Merchants,

It continues to be a novel and thrilling buying and selling atmosphere, and as at all times, I stay up for sharing my ideas and buying and selling plans with you.

Like final week’s watchlist, I’ll share my plans and common ideas for each small—and large-cap shares, given the chance set and the place I’m seeing success. Relating to my commerce and alternative critiques, I solely do this totally throughout my weekly Inside Entry assembly.

So, let’s begin with my plans for particular person small-cap shares, that are uncorrelated to the general market’s course.

The cycle continues to be scorching for small caps, with many day 1 gappers closing within the inexperienced after experiencing important flows. As soon as Day 1 strikes fail extra sharply off the open and VWAP reclaims fail on subdued quantity, I’ll know that the cycle is shifting.

Decrease Excessive, Pops to Brief in FFIE

FFIE was an incredible momentum mover on Thursday and Friday. After all, from a basic perspective, this firm is well-known, having run lately through the meme-mania in Might.

After Friday morning’s blowout and exhaustive transfer within the pre-market, the bottom was confirmed off the open with the pre-market excessive rejection and sharp failure on sustained quantity.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements corresponding to liquidity, slippage and commissions.

So long as the multi-day VWAP doesn’t reclaim, adopted by a worth motion chop, I will likely be targeted on shorting a decrease excessive. Ideally, this has a short-lived SSR push early within the week towards $8.5 – multi-day VWAP and fail. After that, I might provoke a brief swing place versus the day’s excessive. I might plan to carry versus the day’s excessive whereas trimming the place to $7. I’ll purpose to carry this for a number of days and goal a transfer again close to $5s.

On the backburner, a number of different small-cap shares I’m trying to brief:

