Up to date on July twenty fifth, 2024 by Bob Ciura

The Russell 2000 Index is arguably the world’s best-known benchmark for small-cap U.S. shares.

Small-cap shares have traditionally outperformed their bigger counterparts. Accordingly, the Russell 2000 Index could be an intriguing place to search for new funding alternatives.

You may obtain your free Excel record of Russell 2000 shares, together with related monetary metrics like dividend yields and P/E ratios, by clicking on the hyperlink beneath:

We usually rank shares based mostly on their five-year anticipated annual returns, as acknowledged within the Positive Evaluation Analysis Database.

However for buyers primarily desirous about earnings, it is usually helpful to rank small-cap shares in accordance with their dividend yields.

This text will rank the 20 highest-yielding small cap shares in our protection universe (excluding REITs, MLPs, BDCs, and royalty trusts).

Desk of Contents

Why Make investments In Small-Cap Shares?

The Russell 2000 Index comprises the home U.S. shares that rank 1,001 by 3,000 by descending market capitalization.

The Russell 2000 is a superb benchmark for small-cap shares. The typical market capitalization inside the Russell 2000 is ~at the moment $2.9 billion.

Why does this matter? There are a number of benefits to investing in small-cap shares, which we discover within the following video:

Small-cap shares have traditionally outperformed large-cap shares for 2 causes.

Firstly, small-cap shares are likely to develop extra rapidly than their bigger counterparts. There’s merely much less competitors and extra room to develop when your market capitalization is, say, $1 billion when in comparison with mega-cap shares with market caps above $200 billion.

Secondly, many small-cap securities are exterior the funding universes of some bigger institutional funding managers. This creates much less demand for shares, which reduces their costs and creates higher shopping for alternatives.

For that reason, there are usually extra mispriced funding alternatives in a small-cap index just like the Russell 2000 than a large-cap inventory index just like the S&P 500.

The next part ranks the 20 highest-yielding small-cap shares within the U.S. which might be coated within the Positive Evaluation Analysis Database. The shares are ranked so as of lowest dividend yield to highest.

Excessive Yield Small Cap #20: Financial institution of Marin Bancorp (BMRC)

Financial institution of Marin Bancorp operates because the holding firm for Financial institution of Marin that gives a variety of monetary providers primarily to small and medium-sized companies, professionals, not-for-profit organizations, and people by its roughly 30 retail places of work and eight business banking places of work in California.

It presents business and retail deposit and lending applications, private and enterprise checking and financial savings accounts, and wealth administration and belief providers. The vast majority of its income comes from curiosity earnings, with complete property of $3.8 billion, and complete interest-earning property of $3.6 billion.

Supply: Investor presentation

On April twenty ninth, 2024, Financial institution of Marin Bancorp launched first quarter 2024 outcomes for the interval ending March thirty first, 2024. For the quarter, the corporate reported earnings of $2.9 million considerably down from $9.4 million within the first quarter of 2023, however up from $610,000 within the earlier quarter.

Reported diluted earnings per share have been $0.18 for the primary quarter, in comparison with $0.04 for the prior quarter and $0.59 for the primary quarter of 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on BMRC (preview of web page 1 of three proven beneath):

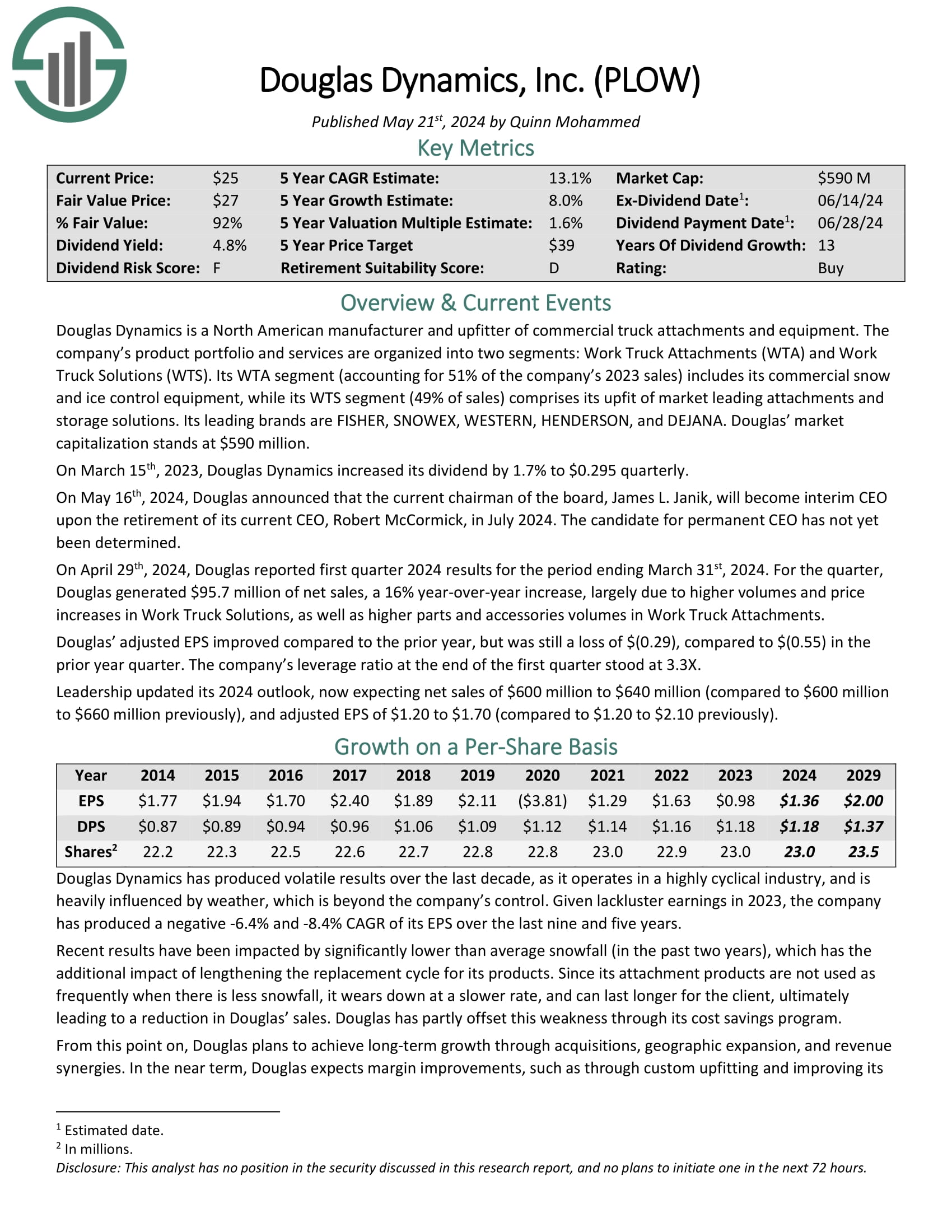

Excessive Yield Small Cap #19: Douglas Dynamics, Inc. (PLOW)

Douglas Dynamics is a North American producer and upfitter of business truck attachments and gear. The corporate’s product portfolio and providers are organized into two segments: Work Truck Attachments (WTA) and Work Truck Options (WTS).

Its WTA section (accounting for 51% of the corporate’s 2023 gross sales) consists of its business snow and ice management gear, whereas its WTS section (49% of gross sales) includes its upfit of market main attachments and storage options. Its main manufacturers are FISHER, SNOWEX, WESTERN, HENDERSON, and DEJANA.

