Up to date on August nineteenth, 2024 by Bob Ciura

Shares with low P/E ratios can supply engaging returns if their valuation multiples broaden. And when a low P/E inventory additionally has a excessive dividend yield, traders get ‘paid to attend’ for the valuation a number of to extend.

On this analysis report, we focus on the prospects of 20 undervalued excessive dividend shares, that are at present buying and selling at P/E ratios below 15 and are providing dividend yields above 5.0%.

We now have ranked the shares by P/E ratio, from lowest to highest. For REITs, we use P/FFO rather than the P/E ratio. And for MLPs, we use P/DCF (which is distributable money flows). These are comparable metrics just like earnings for frequent shares.

Moreover, the free excessive dividend shares checklist spreadsheet beneath has our full checklist of particular person securities (shares, REITs, MLPs, and so forth.) with with 5%+ dividend yields.

Desk of Contents

Preserve studying to see evaluation on these 20 undervalued excessive dividend shares.

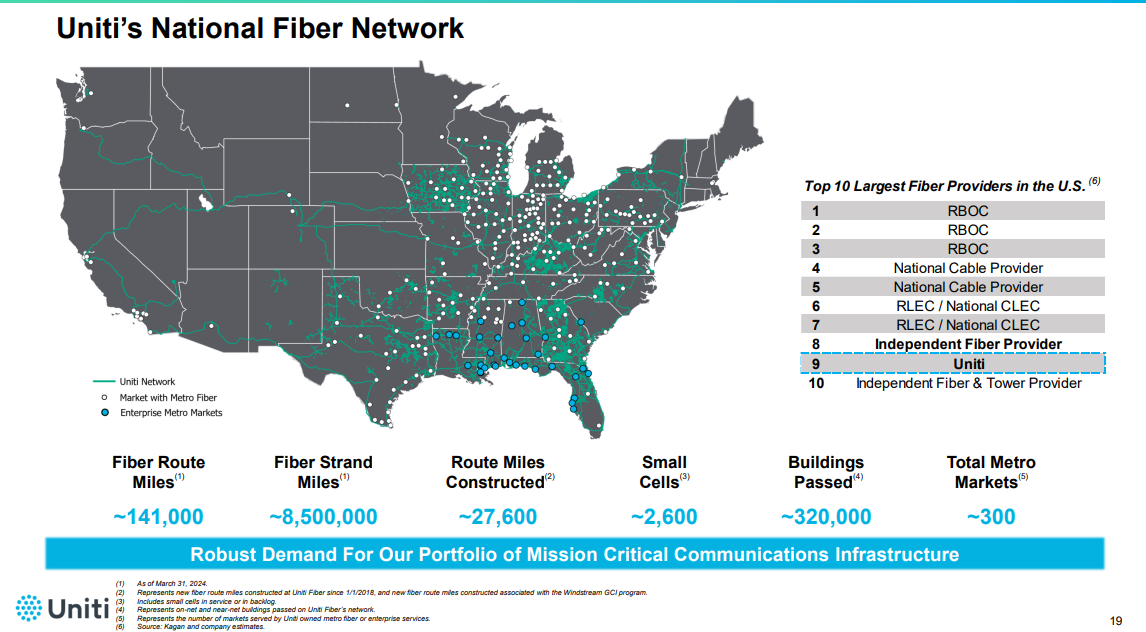

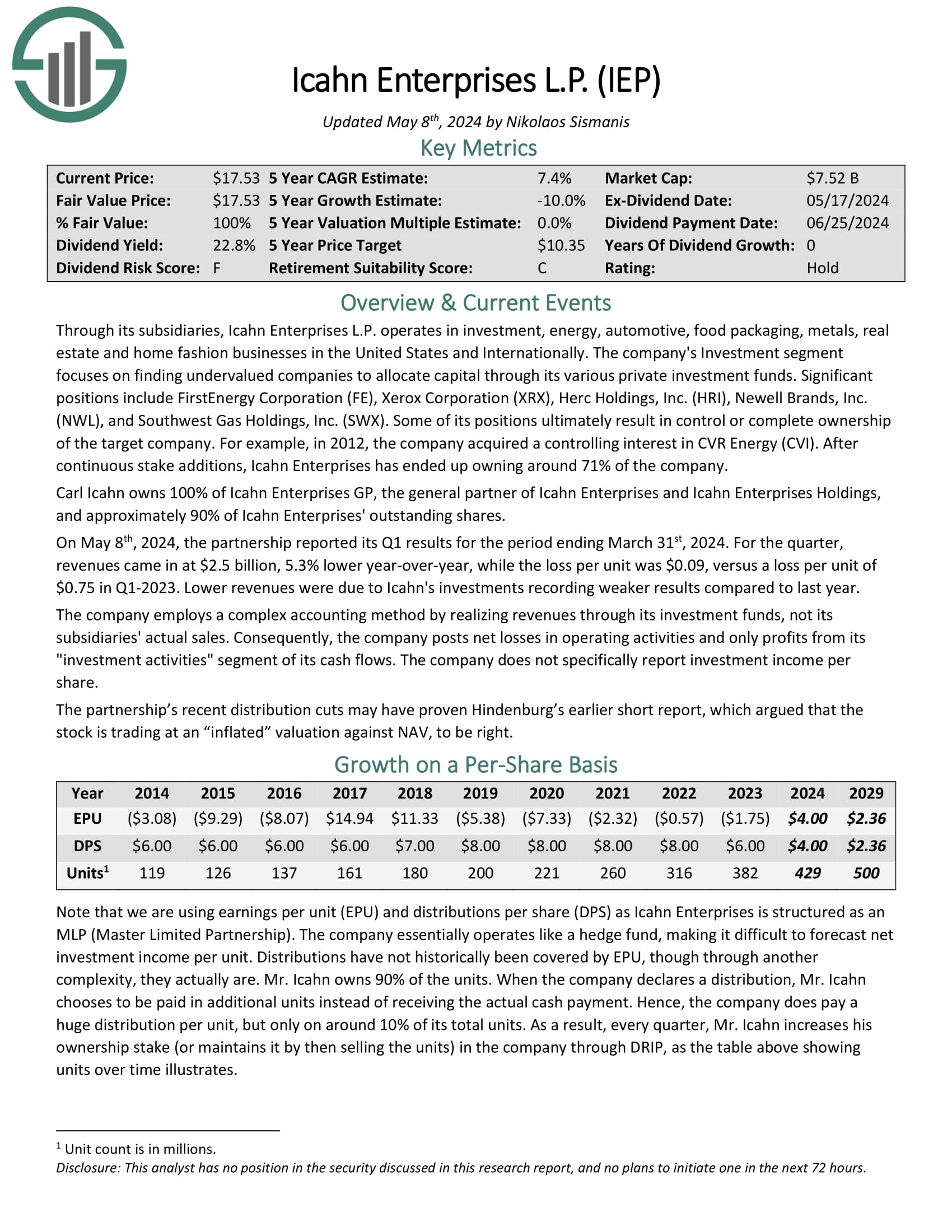

Undervalued Excessive Dividend Inventory #1: Uniti Group (UNIT) – P/E ratio of two.9

Uniti Group focuses on buying, establishing, and leasing out communications infrastructure in the US.

