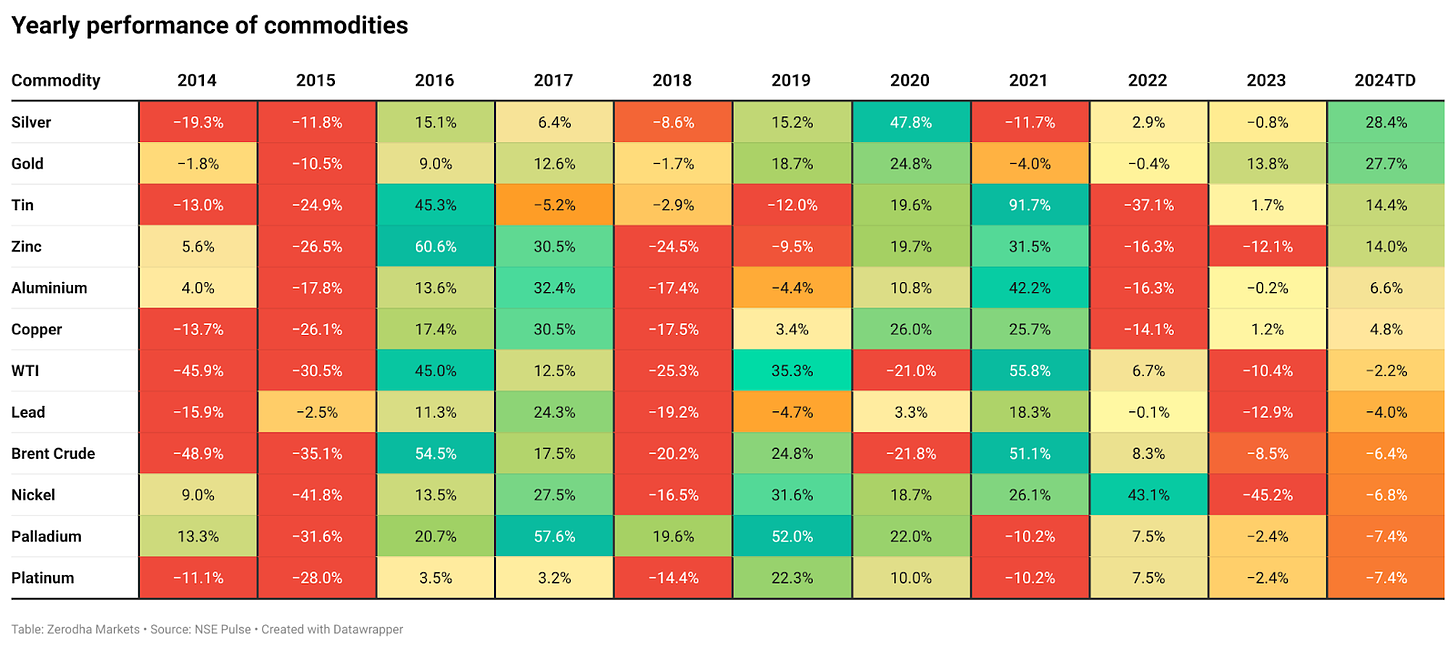

Commodities efficiency

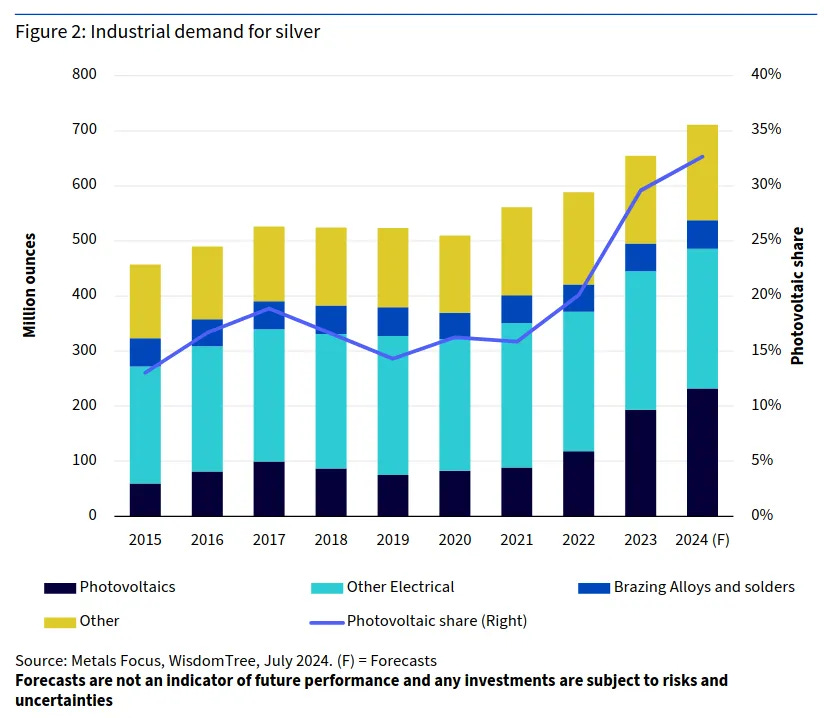

Within the commodities market, most commodity costs cooled down, whereas these of valuable metals like gold and silver surged—costs of silver have been up by over 28%, whereas these of gold have been up round 27%.

This efficiency was largely pushed by international tensions, and fee cuts, which pushed buyers towards safer property. Silver additionally gained from rising industrial demand in rising sectors like photo voltaic panels, electrical autos, and electronics.

The overall decline in different commodity costs was really excellent news for customers and companies, because it helped ease inflation pressures.

Supply: WisdomTree

Earnings

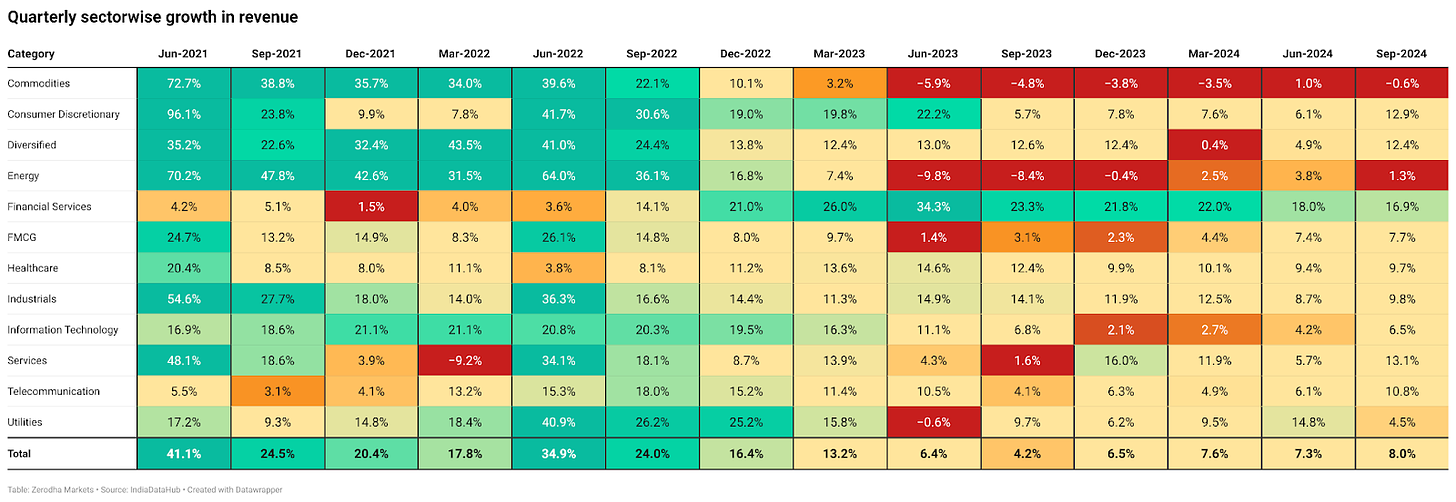

Let’s look at how Indian companies carried out this 12 months.

The July-September quarter was disappointing for company India. Many main firms fell wanting earnings expectations—a regarding signal given their excessive inventory valuations.

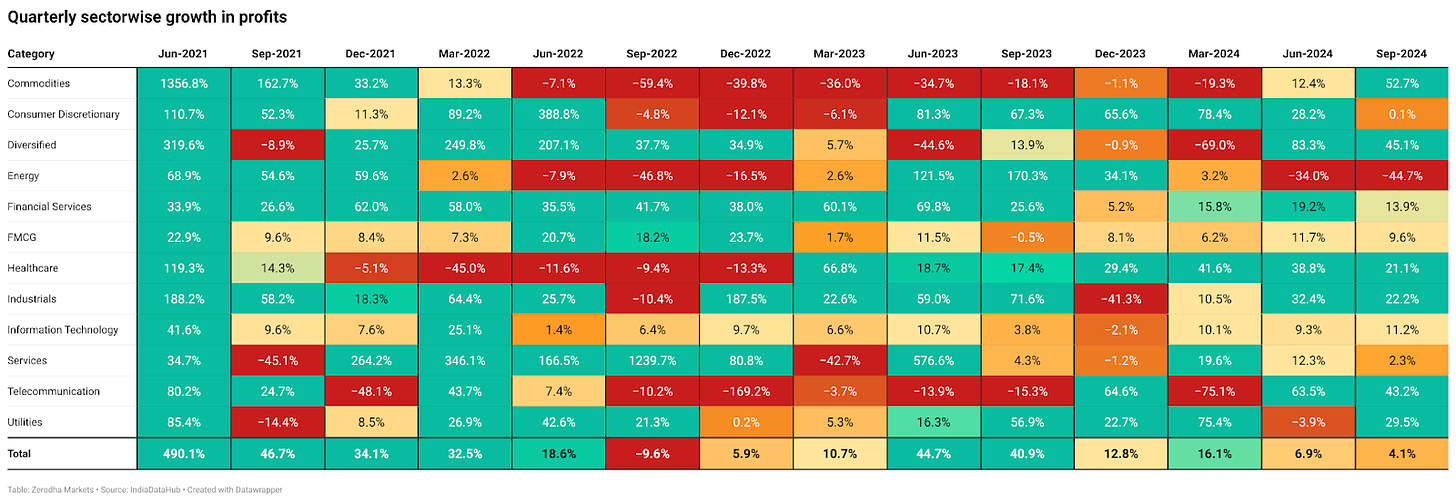

Sadly, this isn’t a one-off, Corporations have now posted weak, single-digit earnings progress for six consecutive quarters. Much more regarding is that revenue progress has slowed to simply 4.1% throughout this era, a noticeable drop from figures reported in September 2023.

