Printed on June twenty fourth, 2024 by Josh Arnold

Excessive-yield shares pay out dividends which can be considerably greater than market common dividends, and ideally, on a sustainable and rising foundation. As a reference level, the S&P 500’s present yield is just ~1.3% because the index trades close to all-time highs.

Excessive-yield shares will be very useful to shore up earnings after retirement. For instance, a $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

UGI Company is a part of our ‘Excessive Dividend 50’ collection, the place we cowl the 50 highest yielding shares within the Certain Evaluation Analysis Database.

We’ve got created a spreadsheet of shares (and carefully associated REITs and MLPs, and so on.) with dividend yields of 5% or extra…

You may obtain your free full record of all securities with 5%+ yields (together with essential monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink under:

Subsequent on our record of excessive dividend shares to overview is UGI Company (UGI). UGI has a really sturdy 36-year dividend improve streak, a interval that spans a number of recessions.

The corporate has been in a position to proceed its dividend development over time due to the predictable nature of earnings and money stream from its utilities section.

Enterprise Overview

UGI is a diversified distributor of power services and products in 17 international locations, however primarily within the US.

Supply: Investor presentation

UGI traces its roots again 142 years, and terribly, has paid dividends for all however two of these years. When it comes to rising its dividend, as talked about earlier than, it’s carried out so because the late-Nineteen Eighties.

The corporate serves business and residential clients with merchandise comparable to propane and pure fuel distribution, in addition to pipeline and storage providers, amongst others.

The inventory trades with a market cap of just below $5 billion, and the corporate produces annual income of greater than $8 billion.

UGI’s most up-to-date earnings report was launched on Might 1st, 2024, and was for the corporate’s fiscal second quarter. Earnings-per-share was $1.97 on an adjusted, diluted foundation, which was up sharply from $1.68 within the year-ago interval.

UGI suffered from hotter climate throughout its service territories, which reduces heating demand. Nonetheless, pure fuel efficiency and decrease working bills helped increase margins.

The administration staff reiterated its steerage for the 12 months, and we now have accordingly projected $2.82 in adjusted earnings-per-share for this 12 months.

Development Prospects

UGI’s development has been uneven at occasions, however basically, has trended upward over the long-term. The corporate is on the mercy of climate to an extent, because it sells commodities and commodity-based providers.

Demand for these providers depends upon how sizzling or chilly the climate is at sure occasions of the 12 months.

Supply: Firm web site

Nonetheless, the administration staff is assured it will possibly proceed to sustainably generate ~5% annual earnings-per-share development on an adjusted foundation, preserve prudent leverage, and increase its price base by at the very least 9% yearly.

Given the regulated utility enterprise is prone to paved the way by way of development, we’re estimating simply 1.2% annual earnings-per-share development from 2024 ranges.

We be aware the chance for greater than that if the extra cyclical components of the enterprise outperform – on colder climate, as an illustration – however that volatility goes each methods. For now, we’re cautious on UGI’s skill to provide excessive earnings development over the long-term.

Aggressive Benefits & Recession Efficiency

Aggressive benefits are tough to return by within the companies UGI competes in, particularly as a result of they’re solely primarily based upon commodity demand. That signifies that pricing and scale are the one levers to drag, and we consider UGI does have some scale within the markets it serves.

The truth that it’s current in 17 international locations gives a degree of diversification most utilities would not have, however we nonetheless see the corporate’s aggressive benefits as minimal.

UGI’s recession efficiency was truly excellent in the course of the Nice Recession. Whereas the commodity-based companies the corporate operates naturally restrict development, additionally they supply secure demand no matter financial circumstances.

UGI’s efficiency in the course of the Nice Recession of 2008-2009 is under:

2008 earnings-per-share: $1.22

2009 earnings-per-share: $1.57

2010 earnings-per-share: $1.57

We see this efficiency throughout recessions as a promoting level for the inventory, significantly because it pertains to dividend sustainability. We’d count on the corporate to have the ability to proceed to pay and lift its dividend in the course of the subsequent main recession.