On April twenty ninth, 2024, Douglas reported first quarter 2024 outcomes for the interval ending March thirty first, 2024. For the quarter, Douglas generated $95.7 million of internet gross sales, a 16% year-over-year enhance, largely because of greater volumes and worth will increase in Work Truck Options, in addition to greater components and equipment volumes in Work Truck Attachments.

Douglas’ adjusted EPS improved in comparison with the prior yr, however was nonetheless a lack of $(0.29), in comparison with $(0.55) within the prior yr quarter. The corporate’s leverage ratio on the finish of the primary quarter stood at 3.3X.

Click on right here to obtain our most up-to-date Positive Evaluation report on PLOW (preview of web page 1 of three proven beneath):

Excessive Yield Small Cap #18: Northwest Pure Holding (NWN)

NW Pure was based in 1859 and has grown from a small utility to a big publicly traded utility immediately. The utility’s mission is to ship pure fuel to its clients within the Pacific Northwest.

The corporate serves almost 3 million folks by its pure fuel, water, and renewable power companies.

NWN inventory trades with a market capitalization of $1.5 billion.

Supply: Investor Presentation

Northwest Pure Holding reported its monetary outcomes for the primary quarter of 2024, with internet earnings reaching $63.8 million ($1.69 per share), a lower from $71.7 million ($2.01 per share) in the identical interval of 2023.

Regardless of this decline, the corporate noticed notable achievements, together with including almost 15,000 fuel and water utility connections within the final 12 months, pushed primarily by strong water acquisitions, and offering invoice credit totaling almost $30 million to Oregon fuel clients in early 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWN (preview of web page 1 of three proven beneath):

Excessive Yield Small Cap #17: Compass Minerals Worldwide (CMP)

Compass Minerals Worldwide produces and sells salt, and specialty plant vitamin, and chemical merchandise internationally. Its varied chloride and salt variants (~55% of gross sales), corresponding to solar-evaporated salt, are utilized as deicers for roadways, human, animal vitamin, and varied different industrial makes use of.

Its plant vitamin section (~45% of gross sales) presents specialty fertilizers in varied grades and different agricultural options. The corporate generates almost $1.2 billion in revenues yearly and is predicated in Overland Park, Kansas.

On Might seventh, 2024, Compass Minerals posted its fiscal Q2 outcomes for the interval ending March thirty first, 2024. For the quarter, revenues fell by 11.5% to $364.0 million. This was as a result of 5% income development from the plant vitamin section not having the ability to offset the 14% decline in salt revenues.

Click on right here to obtain our most up-to-date Positive Evaluation report on CMP (preview of web page 1 of three proven beneath):

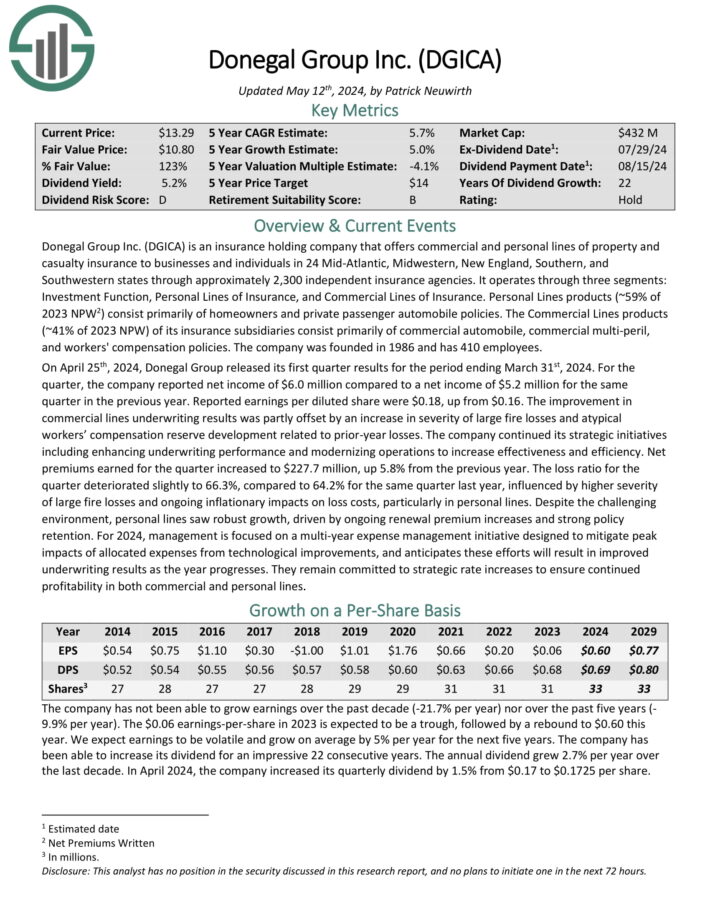

Excessive Yield Small Cap #16: Donegal Group (DGICA)

Donegal Group is an insurance coverage holding firm that gives business and private traces of property and casualty insurance coverage to companies and people in 24 Mid-Atlantic, Midwestern, New England, Southern, and Southwestern states by roughly 2,300 unbiased insurance coverage businesses.

It operates by three segments: Funding Perform, Private Traces of Insurance coverage, and Industrial Traces of Insurance coverage.

Supply: Investor Presentation

Private Traces merchandise (~59% of 2023 NPW2) consist primarily of householders and personal passenger vehicle insurance policies.

The Industrial Traces merchandise (~41% of 2023 NPW) of its insurance coverage subsidiaries consist primarily of business vehicle, business multi-peril, and staff’ compensation insurance policies. The corporate was based in 1986 and has 410 workers.

On April twenty fifth, 2024, Donegal Group launched its first quarter outcomes for the interval ending March thirty first, 2024. For the quarter, the corporate reported internet earnings of $6.0 million in comparison with a internet earnings of $5.2 million for a similar quarter within the earlier yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on DGICA (preview of web page 1 of three proven beneath):

Excessive Yield Small Cap #15: Premier Monetary Corp. (PFC)

Premier Monetary, which is headquartered in Defiance, Ohio, is the holding firm for Premier Financial institution, a neighborhood banking and monetary providers firm that was based in 1920.

Premier Financial institution is a regional financial institution with 73 branches and 9 mortgage manufacturing places of work all through northern Ohio, southeast Michigan, northeast Indiana and western Pennsylvania. Premier Monetary has a market capitalization of ~$700 million.

In late April, Premier Monetary reported (4/23/24) monetary outcomes for the primary quarter of fiscal 2024. Deposits grew 2% in the course of the first quarter however loans decreased -3%. Internet curiosity margin contracted from 2.90% in final yr’s quarter to 2.50% because of elevated deposit prices amid heated competitors amongst banks.

In consequence, internet curiosity earnings decreased -12%. However, due to a rise in non-interest earnings and a lower in non-interest expense, earnings-per-share declined simply -2%, from $0.51 to $0.50, and exceeded the analysts’ consensus by $0.03.