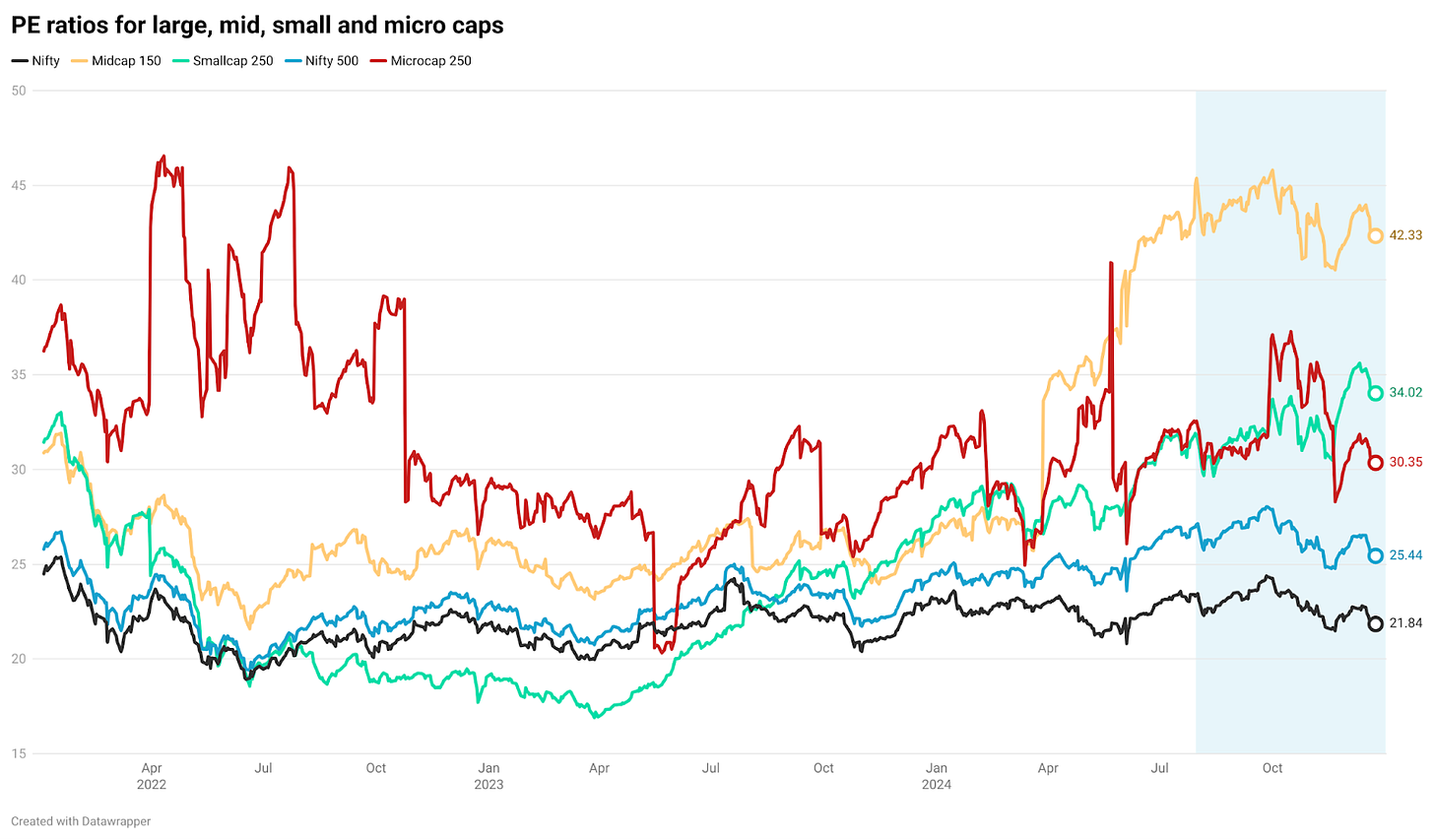

The persistent slowdown in earnings is especially noteworthy when you think about how strongly the inventory markets carried out. It raises questions on whether or not present inventory costs precisely replicate firm efficiency. When inventory costs maintain rising however firm income develop slowly, it usually means shares have gotten costlier relative to their precise earnings.

Trying deeper on the relationship between firm efficiency and market valuations. The mix of excessive inventory costs and weak earnings progress ultimately caught up with the markets.

After reaching peak ranges in October, markets underwent a big correction. This introduced down the PE (Value-to-Earnings) ratios—a key measure of how costly shares are relative to their earnings throughout all market segments.

The Nifty 50’s PE ratio, for instance, has fallen from above 24 to round 21.8. Even Mid, small, and micro-cap indices have seen their valuations cool off.

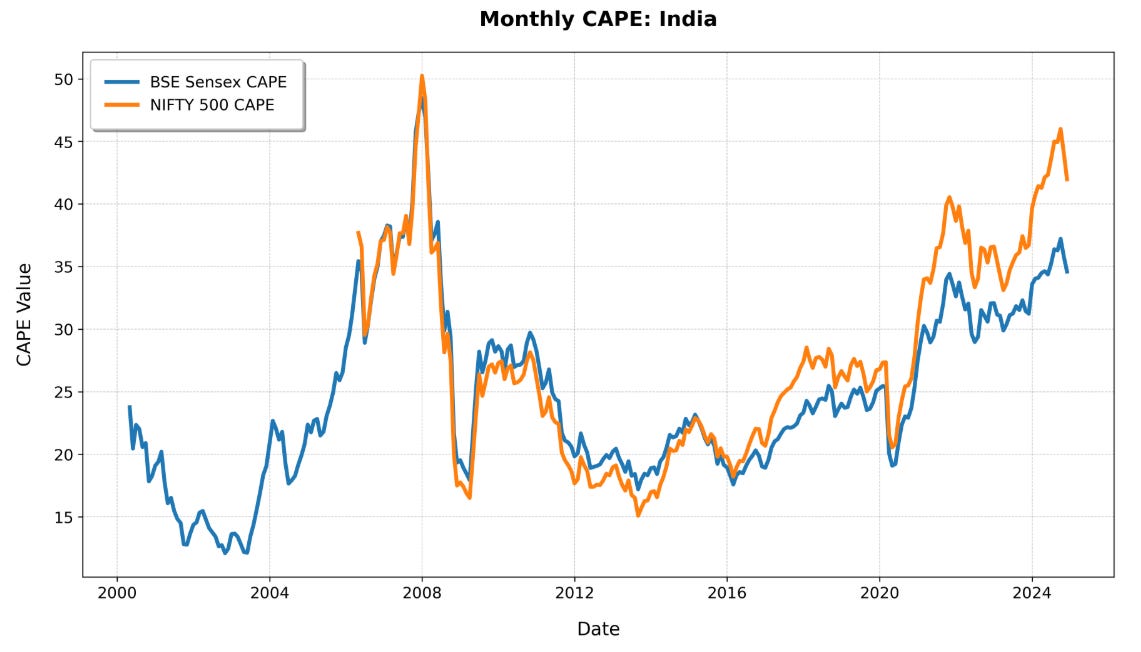

Let’s have a look at one other measure—the CAPE ratio. This metric has additionally declined throughout BSE Sensex and Nifty 500 indices in current months, reflecting the market’s response to the disappointing earnings we mentioned earlier.

Consider CAPE as a longer-term valuation instrument. Whereas common PE ratios are like taking a snapshot of an organization’s present earnings, CAPE seems at earnings over a few years and accounts for financial ups and downs. This provides a extra complete view of whether or not the market is basically overvalued or undervalued in the long term.