Particularly, it owns thousands and thousands of miles of fiber strand together with different communications actual property.

Supply: Investor Presentation

Uniti Group reported strong outcomes for the primary quarter of 2024, with consolidated revenues reaching $286.4 million. Internet revenue stood at $41.3 million, and adjusted EBITDA amounted to $228.6 million, attaining adjusted EBITDA margins of roughly 80%. The core recurring strategic fiber enterprise grew by 4% in comparison with the identical interval in 2023.

Uniti Fiber contributed $68.8 million in revenues and $23.8 million in Adjusted EBITDA for the quarter, whereas Uniti Leasing contributed $217.6 million in revenues and $210.7 million in Adjusted EBITDA.

Click on right here to obtain our most up-to-date Certain Evaluation report on UNIT (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #2: Japanese Bancshares (EBC) – P/E ratio of three.6

Japanese Bankshares, Inc. operates because the financial institution holding firm for Japanese Financial institution that gives banking services primarily to retail, business, and small enterprise prospects. The corporate supplies deposit accounts, curiosity checking accounts, cash market accounts, financial savings accounts, and time certificates of deposit accounts.

It additionally presents business and industrial, business actual property and building, small enterprise, residential actual property, and residential fairness loans.

On July fifteenth, 2024 Cambridge Bancorp (CATC) merged with Japanese Bankshares, Inc. (EBC).

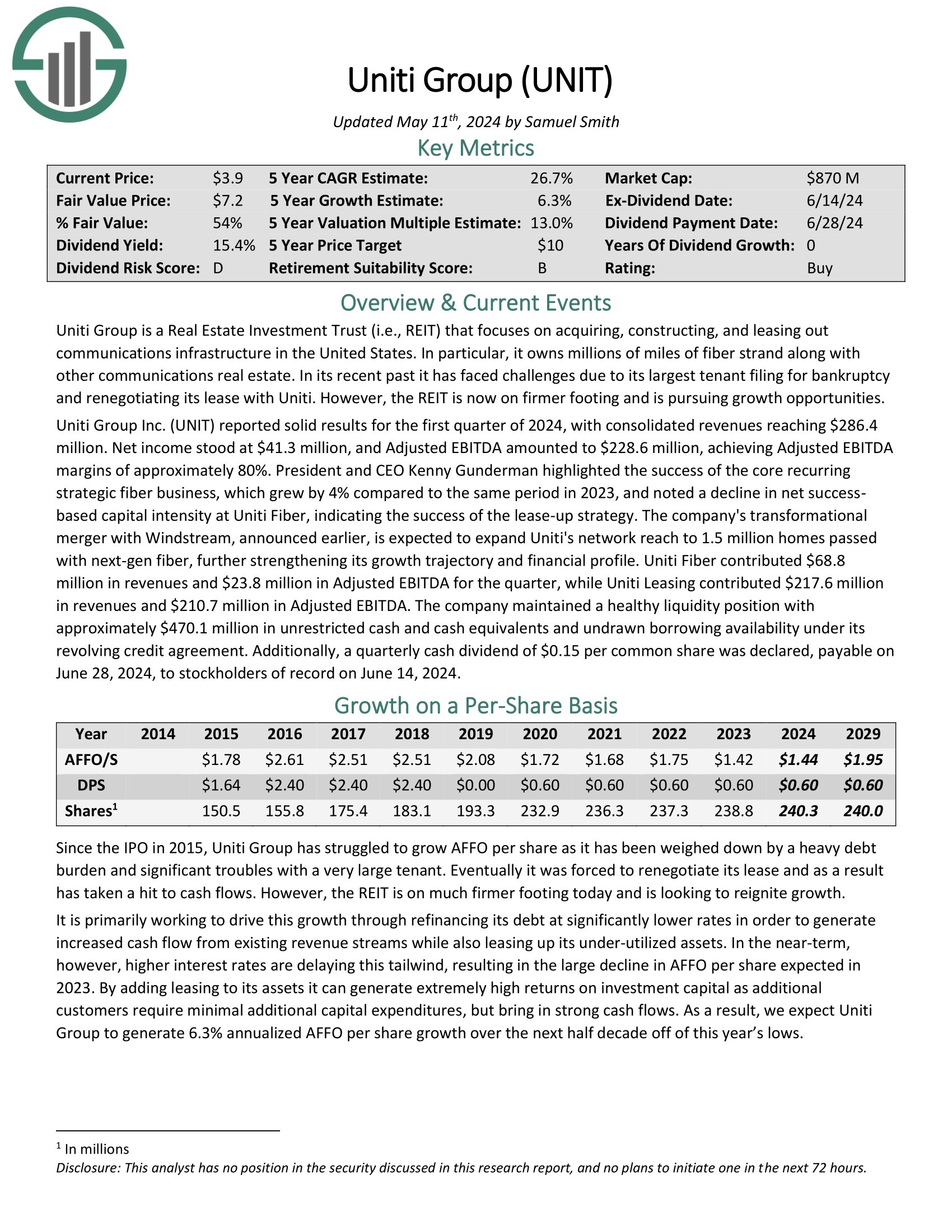

Undervalued Excessive Dividend Inventory #3: Walgreens Boots Alliance (WBA) – P/E ratio of three.8

Walgreens Boots Alliance is the biggest retail pharmacy in each the US and Europe. By its flagship Walgreens enterprise and different enterprise ventures, the $13 billion market cap firm has a presence in 9 nations, employs greater than 330,000 folks and has about 12,500 shops within the U.S., Europe, and Latin America.

On June twenty seventh, 2024, Walgreens reported outcomes for the third quarter of fiscal 2024. Gross sales grew 3% however earnings-per share decreased 36% over final yr’s quarter, from $0.99 to $0.63, as a result of intense competitors, which has eroded revenue margin.

Supply: Investor Presentation

Earnings-per-share missed the analysts’ consensus by $0.08. Walgreens has exceeded the analysts’ estimates in 13 of the final 16 quarters.

Nevertheless, because the pandemic has subsided and competitors has heated within the retail pharmaceutical trade, Walgreens is going through powerful comparisons. It lowered its steerage for earnings-per-share in 2024 from $3.20-$3.35 to $2.80-$2.95. Accordingly, we have now lowered our forecast from $3.28 to $2.87.

Click on right here to obtain our most up-to-date Certain Evaluation report on WBA (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #4: Medical Properties Belief (MPW) – P/E ratio of 4.1

Medical Properties Belief is the one pure-play hospital REIT at present. It owns a portfolio of over 400 properties that are leased to over 30 totally different operators.

Nearly all of the belongings are common acute care hospitals, but additionally embrace inpatient rehabilitation and long-term acute care.

The portfolio of belongings can also be diversified throughout totally different geographies with properties in 29 states, in addition to Germany, the UK, Italy, and Australia.