Dividend Evaluation

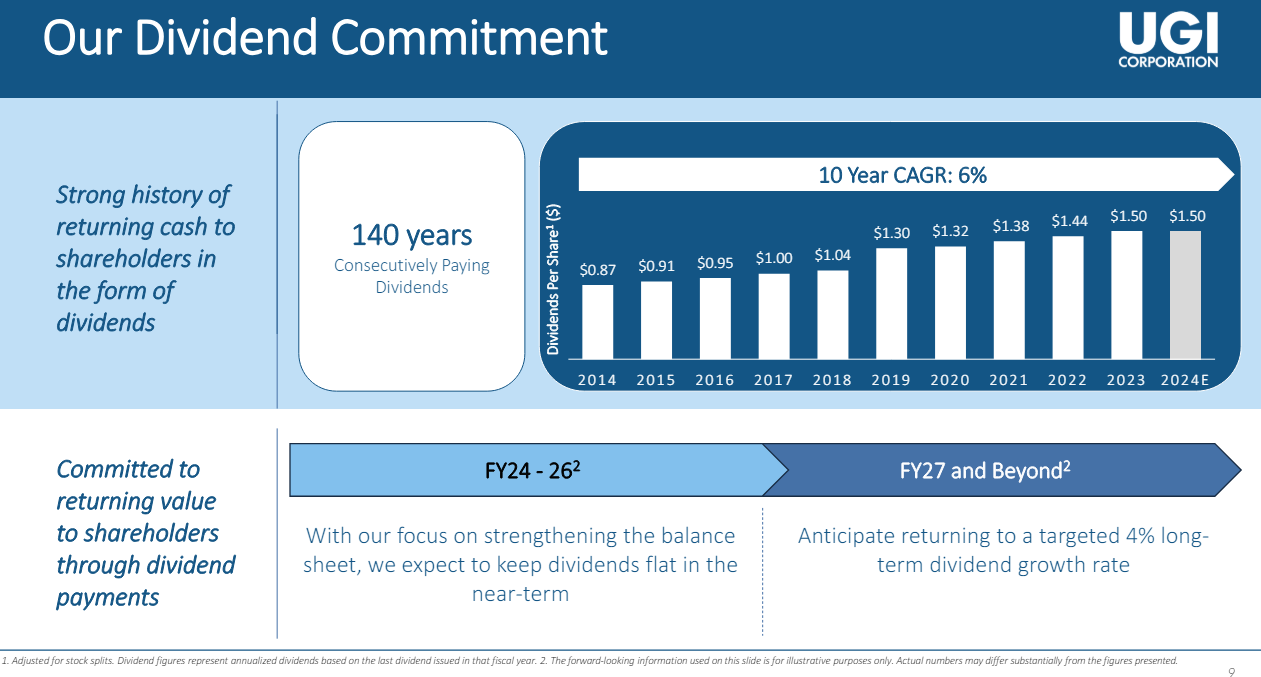

UGI’s present dividend is $1.50 per share yearly, and with the inventory at $23, which means the yield is a really engaging 6.6%. That’s about 5 occasions that of the S&P 500, for reference.

Supply: Investor presentation

With $2.82 in projected earnings-per-share for this 12 months, the payout ratio is simply over 50%. Given the 36 years of consecutive will increase within the dividend, we see that as very manageable going ahead and haven’t any issues a few potential minimize on the horizon.

Administration has been very clear concerning the dedication to defend the dividend and proceed to boost it, and we estimate modest development going ahead, however definitely the power to boost the payout indefinitely.

Ultimate Ideas

UGI’s spectacular streak of practically 4 many years of dividend will increase definitely lends some credibility as a top quality dividend inventory.

As well as, the corporate’s secure earnings and recession resilience are massive elements for dividend sustainability.

Lastly, that extraordinarily excessive yield is tremendously engaging, and we see the inventory as a robust earnings inventory total on account of these elements.

We see the corporate’s development outlook as considerably murky, however from the attitude of dividend traders, UGI has quite a bit to supply.

In case you are serious about discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Certain Dividend assets will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.