Supply: CAPE India

IPOs

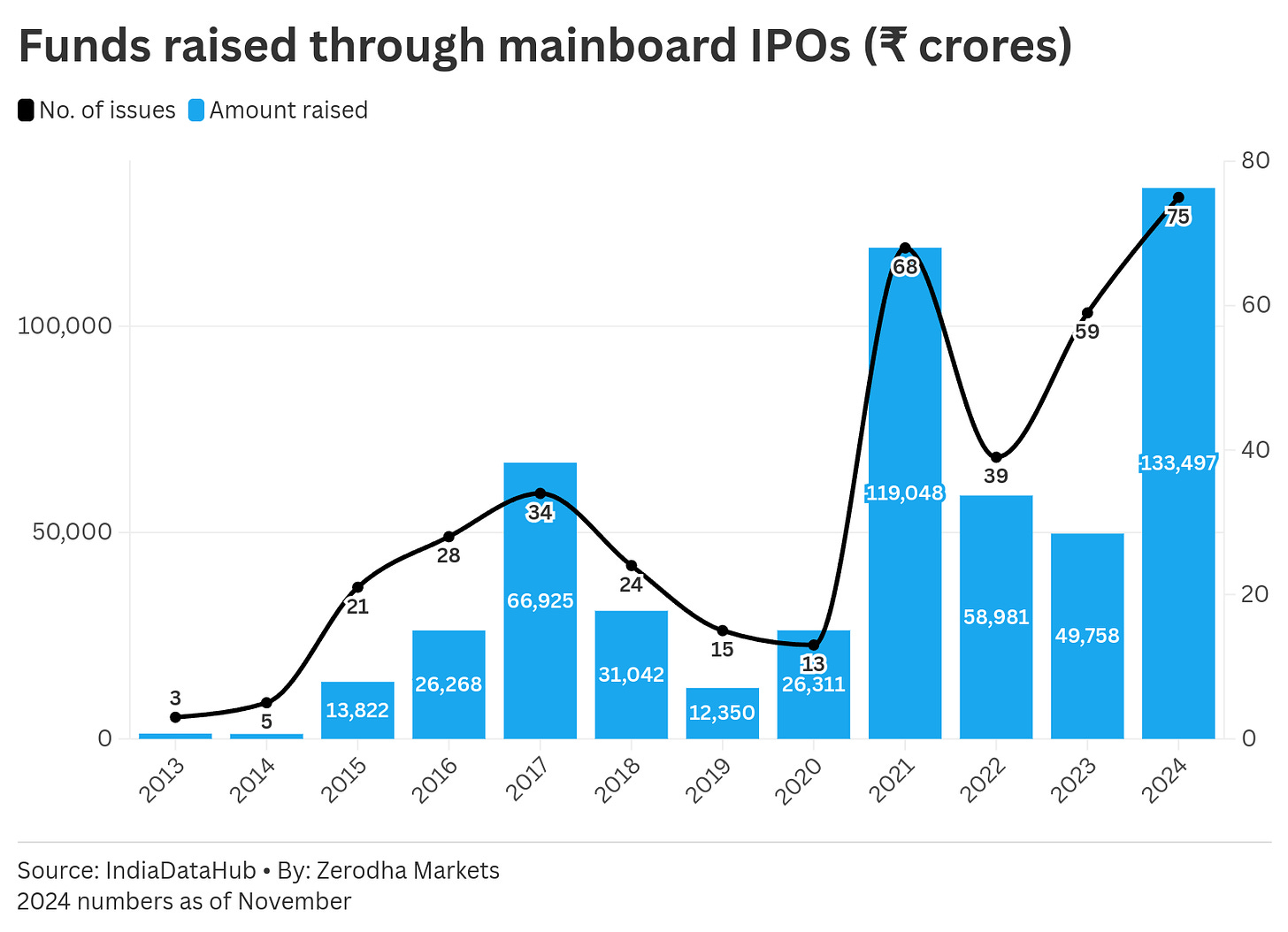

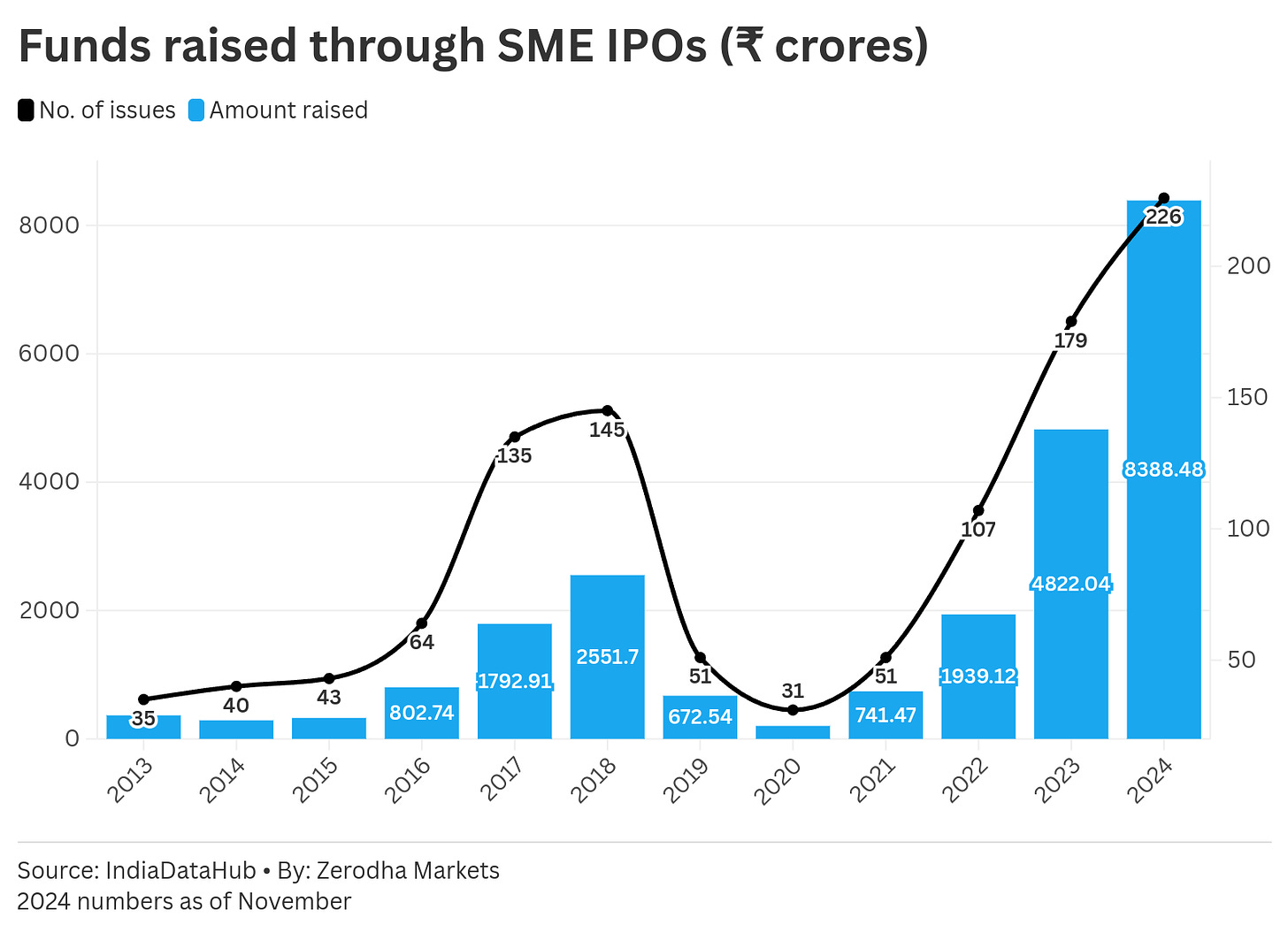

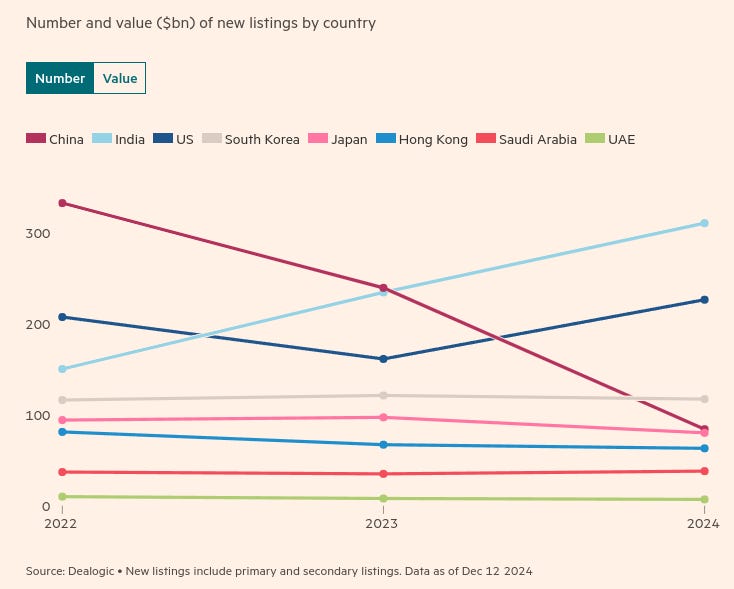

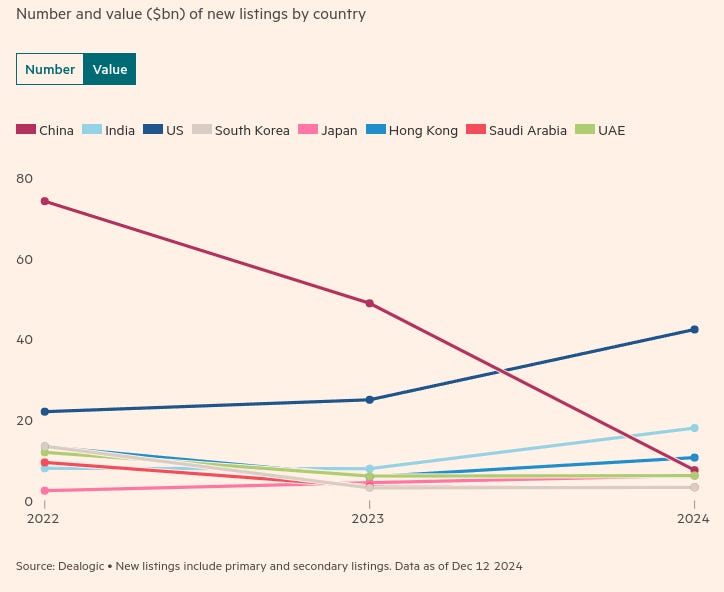

2024 was a record-breaking 12 months for India when it comes to public points. With over 301 firms going public till November, each by means of the primary board and SME segments.

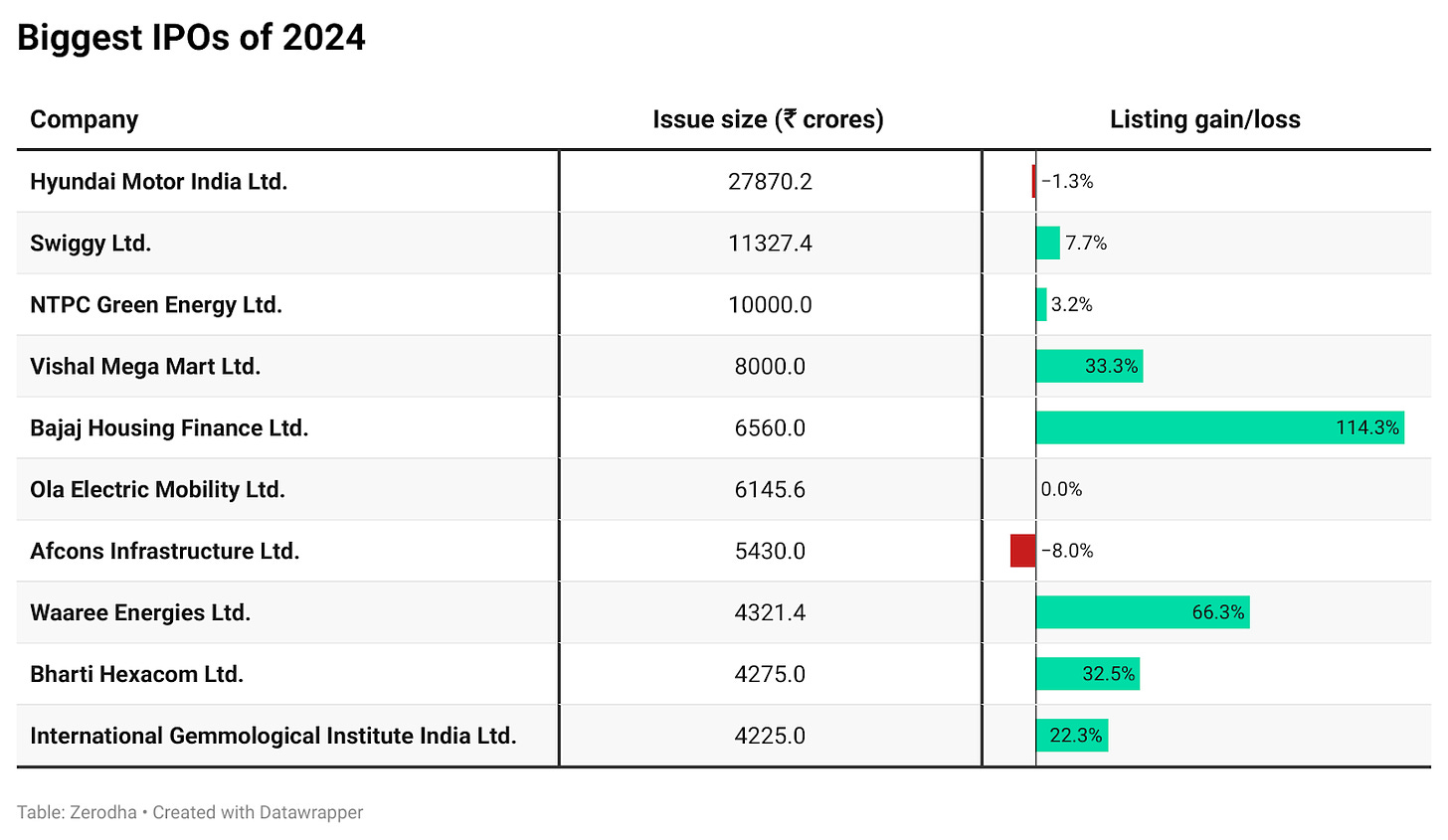

Collectively, these firms raised a powerful ₹1.41 lakh crores. The larger firms led the cost with 75 of them listed on the primary trade and gathering ₹1.33 lakh crores.

226 small and medium-sized firms took their first step into public markets by means of NSE and BSE’s SME platforms, elevating about ₹8,400 crores collectively.

Collectively, the highest 10 IPOs—that includes firms like Hyundai Motors, Swiggy, Vishal Mega Mart, Bajaj Housing Finance, and Ola Electrical—accounted for Rs. 88,000 crores of the entire proceeds.

India actually stood out within the international IPO market in 2024. Right here’s one thing spectacular—we led the world when it comes to the variety of firms going public. And when it got here to the entire cash raised, India completed second globally, with solely the US forward.

Supply: FT

Supply: FT

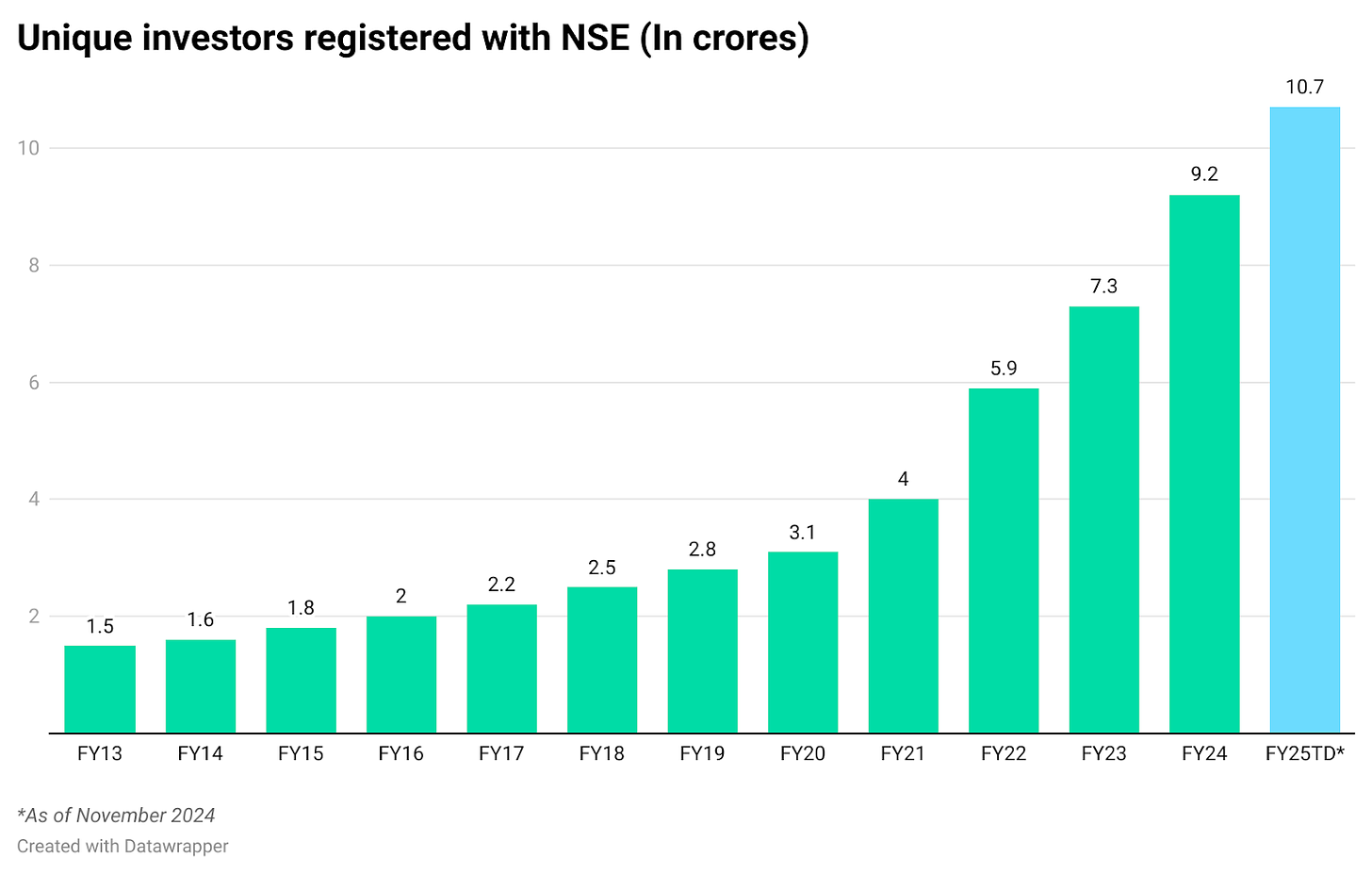

Rising investor base

The variety of individuals investing in Indian markets stored rising robust in 2024. By November, there have been greater than 10.7 crore distinctive buyers registered with NSE. What’s much more spectacular is that in simply the primary 9 months of the monetary 12 months 2025, there was the addition of 1.5 crore extra buyers.