Click on right here to obtain our most up-to-date Positive Evaluation report on PFC (preview of web page 1 of three proven beneath):

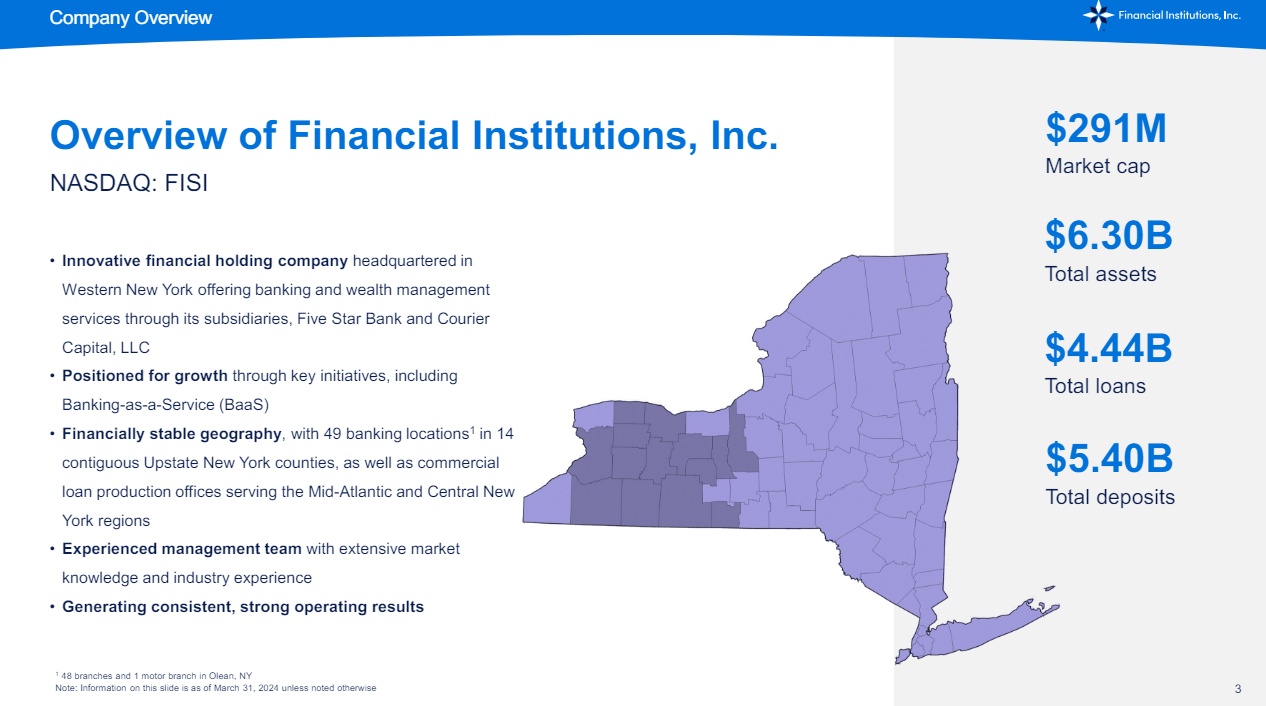

Excessive Yield Small Cap #14: Monetary Establishments Inc. (FISI)

FISI is a holding firm for 5 Star Financial institution, which is a chartered neighborhood financial institution in New York.

It presents the everyday mixture of conventional banking merchandise, together with checking an financial savings accounts, certificates of deposit, retirement and certified plan accounts, business and actual property lending, enterprise loans, working capital loans, and extra.

The financial institution was based in 1817, and is headquartered in Warsaw, New York.

Supply: Investor presentation

The financial institution has 49 places of work in New York state, and has greater than $6 billion in complete property. The financial institution’s loan-to-deposit ratio is 82% as of the latest quarter.

FISI reported first quarter earnings on April twenty fifth, 2024, and outcomes have been largely flat year-over-year, apart from a fraud occasion that price the financial institution dearly in the course of the quarter.

Loans and deposits have been up about 5% year-over-year, however internet curiosity earnings fell about 4%. Internet curiosity margin fell sharply, ceding about 30 foundation factors from the year-ago interval, which was attributable to the upper price of deposits.

Click on right here to obtain our most up-to-date Positive Evaluation report on FISI (preview of web page 1 of three proven beneath):

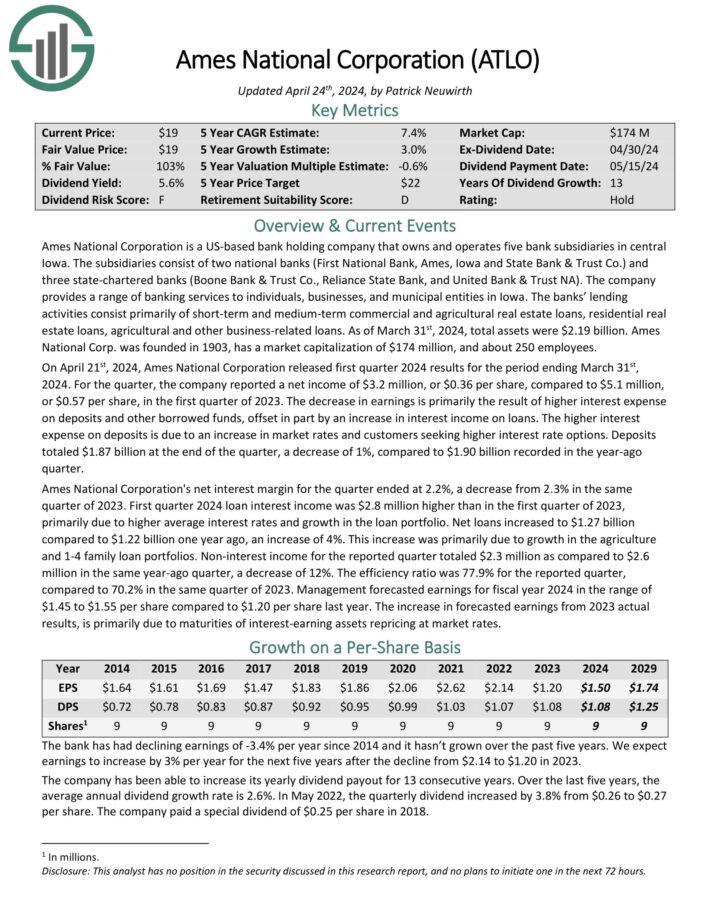

Excessive Yield Small Cap #13: Ames Nationwide Company (ATLO)

Ames Nationwide Company is a U.S.-based financial institution holding firm that owns and operates 5 financial institution subsidiaries in central Iowa.

The subsidiaries embrace two nationwide banks, First Nationwide Financial institution, Ames, Iowa, and State Financial institution & Belief Co., and three state-charted banks, Boone Financial institution & Belief Co., Reliance State Financial institution, and Iowa State Financial savings Financial institution.

The final three years have been tough for the financial institution.

Supply: Investor Relations

Ames Nationwide Company reported earnings outcomes for the primary quarter of 2024 on March thirty first, 2024. Internet earnings of $3.2 million, or $0.36 per share, in contrast unfavorably to internet earnings of $5.1 million, or $0.57 per share, within the prior yr.

The lower in earnings is primarily the results of greater curiosity expense on deposits and different borrowed funds. This was partially offset by a rise in curiosity earnings on loans.