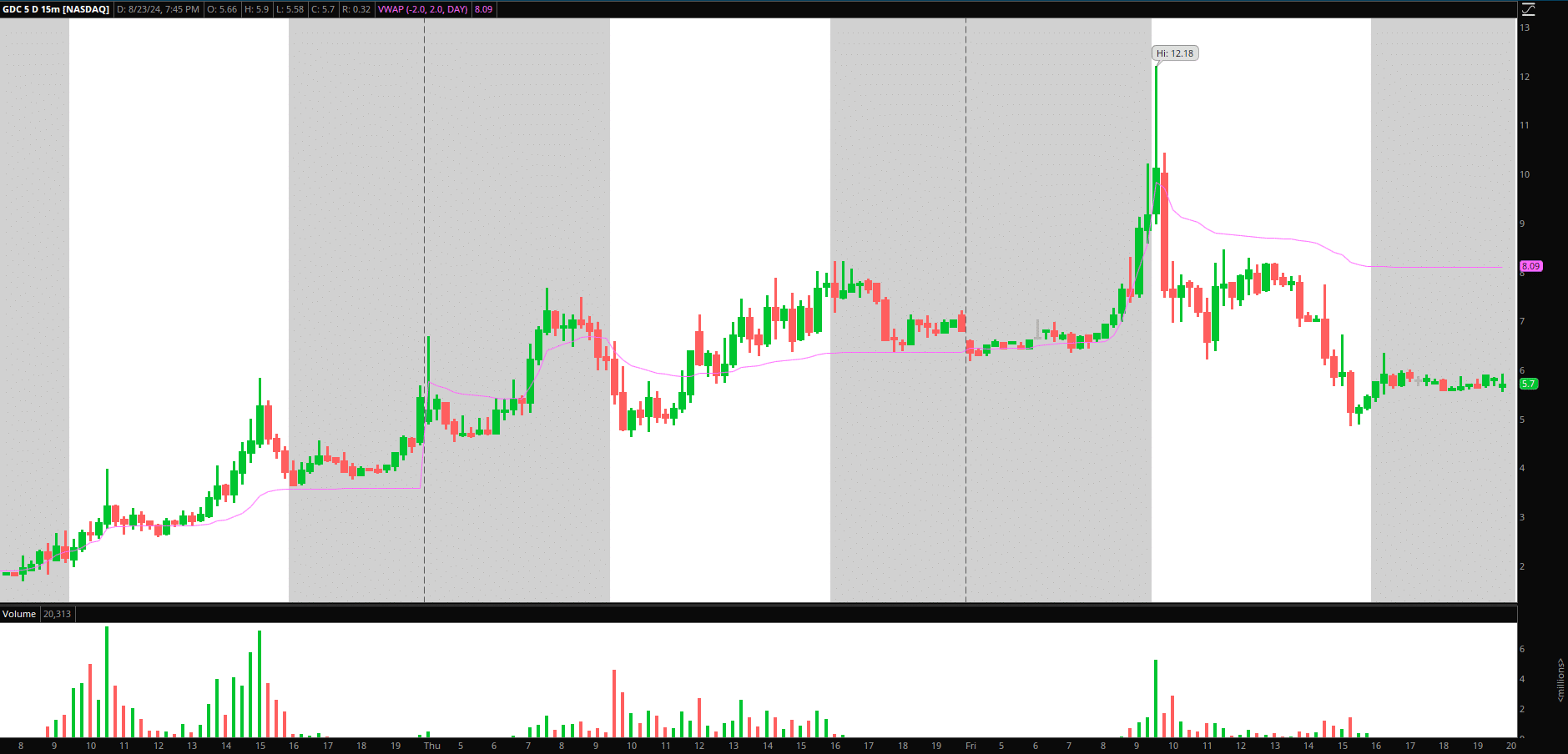

GDC – Comparable blowout Friday to FFIE. Like FFIE, I’m searching for failed follow-through pops towards its multi-day VWAP. Nevertheless, whereas I see this giving again many of the up transfer within the coming weeks, its pops might go additional than one thinks as a result of trickery that befell within the inventory.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements corresponding to liquidity, slippage and commissions.

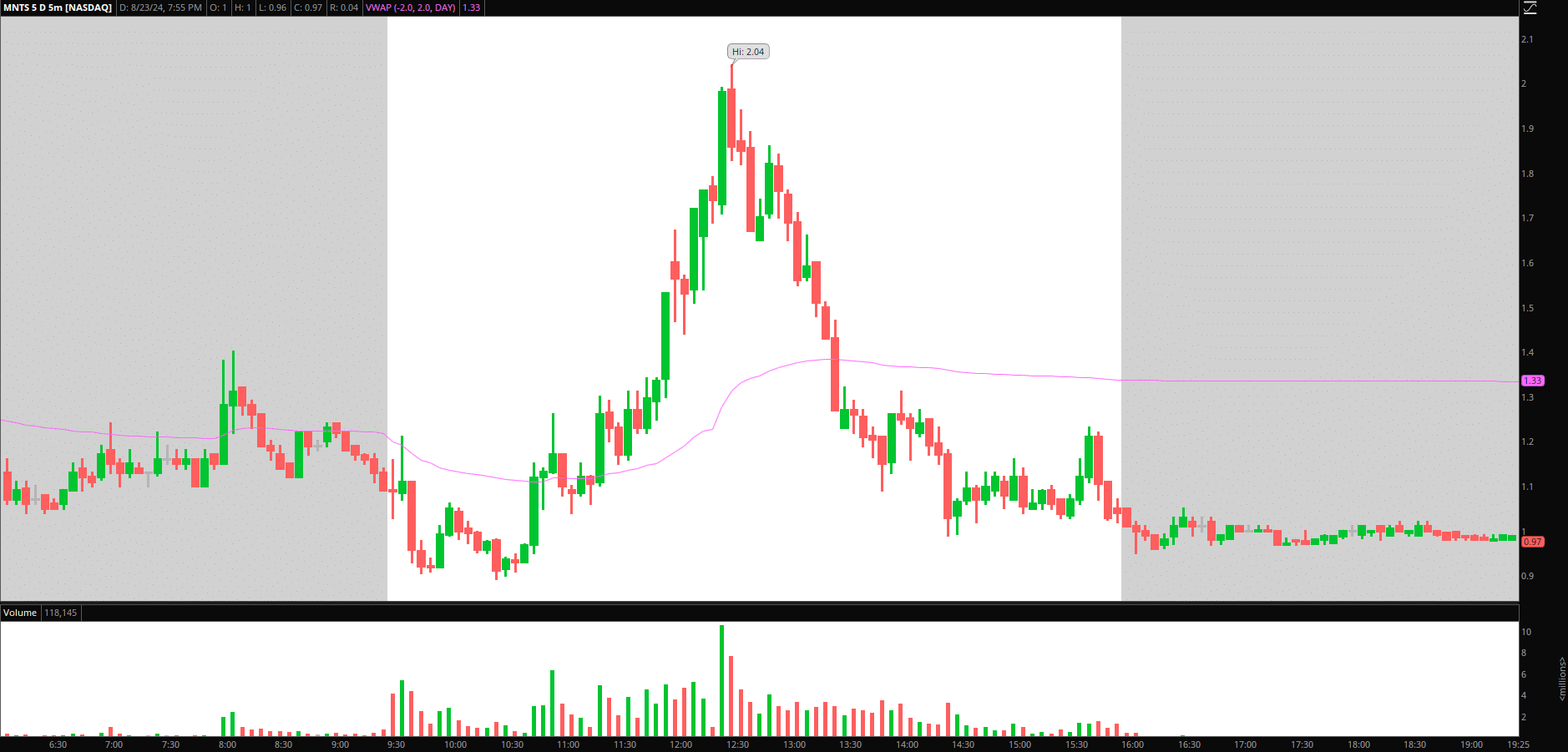

MNTS – I’ll set alerts for pops towards $1.3 + for intraday brief and unwind sub $1.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements corresponding to liquidity, slippage and commissions.

Focus Shifts to Favor Swing Longs

As I’ve been going over in my inside entry conferences, I’m searching for the market to consolidate and digest this transfer, having supplied a number of pullback alternatives final week. I must see earlier resistance maintain agency as newfound help and bases to construct to have larger confidence in directional swing longs in massive caps.