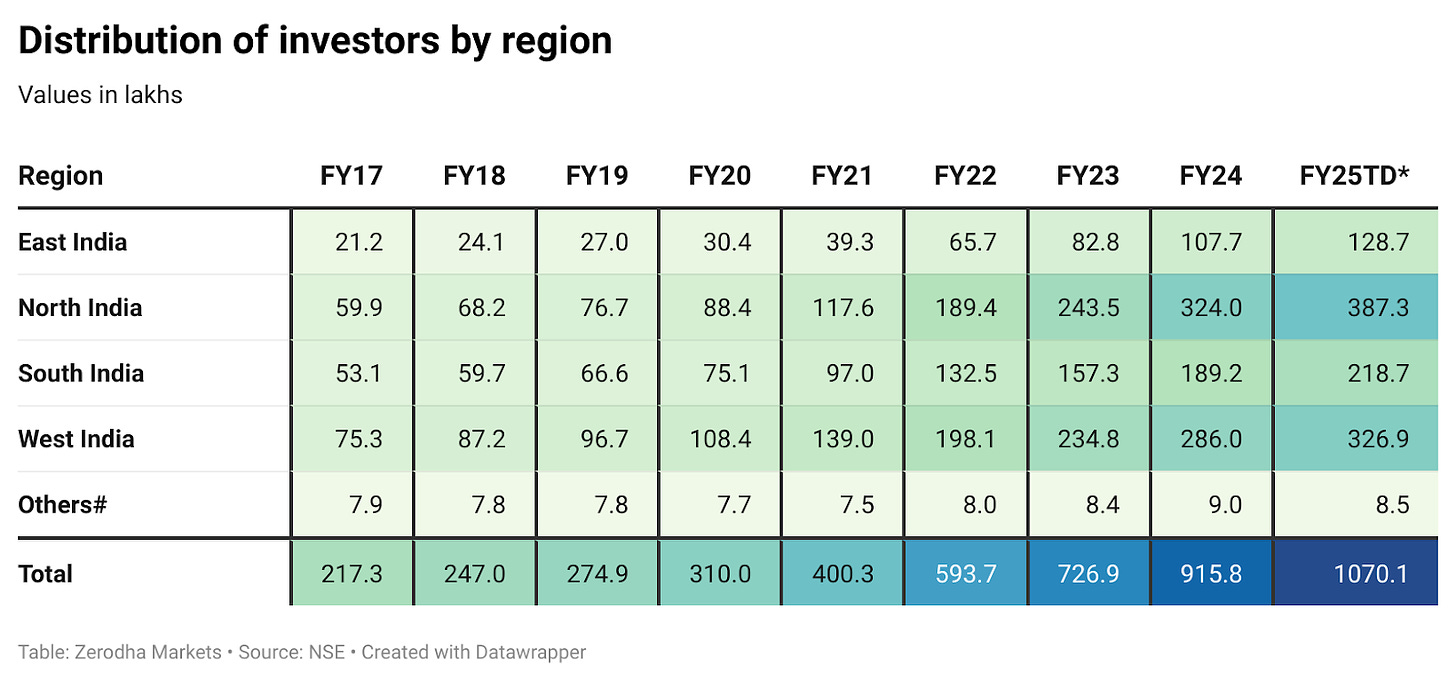

The sorts of individuals investing in India are altering, and the place they’re coming from tells an fascinating story. Whereas buyers was principally from Western India, we’re now seeing massive modifications throughout the nation. With an growing investor base in Northern and Japanese elements of India.

Northern India has seen a powerful rise, with its investor rely reaching 3.8 crores—making it even larger than the Western area.

This exhibits that investing is changing into well-liked throughout completely different elements of the nation, not simply in conventional monetary facilities.

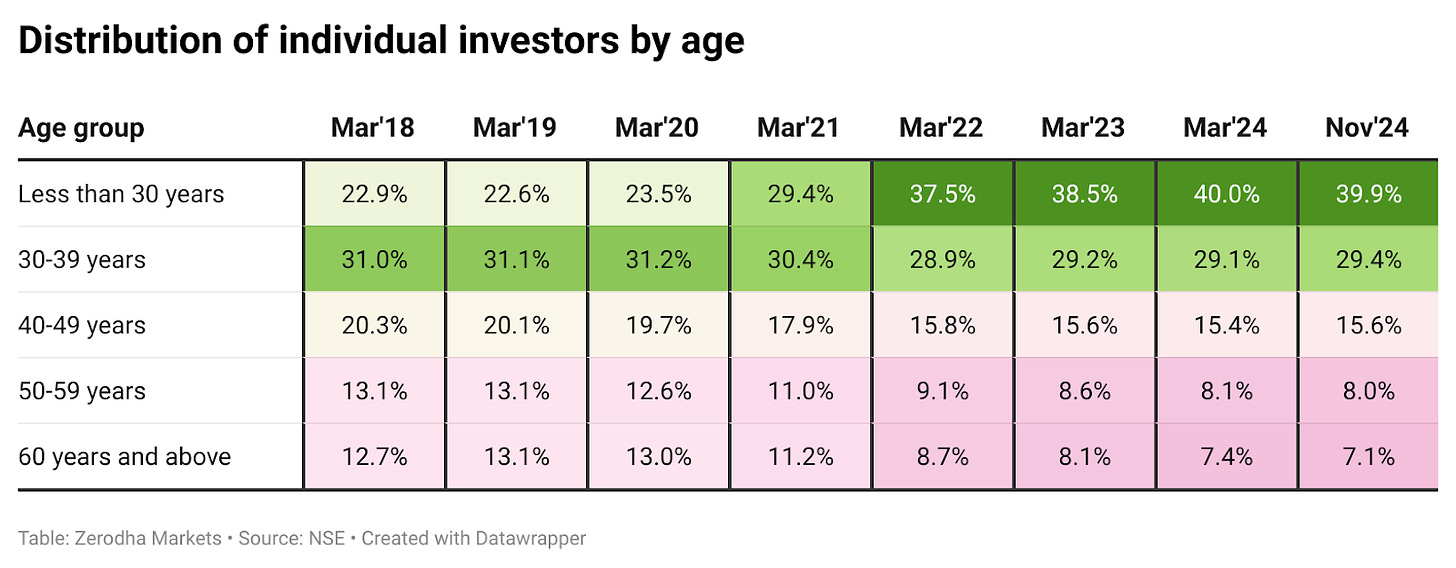

Not solely have we seen regional shifts, however investor demographics by age are additionally altering. Increasingly younger persons are coming to the market. In the present day, 4 out of each 10 buyers are underneath 30 years outdated. That’s an enormous change from simply 5 years in the past when younger buyers made up lower than 1 / 4 of all buyers.

FIIs vs DIIs

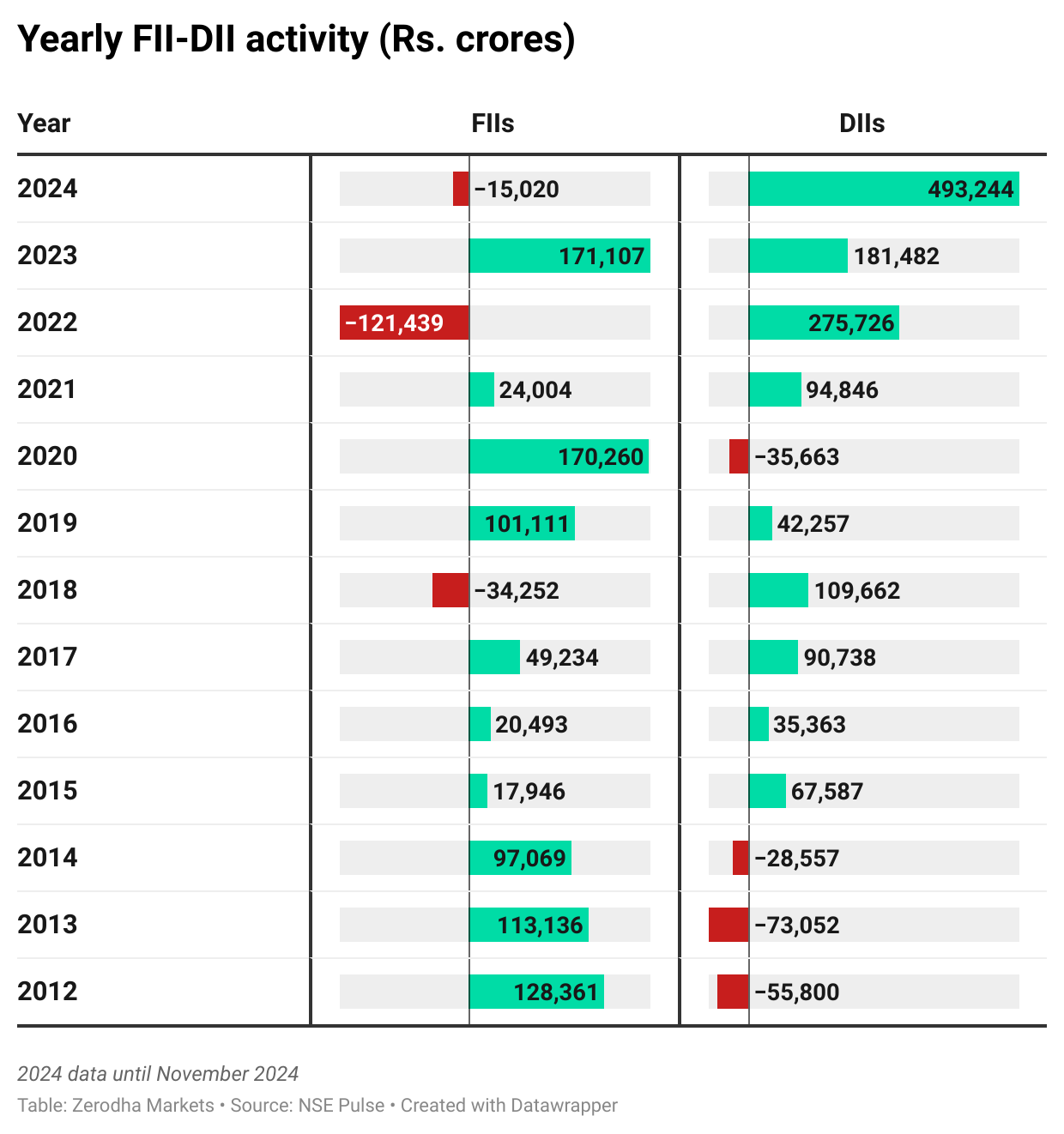

International Institutional Buyers (FIIs) have been pulling cash out of Indian markets, particularly in October and November. Throughout these two months, they offered shares value over Rs. 1.1 lakh crore, which triggered a market correction. Nevertheless, wanting on the full 12 months, the scenario appears much less alarming: the web FII outflow in 2024 stands at round Rs. 15,000 crore.

Home Institutional Buyers (DIIs), then again, have been doing the alternative. In 2024, they’ve invested a hefty Rs. 4.93 lakh out there.

Over the past 5 years—since 2020—there was a noticeable change in how FIIs and DIIs make investments. Between 2020 and now, FIIs invested about Rs. 2.3 lakh crore, whereas DIIs poured in round Rs. 10 lakh crore into Indian markets.