Click on right here to obtain our most up-to-date Positive Evaluation report on ATLO (preview of web page 1 of three proven beneath):

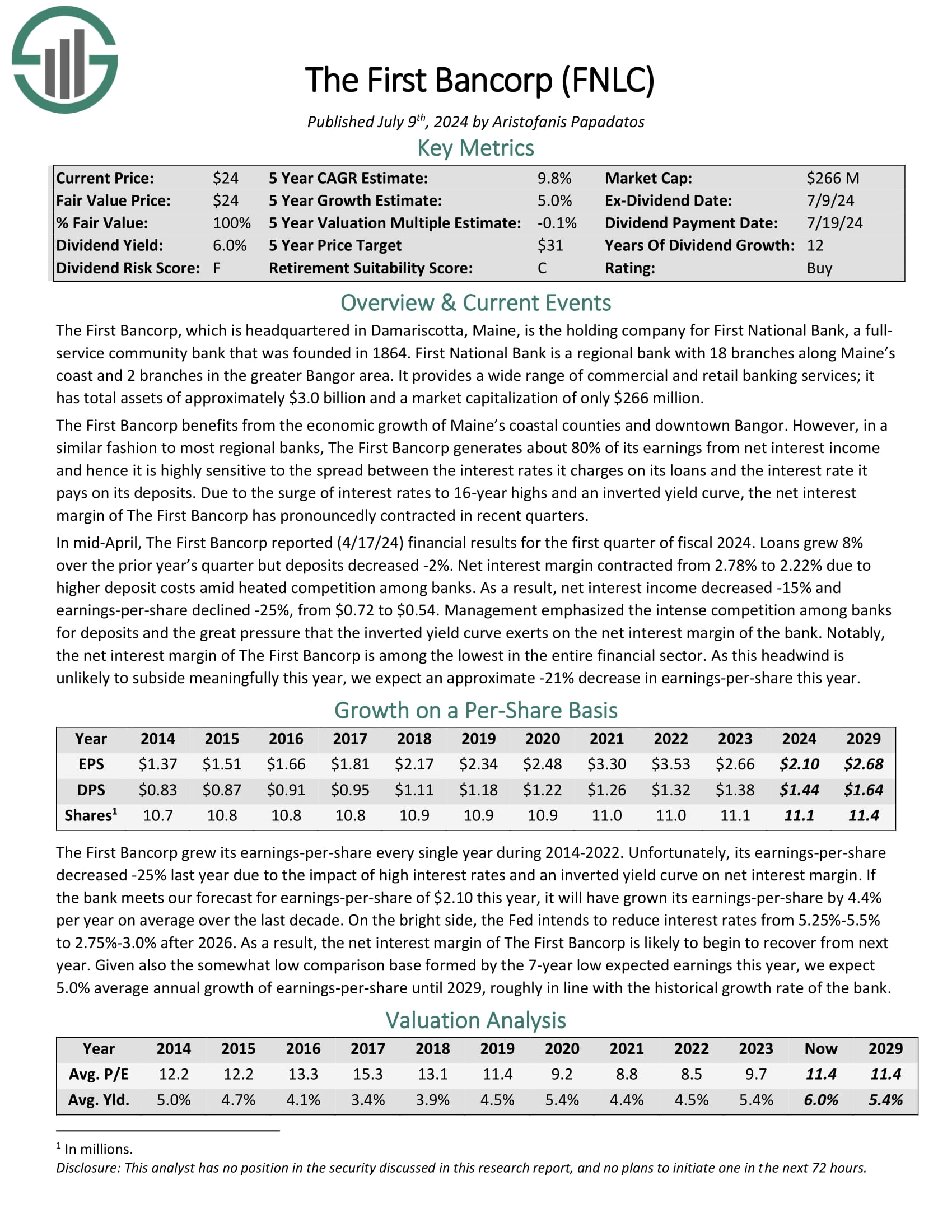

Excessive Yield Small Cap #12: First Bancorp Inc. (FNLC)

The First Bancorp is the holding firm for First Nationwide Financial institution, a full service neighborhood financial institution that was based in 1864. First Nationwide Financial institution is a regional financial institution with 18 branches alongside Maine’s coast and a couple of branches within the higher Bangor space. It gives a variety of business and retail banking providers; it has complete property of roughly $3.0 billion.

Internet earnings was $6.2 million, or $0.55 per diluted share, for the three months ended June 30, 2024. EPS grew barely for the quarter from $0.54 per share within the year-ago interval.

Internet curiosity earnings was $15.1 million for the three months ended June 30, 2024, a rise of 1.3% from the primary quarter of 2024. Internet curiosity margin was 2.21% for the second quarter of 2024, down barely from 2.22% within the earlier quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on FNLC (preview of web page 1 of three proven beneath):

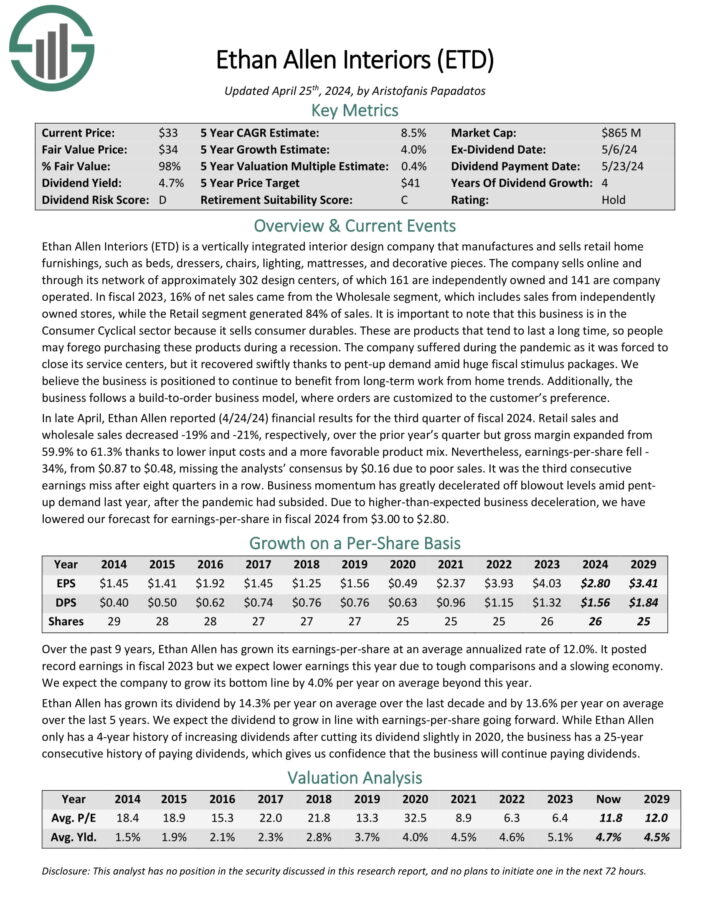

Excessive Yield Small Cap #11: Ethan Allen Interiors (ETD)

Ethan Allen Interiors is a vertically built-in inside design firm that manufactures and sells retail residence furnishings, corresponding to beds, dressers, chairs, lighting, mattresses, and ornamental items.

The corporate sells on-line and thru its community of roughly 302 design facilities, the place 161 are independently owned and 141 are firm operated.

Within the fiscal 2024 third quarter, Ethan Allen Interiors Inc. reported consolidated internet gross sales of $146.4 million, marking a 21.4% lower from the earlier yr.

Retail internet gross sales dropped by 18.8% to $122.6 million, whereas wholesale internet gross sales fell by 21.3% to $89.8 million. The corporate’s retail and wholesale written orders additionally noticed declines of 8.6% and 14.6%, respectively.