Supply: Investor Presentation

Medical Properties Belief, Inc. (MPW) introduced its monetary and operational outcomes for the primary quarter. The corporate executed whole liquidity transactions of $1.6 billion year-to-date, reaching 80% of its preliminary FY 2024 goal.

Regardless of recording a web lack of ($1.23) per share and Normalized Funds from Operations (NFFO) of $0.24 per share within the first quarter of 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on MPW (preview of web page 1 of three proven beneath):

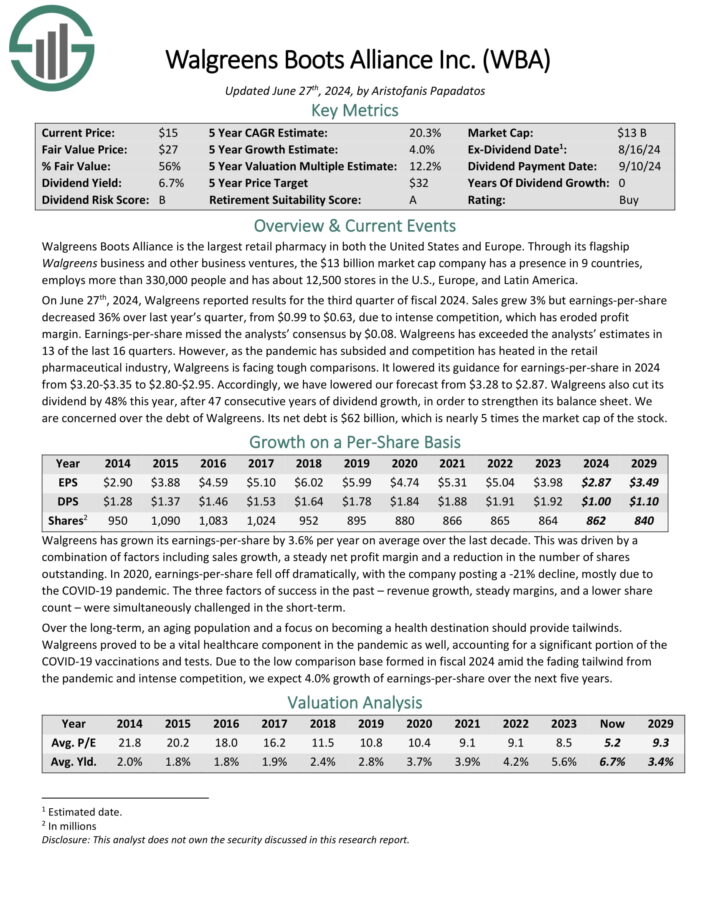

Undervalued Excessive Dividend Inventory #5: Icahn Enterprises LP (IEP) – P/E ratio of 4.2

Icahn Enterprises L.P. operates in funding, power, automotive, meals packaging, metals, actual property, and residential vogue companies in the US and Internationally.

The corporate’s Funding phase focuses on discovering undervalued corporations to allocate capital by way of its numerous personal funding funds.

Important positions embrace FirstEnergy Company (FE), Xerox Company (XRX), Herc Holdings, Inc. (HRI), Newell Manufacturers, Inc. (NWL), and Southwest Gasoline Holdings, Inc. (SWX).

Carl Icahn owns 100% of Icahn Enterprises GP, the overall accomplice of Icahn Enterprises and Icahn Enterprises Holdings, and roughly 95% of Icahn Enterprises’ excellent shares.

On Could eighth, 2024, the partnership reported its Q1 outcomes for the interval ending March thirty first, 2024. For the quarter, revenues got here in at $2.5 billion, 5.3% decrease year-over-year, whereas the loss per unit was $0.09, versus a loss per unit of $0.75 in Q1-2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on IEP (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #6: AGNC Funding Company (AGNC) – P/E ratio of 4.6

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage move–by way of securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

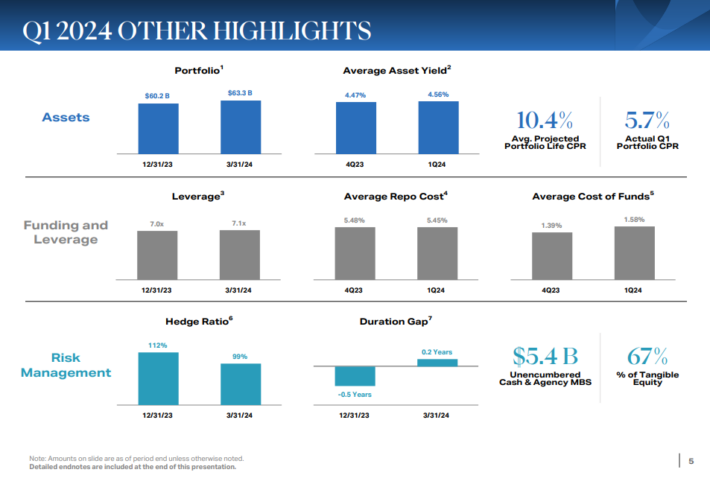

AGNC Funding’s first-quarter non-GAAP earnings continued their downward development amid the corporate’s operation in a better rate of interest setting.

Supply: Investor Presentation

Q1 web unfold and greenback roll revenue per share of $0.58, barely surpassing expectations, declined from earlier quarters.

The quarter’s earnings excluded an estimated “catch-up” premium amortization profit. Tangible web e-book worth per frequent share elevated to $8.84, though the financial return on tangible frequent fairness declined.

Click on right here to obtain our most up-to-date Certain Evaluation report on AGNC Funding Corp (AGNC) (preview of web page 1 of three proven beneath):

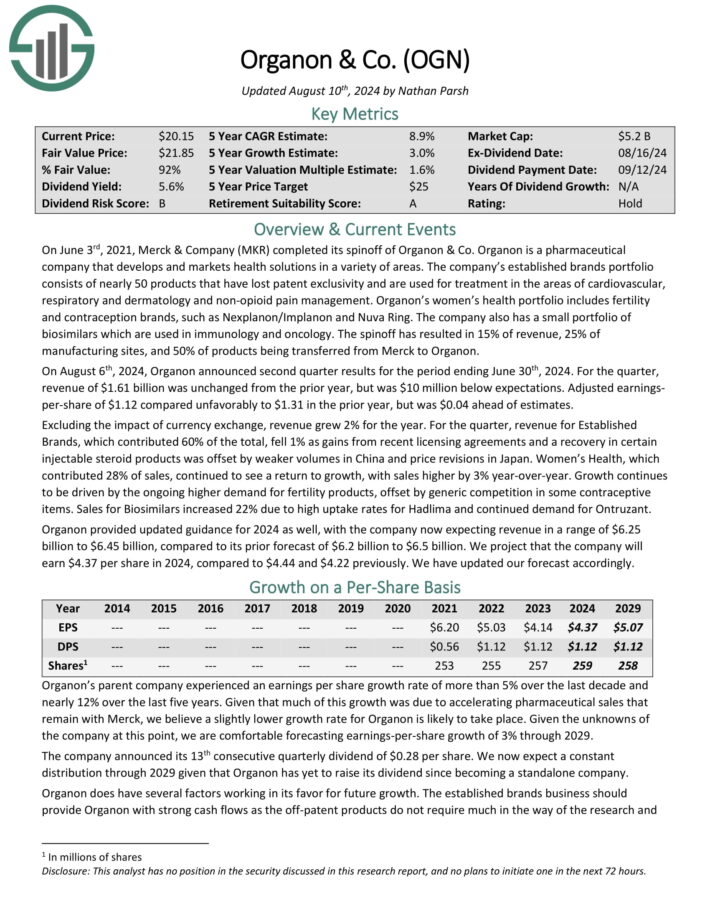

Undervalued Excessive Dividend Inventory #7: Organon & Co. (OGN) – P/E ratio of 4.7