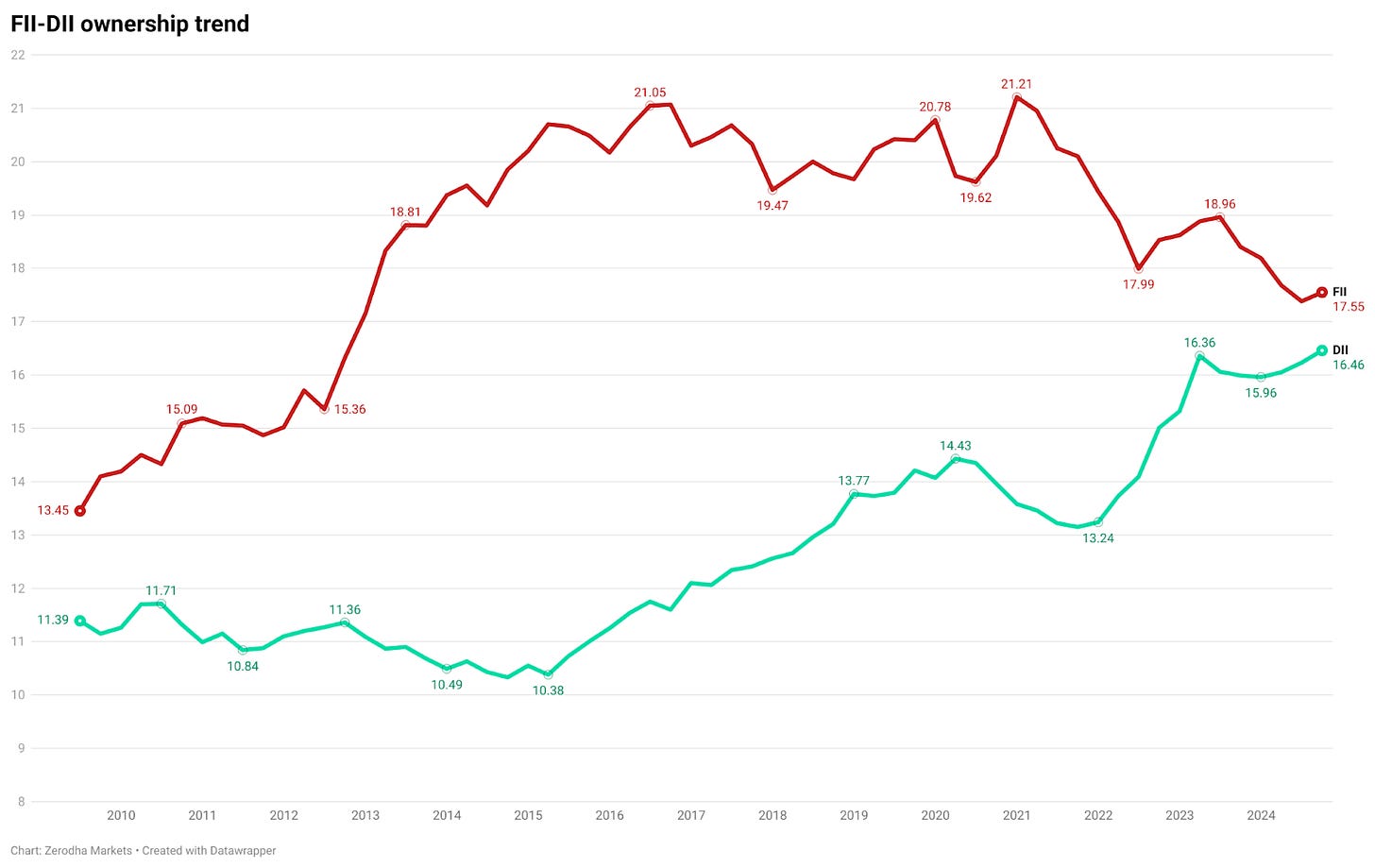

We will see this in different possession patterns of each FIIs and DIIs.

FIIs have historically held the biggest stake in Indian equities. Nevertheless, their share has been on a gradual decline since 2020 and is now at its lowest stage in over a decade. On the identical time, the share of DIIs has been on the rise.

If this pattern continues, DIIs may quickly overtake FIIs when it comes to possession.

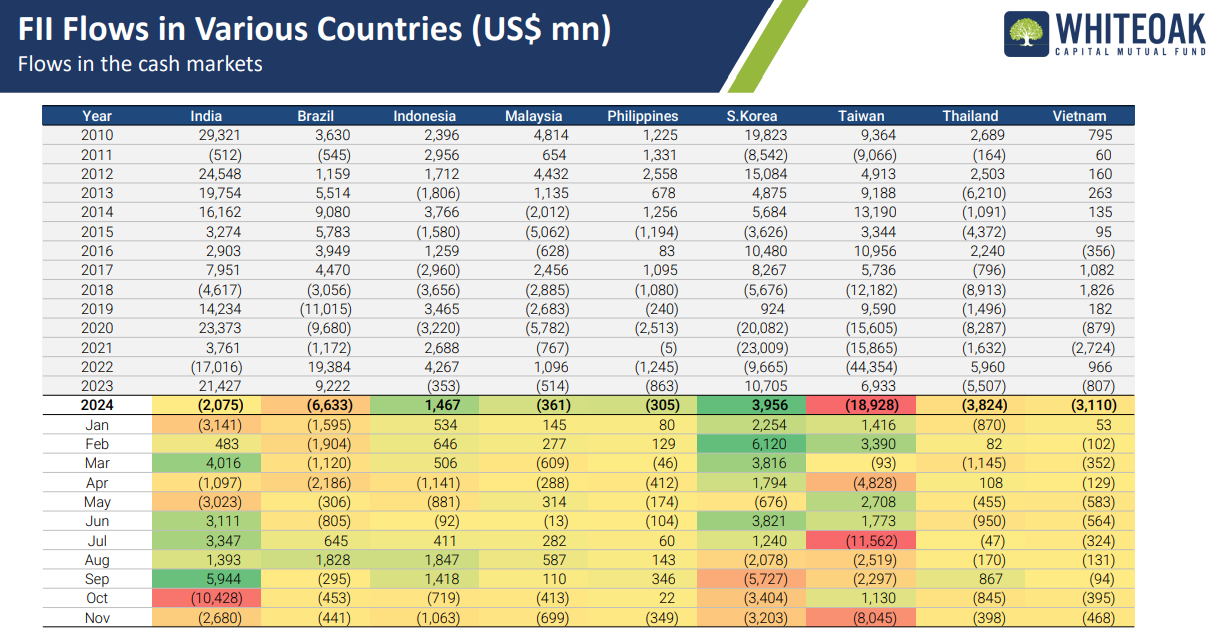

International Institutional Buyers have been offloading shares in most rising markets, not simply in India. This 12 months, they’ve been web patrons solely in Indonesia and South Korea, whereas India, Brazil, Taiwan, and a number of other different markets have seen web outflows in 2024.

Supply: Whiteoak Mutual Fund

Now, let’s flip our consideration to how the efficiency of the Indian financial system.

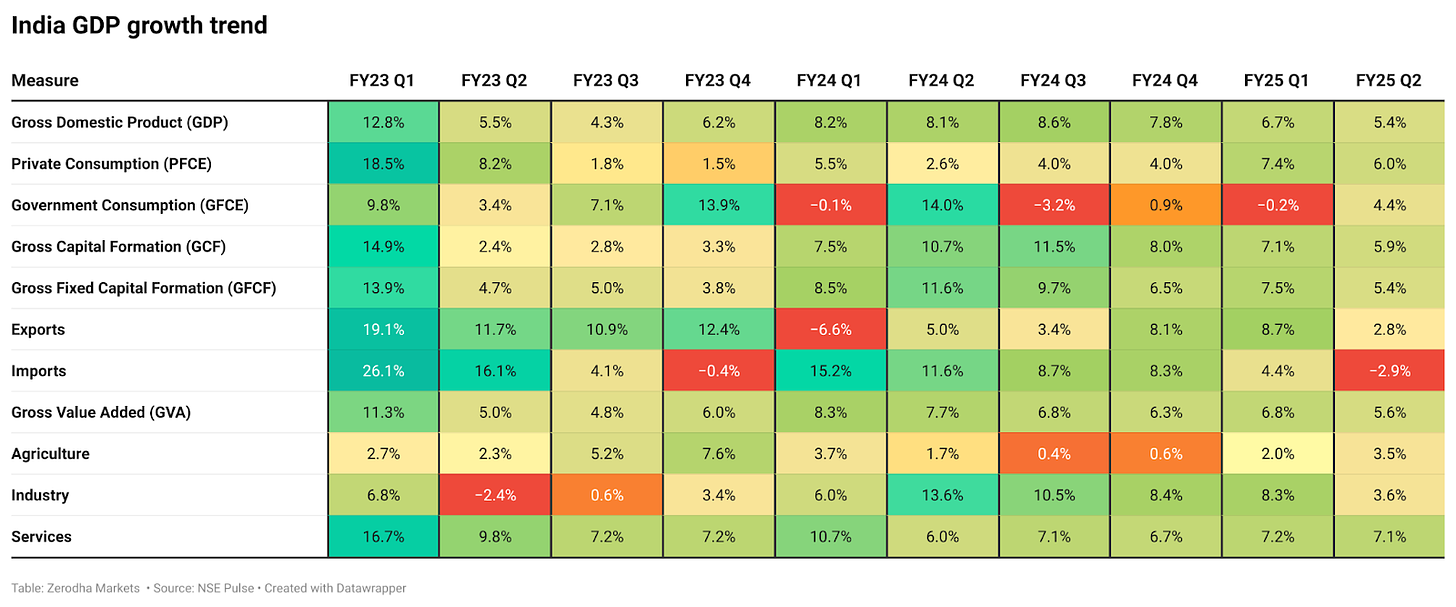

India’s GDP progress slowed to five.4% within the September quarter—the bottom in seven quarters and effectively under the RBI’s forecast of 6.7%.

This slowdown wasn’t a whole shock, as a number of financial indicators had already hinted at weaker progress. Nevertheless, the scale of the decline is important. The principle causes have been the poor efficiency of agriculture and manufacturing, two key elements of the financial system. On high of that, authorities spending cuts, particularly in massive infrastructure tasks, added to the general slowdown.