Click on right here to obtain our most up-to-date Positive Evaluation report on Ethan Allen (preview of web page 1 of three proven beneath):

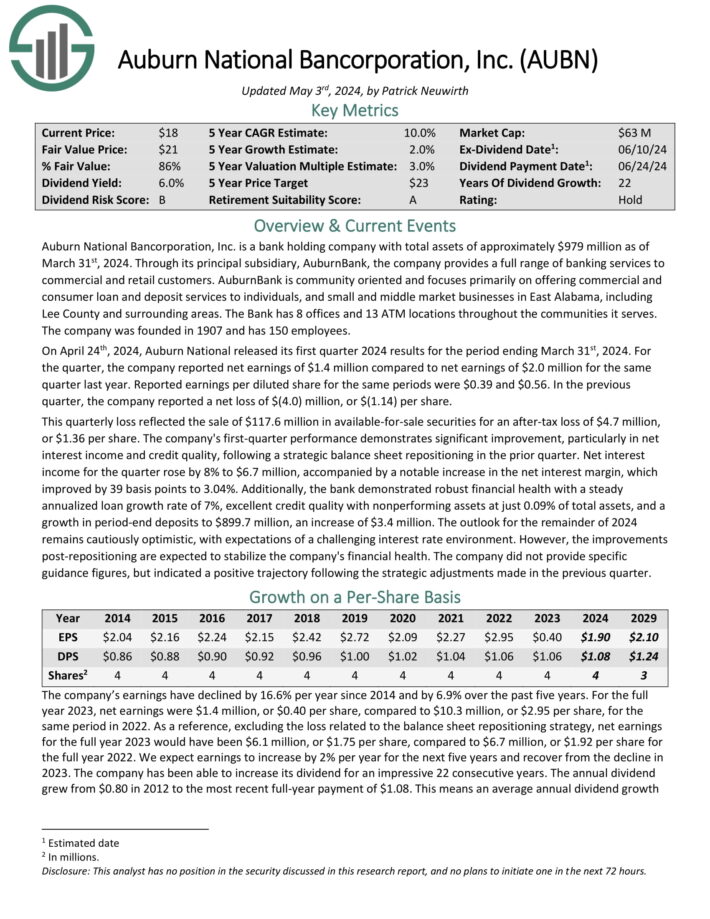

Excessive Yield Small Cap #10: Auburn Nationwide Bancorporation (AUBN)

Auburn Nationwide Bancorporation is a financial institution holding firm. By way of its principal subsidiary, AuburnBank, the corporate gives a full vary of banking providers to business and retail clients.

AuburnBank is neighborhood oriented and focuses totally on providing business and client mortgage and deposit providers to people, and small and center market companies in East Alabama, together with Lee County and surrounding areas.

Auburn Nationwide Bancorporation introduced its first quarter 2024 monetary outcomes, reporting a internet earnings of $1.4 million, or $0.39 per share.

This marked a big restoration from the fourth quarter of 2023, which noticed a internet lack of $(4.0) million, or $(1.14) per share, largely because of strategic stability sheet changes involving the sale of low-yielding securities.

Excluding this one-time loss, internet earnings for the fourth quarter of 2023 would have been $0.7 million, or $0.21 per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on AUBN (preview of web page 1 of three proven beneath):

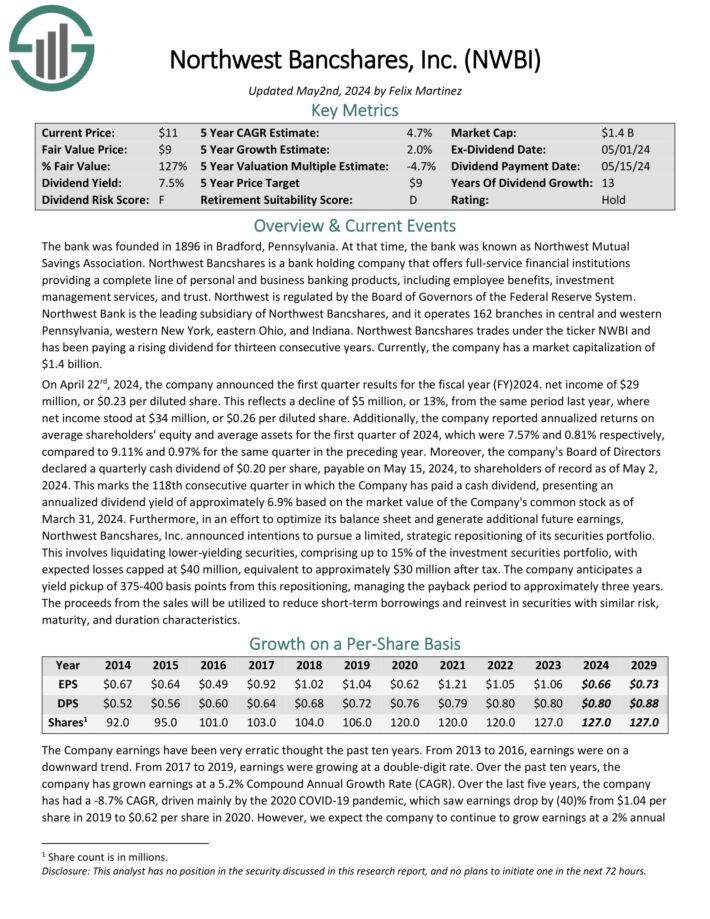

Excessive Yield Small Cap #9: Northwest Bancshares (NWBI)

Northwest Bancshares is a 100+ year-old financial institution based in Pennsylvania and headquartered in Columbus, Ohio. In the present day, the financial institution has about 142 branches and eight drive-through areas in Ohio, Pennsylvania, Western New York, and Indiana.

Northwest takes in deposits and loans out cash to customers and small-to-medium-sized companies like most neighborhood banks. Moreover loans, the financial institution invests deposits in money and money equivalents.

The financial institution presents customers checking and financial savings accounts, mortgages, auto loans, private loans, and bank cards. For small companies, the financial institution presents enterprise checking and financial savings, bank cards, loans, payables and receivables, retirement plans, and so on.

As well as, Northwest gives wealth administration, providing mutual funds, insurance coverage, and annuities.

The corporate introduced first-quarter outcomes on April twenty second, 2024. Internet curiosity earnings fell greater than 8% for the quarter, from $112.5 million in the identical prior yr interval to $103.3 million in the latest interval. This decline was a results of a 154% surge in curiosity expense that greater than offset a 19% acquire in curiosity earnings.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWBI (preview of web page 1 of three proven beneath):

Excessive Yield Small Cap #8: Common Company (UVV)

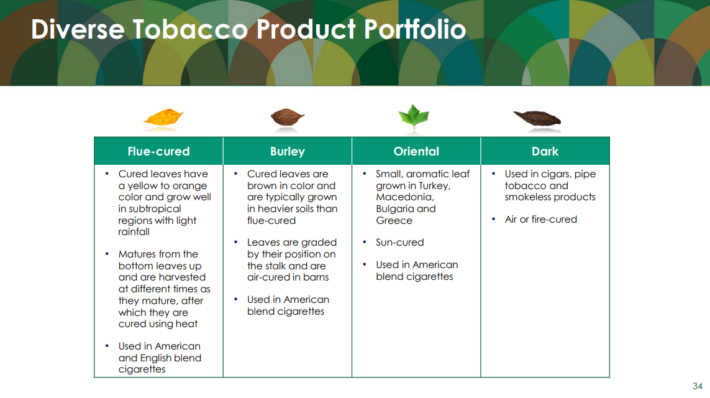

Common Company is a market chief in supplying leaf tobacco and different plant-based inputs to client product producers.

The Tobacco Operations section buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless merchandise.

Common buys tobacco from its suppliers, processes it, and sells it to giant tobacco corporations within the US and internationally.

Supply: Investor Presentation

The Ingredient Operations deal primarily with greens and fruits however is considerably smaller than the tobacco operations. Common has been rising this enterprise by acquisitions beginning in 2020.

Common Company reported its fourth-quarter earnings outcomes on the finish of Might. The corporate generated revenues of $770 million in the course of the quarter, which was 11% greater than the revenues that Common Company generated in the course of the earlier yr’s interval.

Revenues have been positively impacted by product combine modifications, and development was weaker than in the course of the earlier quarter. Common’s gross margin was up in comparison with the earlier yr’s interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on Common (preview of web page 1 of three proven beneath):

Excessive Yield Small Cap #7: Kronos Worldwide (KRO)

Kronos Worldwide is an organization that makes a speciality of the manufacturing of titanium dioxide pigments, that are primarily used to boost the colour and brightness of merchandise like paint, cosmetics, and plastics.