Supply: Investor Displays

On August sixth, 2024, Organon introduced second quarter outcomes for the interval ending June thirtieth, 2024. For the quarter, income of $1.61 billion was unchanged from the prior yr, however was $10 million beneath expectations.

Adjusted earnings per-share of $1.12 in contrast unfavorably to $1.31 within the prior yr, however was $0.04 forward of estimates. Excluding the impression of foreign money change, income grew 2% for the yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on Organon (preview of web page 1 of three proven beneath):

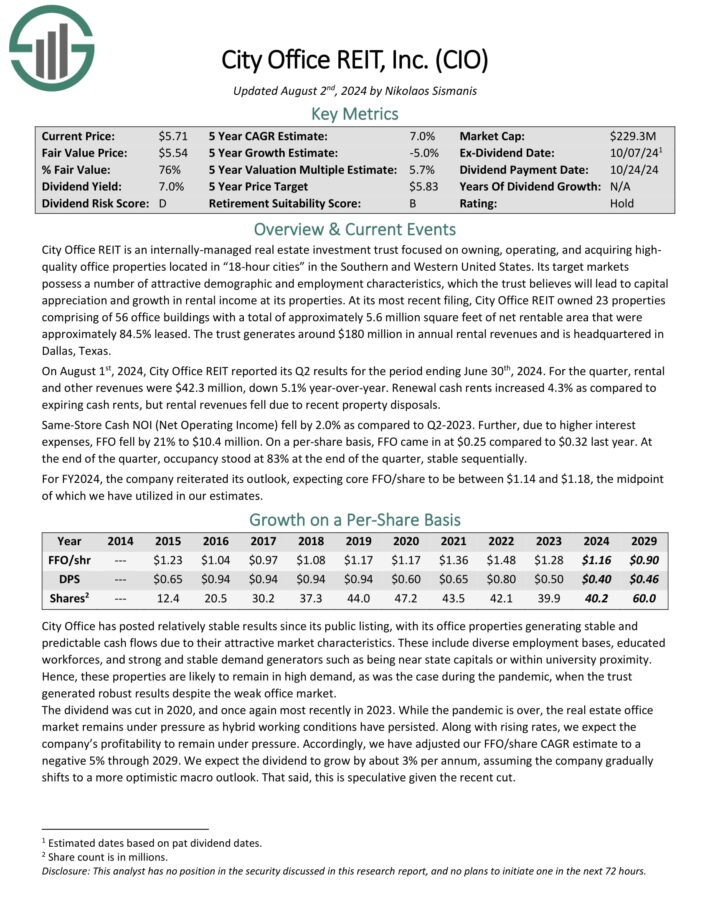

Undervalued Excessive Dividend Inventory #8: Metropolis Workplace REIT (CIO) – P/E ratio of 4.7

Metropolis Workplace REIT is an internally-managed actual property funding belief targeted on proudly owning, working, and buying top quality workplace properties situated in “18-hour cities” within the Southern and Western United States.

Its goal markets possess quite a few engaging demographic and employment traits, which the belief believes will result in capital appreciation and progress in rental revenue at its properties.

At its most up-to-date submitting, Metropolis Workplace REIT owned 23 properties comprising of 56 workplace buildings with a complete of roughly 5.6 million sq. ft of web rentable space that have been roughly 84.5% leased.

On August 1st, 2024, Metropolis Workplace REIT reported its Q2 outcomes for the interval ending June thirtieth, 2024. For the quarter, rental and different revenues have been $42.3 million, down 5.1% year-over-year. Renewal money rents elevated 4.3% as in comparison with expiring money rents, however rental revenues fell as a result of latest property disposals.

Similar-Retailer Money NOI (Internet Working Earnings) fell by 2.0% as in comparison with Q2-2023. Additional, as a result of increased curiosity bills, FFO fell by 21% to $10.4 million. On a per-share foundation, FFO got here in at $0.25 in comparison with $0.32 final yr. On the finish of the quarter, occupancy stood at 83% on the finish of the quarter, secure sequentially.

Click on right here to obtain our most up-to-date Certain Evaluation report on CIO (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #9: ARMOUR Residential REIT (ARR) – P/E ratio of 4.8

ARMOUR Residential invests in residential mortgage-backed securities that embrace U.S. Authorities-sponsored entities (GSE) similar to Fannie Mae and Freddie Mac.

It additionally consists of Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate residence loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different varieties of investments.

ARMOUR’s first-quarter 2024 outcomes confirmed GAAP web revenue out there to frequent stockholders of $11.5 million or $0.24 per frequent share, with web curiosity revenue amounting to $5.3 million.

Distributable Earnings out there to frequent stockholders stood at $40.4 million, representing $0.82 per frequent share. The corporate paid frequent inventory dividends of $0.24 per share monthly or $0.72 per share for the primary quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #10: Vitality Switch LP (ET) – P/E ratio of 5.3

Vitality Switch owns and operates one of many largest and most diversified portfolios of power belongings in the US.

Operations embrace pure gasoline transportation and storage together with crude oil, pure gasoline liquids, refined product transportation, and storage totaling 83,000 miles of pipelines.

Vitality Switch operates with a primarily fee-based mannequin, which considerably mitigates the sensitivity of the MLP to commodity costs.

Supply: Investor Presentation

In early Could, Vitality Switch reported (5/8/24) monetary outcomes for the primary quarter of fiscal 2024. It grew its volumes in all of the segments and achieved report crude oil transportation volumes.

Because of this, distributable money circulation grew 17% over the prior yr’s quarter. Vitality Switch posted a wholesome distribution protection ratio of two.2x for the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on ET (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #11: TriplePoint Enterprise Development BDC (TPVG) – P/E ratio of 5.3

TriplePoint Enterprise Development BDC Corp makes a speciality of offering capital and guiding corporations throughout their personal progress stage, earlier than they finally IPO to the general public markets.

Supply: Investor Presentation

On Could 1st, 2024, the corporate posted its Q1 outcomes. For the quarter, whole funding revenue of $29.3 million in comparison with $33.6 million in Q1-2023.