Inflation

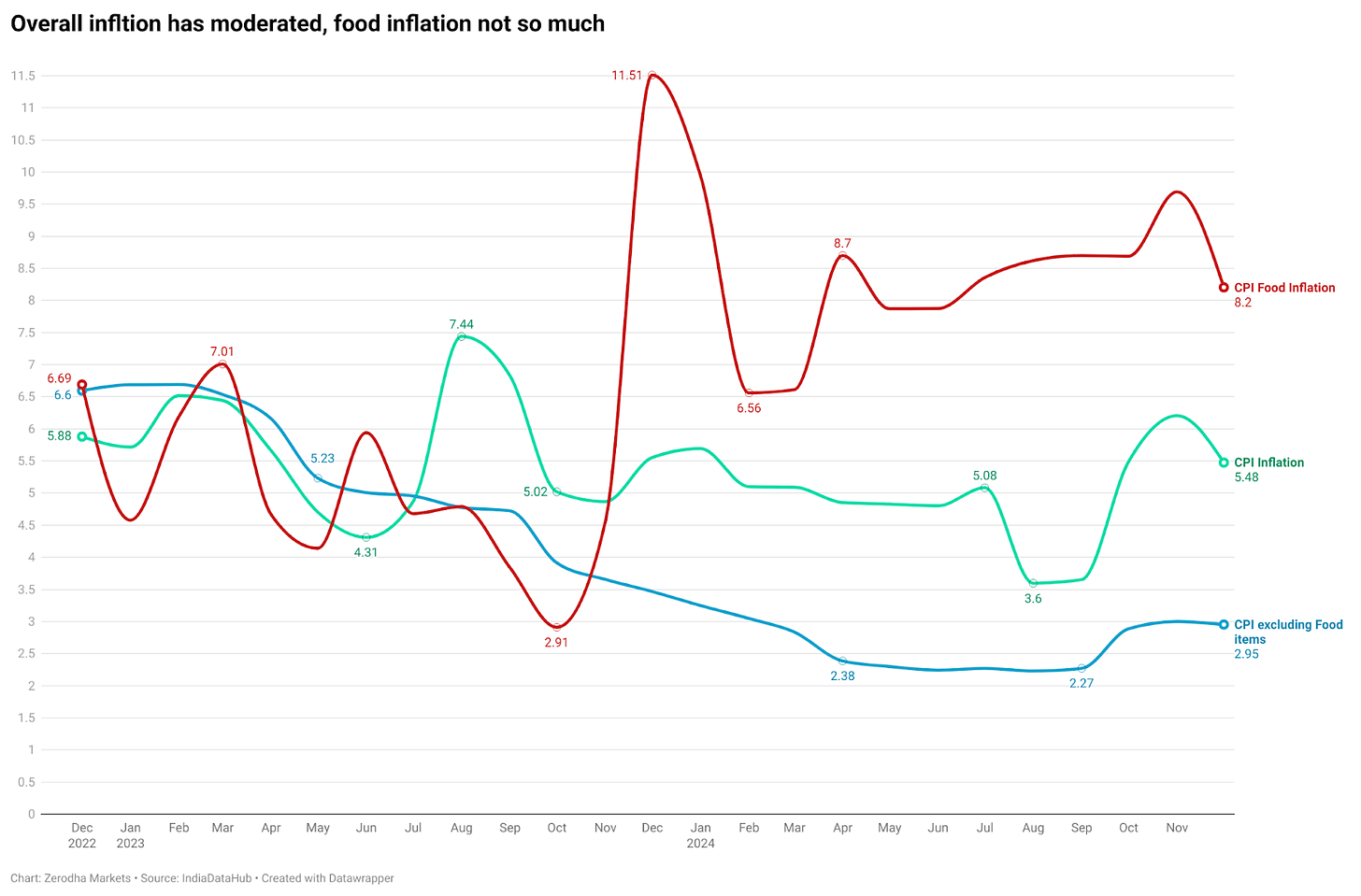

Inflation continues to be an enormous concern, placing a pressure on family budgets. After easing earlier in 2024, it began climbing once more within the second half of the 12 months, principally due to rising meals costs. By November, total inflation had reached 5.5%, with meals costs rising even quicker at 8.2%.

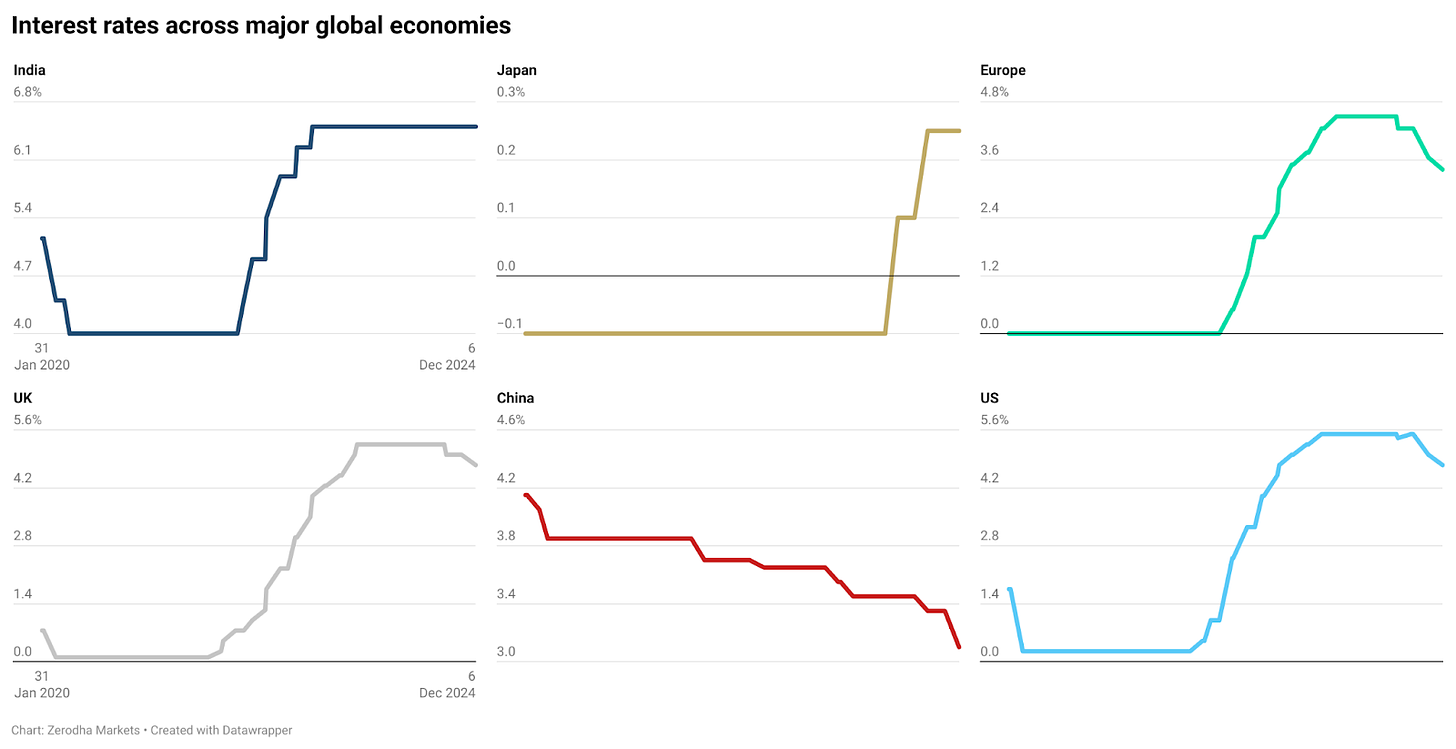

With inflation remaining excessive, the RBI has determined to not reduce rates of interest, not like many different main economies which have began reducing theirs. Whereas chopping charges may assist enhance progress, the RBI is being cautious to keep away from worsening the inflation drawback.

Client confidence

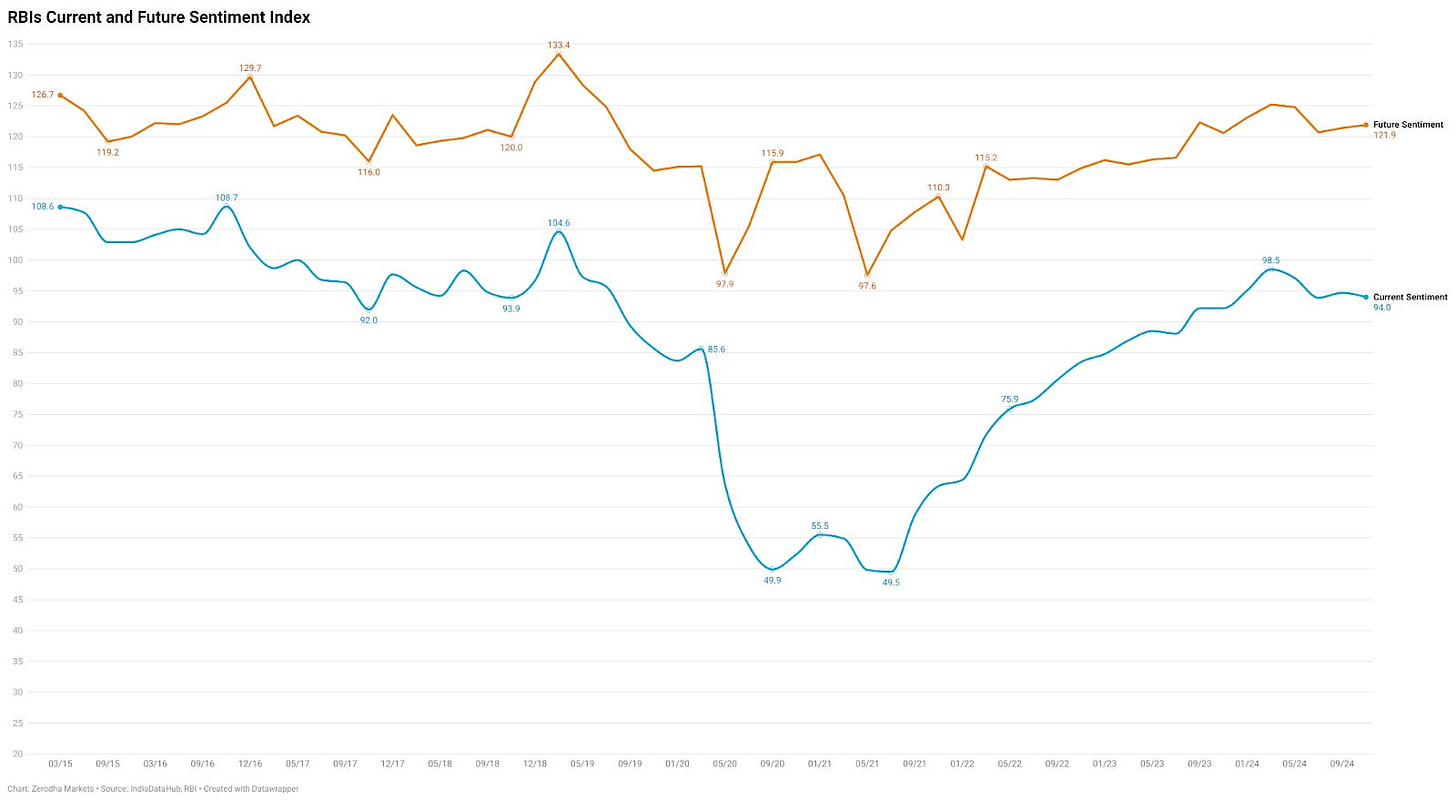

The RBI’s shopper confidence survey gives perception into family sentiments relating to the financial system, earnings, job prospects, inflation, and spending. The Present Scenario Index—which displays how individuals really feel in regards to the current state of the financial system—dropped from 98 in March to 94 in November. This means that fewer individuals consider job alternatives, earnings, and total financial situations have improved in comparison with the earlier 12 months.

Nevertheless, regardless of short-term considerations, optimism in regards to the future stays robust. Households count on higher job alternatives, increased incomes, and improved spending energy within the coming 12 months.

