Merchants,

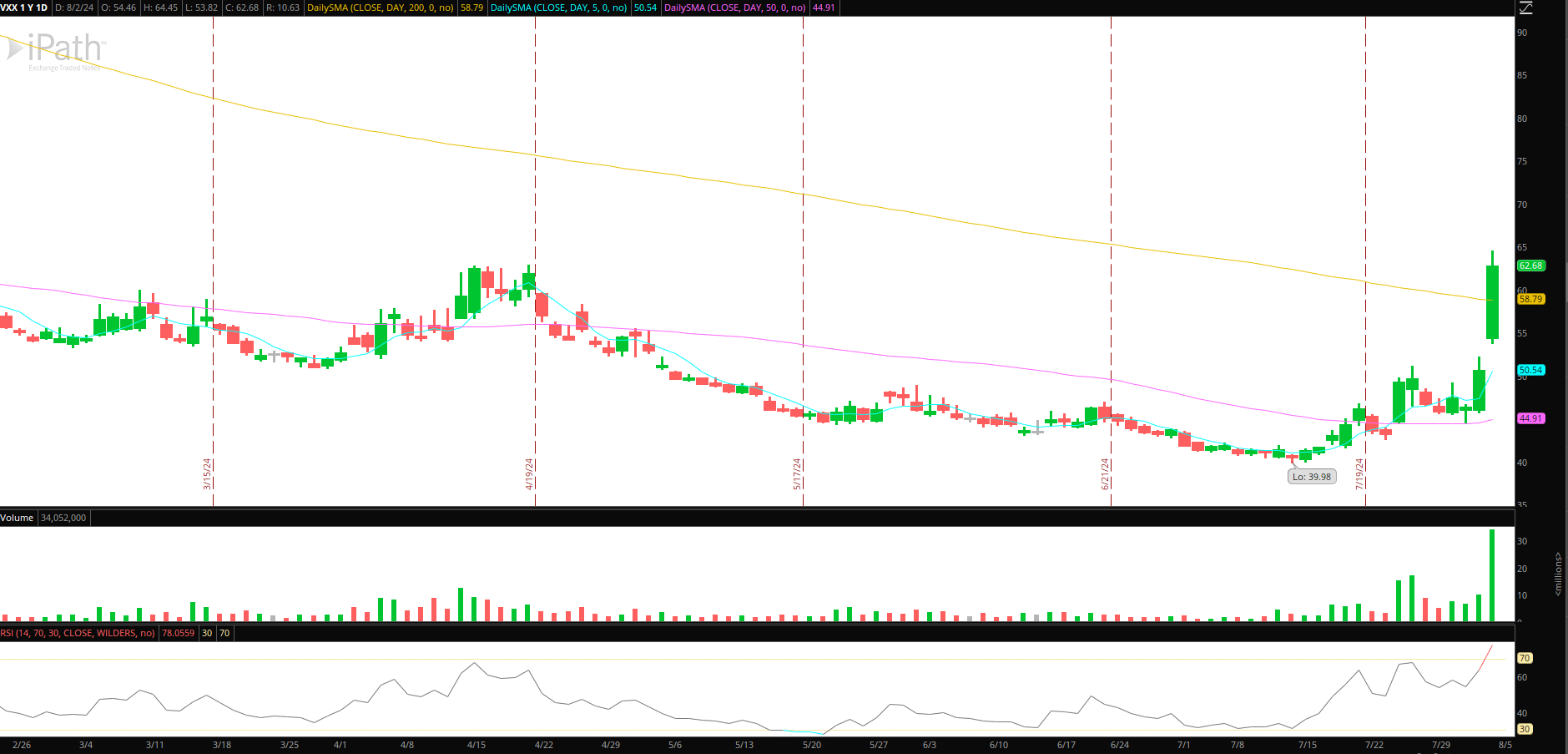

Proper earlier than I focus on my prime concepts for the week, I needed to briefly point out an necessary remark. An elevated VIX, as we at the moment have, is extraordinarily totally different from a subdued VIX.

When the volatility index is buying and selling at elevated ranges, swing trades develop into extra dangerous as vital in a single day directional gaps develop into probably. Move2Move kind buying and selling, together with buying and selling volatility merchandise and index ETF’s offers unbelievable alternatives every day.

Total, the anticipation of a recession has now impacted flows and sentiment with shares, together with a better VIX, which places the general market and sectors in play versus particular person shares.

So, with a move2move focus and a dealer’s market mindset in thoughts, listed below are my focuses for the upcoming week:

Move2Move Bounce in SOXL

Virtually 60% off from its excessive in a matter of weeks and a aid bounce in SOXL is changing into more and more probably and engaging from a threat: reward perspective for me. For me, it has develop into extremely stretched, with an growth from important SMA’s and better timeframe capitulation to the draw back. As talked about, this isn’t a swing tape, so I’ll search for day trades. The one swing positions I’ll take are if the commerce works out nicely and closes close to the excessive, then I’ll take a small piece in a single day for a niche continuation.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market components corresponding to liquidity, slippage and commissions.

Right here’s my plan:

The A+ model of the setup could be if the market gapped decrease on Monday and SOXL was down one other 5 – 10% +, establishing an intraday washout lengthy reversal sample. In that case, I might be intently watching worth motion for indicators of a backside, trying to enter lengthy on the fitting aspect of V, i.e., as soon as the inventory marks a LOD – reclaims its intraday VWAP, and/or makes a major greater low, with quantity to again it up. I’ll be buying and selling this on a decreased timeframe as it’s not a swing place, utilizing greater lows as a path and decreasing my place on greater highs and extensions from its intraday VWAP.