The lower in whole funding was primarily as a result of a decrease weighted common principal quantity excellent on the BDC’s income-bearing debt funding portfolio. The variety of portfolio corporations fell from 59 final yr to 49.

The corporate’s weighted common annualized portfolio yield got here in at 15.4% for the quarter, up from 14.7% within the prior-year interval.

Additionally throughout Q1, the corporate funded $13.5 million in debt investments to a few portfolio corporations with a 14.3% weighted common annualized yield at origination.

Click on right here to obtain our most up-to-date Certain Evaluation report on TPVG (preview of web page 1 of three proven beneath):

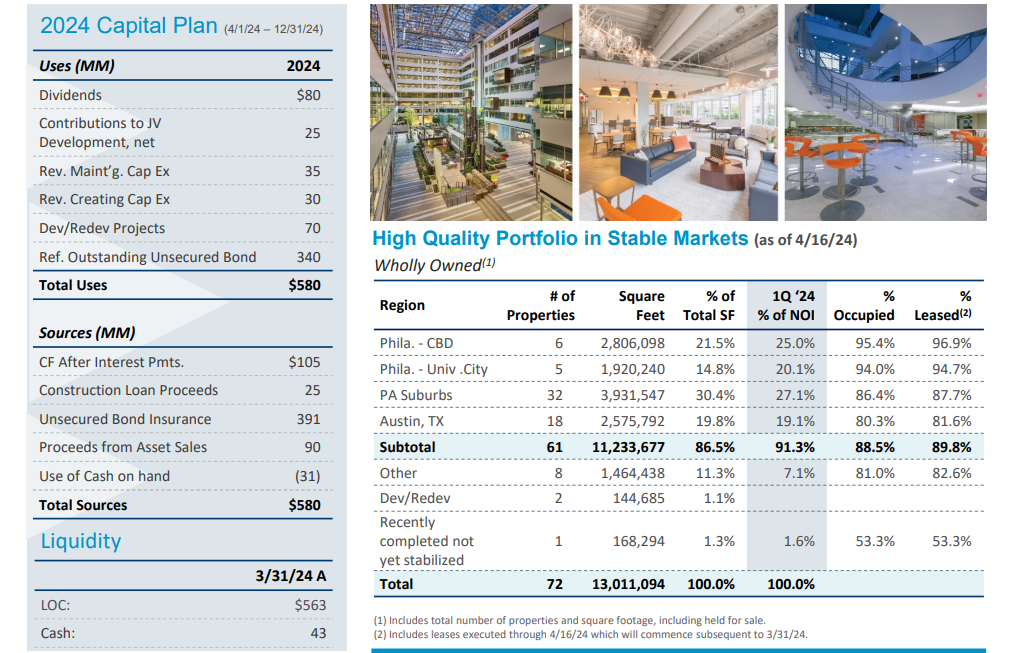

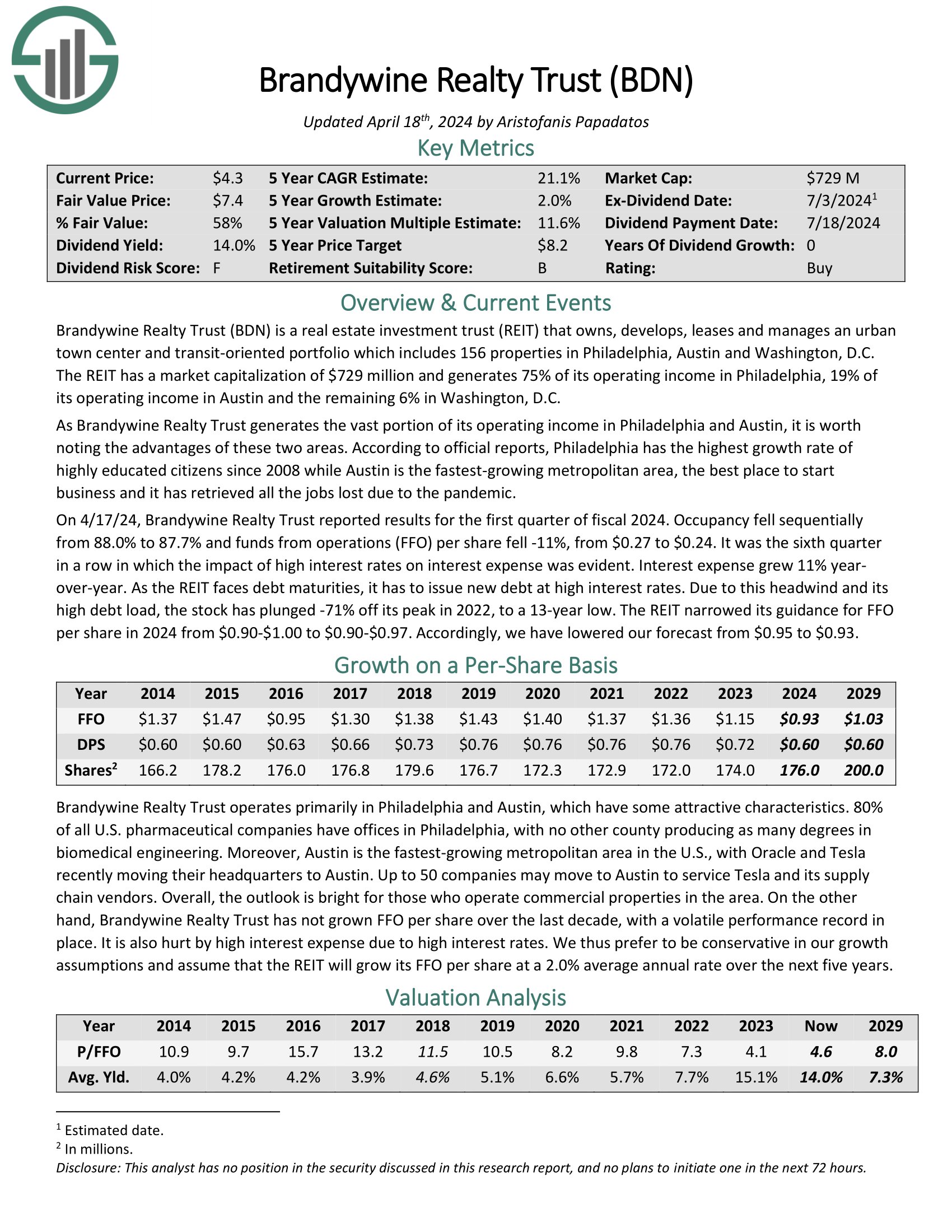

Undervalued Excessive Dividend Inventory #12: Brandywine Realty Belief (BDN) – P/E ratio of 5.4

Brandywine Realty owns, develops, leases and manages an city city heart and transit-oriented portfolio which incorporates 163 properties in Philadelphia, Austin, and different cities.

The REIT generates most of its working revenue in Pennsylvania, with the rest in Austin, TX and numerous different markets.