So, with the SPY now exhibiting early indicators of consolidation above the $555 band of help, I’m searching for additional sideways motion and vitality to construct. So long as the market can keep its footing above this essential zone, I’ll shift my focus to incorporate directional swing lengthy setups. On the flip aspect, if the market breaks beneath its rising 5-day after which $555, I’ll be arms off and searching for help and a better low close to $550 and its rising 50-day.

So, inside that, from an extended perspective, I’m in search of out relative power and engaging technicals for my watchlist.

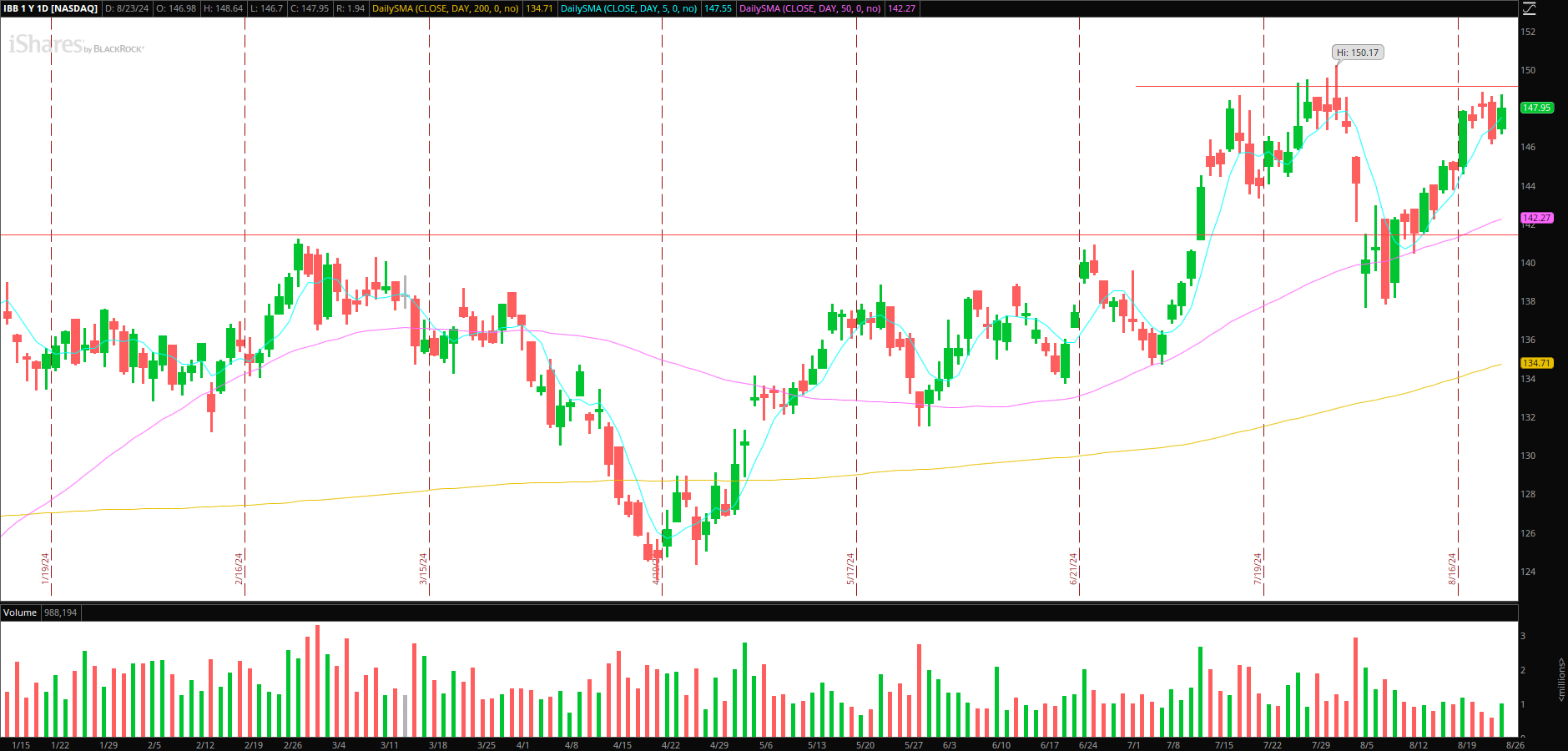

For instance, the biotech sector was one of many strongest final week. The IBB and XBI closed shy of their 52-week highs and close to a serious breakout and inflection level.

*Please be aware that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market elements corresponding to liquidity, slippage and commissions.

So, any more, a spotlight will likely be on figuring out probably the most well-positioned shares inside that sector for a possible breakout. Alternatively, I may even be eyeing the IBB for a consolidation breakout within the coming days and weeks. Given its nearly 10% transfer off the lows, nonetheless, I’d choose for a couple of extra days – per week of sideways motion earlier than a consolidation breakout happens.

Get the SMB Swing Buying and selling Analysis Template Right here!

Essential Disclosures