My plan in TQQQ—triple-levered QQQ ETF—is similar to the plan in SOXL. Like my plan in SOXL, a niche down or additional weak spot within the general market at this stage within the down transfer would enhance the expectation of the commerce and general threat: reward for me.

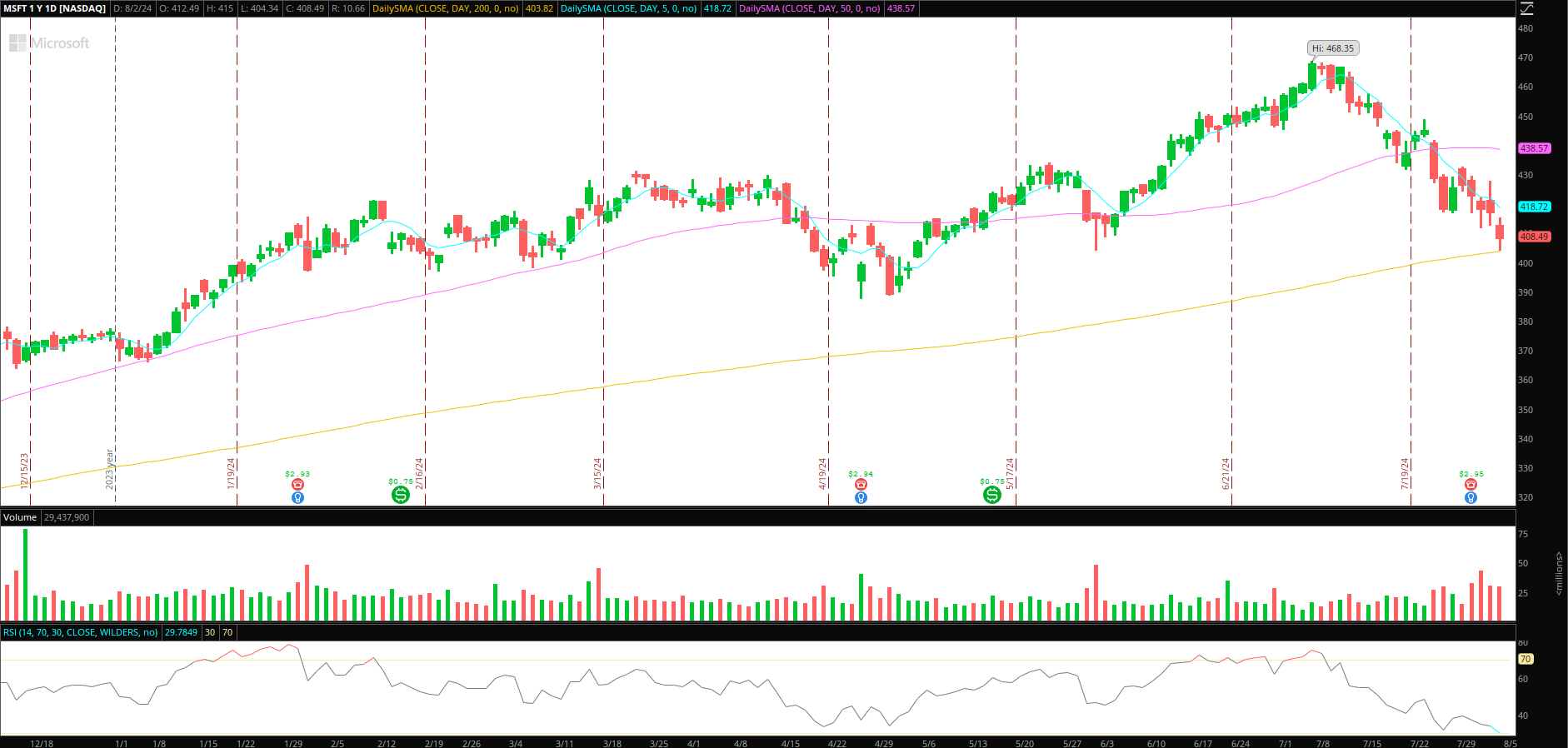

Now, together with the final thesis and concept for the concepts talked about above, very related plans may be laid out for a number of shares which have prolonged to the draw back within the quick time period. So, in that regard, I’ve a rising checklist of names that I’m monitoring for related fashion strikes to the plan talked about above. For instance, MSFT is one other identify I’m intently monitoring for a aid bounce after it’s bought off virtually 13% from its excessive in a number of weeks, buying and selling at its lowest RSI since 2022. Once more, ideally, there will likely be additional draw back and washout beneath its 200-day SMA.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market components corresponding to liquidity, slippage and commissions.

Along with monitoring a number of sectors and key indexes, my fundamental concentrate on Monday and possibly all week, together with the general market (SPY), tech (QQQ), and SOXL, will likely be VXX – the ETN that tracks the VIX short-term futures.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t replicate the affect, if any, of sure market components corresponding to liquidity, slippage and commissions.

An elevated VIX creates insanely nice move-to-move momentum scalping and reversion scalping alternatives. In these environments, I excel in quickly shifting gears from a swing mindset to a move-to-move mindset, and the VXX is a good automobile for it. So, I’ll intently watch VIX futures, the VXX worth motion and chart, and the general marketplace for cash-flowing scalping alternatives intraday.

Now, it is a totally different fashion and mindset from what I’ve beforehand mentioned, with essential changes being made, so I’ll focus on this in larger element within the upcoming Inside Entry assembly with you on Thursday.

Essential Disclosures