Supply: Investor Presentation

On 4/17/24, Brandywine Realty Belief reported outcomes for the primary quarter of fiscal 2024. Occupancy fell sequentially from 88.0% to 87.7% and funds from operations (FFO) per share fell -11%, from $0.27 to $0.24.

It was the sixth quarter in a row during which the impression of excessive rates of interest on curiosity expense was evident. Curiosity expense grew 11% year-over-year. Because the REIT faces debt maturities, it has to challenge new debt at excessive rates of interest.

Click on right here to obtain our most up-to-date Certain Evaluation report on BDN (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #13: Lincoln Nationwide Corp. (LNC) – P/E ratio of 5.4

Lincoln Nationwide Company presents life insurance coverage, annuities, retirement plan providers and group safety. The company was based in 1905.

Lincoln Nationwide reported second quarter 2024 outcomes on August 1st, 2024, for the interval ending June thirtieth, 2024. The corporate generated web revenue of $5.11 per share within the quarter, which in contrast favorably to $2.94 within the second quarter of 2023. Adjusted revenue from operations equaled $1.84 per share in comparison with $2.02 in the identical prior yr interval.

Moreover, annuities common account balances rose by 6.8% to $158 billion and group safety insurance coverage premiums grew 2.8% to $1.3 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on LNC (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #14: Ford Motor Co. (F) – P/E ratio of 5.5

Ford Motor Firm was first included in 1903 and previously 120 years, it has grow to be one of many world’s largest automakers. It operates a big financing enterprise in addition to its core manufacturing division, which produces a well-liked assortment of automobiles, vehicles, and SUVs. Ford may produce $170+ billion in income this yr and it trades with a $40 billion market capitalization.

Ford posted second quarter earnings on July twenty fourth, 2024, and outcomes have been considerably weaker than anticipated. Adjusted earnings-per-share got here to 47 cents, which was 21 cents worse than anticipated. Automotive income was $44.81 billion, which was up 5.6% year-on-year, however $70 million decrease than anticipated.

The corporate’s margins eroded within the second quarter as elevated guarantee prices and losses related to its unsuccessful EV division. Administration famous the corporate is working to enhance high quality and scale back complexity, which ought to assist over time to rebuild margins.

Industrial gross sales have been up 2.9%, however adjusted EBIT plummeted from $2.8 billion to $1 billion year-over-year. Adjusted free money circulation was up $300 million to $3.2 billion. Gross sales of hybrid autos rose 34% year-over-year, or 9% of whole quantity globally.

Click on right here to obtain our most up-to-date Certain Evaluation report on Ford Motor (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #15: Nice Elm Capital (GECC) – P/E ratio of 5.8

Nice Elm Capital Company is a enterprise growth firm that makes a speciality of mortgage and mezzanine, center market investments.

It seeks to create long-term shareholder worth by constructing its enterprise throughout three verticals: Working Firms, Funding Administration, and Actual Property.

The corporate favors investing in media, healthcare, telecommunication providers, communications tools, business providers and provides.

Supply: Investor Presentation

Within the 2024 first quarter, Nice Elm Capital reported whole funding revenue of $1.03 per share. Nevertheless, GECC additionally reported web realized and unrealized losses of roughly $3.7 million, or $0.42 per share, throughout this era.

GECC deployed roughly $64.2 million into 29 investments at a weighted common present yield of 12.5% in the course of the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on GECC (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #16: Piedmont Workplace Realty Belief (PDM) – P/E ratio of 5.9

Piedmont Workplace Realty Belief, Inc. owns, manages, develops, redevelops, and operates high-quality workplace properties situated primarily in sub-markets inside seven main Japanese U.S. workplace markets.

The corporate derives most of its revenues from U.S. authorities entities, enterprise providers corporations, and monetary establishments within the Sunbelt area. PDM is totally built-in and self-managed. The corporate has native administration places of work in every of their markets.

On July twenty sixth, 2023, Piedmont Workplace Realty slashed its quarterly dividend by 41% to $0.125, as elevated curiosity expense weighed closely on its outcomes.

On July thirty first, 2024, Piedmont reported second quarter 2024 outcomes. The corporate reported core funds from operations (FFO) of $0.37 per share for the quarter, an 18% lower in comparison with final yr’s ends in the second quarter, principally as a result of a rise in curiosity expense.

PDM noticed a 3.7% improve in similar retailer web working revenue on an accrual foundation throughout Q2. The corporate leased 1.04M sq. ft within the quarter, together with 404K sq. ft of latest tenant leasing. As of June thirtieth, 2024, roughly 1.6 million sq. ft of executed leases have been but to start or below rental abatement.

Click on right here to obtain our most up-to-date Certain Evaluation report on Piedmont Workplace (PDM) (preview of web page 1 of three proven beneath):