Kronos estimates it’s the largest producer of TiO2 in Europe, with near 50% of gross sales volumes attributable to markets in Europe.

The corporate’s most up-to-date quarterly report confirmed a return to development. Launched on Might eighth, 2024, income grew 12.3% to $479 million whereas earnings-per-share of $0.07 improved from a lack of $0.13 within the prior yr.

Value for TiO2 have been decrease 11% for the quarter, however this was greater than offset by a 28% surge in quantity as demand improved.

Click on right here to obtain our most up-to-date Positive Evaluation report on KRO (preview of web page 1 of three proven beneath):

Excessive Yield Small Cap #6: Vector Group (VGR)

Vector Group is a diversified holding firm that could be a mixture of a cigarette producer, and an actual property developer. The corporate owns and controls two tobacco corporations: Liggett Group, LLC and Vector Tobacco, Inc.

Vector Group’s tobacco section primarily sells low cost cigarette manufacturers, together with Eagle ’20s, Pyramid, Grand Prix, Liggett Choose, and Eve. The corporate is the 4th largest cigarette producer, by way of quantity, in the USA.

Vector Group additionally owns New Valley LLC, which is an actual property funding enterprise. The actual property section New Valley has invested roughly $171 million, as of March thirty first, 2024, in a broad portfolio of actual property ventures, together with condominium and mixed-used developments, residence buildings, accommodations, and business properties.

Supply: Investor Presentation

Vector Group just lately reported its Q1 2024 outcomes on Might 1st, 2024, with the numbers coming in weaker than anticipated. The corporate noticed a income lower of two.9% to $324.6 million. Whereas earnings per share did lower to $0.24 from $0.22 regardless of a decline in tobacco quantity.

Click on right here to obtain our most up-to-date Positive Evaluation report on VGR (preview of web page 1 of three proven beneath):

Excessive Yield Small Cap #5: First of Lengthy Island Corp. (FLIC)

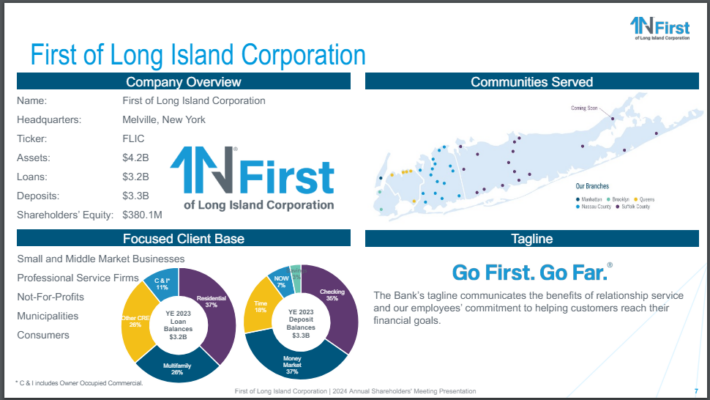

The First of Lengthy Island is the holding firm for The First Nationwide Financial institution of Lengthy Island, which is a small-sized financial institution.

The First of Lengthy Island gives a variety of monetary providers to customers and small to medium-sized companies. These choices embrace financial savings accounts, mortgages, and enterprise and client loans, amongst others.

The First of Lengthy Island has roughly 50 branches in two Lengthy Island counties and a number of other NYC burrows, together with Brooklyn, Manhattan, and Queens.

Supply: Investor Presentation

FLIC reported first quarter earnings outcomes on April twenty fifth, 2024, with outcomes displaying weak point for the interval. Income fell 8% to $21 million whereas earnings-per-share of $0.20 in contrast unfavorably to $0.29 within the prior yr.

Whole deposits fell $162.6 million, or 4.7%, to $3.3 billion, however elevated $55.5 million on a sequential foundation. Whole common loans declined 1.3% to $3.2 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on FLIC (preview of web page 1 of three proven beneath):

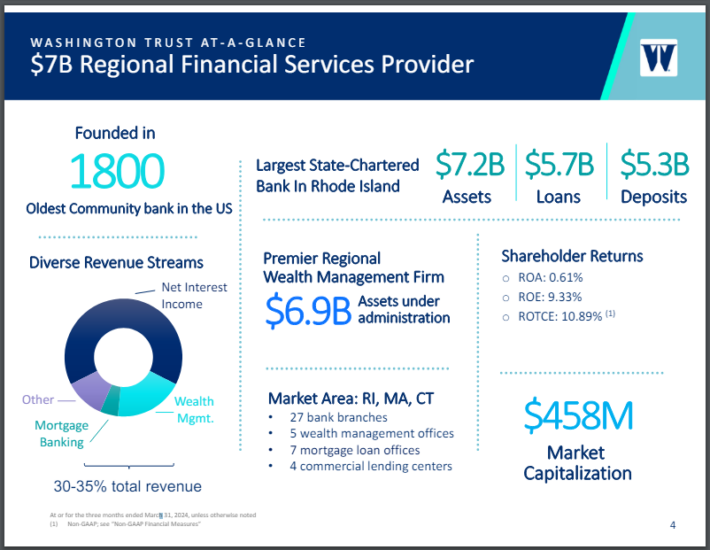

Excessive Yield Small Cap #4: Washington Belief Bancorp (WASH)

Washington Belief was based in 1800, making it the oldest neighborhood financial institution within the U.S. The financial institution is the biggest state-charted financial institution in Rhode Island and has small operations in Massachusetts and Connecticut.

Supply: Investor Relations

Washington Belief operates as a holding firm, with property totaling greater than $7 billion. The financial institution gives extra banking providers, corresponding to financial savings accounts, certificates of deposit, and cash market accounts to its clients as nicely.

The financial institution additionally presents loans for residential, business, client, and development clients, in addition to reverse mortgages.

Lastly, Washington Belief has almost $7 billion in property below administration in its wealth administration enterprise, the place it gives monetary planning and advisory providers.

Click on right here to obtain our most up-to-date Positive Evaluation report on WASH (preview of web page 1 of three proven beneath):