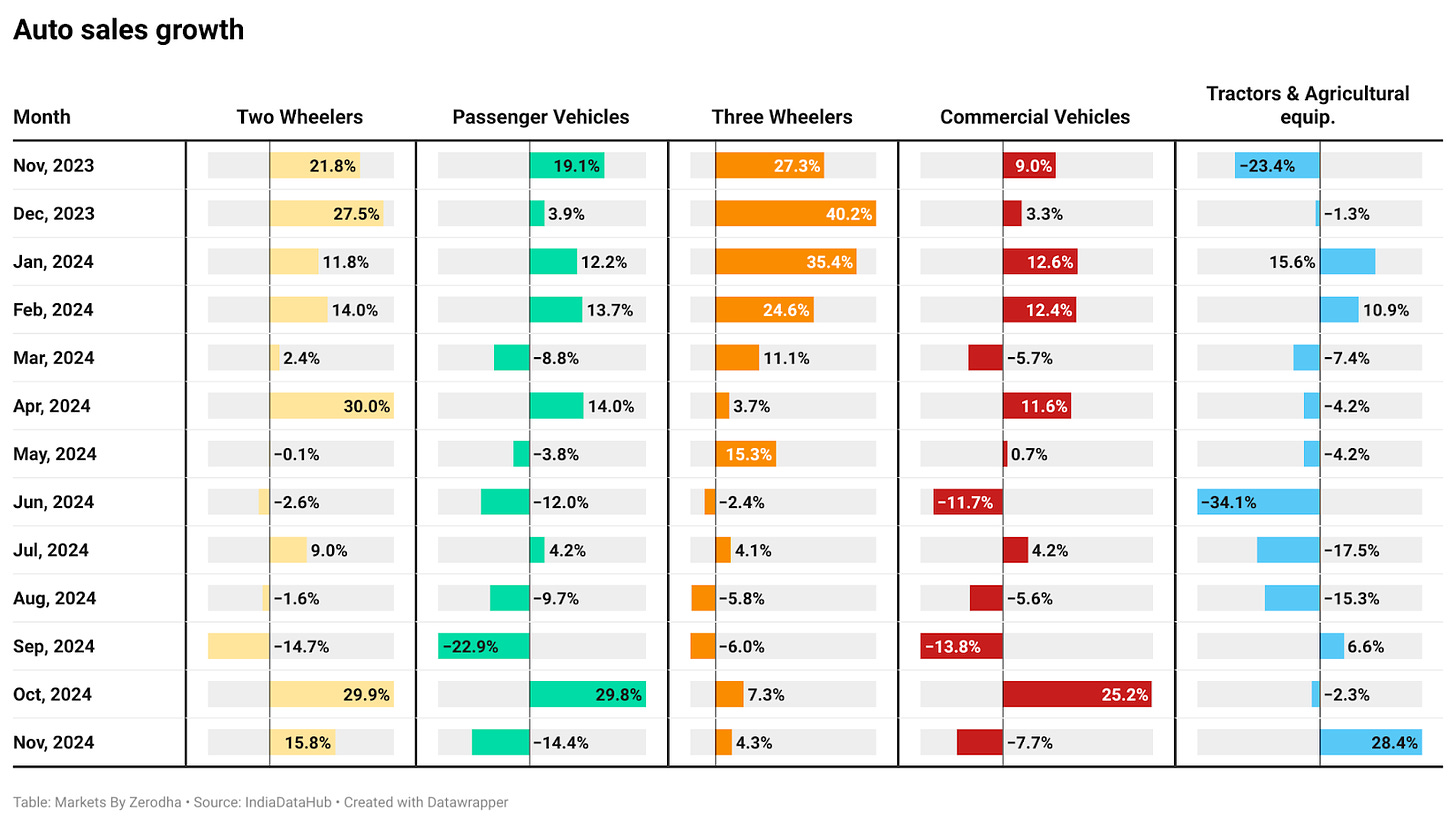

Auto gross sales

The automotive sector had a difficult 12 months, with sluggish gross sales all through 2024. Whereas there was a small enhance in car purchases throughout the festive season in October, it didn’t final lengthy. By November, gross sales of passenger vehicles and industrial autos dropped once more, displaying weak shopper demand and the influence of upper borrowing prices.

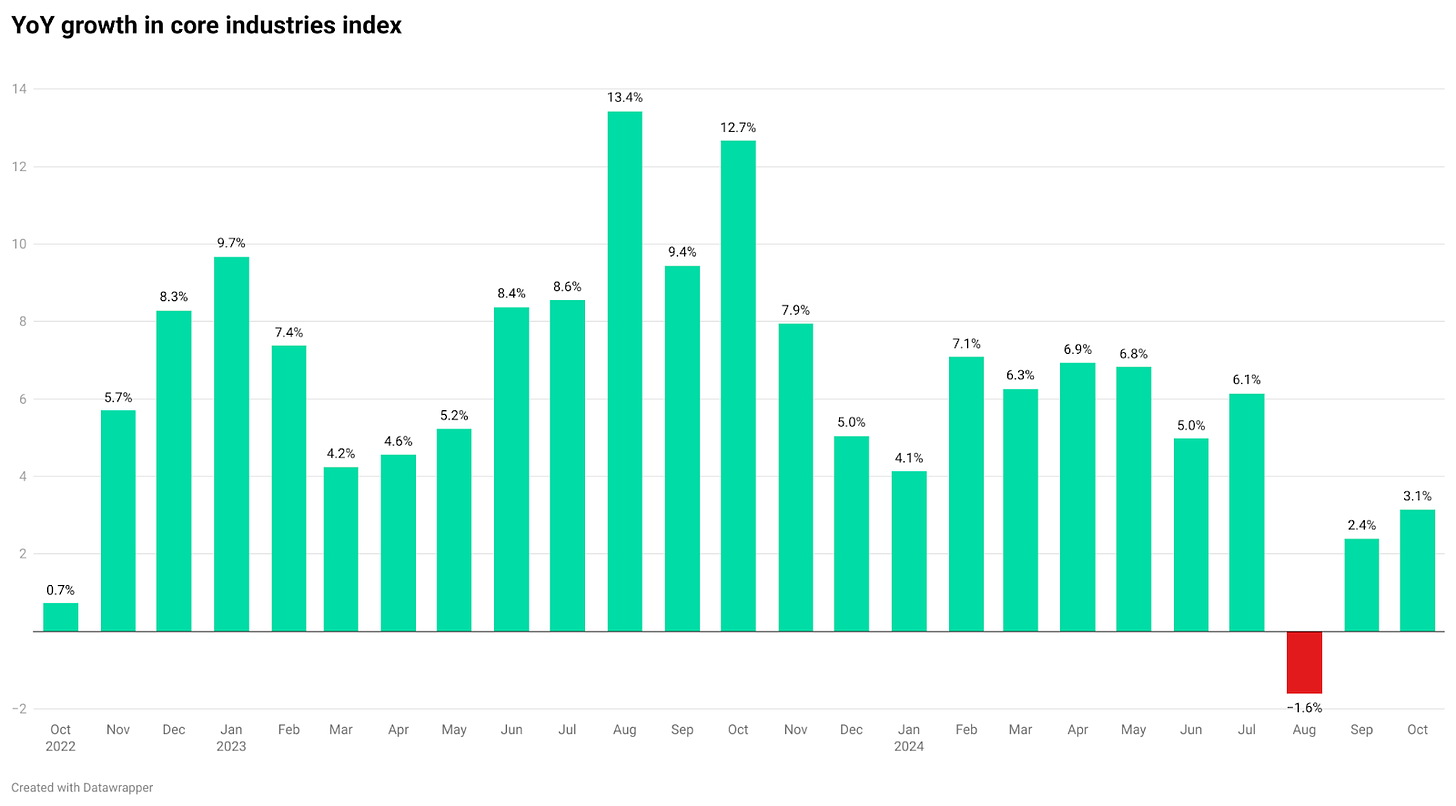

Industrial sector efficiency

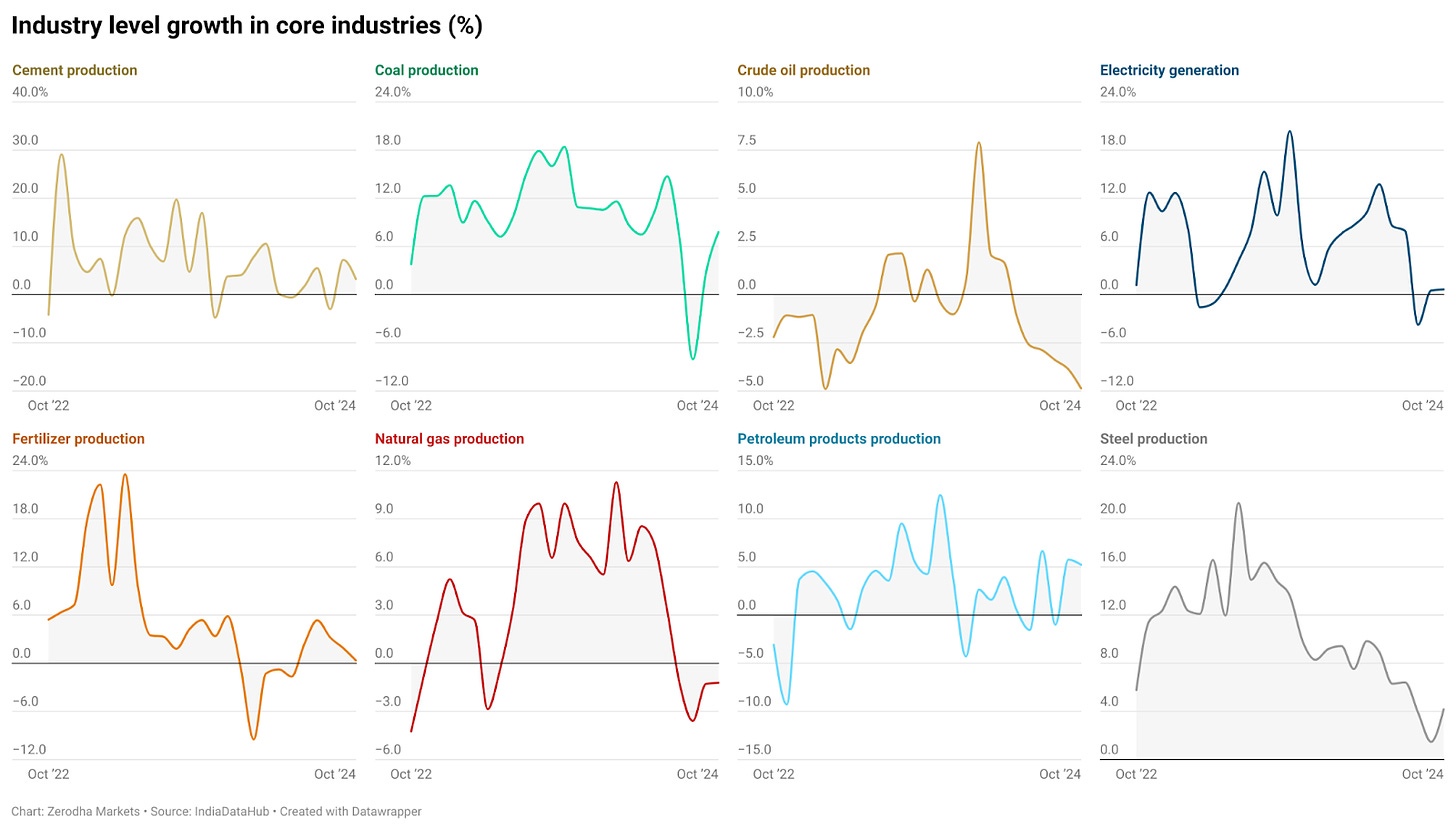

India’s core sector industries—coal, metal, cement, electrical energy, and others—confirmed combined efficiency. The index monitoring these industries rebounded barely in September and October, however progress ranges stay low. That is the weakest progress since October 2022.

Breaking it down by sector offers us a clearer image. Coal and metal manufacturing confirmed slight enchancment, however most different sectors continued to say no. This exhibits that the small restoration within the total index was principally pushed by these two industries, whereas the remaining are nonetheless struggling to select up tempo.