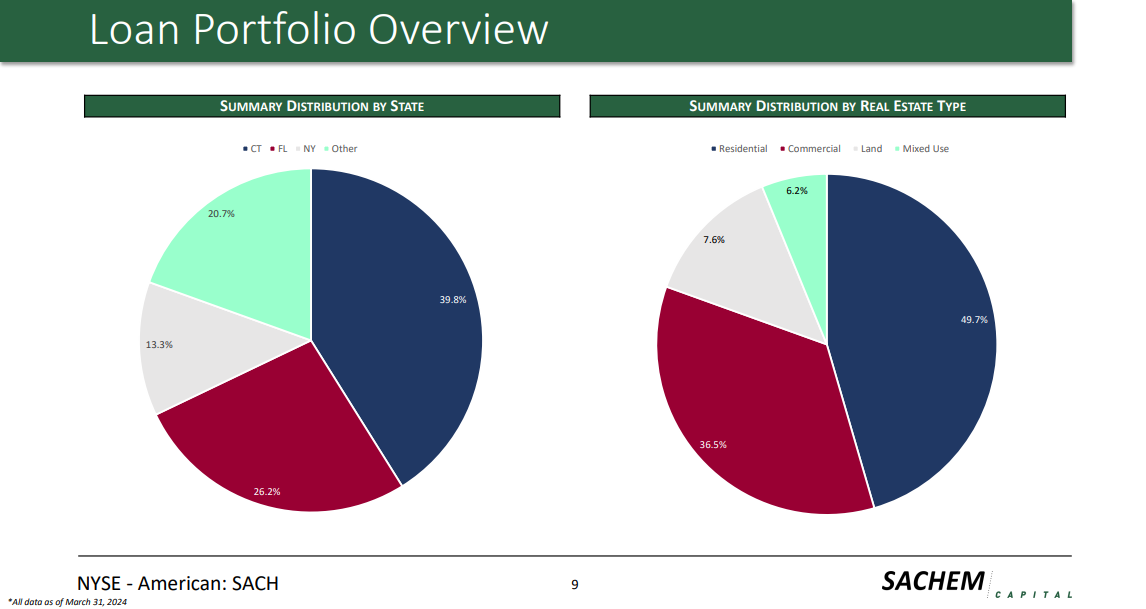

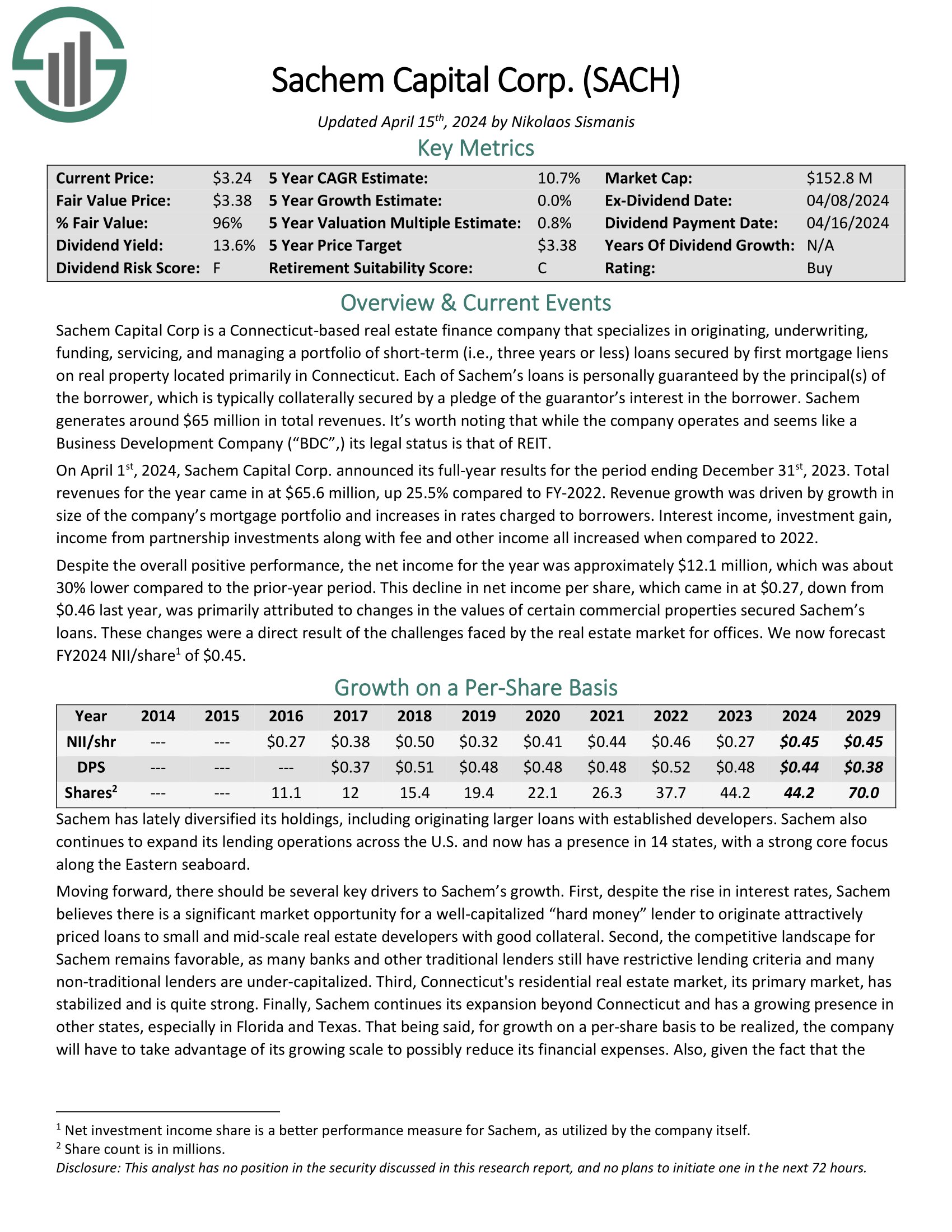

Undervalued Excessive Dividend Inventory #17: Sachem Capital (SACH) – P/E ratio of 5.9

Sachem Capital Corp is a Connecticut-based actual property finance firm that makes a speciality of originating, underwriting, funding, servicing, and managing a portfolio of short-term (i.e., three years or much less) loans secured by first mortgage liens on actual property situated primarily in Connecticut.

Every of Sachem’s loans is personally assured by the principal(s) of the borrower, which is usually collaterally secured by a pledge of the guarantor’s curiosity within the borrower. Sachem generates round $65 million in whole revenues.

Supply: Investor Presentation

On April 1st, 2024, Sachem Capital Corp. introduced its full-year outcomes for the interval ending December thirty first, 2023. Whole revenues for the yr got here in at $65.6 million, up 25.5% in comparison with FY-2022.

Income progress was pushed by progress in measurement of the corporate’s mortgage portfolio and will increase in charges charged to debtors.

Click on right here to obtain our most up-to-date Certain Evaluation report on SACH (preview of web page 1 of three proven beneath):

Undervalued Excessive Dividend Inventory #18: Alliance Useful resource Companions LP (ARLP) – P/E ratio of 6.0

Alliance Useful resource Companions is the second–largest coal producer within the jap United States. Its main operations are producing and advertising and marketing coal to main home and worldwide utility customers.

Nevertheless, the corporate additionally owns mineral and royalty pursuits in premier oil & gasoline areas, just like the Permian, Anadarko, and Williston Basins.

Lastly, the corporate supplies terminal providers, together with transporting and loading coal and expertise services.

Supply: Investor Presentation

On April twenty seventh, 2024, Alliance Useful resource Companions reported its Q1 and full yr outcomes. For the quarter, revenues declined by 1.7% year-over-year to $651.7 million.

Decrease revenues have been primarily the results of decrease common coal gross sales costs, partially offset by increased oil & gasoline royalties and different revenues. Internet revenue got here in at $158.1 million, or $1.21 per unit, in comparison with $191.2 million, or $1.45 per unit final yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on ARLP (preview of web page 1 of three proven beneath):