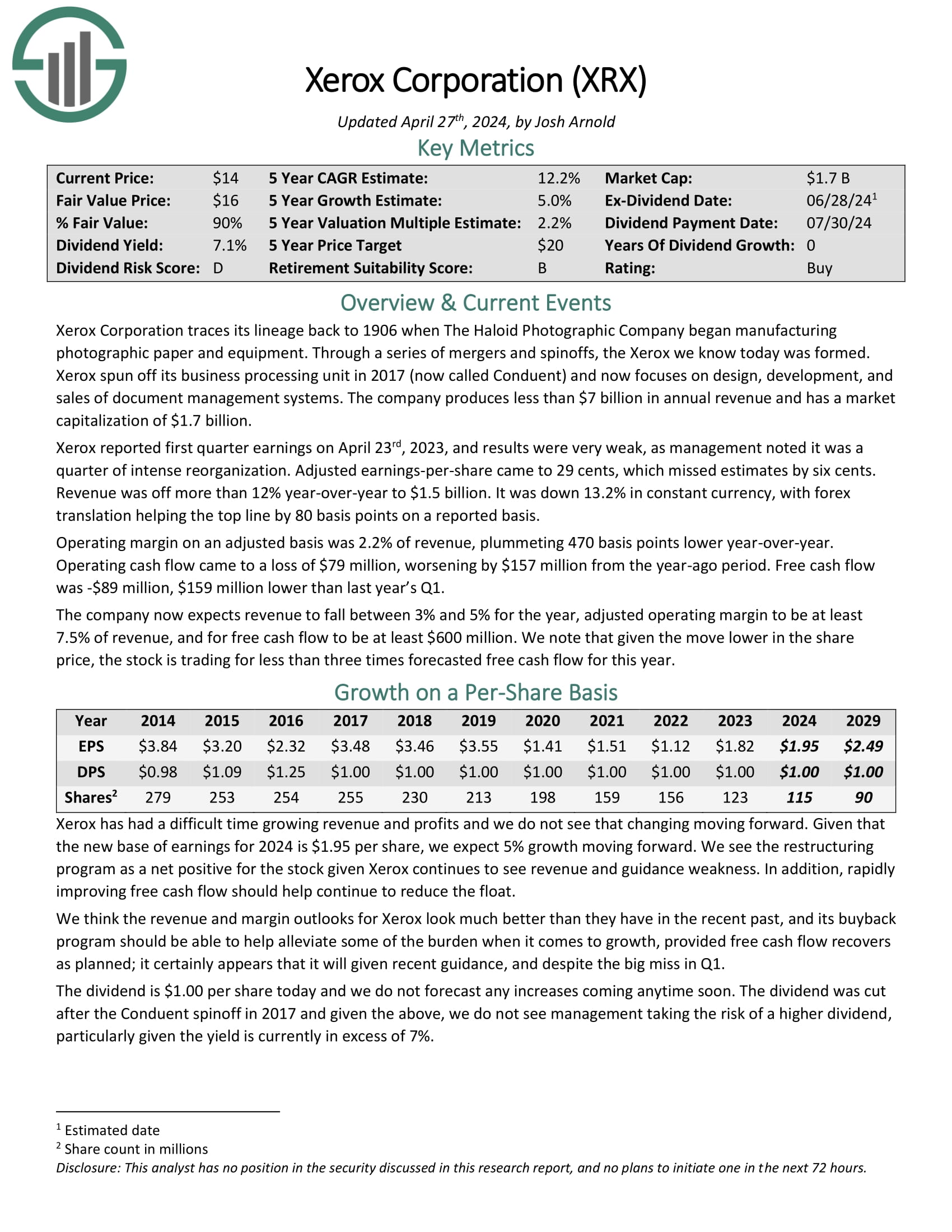

Excessive Yield Small Cap #3: Xerox Holdings (XRX)

Xerox is a expertise firm that designs, develops, and sells a variety of enterprise options in the USA and all over the world.

Its choices embrace coloration and multi-function printers, digital printing presses, digital providers for workflow automation, content material administration options, and extra.

From a comparatively hardware-focused firm, Xerox has developed right into a extra diversified enterprise over time, including software program and providers segments by way of natural enlargement and acquisitions.

In consequence, non-equipment income contributes most of Xerox’s gross sales immediately:

Supply: Investor Presentation

In the latest quarter, Xerox reported revenues of $1.5 billion, which was a 12.4% lower year-over-year and decrease by 13.2% in fixed foreign money. International alternate translations helped the top-line by 80 foundation factors on a reported foundation.

Click on right here to obtain our most up-to-date Positive Evaluation report on XRX (preview of web page 1 of three proven beneath):

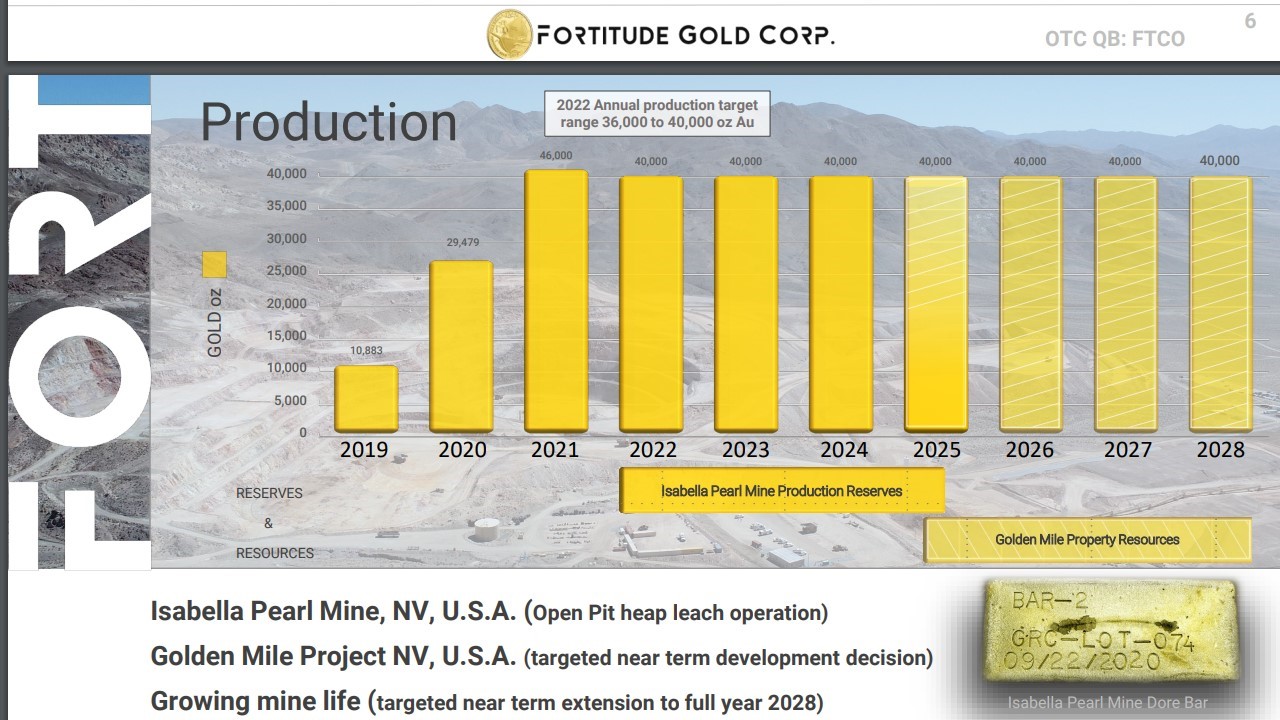

Excessive Yield Small Cap #2: B&G Meals (BGS)

B&G Meals was created within the late Nineties with the preliminary goal of buying Bloch & Guggenheimer, who bought pickles, relish, and condiments. Bloch was based in 1889. Final yr, the corporate had simply over $2 billion in gross sales.

A few of the firm’s well-known manufacturers embrace Inexperienced Big, Ortega, Cream of Wheat, Mrs. Sprint, and Again to Nature, with over 50 manufacturers in complete. The product portfolio focuses on shelf-stable, frozen and snack manufacturers.