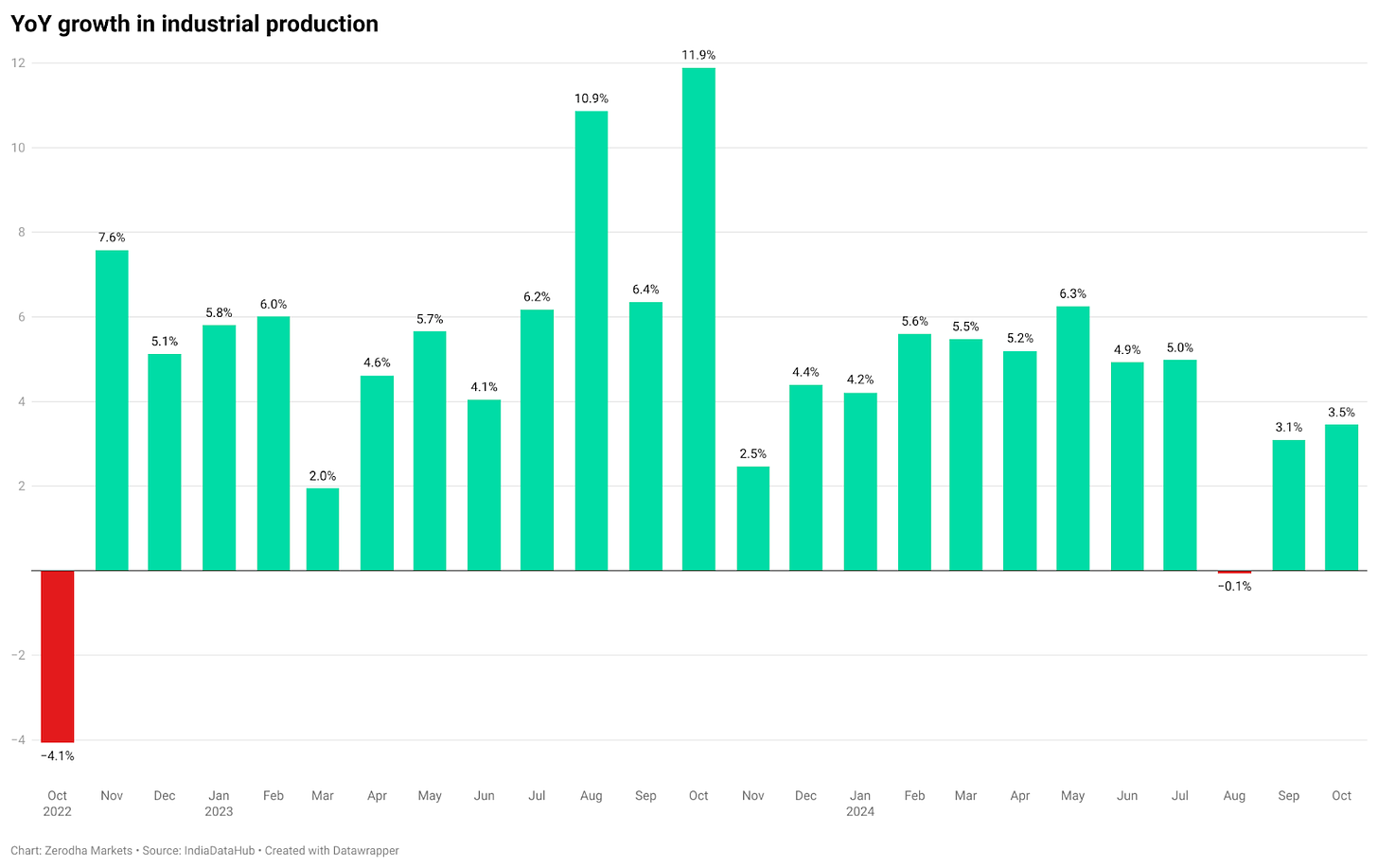

The sluggish efficiency of core sectors is clearly mirrored in industrial manufacturing numbers. When key industries wrestle, it pulls down total industrial manufacturing. Though the expansion fee of three.5% in October was higher than the earlier two months, it’s nonetheless fairly low—really, it’s the weakest since November 2023.

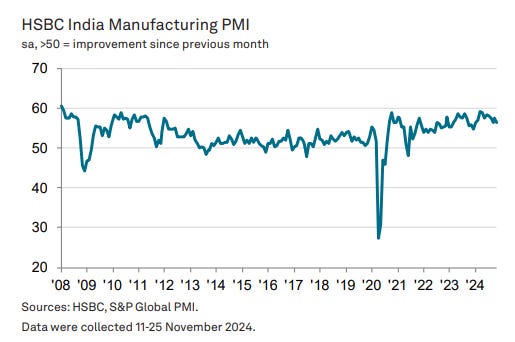

Regardless of some slowdown, India’s manufacturing sector has remained resilient. Knowledge from the HSBC India Manufacturing PMI confirmed continued enlargement in November, though the tempo of progress softened.

Optimistic demand traits, particularly from worldwide markets, helped producers keep output ranges. Nevertheless, rising prices of inputs akin to cotton, chemical substances, and rubber pushed up manufacturing costs, limiting revenue margins for a lot of corporations.

Supply: HSBC, S&P International PMI

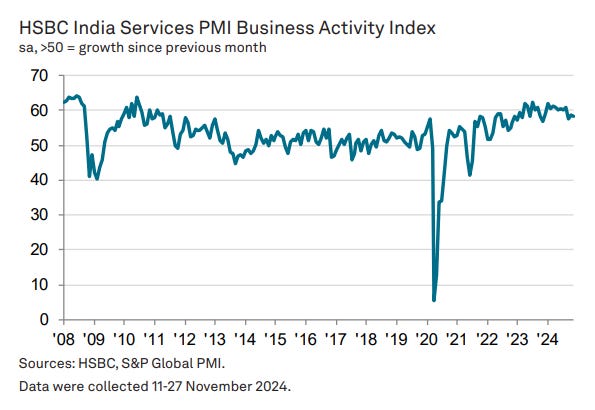

Then again, India’s companies sector can be performing effectively. In November, companies companies—like transport, finance, and actual property—continued to develop strongly. India’s Companies Buying Managers Index or PMI stayed excessive at 58.4, barely down from 58.5 in October.

A serious spotlight is job creation. The companies sector added new jobs on the quickest fee for the reason that survey started in 2005. Nevertheless, this progress additionally led to increased prices. Wages and meals costs elevated, ensuing within the steepest value rises in practically 12 years.

Supply: HSBC, S&P International PMI

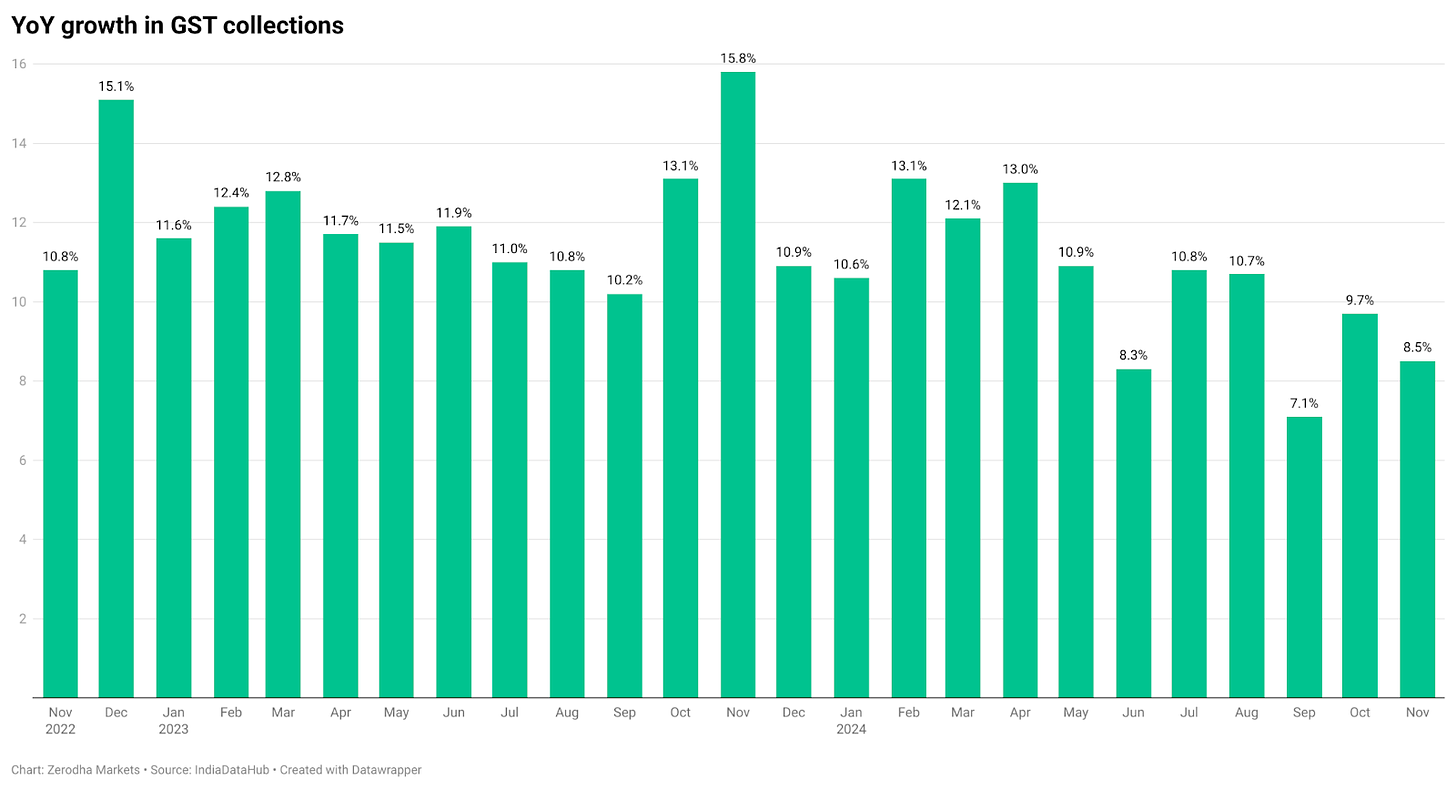

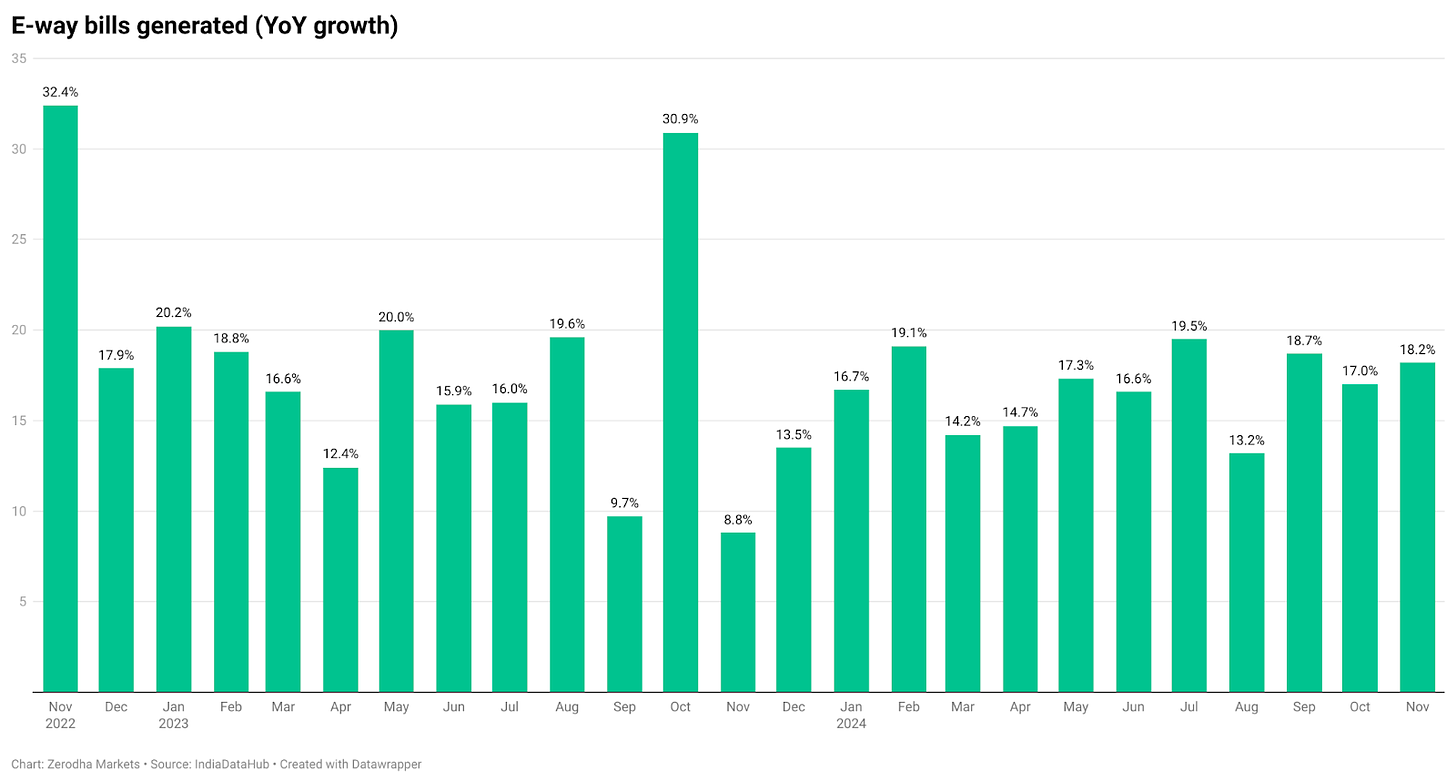

GST and E-way invoice collections

For the primary time in three years, GST collections have grown by lower than 10% over the previous three months. Even with the festive season in September, October, and November, the expansion didn’t meet expectations.

On the intense facet, e-way invoice era—which tracks the motion of products—has been robust, displaying an 18% year-on-year improve. This means that whereas tax collections have slowed, commerce and items transportation stay lively throughout the nation.

To sum it up, whereas India’s financial system continues to develop, the tempo has slowed down lately. With some key sectors dealing with challenges, inflation can be proving to be cussed straining family funds and slowing down spending on non-essentials.

That’s it from us at this time. Do share this with your pals to unfold the phrase.

Additionally, in case you have any suggestions, do tell us within the feedback.