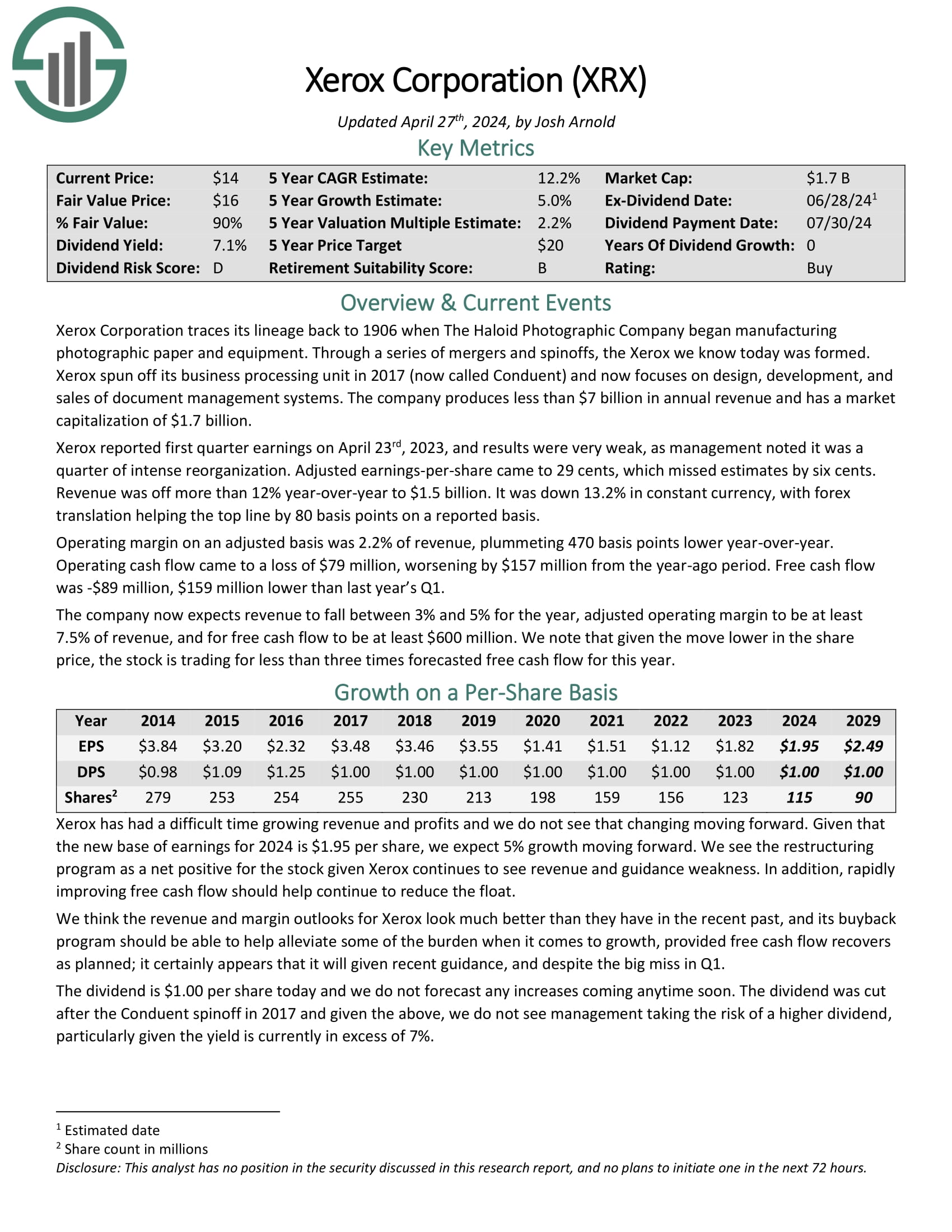

Undervalued Excessive Dividend Inventory #19: Xerox Holding (XRX) – P/E ratio of 6.0

Xerox is a expertise firm that designs, develops, and sells a variety of enterprise options in the US and world wide.

Its choices embrace coloration and multi-function printers, digital printing presses, digital providers for workflow automation, content material administration options, and extra.

From a comparatively hardware-focused firm, Xerox has developed right into a extra diversified enterprise over time, including software program and providers segments by way of natural enlargement and acquisitions.

Because of this, non-equipment income contributes most of Xerox’s gross sales at present:

Supply: Investor Presentation

In the newest quarter, Xerox reported revenues of $1.5 billion, which was a 12.4% lower year-over-year and decrease by 13.2% in fixed foreign money. Overseas change translations helped the top-line by 80 foundation factors on a reported foundation.

Click on right here to obtain our most up-to-date Certain Evaluation report on XRX (preview of web page 1 of three proven beneath):

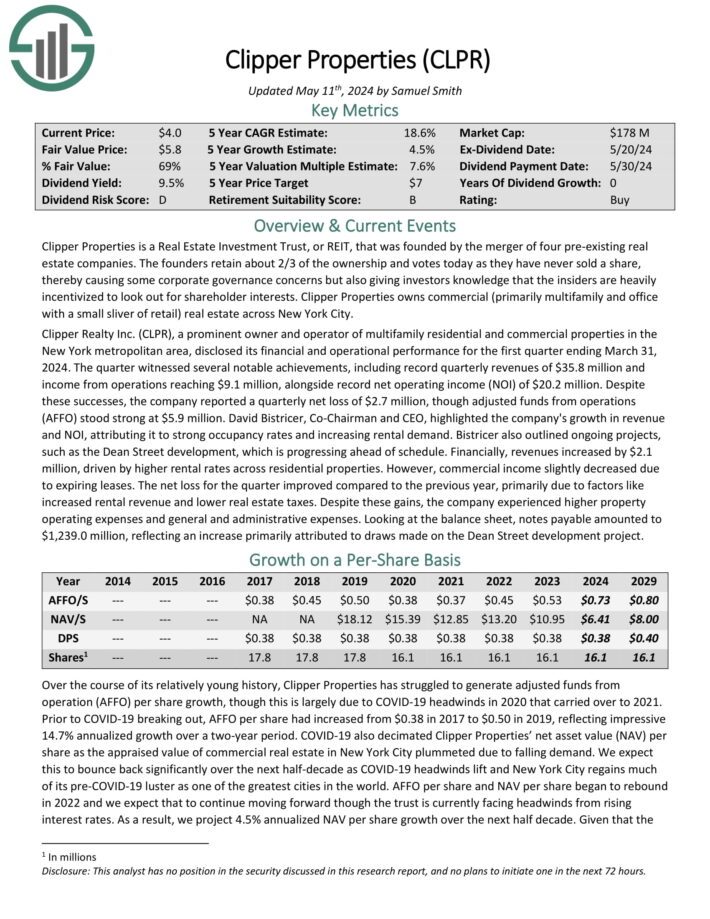

Undervalued Excessive Dividend Inventory #20: Clipper Realty (CLPR) – P/E ratio of 6.2

Clipper Properties owns business (primarily multifamily and workplace with a small sliver of retail) actual property throughout New York Metropolis.

For the primary quarter ending March 31, 2024, CLPR reported report quarterly income of $35.8 million and revenue from operations reaching $9.1 million, alongside report web working revenue (NOI) of $20.2 million.

Regardless of this, the corporate reported a quarterly web lack of $2.7 million, although adjusted funds from operations (AFFO) stood robust at $5.9 million.

Income elevated by $2.1 million, pushed by increased rental charges throughout residential properties. Nevertheless, business revenue barely decreased as a result of expiring leases.

The online loss for the quarter improved in comparison with the earlier yr, primarily as a result of components like elevated rental income and decrease actual property taxes.

Click on right here to obtain our most up-to-date Certain Evaluation report on CLPR (preview of web page 1 of three proven beneath):

Closing Ideas

All of the above shares are buying and selling at remarkably low-cost valuation ranges as a result of some enterprise headwinds. A few of them have been harm by excessive inflation or the most recent financial slowdown whereas others are going through their very own particular points.

Furthermore, all of the above shares are providing dividend yields above 5%. Thus, they make it a lot simpler for traders to attend patiently for the enterprise headwinds to subside.

If you’re desirous about discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Certain Dividend assets shall be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.