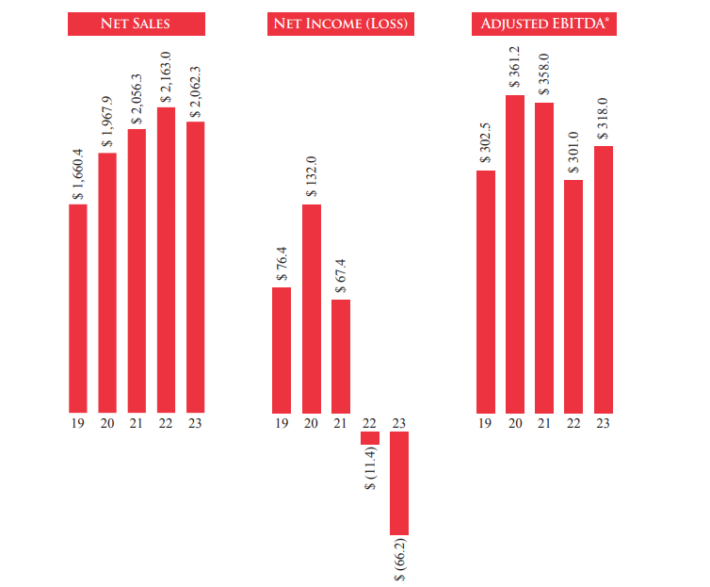

You may see a picture of the corporate’s five-year monetary efficiency beneath:

Supply: 2023 Annual Report

B&G Meals reported first-quarter 2024 outcomes on Might eighth, 2024. Quarterly income of $475 million declined 7% year-over-year, due largely to decrease quantity and the divestiture of the Inexperienced Big U.S. shelf-stable product line.

Adjusted earnings-per-share declined 33% year-over-year, to $0.18 per share.

B&G Meals additionally decreased 2024 steering, and now expects internet gross sales in a variety of $1.955 billion to $1.985 billion (from $1.975 billion to $2.020 billion beforehand), and adjusted EPS between $0.75 to $0.95 (from $0.80 to $1.00 beforehand).

Click on right here to obtain our most up-to-date Positive Evaluation report on BGS (preview of web page 1 of three proven beneath):

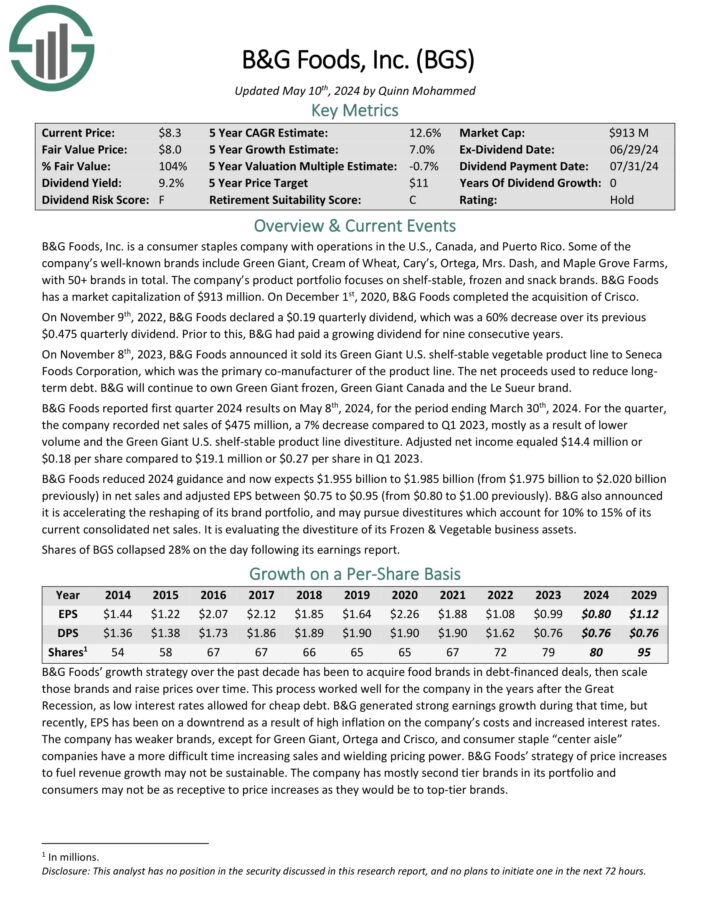

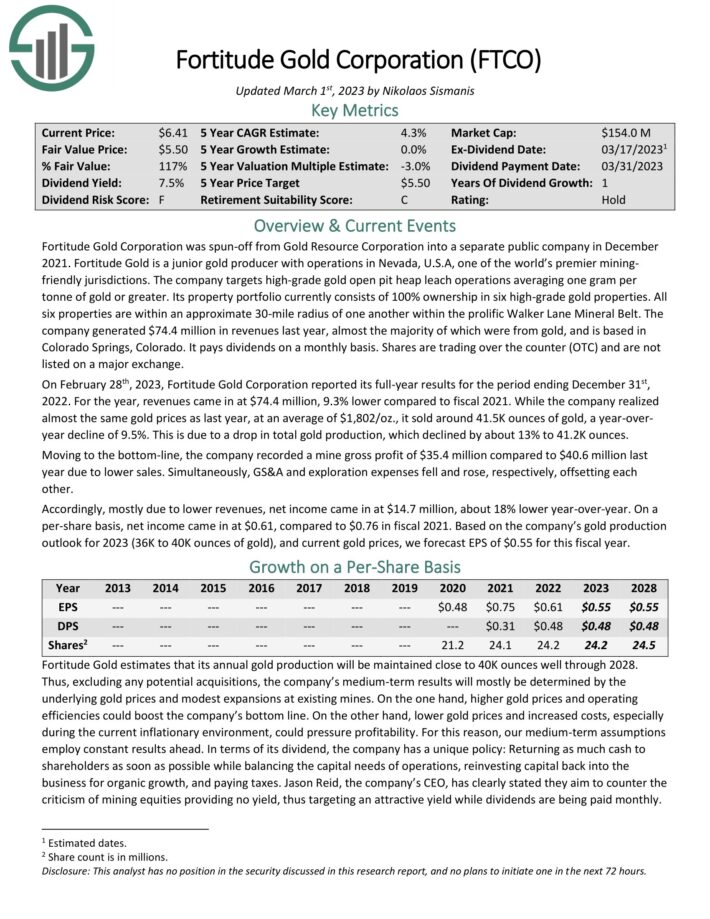

Excessive Yield Small Cap #1: Fortitude Gold Company (FTCO)

Fortitude Gold is a gold producer, which is predicated within the U.S., generates 99% of its income from gold and targets initiatives with low working prices, excessive returns on capital and vast margins.

Its Nevada Mining Unit consists of 5 high-grade gold properties situated within the Walker Lane Mineral Belt. Nevada is among the friendliest jurisdictions to miners on the earth.

Fortitude Gold has grown its manufacturing at a quick tempo in every of the final two years, primarily due to the most important development challenge of Isabella Pearl Mine.

Supply: Investor Presentation

As proven within the above chart, the reserves of Isabella Pearl Mine will final till roughly 2025 after which they are going to most likely be replenished by the extra reserves of the Golden Mile Venture.

The chart depicts primarily flat manufacturing within the upcoming years. In consequence, the earnings of Fortitude Gold might be primarily decided by the prevailing worth of gold.

Then again, Fortitude Gold has some engaging options for dividend buyers. It’s providing a month-to-month dividend of $0.04, which corresponds to an annualized dividend yield of seven.3%.

Click on right here to obtain our most up-to-date Positive Evaluation report on FTCO (preview of web page 1 of three proven beneath):

Closing Ideas

Excessive yield dividend shares have apparent attraction to earnings buyers. The S&P 500 Index yields simply ~1.3% proper now on common, making excessive yield shares much more engaging by comparability.

As well as, small-cap shares may have stronger development potential than bigger opponents of their respective sectors.

After all, buyers ought to all the time do their analysis earlier than shopping for particular person shares.

That mentioned, the 20 shares on this record have yields not less than double the S&P 500 Index common, going all the best way as much as over 10%. In consequence, earnings buyers could discover these 20 dividend shares engaging.

Additional Studying

In case you are desirous about discovering extra high-quality dividend development shares appropriate for long-term funding, the next Positive Dividend databases might be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.